ANNUAL REPORT 2011 - DONG Energy

ANNUAL REPORT 2011 - DONG Energy

ANNUAL REPORT 2011 - DONG Energy

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

notes<br />

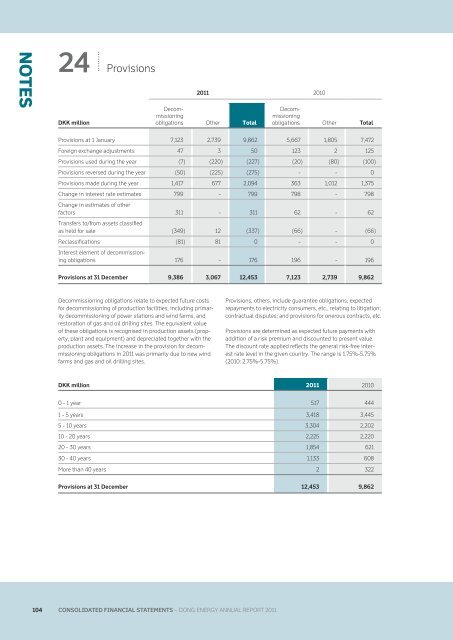

24 Provisions<br />

DKK million<br />

<strong>2011</strong> 2010<br />

Decommissioning<br />

obligations Other total<br />

Decommissioning<br />

obligations Other total<br />

Provisions at 1 January 7,123 2,739 9,862 5,667 1,805 7,472<br />

Foreign exchange adjustments 47 3 50 123 2 125<br />

Provisions used during the year (7) (220) (227) (20) (80) (100)<br />

Provisions reversed during the year (50) (225) (275) - - 0<br />

Provisions made during the year 1,417 677 2,094 363 1,012 1,375<br />

Change in interest rate estimates 799 - 799 798 - 798<br />

Change in estimates of other<br />

factors 311 - 311 62 - 62<br />

Transfers to/from assets classifi ed<br />

as held for sale (349) 12 (337) (66) - (66)<br />

Reclassifi cations (81) 81 0 - - 0<br />

Interest element of decommissioning<br />

obligations 176 - 176 196 - 196<br />

provisions at 31 December 9,386 3,067 12,453 7,123 2,739 9,862<br />

Decommissioning obligations relate to expected future costs<br />

for decommissioning of production facilities, including primarily<br />

decommissioning of power stations and wind farms, and<br />

restoration of gas and oil drilling sites. The equivalent value<br />

of these obligations is recognised in production assets (property,<br />

plant and equipment) and depreciated together with the<br />

production assets. The increase in the provision for decommissioning<br />

obligations in <strong>2011</strong> was primarily due to new wind<br />

farms and gas and oil drilling sites.<br />

Provisions, others, include guarantee obligations; expected<br />

repayments to electricity consumers, etc., relating to litigation;<br />

contractual disputes; and provisions for onerous contracts, etc.<br />

Provisions are determined as expected future payments with<br />

addition of a risk premium and discounted to present value.<br />

The discount rate applied refl ects the general risk-free interest<br />

rate level in the given country. The range is 1.75%-5.75%<br />

(2010: 2.75%-5.75%).<br />

DKK million <strong>2011</strong> 2010<br />

0 - 1 year 517 444<br />

1 - 5 years 3,418 3,445<br />

5 - 10 years 3,304 2,202<br />

10 - 20 years 2,225 2,220<br />

20 - 30 years 1,854 621<br />

30 - 40 years 1,133 608<br />

More than 40 years 2 322<br />

provisions at 31 December 12,453 9,862<br />

100 104 COnsOliDatED finanCial statEmEnts – <strong>DONG</strong> ENERGY GROUP <strong>ANNUAL</strong> <strong>ANNUAL</strong> <strong>REPORT</strong> <strong>REPORT</strong> <strong>2011</strong><br />

<strong>2011</strong>