Microsoft Word - Agenda 121109 - College of the Desert

Microsoft Word - Agenda 121109 - College of the Desert

Microsoft Word - Agenda 121109 - College of the Desert

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

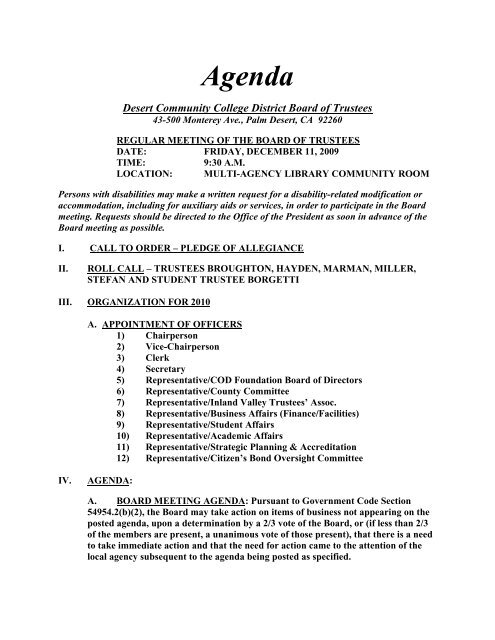

<strong>Agenda</strong><br />

<strong>Desert</strong> Community <strong>College</strong> District Board <strong>of</strong> Trustees<br />

43-500 Monterey Ave., Palm <strong>Desert</strong>, CA 92260<br />

REGULAR MEETING OF THE BOARD OF TRUSTEES<br />

DATE: FRIDAY, DECEMBER 11, 2009<br />

TIME: 9:30 A.M.<br />

LOCATION: MULTI-AGENCY LIBRARY COMMUNITY ROOM<br />

Persons with disabilities may make a written request for a disability-related modification or<br />

accommodation, including for auxiliary aids or services, in order to participate in <strong>the</strong> Board<br />

meeting. Requests should be directed to <strong>the</strong> Office <strong>of</strong> <strong>the</strong> President as soon in advance <strong>of</strong> <strong>the</strong><br />

Board meeting as possible.<br />

I. CALL TO ORDER – PLEDGE OF ALLEGIANCE<br />

II. ROLL CALL – TRUSTEES BROUGHTON, HAYDEN, MARMAN, MILLER,<br />

STEFAN AND STUDENT TRUSTEE BORGETTI<br />

III. ORGANIZATION FOR 2010<br />

A. APPOINTMENT OF OFFICERS<br />

1) Chairperson<br />

2) Vice-Chairperson<br />

3) Clerk<br />

4) Secretary<br />

5) Representative/COD Foundation Board <strong>of</strong> Directors<br />

6) Representative/County Committee<br />

7) Representative/Inland Valley Trustees’ Assoc.<br />

8) Representative/Business Affairs (Finance/Facilities)<br />

9) Representative/Student Affairs<br />

10) Representative/Academic Affairs<br />

11) Representative/Strategic Planning & Accreditation<br />

12) Representative/Citizen’s Bond Oversight Committee<br />

IV. AGENDA:<br />

A. BOARD MEETING AGENDA: Pursuant to Government Code Section<br />

54954.2(b)(2), <strong>the</strong> Board may take action on items <strong>of</strong> business not appearing on <strong>the</strong><br />

posted agenda, upon a determination by a 2/3 vote <strong>of</strong> <strong>the</strong> Board, or (if less than 2/3<br />

<strong>of</strong> <strong>the</strong> members are present, a unanimous vote <strong>of</strong> those present), that <strong>the</strong>re is a need<br />

to take immediate action and that <strong>the</strong> need for action came to <strong>the</strong> attention <strong>of</strong> <strong>the</strong><br />

local agency subsequent to <strong>the</strong> agenda being posted as specified.

B. CONFIRMATION OF AGENDA: Approve <strong>the</strong> agenda <strong>of</strong> <strong>the</strong> Regular Meeting<br />

<strong>of</strong> December 11, 2009, with any additions, corrections, or deletions.<br />

V. PUBLIC COMMENTS (<strong>Agenda</strong> Items): PERSONS WHO WISH TO SPEAK TO<br />

THE BOARD ON ANY ITEM SHOULD COMPLETE THE “REQUEST TO<br />

ADDRESS THE BOARD” FORM AND PRESENT IT TO THE SECRETARY.<br />

PERSONS WHO WISH TO SPEAK TO THE BOARD ON ANY ITEM MAY DO<br />

SO AT THIS TIME. THERE IS A TIME LIMIT OF 3 MINUTES PER PERSON<br />

AND 15 MINUTES PER TOPIC, UNLESS FURTHER TIME IS GRANTED BY<br />

THE BOARD.<br />

VI. APPROVE THE MINUTES OF:<br />

1. The Regular meeting <strong>of</strong> November 13, 2009.<br />

VII. REPORTS<br />

A. GOVERNING BOARD<br />

B. COLLEGE OF THE DESERT FOUNDATION<br />

C. COLLEGE OF THE DESERT ALUMNI ASSOCIATION<br />

D. ACADEMIC SENATE<br />

E. FACULTY ASSOCIATION<br />

F. C.O.D.A.A.<br />

G. CSEA<br />

H. ASCOD<br />

VIII. ADMINISTRATIVE REPORTS<br />

A. President<br />

B. Vice President Business Affairs – Dr. Edwin Deas<br />

C. Vice President Academic Affairs – Farley Herzek<br />

D. Vice President Student Affairs – Dr. Diane Ramirez<br />

IX. CONSENT AGENDA: All items on <strong>the</strong> Consent <strong>Agenda</strong> will be considered for<br />

approval by a single vote without discussion. Any Board member may request that<br />

an item be pulled from <strong>the</strong> Consent <strong>Agenda</strong> to be discussed and considered<br />

separately in <strong>the</strong> Action <strong>Agenda</strong>.<br />

A. BUSINESS AFFAIRS – Human Resources<br />

1. Hourly Personnel – Student Workers/Substitutes<br />

2. Leadership/Confidential – Working Out-<strong>of</strong>-Class<br />

3. Employment Agreements<br />

B. BUSINESS AFFAIRS – Business Services, Fiscal Services<br />

1. Change Order #2 – Dining Hall Renovation – Doug Wall Construction<br />

2. Change Order #1 – Dining Hall Renovation – Kincaid Industries<br />

3. Change Order #1 – Dining Hall Renovation – Los Angeles Air Conditioning<br />

4. Approval <strong>of</strong> Contracts<br />

5. Payroll #5

6. To Ratify or Approve Out-<strong>of</strong>-State/Country Travel<br />

X. ACTION AGENDA<br />

A. ITEMS PULLED FROM THE CONSENT AGENDA FOR SEPARATE<br />

DISCUSSION AND CONSIDERATION<br />

B. BOARD OF TRUSTEES<br />

1. Revised Board Policy 1200: District Mission – Second Reading<br />

2. Accept President and Leadership Voluntary Salary Reduction and Support <strong>of</strong><br />

Fiscal Solvency<br />

C. PRESIDENT<br />

1. Approval <strong>of</strong> <strong>the</strong> Certification <strong>of</strong> Signature Form<br />

D. HUMAN RESOURCES<br />

1. Approval <strong>of</strong> <strong>Desert</strong> Community <strong>College</strong> District’s Proposed Amendments to<br />

Conflict-<strong>of</strong>-Interest Code<br />

2. Leadership – Non-renewal <strong>of</strong> Contracts<br />

3. Leadership – Ending <strong>of</strong> Contract<br />

4. Leadership – Approval <strong>of</strong> Job Description<br />

5. Leadership - Appointment<br />

E. BUSINESS AFFAIRS – Business Services, Fiscal Services, Facilities Services<br />

1. Acceptance <strong>of</strong> 2008-2009 Audit Reports<br />

2. Receive 2008-2009 Audit Report for <strong>the</strong> <strong>College</strong> <strong>of</strong> <strong>the</strong> <strong>Desert</strong> Foundation<br />

3. Quarterly Financial Report 2009-2010<br />

4. Resolution #194 for Budget Adjustments<br />

5. Public Hearing Categorical Flexibility for 2009-2010 Budget<br />

6. Adoption <strong>of</strong> Resolution #195 Categorical Flexibility for 2009-2010<br />

Budget<br />

7. Approval <strong>of</strong> Warrant Lists<br />

8. Approve MOU between City <strong>of</strong> Indio Redevelopment Agency and <strong>Desert</strong><br />

Community <strong>College</strong> District<br />

F. ACADEMIC AFFAIRS – Instruction<br />

1. Approval <strong>of</strong> Curriculum Modifications for 2010-11 Academic Year

XI. SUGGESTIONS FOR FUTURE AGENDAS<br />

XII. ADJOURN TO CLOSED SESSION<br />

XIII. CLOSED SESSION:<br />

1. CONFERENCE WITH LABOR NEGOTIATOR, Pursuant to Section 54957.6;<br />

labor unions on campus include CTA, CODAA, and CSEA; Agency Designated<br />

Representative: Dr. Edwin Deas<br />

2. PUBLIC EMPLOYEE/GOVERNMENT CODE SECTION 54957:<br />

Discipline/Dismissal/Release <strong>of</strong> a Public Employee<br />

3. CONFERENCE WITH REAL PROPERTY NEGOTIATORS<br />

Property: Parcel Numbers: 657230015, 657230025, 657230028, 669330015,<br />

669330025, 669330029, 669330030, 657280015, 657280014, 657280016,<br />

657280002, 657280003, 6693300294, 717270002, 717270003, 717270004,<br />

71270007, 71720008, 71720011, 71720012, 71720012, 71720014, 664100002,<br />

664100003, 664100019, 664110046, 664190025, 663290003, 663250004, 664110051<br />

and 611211002.<br />

Agency Negotiator: Dr. Edwin Deas<br />

Negotiating Parties: Jim Goodell<br />

Under Negotiation: Reviewing Land Acquisition<br />

4. FINAL DISTRICT DECISION APPEAL (Complaint involving information<br />

protected by Federal Law – pursuant to Section 54956.86)<br />

Representative: Dr. Edwin Deas<br />

XIV. RECONVENE TO OPEN SESSION<br />

1. Closed session report (if any)<br />

XV. ADJOURN

DESERT COMMUNITY COLLEGE DISTRICT<br />

REGULAR BOARD MEETING<br />

MULTI-AGENCY LIBRARY COMMUNITY ROOM<br />

FRIDAY, NOVEMBER 13, 2009<br />

MINUTES<br />

I. CALL TO ORDER – PLEDGE OF ALLEGIANCE<br />

The meeting was called to order at 9:36 a.m. by Board Chair Broughton. Michelle Price,<br />

past Student Trustee and ASCOD President, led <strong>the</strong> Pledge <strong>of</strong> Allegiance.<br />

II. ROLL CALL<br />

Trustees Becky Broughton, Charles Hayden, John Marman, Bonnie Stefan and Student<br />

Trustee Borgetti were present. Merle C. “Bud” Miller was not present.<br />

III. AGENDA:<br />

A. CONFIRMATION OF AGENDA:<br />

Trustee Broughton asked that a closed session be added following <strong>the</strong> ASCOD report. This<br />

closed session item would be “Conference with Labor Negotiator”. A motion was made by<br />

Trustee Stefan, seconded by Trustee Marman, to approve <strong>the</strong> agenda <strong>of</strong> <strong>the</strong> regular meeting<br />

<strong>of</strong> October 16, 2009 with <strong>the</strong> change noted. The motion carried unanimously with one<br />

absent.<br />

IV. PUBLIC COMMENTS (All Items):<br />

None.<br />

V. APPROVE THE MINUTES OF:<br />

There were no corrections to <strong>the</strong> minutes <strong>of</strong> October 16, 2009 and <strong>the</strong>y stand approved.<br />

VI. REPORTS<br />

A. GOVERNING BOARD<br />

Trustee Hayden had nothing to report.<br />

Trustee John Marman reported on his activities:<br />

Attended various athletic contests as well as Homecoming.<br />

Gave a campus tour to Michael Barnard, new Interim Exec. Director <strong>of</strong> <strong>the</strong><br />

Foundation<br />

Attended a Palm Springs Unified School District Advisory Board meeting<br />

Attended an East Valley Alumni Committee meeting<br />

Attended a Pathways to Success Steering Committee meeting<br />

Attended <strong>the</strong> Student Senate Forum

Trustee Marman stated that after <strong>the</strong> Board Retreat <strong>the</strong> Board wanted to make a statement<br />

<strong>of</strong> support to <strong>the</strong> President during this fiscal crisis. He distributed a Proclamation and read<br />

it aloud.<br />

Trustee Broughton asked for a verbal consensus in support <strong>of</strong> <strong>the</strong> Proclamation. The<br />

following Trustees approved <strong>of</strong> <strong>the</strong> Proclamation: Becky Broughton, John Marman, Bonnie<br />

Stefan, Cindy Borgetti. Trustee Hayden had no comment. Trustee Miller was absent.<br />

Trustee Stefan had nothing to report but thanked <strong>the</strong> Alumni Association for <strong>the</strong><br />

Homecoming Bar-B-Q.<br />

Student Trustee Borgetti had two Power Point Presentations that were not compatible with<br />

<strong>the</strong> laptop and will email it to <strong>the</strong> o<strong>the</strong>r Trustees. She reported on her activities:<br />

Attended <strong>the</strong> CCCSSA Leadership Conference<br />

Attended a Textbook Affordability Taskforce meeting<br />

Attend <strong>the</strong> ASCOD Senate Open Forum<br />

Attended <strong>the</strong> HACU Conference in Orlando, FL<br />

Trustee Marman pointed out that grades will be due soon and asked Vice President Herzek<br />

to encourage Faculty to get <strong>the</strong>ir grades in on time. He also asked Student Trustee Borgetti<br />

how <strong>the</strong> Faculty did with <strong>the</strong>ir textbook approval turn-ins. Student Trustee Borgetti asked<br />

Vice President Ramirez to report. Dr. Ramirez reported <strong>the</strong> improvement went from 5% to<br />

65% this time.<br />

Trustee Broughton thanked everyone for all <strong>the</strong> hard work put into <strong>the</strong> Board Retreat. She<br />

thought <strong>the</strong> Board learned more about <strong>the</strong>ir job as Trustees and <strong>the</strong> college and how it<br />

functions. The various presentations, including Pam LiCalsi’s presentation on Institutional<br />

Effectiveness; <strong>the</strong> first draft <strong>of</strong> <strong>the</strong> Annual Report; Amy DiBello and Carol Lasquade’s<br />

presentation on learning outcomes and assessments, were all extremely informative and<br />

beneficial. Trustee Broughton was extremely pleased to have heard <strong>the</strong> entire faculty was<br />

working as a team to move forward with <strong>the</strong> SLO’s and assessments.<br />

Trustee Broughton also reported on her o<strong>the</strong>r activities:<br />

Attended <strong>the</strong> Homecoming Bar-B-Q and game and would like to have seen more<br />

faculty and staff attend.<br />

Attended an East Valley Friends and Alumni meeting in Mecca and thanked Dean<br />

Juan Lujan for <strong>the</strong> opportunity to introduce more members <strong>of</strong> our community to<br />

that campus.<br />

Attended meetings with Accreditation Standard IV Team for COD’s Accreditation<br />

Self-Study.<br />

Toured <strong>the</strong> new Alumni Building<br />

B. COLLEGE OF THE DESERT FOUNDATION<br />

Michael Barnard, Interim Executive Director <strong>of</strong> <strong>the</strong> Foundation was present and gave a brief<br />

report.

C. COLLEGE OF THE DESERT ALUMNI ASSOCIATION<br />

Mr. Gene Marchu, Executive Director <strong>of</strong> <strong>the</strong> Alumni Association, was present and gave a<br />

brief report.<br />

D. ACADEMIC SENATE<br />

Dr. Rey Ortiz, Academic Senate President, was present and gave a brief report.<br />

E. FACULTY ASSOCIATION<br />

Mr. Chuck Decker, President <strong>of</strong> <strong>the</strong> Faculty Association, was present and gave a brief report.<br />

F. C.O.D.A.A.<br />

Dr. Fergus Currie, President <strong>of</strong> CODAA, was not able to attend and had previously emailed<br />

his report to <strong>the</strong> Board <strong>of</strong> Trustees.<br />

G. CSEA<br />

Ms. Mary Lisi, President <strong>of</strong> CSEA, was present and gave a brief report.<br />

H. ASCOD<br />

Ms. Aries Jaramillo, President <strong>of</strong> ASCOD, was present and gave a brief report.<br />

Dr. Diane Ramirez, Vice President, Student Affairs, congratulated Michelle Price, former<br />

Student Trustee and ASCOD President on her selection as a Senator to <strong>the</strong> California<br />

Community <strong>College</strong> Board <strong>of</strong> Governors.<br />

VII. ADJOURN TO CLOSED SESSION<br />

VIII. CLOSED SESSION:<br />

1. CONFERENCE WITH LABOR NEGOTIATOR, Pursuant to Section 54957.6; labor<br />

unions on campus include CTA, CODAA, and CSEA; Agency Designated Representative:<br />

Dr. Edwin Deas<br />

IX. RECONVENE TO OPEN SESSION<br />

1. No reportable action taken in closed session.<br />

X. ADMINISTRATIVE REPORTS<br />

A. President<br />

President Patton reminded everyone to be sure to look at COD’s online newsletter, The<br />

Insider, as it contains information about everything that happens at <strong>the</strong> college.<br />

Dr. Edwin Deas, Vice President, Business Affairs, reported <strong>the</strong> State Community <strong>College</strong><br />

Facility Coalition has accorded <strong>College</strong> <strong>of</strong> <strong>the</strong> <strong>Desert</strong> an award <strong>of</strong> merit for building design<br />

<strong>of</strong> <strong>the</strong> Nursing & Health Sciences Center. The award notes <strong>the</strong> building contains a modern<br />

nursing skills lab with patient simulator mannequins, a flexible use EMT lab, demonstration<br />

and viewing areas, media learning rooms, a computer lab, lecture rooms as well as <strong>of</strong>fices

and support facilities. They also note <strong>the</strong> new facility respects <strong>the</strong> strong architectural<br />

language <strong>of</strong> <strong>the</strong> existing campus and <strong>the</strong>re are innovative, sustainable design features in<br />

abundance. This project is registered with <strong>the</strong> U.S. Green Building Council and will receive<br />

Leed Silver status, which is our first.<br />

XI. CONSENT AGENDA: All items on <strong>the</strong> Consent <strong>Agenda</strong> will be considered for<br />

approval by a single vote without discussion. Any Board member may request that<br />

an item be pulled from <strong>the</strong> Consent <strong>Agenda</strong> to be discussed and considered<br />

separately in <strong>the</strong> Action <strong>Agenda</strong>.<br />

A motion was made by Trustee Stefan, seconded by Trustee Marman, to approve <strong>the</strong><br />

consent agenda as presented. The motion carried unanimously with one absent.<br />

A. BUSINESS AFFAIRS – Human Resources<br />

1. Approval <strong>of</strong> <strong>the</strong> 2010-2011 Holiday Schedule<br />

2. Classified – Continuation <strong>of</strong> Assignment<br />

3. Classified – Temporary On-Call Appointments<br />

4. Classified – Termination/Resignations<br />

5. Hourly Personnel – Adjunct Faculty<br />

6. Hourly Personnel – Student Workers/Tutors<br />

7. Volunteers<br />

8. Employment Agreements<br />

B. BUSINESS AFFAIRS – Business Services, Fiscal Services<br />

1. Change Order #1 – Alumni Association Building Project – Doug Wall<br />

Construction<br />

2. Gifts/Donations to <strong>the</strong> District<br />

3. Approval <strong>of</strong> Contracts<br />

4. Payroll #4<br />

5. To Ratify or Approve Out-<strong>of</strong>-State/Country Travel<br />

XII. ACTION AGENDA<br />

A. BOARD OF TRUSTEES<br />

1. Annual Organization meeting date.<br />

A motion was made by Student Trustee Borgetti, seconded by Trustee Stefan, to<br />

approve <strong>the</strong> annual organization meeting date <strong>of</strong> December 11, 2009 as presented. The<br />

motion carried unanimously with one absent.<br />

2. New Board Policy 6850: Sustainability Stewardship – Second Reading<br />

Dr. Deas explained this was a landmark for <strong>College</strong> <strong>of</strong> <strong>the</strong> <strong>Desert</strong>. This is a voluntary<br />

policy and an example <strong>of</strong> COD setting standards by which it will be judged. The Policy<br />

states <strong>College</strong> <strong>of</strong> <strong>the</strong> <strong>Desert</strong> will practice a high level <strong>of</strong> sustainability stewardship in

everything we do. The Policy is guided by eight principles that cover everything from<br />

green building, to our operating practices, to our curriculum.<br />

A motion was made by Trustee Hayden, seconded by Trustee Stefan, to approve <strong>the</strong><br />

new board policy as presented. The motion carried unanimously with one absent.<br />

B. BUSINESS AFFAIRS – Business Services, Fiscal Services, Facilities Services<br />

1. Bid Award – Facilities Yard Improvements<br />

A motion was made by Trustee Hayden, seconded by Student Trustee Borgetti, to<br />

approve <strong>the</strong> bid award to MJS Construction as presented. The motion carried<br />

unanimously with one absent.<br />

2. Bid Award – Nursing Building (original) Renovation<br />

A motion was made by Trustee Stefan, seconded by Student Trustee Borgetti, to<br />

approve <strong>the</strong> bid award to ORR Builders as presented. The motion carried unanimously<br />

with one absent.<br />

3. Bid Award – Cravens Student Services Center Bid Package 24 for Audio Visual<br />

Equipment and Installation<br />

A motion was made by Student Trustee Borgetti, seconded by Trustee Stefan, to<br />

approve <strong>the</strong> bid award to Western Audio Visual as presented. The motion carried<br />

unanimously with one absent.<br />

4. Notice <strong>of</strong> Completion – Alumni Association Building Project<br />

A motion was made by Trustee Marman, seconded by Trustee Stefan, to accept <strong>the</strong><br />

notice <strong>of</strong> completion as presented. The motion carried unanimously with one absent.<br />

5. Receive <strong>the</strong> CCFS311 Annual Budget Report<br />

A motion was made by Trustee Stefan, seconded by Trustee Marman, to receive <strong>the</strong><br />

CCFS311 Annual Budget Report as presented. The motion carried unanimously with<br />

one absent.<br />

6. Resolution #193 for Budget Adjustments<br />

A motion was made by Trustee Stefan, seconded by Trustee Marman, to approve<br />

Resolution #193 for Budget Adjustments as presented. A roll-call vote was taken with<br />

all members voting aye. The motion carried unanimously with one absent.<br />

7. Approval <strong>of</strong> Warrant Lists<br />

A motion was made by Trustee Hayden, seconded by Trustee Stefan, to approve <strong>the</strong><br />

warrant lists as presented. The motion carried unanimously with one absent.

Wade Ellis, Director <strong>of</strong> Fiscal Services, distributed a handout and gave a brief budget<br />

update.<br />

8. Rejection <strong>of</strong> Claim<br />

A motion was made by Trustee Hayden, seconded by Trustee Stefan, to approve <strong>the</strong><br />

rejection <strong>of</strong> claim as presented. The motion carried unanimously with one absent.<br />

C. ACADEMIC AFFAIRS – Instruction<br />

1. Approval <strong>of</strong> <strong>the</strong> 2010-2011 and 2011-2012 <strong>College</strong> <strong>of</strong> <strong>the</strong> <strong>Desert</strong> Academic<br />

Calendars<br />

A motion was made by Trustee Hayden, seconded by Student Trustee Borgetti, to<br />

approve <strong>the</strong> 2010-2011 and 2011-2012 <strong>College</strong> <strong>of</strong> <strong>the</strong> <strong>Desert</strong> Academic Calendars as<br />

presented. The motion carried unanimously with one absent.<br />

2. Approval <strong>of</strong> Curriculum Modifications for 2010-11 Academic Year<br />

A motion was made by Trustee Stefan, seconded by Trustee Hayden, to approve <strong>the</strong><br />

curriculum modifications as presented. The motion carried unanimously with one<br />

absent.<br />

D. HUMAN RESOURCES<br />

1. 45-Day Lay<strong>of</strong>f Notices<br />

A motion was made by Trustee Hayden, seconded by Trustee Stefan, to approve <strong>the</strong> 45day<br />

lay<strong>of</strong>f notices as presented.<br />

Discussion followed. Mary Lisi, President CSEA Union, stated this agenda item is<br />

worded erroneously as it refers to “positions be reduced or discontinued”. It would<br />

need to say “subject to negotiations” to be correct. President Patton stated <strong>the</strong> intent<br />

was “reduction in force”, not reduction in hours.<br />

For <strong>the</strong> purposes <strong>of</strong> clarification, it was suggested this item should read “The Board <strong>of</strong><br />

Trustees approves <strong>the</strong> following classified positions be “reduced in force” or<br />

discontinued effective……”. Wade Ellis fur<strong>the</strong>r clarified <strong>the</strong> item should read “<strong>the</strong><br />

following classified positions be discontinued effective………”. The intent is to lay<strong>of</strong>f<br />

classified staff. It is a 45-day lay<strong>of</strong>f notice. Approval <strong>of</strong> this item does not mean <strong>the</strong>se<br />

positions are being laid <strong>of</strong>f. The approval <strong>of</strong> this item allows <strong>the</strong> discussions regarding<br />

lay<strong>of</strong>fs to commence. It is a formality before <strong>the</strong> 45 day notices would be sent out. It<br />

has not been determined who <strong>the</strong> notices will go to.<br />

Trustee Stefan wanted to be sure that all parties understood what <strong>the</strong> intent <strong>of</strong> this item<br />

is. The intent is for <strong>the</strong> Board to give <strong>the</strong> Administration <strong>the</strong> authority to start <strong>the</strong><br />

process. All parties agreed.<br />

The motion carried unanimously with one absent.

XIII. SUGGESTIONS FOR FUTURE AGENDAS<br />

1. Trustee Marman asked for a report on textbooks and how students get <strong>the</strong> help <strong>the</strong>y<br />

need in purchasing textbooks and who <strong>the</strong>y go to.<br />

XIV. ITEMS OF INFORMATION<br />

1. Revised Board Policy 1200: District Mission – First Reading<br />

XV. ADJOURN TO CLOSED SESSION<br />

XVI. CLOSED SESSION:<br />

1. CONFERENCE WITH REAL PROPERTY NEGOTIATORS<br />

Property: Parcel Numbers: 657230015, 657230025, 657230028, 669330015, 669330025,<br />

669330029, 669330030, 657280015, 657280014, 657280016, 657280002, 657280003,<br />

6693300294, 717270002, 717270003, 717270004, 71270007, 71720008, 71720011,<br />

71720012, 71720012, 71720014, 664100002, 664100003, 664100019, 664110046,<br />

664190025, 663290003, 663250004, 664110051 and 611211002.<br />

Under Negotiation: Reviewing Land Acquisition<br />

Dr. Edwin Deas<br />

XVII. RECONVENE TO OPEN SESSION<br />

No reportable action taken in closed session.<br />

XVIII. ADJOURN<br />

A motion was made by Trustee Stefan to adjourn. Meeting adjourned at 1:35 p.m.<br />

_____________________________<br />

By: Charles Hayden, Clerk

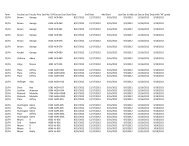

STUDENT WORKER/SUBSTITUTE LISTING - DECEMBER 2009<br />

Funding<br />

Source<br />

Hourly 1=lnternal E-<br />

Name Title Department Salary Dates/Comments External<br />

Albright, Elizabeth Student Worker Financial Aid $8.50 7/1/09 - 6/30/10 - 15 hours max/wk E<br />

Blunt, Laura Student Worker CDC/CW $8.50 11/1/09 - 6/30/10 - 20 hours max/wk E<br />

Davis, Antoine Student Worker Athletics $8.50 11/15/09 - 5/30/10-15 hours max/wk I<br />

Khadka, Ranjan Student Worker Student Life $8.50 10/6/09 - 12/30/09 - 15 hours max/wk E<br />

King, Sahah Student Worker CDC $8.50 10/30/09 - 6/30/10 - 20 hours max/wk E<br />

Martinez, Benjamin Student Worker Athletics $8.50 11/12/09 - 5/30/10 - 12 hours max/wk I<br />

Miller, Jeneigih Student Worker CDC $8.50 7/1/09 - 6/30/10 - 15 hours max/wk E<br />

Monreal, Isabel Student Worker EVC $8.50 7/1/09 - 6/30/10 - 15 hours max/wk E<br />

Puga, Yolanda Student Worker ASC $8.50 7/10/09 - 6/30/10 - 20 hours max/wk E<br />

Saldana Parades,Raquel Student Worker CDC $8.50 7/1/09 - 6/30/10 - lS hours max/wk E<br />

SOOI1, Eva Student Worker CDC $8.50 8/29/09 - 6/30/10 - S hours max/wk I&E<br />

10/30/09 -to substitute for Nancy Keller<br />

Nickoli, Christine Substitute SS&A/Gallery $13.19 (resigned) until replacement is hired. E<br />

To cover Admin Asst, VP Instruction, for 2<br />

Eley, Mary Substitute Academic Affairs $18.57 days while Admin Asst is on vacation.

DESERT COMMUNITY COLLEGE DISTRICT AGENDA ITEM<br />

BOARD OF TRUSTEES<br />

Date <strong>of</strong> Meeting December 11. 2009 Area Human Resources<br />

Communication No. *2<br />

TOPIC: LEADERSHIP/CONFIDENTIAL· WORKING OUT·OF·CLASS<br />

PROPOSAL<br />

To ratify <strong>the</strong> working out·<strong>of</strong>·class assignment for <strong>the</strong> following individual on <strong>the</strong> effective<br />

date indicated:<br />

Marisol Reyes, Sr. Human Resources Tech, Human Resources, 1.0 FTE, effective<br />

October 12, 2009 through November 12, 2009, Range III, Step 4, on <strong>the</strong> leadership<br />

salary schedule.<br />

BACKGROUND<br />

Ms. Reyes worked 80 hours in training PeopleAdmin (electronic application process)<br />

with Barbara Creson on portions <strong>of</strong> <strong>the</strong> electronic process that Ms. Creson will be doing<br />

in <strong>the</strong> Employment Specialist position. Ms. Creson had been out ill when <strong>the</strong> training<br />

was originally given.<br />

BUDGET IMPLICATIONS<br />

Ms. Reyes' salary will be Range V, Step 1, on <strong>the</strong> leadership salary schedule and will<br />

be an increase <strong>of</strong> $3.90 per hour for 80 hours, totaling $312.00 .<br />

RECOMMENDATION<br />

It is recommended that <strong>the</strong> out·<strong>of</strong>·class assignment for Ms. Reyes be ratified on <strong>the</strong><br />

effective date indicated .<br />

Prepared by:<br />

Approved by:

DESERT COMMUNITY COLLEGE DISTRICT AGENDA ITEM<br />

BOARD OF TRUSTEES<br />

Date <strong>of</strong> Meeting December 11. 2009 Area Business Affairs - Human Resources<br />

TOPIC: EMPLOYMENT AGREEMENTS<br />

PROPOSAL<br />

To ratify <strong>the</strong> listing <strong>of</strong> employment agreements as provided.<br />

BACKGROUND<br />

Communication No. *;!<br />

In order to assure appropriate compliance with relevant state and Federal laws, <strong>the</strong><br />

District is entering into employment agreements with individuals who provide particular<br />

kinds <strong>of</strong> services. Primarily <strong>the</strong>se individuals will be serving as Community Education<br />

presenters or Contract Education instructors. There are also occasional agreements for<br />

specialized services which support a variety <strong>of</strong> programs within <strong>the</strong> District. In all cases,<br />

<strong>the</strong> length <strong>of</strong> service is governed by <strong>the</strong> term <strong>of</strong> <strong>the</strong> agreement and no permanency<br />

rights are attached.<br />

BUDGET IMPLICATIONS<br />

Funding for <strong>the</strong> various agreements are self-generating, externally funded, or provided<br />

for in <strong>the</strong> District's budget. (see attached)<br />

RECOMMENDATION<br />

It is recommended that <strong>the</strong> attached listing <strong>of</strong> employment agreements be ratified as<br />

presented.<br />

Prepared by:<br />

Approved by:

DESERT COMMUNITY COLLEGE DISTRICT AGENDA ITEM<br />

BOARD OF TRUSTEES<br />

Date <strong>of</strong> Meeting December 11. 2009 Area Business Affairs - Business Services<br />

Communication No . .r:<br />

TOPIC: Change Order #2 - Dining Hall Renovation - Doug Wall Construction<br />

PROPOSAL<br />

That <strong>the</strong> Board <strong>of</strong> Trustees approves Change Order #2 to <strong>the</strong> contract with Doug Wall<br />

Construction for <strong>the</strong> renovation <strong>of</strong> <strong>the</strong> Dining Hall Building.<br />

BACKGROUND<br />

Change Order #2 is a change order in <strong>the</strong> amount <strong>of</strong> $6,889.00 to provide for utility<br />

connections to <strong>the</strong> new infrastructure system that were not in <strong>the</strong> original scope <strong>of</strong> work.<br />

This change order is in <strong>the</strong> amount <strong>of</strong> $6,889.00, amending <strong>the</strong> total contract amount to<br />

$1,383,553.00. The completion date remains unchanged at February 26, 2010. The<br />

total change order amount remains within <strong>the</strong> 10% allowance <strong>of</strong> $137,200.00.<br />

BUDGET IMPLICATIONS<br />

This project is funded by Measure B Bond proceeds and remains within budget.<br />

Note: This change order relates to work which was originally budgeted in <strong>the</strong><br />

infrastructure project and consequently a savings <strong>of</strong> $6,889.00 will be made in that<br />

budget.<br />

RECOMMENDATION<br />

The President recommends that <strong>the</strong> Board <strong>of</strong> Trustees approve Change Order #2 to <strong>the</strong><br />

contract with Doug Wall Construction for <strong>the</strong> Dining Hall Renovation, amending <strong>the</strong><br />

contract amount to $1,383,553.00.<br />

Prepared by:<br />

Approved by:<br />

Vice Presi enf,8usi es ffairs

DESERT COMMUNITY COLLEGE DISTRICT AGENDA ITEM<br />

BOARD OF TRUSTEES<br />

Date <strong>of</strong> Meeting December 11, 2009 Area Business Affairs - Business Services<br />

Communication No. 2*<br />

TOPIC: Change Order #1 - Dining Hall Renovation - Kincaid Industries<br />

PROPOSAL<br />

That <strong>the</strong> Board <strong>of</strong> Trustees approves Change Order #1 to <strong>the</strong> contract with Kincaid<br />

Industries for <strong>the</strong> renovation <strong>of</strong> <strong>the</strong> Dining Hall Building.<br />

BACKGROUND<br />

Change Order #1 is a change order in <strong>the</strong> amount <strong>of</strong> $31 ,538.00 to provide for utility<br />

connections to <strong>the</strong> new infrastructure system that were not in <strong>the</strong> original scope <strong>of</strong> work.<br />

This change order is in <strong>the</strong> amount <strong>of</strong> $31 ,538.00, amending <strong>the</strong> total contract amount<br />

to $392,538.00. The completion date remains unchanged at February 26, 2010. The<br />

total change order amount remains within <strong>the</strong> 10% allowance <strong>of</strong> $36,100.00.<br />

BUDGET IMPLICATIONS<br />

This project is funded by Measure B Bond proceeds and remains within budget.<br />

Note: This change order relates to work which was originally budgeted in <strong>the</strong><br />

infrastructure project and consequently a savings <strong>of</strong> $31 ,538.00 will be made in that<br />

budget.<br />

RECOMMENDATION<br />

The President recommends that <strong>the</strong> Board <strong>of</strong> Trustees approve Change Order #1 to <strong>the</strong><br />

contract with Kincaid Industries for <strong>the</strong> Dining Hall Renovation, amending <strong>the</strong> contract<br />

amount to $392,538.00.<br />

Prepared by:<br />

Approved by:

DESERT COMMUNITY COLLEGE DISTRICT AGENDA ITEM<br />

BOARD OF TRUSTEES<br />

Date <strong>of</strong> Meeting December 11. 2009 Area Business Affairs - Business Services<br />

Communication No. 3*<br />

TOPIC: Change Order #1 - Dining Hall Renovation - Los Angeles Air Conditioning<br />

PROPOSAL<br />

That <strong>the</strong> Board <strong>of</strong> Trustees approves Change Order #1 to <strong>the</strong> contract with Los Angeles<br />

Air Conditioning for <strong>the</strong> renovation <strong>of</strong> <strong>the</strong> Dining Hall Building.<br />

BACKGROUND<br />

Change Order #1 is a change order in <strong>the</strong> amount <strong>of</strong> $44,933.00 to provide for utility<br />

connections to <strong>the</strong> new infrastructure system that were not in <strong>the</strong> original scope <strong>of</strong> work.<br />

This change order is in <strong>the</strong> amount <strong>of</strong> $44,933.00, amending <strong>the</strong> total contract amount<br />

to $580,933.00. The completion date remains unchanged at February 26, 2010. The<br />

total change order amount remains within <strong>the</strong> 10% allowance <strong>of</strong> $53,600.00.<br />

BUDGET IMPLICATIONS<br />

This project is funded by Measure B Bond proceeds and remains within budget.<br />

Note: This change order relates wo work which was originally budgeted in <strong>the</strong><br />

infrastructure project and consequently a savings <strong>of</strong> $44,933.00 will be made in that<br />

budget.<br />

RECOMMENDATION<br />

The President recommends that <strong>the</strong> Board <strong>of</strong> Trustees approve Change Order #1 to <strong>the</strong><br />

contract with Los Angeles Air Condition for <strong>the</strong> Dining Hall Renovation, amending <strong>the</strong><br />

contract amount to $580,933.00.<br />

Prepared by:<br />

Approved by:

DESERT COMMUNITY COLLEGE DISTRICT AGENDA ITEM<br />

BOARD OF TRUSTEES<br />

Date <strong>of</strong> Meeting December 11. 2009 Area Business Affairs - Business Services<br />

TOPIC: Approval <strong>of</strong> Contracts<br />

PROPOSAL<br />

To approve and ratify contracts.<br />

BACKGROUND<br />

Communication No. 4*<br />

Each month <strong>the</strong> Business Office submits contracts for Board approval. Because <strong>the</strong><br />

Board meets only once per month, <strong>the</strong>re are frequently periods and circumstances<br />

which do not allow for Board approval prior to entering into an agreement..<br />

In <strong>the</strong> case <strong>of</strong> contracting with pr<strong>of</strong>essional firms, <strong>the</strong> District <strong>of</strong>ten goes through a<br />

process <strong>of</strong> prequalification based on status, work history, suitability for <strong>the</strong> work<br />

required, and fees. Contracts are subsequently awarded from within <strong>the</strong> prequalified<br />

group <strong>of</strong> firms. Such is <strong>the</strong> case with <strong>the</strong> listed contracts that are part <strong>of</strong> <strong>the</strong> Bond'<br />

Program.<br />

BUDGET IMPLICATIONS<br />

The contracts are put through an approval process which includes verification <strong>of</strong> funds<br />

available in <strong>the</strong> budget.<br />

RECOMMENDATION<br />

The President recommends that <strong>the</strong> Board <strong>of</strong> Trustees approve/ratify <strong>the</strong> contracts<br />

presented.<br />

Prepared by:<br />

Approved by:<br />

contracts

Board <strong>of</strong> Trustees Meeting<br />

December 11, 2009<br />

LIST OF CONTRACTS/AGREEMENTS<br />

Center for Training & Development (CTD)<br />

Arbor Youth Opportunity Center<br />

This agreement is to provide 24 hours <strong>of</strong> computer application training on<br />

December 7, 2009, January 25, 2010, March 15 - April 2, 2010 for a fee <strong>of</strong><br />

$4,500.00 per course <strong>of</strong>fering, not to exceed $15,000.00.<br />

CAL WORKS Agreement<br />

S & B Foods<br />

This work study agreement is for student employment for Crystal Hinojosa from<br />

10/01/09 - 6/30/10 for a fee not to exceed $3,500.00.<br />

Intensive English Academy (lEA)<br />

Agreements with:<br />

Genesis Immigration (P) Ltd . For marketing efforts in India<br />

Kemeredu for marketing efforts in Turkey<br />

Global Tourism Education for marketing efforts in Vietnam & India<br />

Jessica Consultants for marketing efforts in India<br />

Fees payable are:<br />

One-time marketing fee <strong>of</strong> $700.00 for each student recruited<br />

$600.00 for each student who enrolls in <strong>the</strong> lEA 16-week program<br />

$300.00 for each student who enrolls in <strong>the</strong> lEA 8-week program<br />

$700.00 for each student who enrolled in <strong>the</strong> lEA who <strong>the</strong>n enrolls in COD<br />

Referral and Enrollment <strong>of</strong> 3 - 5 stUdents<br />

Referral and Enrollment <strong>of</strong> 6 - 9 students<br />

Referral and Enrollment <strong>of</strong> 10 or more students<br />

$1,000<br />

$2,000<br />

$3,000

Grant Funded Agreements<br />

Shadow Mountain Resort<br />

This agreement is for <strong>the</strong> use <strong>of</strong> <strong>the</strong> tennis courts for <strong>the</strong> spring 2010 academic<br />

semester in <strong>the</strong> amount <strong>of</strong> $1 ,950.00.<br />

Law Firm <strong>of</strong> Zampi. Determan & Erickson. LLP<br />

This agreement is for legal services for <strong>the</strong> 2009-2010 academic year at a rate <strong>of</strong><br />

$135.00 per hour.

DESERT COMMUNITY COLLEGE DISTRICT AGENDA ITEM<br />

BOARD OF TRUSTEES<br />

Date <strong>of</strong> Meeting December 11. 2009 Area Business Affairs - Fiscal Services<br />

TOPIC: To Ratify or Approve Out-<strong>of</strong>-State/Country Travel<br />

PROPOSAL<br />

Communication No. 6*<br />

1. Academic Affairs - To Approve Out-ot-State Travel for Ms. Caroline Conway,<br />

Applied Science and Business Division, to attend <strong>the</strong> 40 th Annual Institute <strong>of</strong> <strong>Desert</strong><br />

Ecology in Tucson, AZ, April 15-18, 2010.<br />

2. Academic Affairs - To Approve Out-ot-State Travel for Ms. Elizabeth Morgan,<br />

Applied Science and Business Division, to attend <strong>the</strong> 40 th Annual Institute ot <strong>Desert</strong><br />

Ecology in Tucson, AZ, April 15-18, 2010.<br />

3. Academic Affairs - To Ratify Out-<strong>of</strong>-State Travel for Ms. Melissa Flora, Math/Science<br />

Division, to participate in <strong>the</strong> Quality Education for Minorities (QEM) Follow-up Forums<br />

for Hispanic Serving Institutions (HSls) in Las Vegas, NV, December 4-5, 2009.<br />

4. Academic Affairs - To Ratify Out-<strong>of</strong>-State Travel for Ms. Karen Tabor, Math/Science<br />

Division, to participate in <strong>the</strong> Quality Education for Minorities (QEM) Follow-up Forum<br />

for HSls in Las Vegas, NV, December 3-5, 2009.<br />

5. Academic Affairs - To Approve Out-ot-State for Mr. Dean Dowty, Head Football<br />

Coach, to participate in <strong>the</strong> National Football Coaches Convention in Orlando, FL,<br />

January 10-13, 2010.<br />

6. Student Affairs - To Ratify Out-<strong>of</strong>-State Travel for Ms. Heidi Granger, Director <strong>of</strong><br />

Financial Aid, to attend <strong>the</strong> Annual U. S. Department <strong>of</strong> Education's Federal Student Aid<br />

Conterence (formerly known as <strong>the</strong> Electronic Access Conference (EAC)) in Nashville,<br />

TN, December 1-3, 2009.<br />

BACKGROUND<br />

1. The participants in this conference will expand <strong>the</strong>ir knowledge <strong>of</strong> Sonoran <strong>Desert</strong><br />

ecology and learn about current research .<br />

2. The participants in this conference will expand <strong>the</strong>ir knowledge <strong>of</strong> Sonoran <strong>Desert</strong><br />

ecology and learn about current research .

3. The purpose <strong>of</strong> this forum is to provide STEM (science, technology, engineering and<br />

ma<strong>the</strong>matics) faculty from an expanded group <strong>of</strong> HSls with information on existing<br />

programs at <strong>the</strong> National Science Foundation (NSF) that <strong>of</strong>fer support in several <strong>of</strong> <strong>the</strong><br />

areas <strong>of</strong> critical needs in STEM identified by <strong>the</strong> September 2009 Outreach Forum<br />

participants.<br />

4. This purpose <strong>of</strong> this forum is to provide STEM (science, technology, engineering and<br />

ma<strong>the</strong>matics) faculty from an expanded group <strong>of</strong> HSls with information on existing<br />

programs at <strong>the</strong> National Science Foundation (NSF) that <strong>of</strong>fer support in several <strong>of</strong> <strong>the</strong><br />

areas <strong>of</strong> critical needs in STEM identified by <strong>the</strong> September 2009 Outreach Forum<br />

participants.<br />

5. To participate in legislation, changes, rules, and voting in <strong>the</strong> Football Association.<br />

6. Ms. Granger will attend this conference in order to learn about <strong>the</strong> four new<br />

regulatory packages recently released by <strong>the</strong> Legislature in <strong>the</strong> Higher Education<br />

Opportunity Act. She will learn about <strong>the</strong> newly required electronic processes and <strong>the</strong><br />

newest regulations due to <strong>the</strong> passage <strong>of</strong> <strong>the</strong> Higher Education Act regarding <strong>the</strong><br />

financial aid programs. Additionally, she will be able to gain knowledge <strong>of</strong> <strong>the</strong> latest<br />

changes to both <strong>the</strong> technological processes and federal policies affecting fi nancial aid .<br />

BUDGET IMPLICATIONS<br />

1. Expenses will be paid from <strong>the</strong> Faculty Development funds.<br />

2. Expenses will be paid from <strong>the</strong> Faculty Development funds.<br />

3. OEM is paying all expenses.<br />

4. OEM is paying all expenses.<br />

5. There is no cost to <strong>the</strong> District. Costs will be borne by Varsity Club and Mr. Dowty.<br />

6. All expenses will be paid out <strong>of</strong> <strong>the</strong> BFAP Administration Allowance.<br />

RECOMMENDATION<br />

It is recommended that <strong>the</strong> Board <strong>of</strong> Trustees ratify or approve <strong>the</strong> out-<strong>of</strong>-state/country<br />

travel requests for <strong>the</strong> individuals listed.<br />

Prepared by:<br />

Approved by:

DESERT COMMUNITY COLLEGE DISTRICT AGENDA ITEM<br />

BOARD OF TRUSTEES<br />

Date <strong>of</strong> Meeting December 11. 2009 Area Board <strong>of</strong> Trustees<br />

Communication No.1<br />

TOPIC: Revised Board Policy 1200: District Mission - Second reading<br />

PROPOSAL<br />

The Board <strong>of</strong> Trustees <strong>of</strong> <strong>the</strong> <strong>Desert</strong> Community <strong>College</strong> District has requested <strong>the</strong><br />

approval <strong>of</strong> a revised board policy regarding District Mission .<br />

BACKGROUND<br />

In order to promote <strong>the</strong> efficiency <strong>of</strong> <strong>the</strong> Board, and in order to ensure compliance with<br />

<strong>the</strong> Brown Act, a Board policy regarding District Mission is being revised .<br />

Pursuant to Board Policy 2410, <strong>the</strong> Board <strong>of</strong> Trustees submits this Board Policy for a<br />

Second reading .<br />

BUDGET IMPLICATIONS<br />

None.<br />

RECOMMENDATION<br />

It is recommended that <strong>the</strong> Board <strong>of</strong> Trustees approves this revised Board Policy.<br />

Prepared and Approved by:<br />

John Marman<br />

Ct\a'r, Board <strong>of</strong> Trustees

DISTRICT MISSION<br />

DESERT COMMUNITY COLLEGE DISTRICT<br />

1200<br />

<strong>College</strong> <strong>of</strong> <strong>the</strong> <strong>Desert</strong> provides excellent educational programs and services that<br />

contribute to <strong>the</strong> success <strong>of</strong> our students and <strong>the</strong> vitality <strong>of</strong> <strong>the</strong> communities we serve.<br />

Vision<br />

<strong>College</strong> <strong>of</strong> <strong>the</strong> <strong>Desert</strong> will be a center <strong>of</strong> collaborations and innovations for educational<br />

enrichment, economic development and quality <strong>of</strong> life in <strong>the</strong> Coachella Valley and<br />

surrounding communities.<br />

Approval Date: December 9,2004<br />

Revised: December 11,2009

RECOMMENDATION<br />

It is recommended that <strong>the</strong> <strong>Desert</strong> Community <strong>College</strong> District Board <strong>of</strong> Trustees<br />

accept <strong>the</strong> proposed salary reductions as indicated and authorize <strong>the</strong> President<br />

to take appropriate action to keep <strong>the</strong> college fiscally solvent through long range<br />

planning.<br />

Prepared and Approved by:

· PROCLAMATION<br />

he <strong>College</strong> <strong>of</strong> <strong>the</strong> <strong>Desert</strong> Board <strong>of</strong> Trustees acknowledges <strong>the</strong> significant impact to <strong>the</strong> <strong>College</strong>'s budget by <strong>the</strong><br />

state's fiscal crisis and <strong>the</strong> resulting reduction in state appropriations, we want to continue to focus and keep in<br />

mind our mission to provide <strong>the</strong> best possible education to <strong>the</strong> students <strong>of</strong> our District. The Board also<br />

acknowledges <strong>the</strong> recovery <strong>of</strong> <strong>the</strong> nation and <strong>the</strong> State <strong>of</strong> California may extend for several years before <strong>the</strong><br />

restoration <strong>of</strong> budget reductions actually returns to <strong>the</strong> <strong>College</strong>. In that respect, <strong>the</strong> Board <strong>of</strong> Trustees has, by<br />

Board Policy, delegated <strong>the</strong> responsibility for fiscal solvency to <strong>the</strong> President <strong>of</strong> <strong>the</strong> <strong>College</strong> and issues this<br />

Proclamation:<br />

WHEREAS, The Board <strong>of</strong> Trustees hereby continues to support <strong>the</strong> efforts <strong>of</strong> <strong>the</strong> President for <strong>the</strong> <strong>College</strong> to<br />

remain fiscally sound through prudent stewardship during <strong>the</strong>se difficult economic times. The Board realizes<br />

that many difficult decisions and activities will occur over <strong>the</strong> course <strong>of</strong>time to enact this proclamation, and <strong>the</strong><br />

Board also appreciates <strong>the</strong> fact that students, faculty and staff understand <strong>the</strong> enormity <strong>of</strong> <strong>the</strong> state's fiscal crisis<br />

and that all such necessary fiscal stewardship actions will impact everyone; and<br />

WHEREAS, <strong>the</strong> Board <strong>of</strong> Trustees encourages <strong>the</strong> president to continue <strong>the</strong> long-range plmming necessary to<br />

spread out <strong>the</strong> fiscal activity over multiple years in order to minimize <strong>the</strong> monetary impact in anyone year; and<br />

WHEREAS, <strong>the</strong> Board <strong>of</strong> Trustees continues to authorize <strong>the</strong> President to take appropriate action, within all<br />

rules, regulations, laws and bargaining agreements, which is necessary to keep <strong>the</strong> <strong>College</strong> fiscally sound;<br />

NOW THEREFORE, <strong>the</strong> Board <strong>of</strong> Trustees recognizes and accepts <strong>the</strong> voluntary salary reduction <strong>of</strong> <strong>the</strong><br />

President <strong>of</strong> 5.5% annual salary effective July 1,2009 and <strong>the</strong> 2.5% voluntary salary reduction <strong>of</strong> <strong>the</strong><br />

eadership Group effective January 1, 2010 through June 30, 2010 by taking furlough days during this six<br />

month period. The Board <strong>of</strong> Trustees also expresses appreciation in advance to <strong>the</strong> Leadership Group for<br />

actively participating in salary and benefit adjustments along with o<strong>the</strong>r employee groups for <strong>the</strong> FY 10-11.<br />

Issued this 13 th Day <strong>of</strong> November, 2009 by <strong>the</strong> <strong>College</strong> <strong>of</strong> <strong>the</strong> <strong>Desert</strong> Board <strong>of</strong> Trustees.<br />

101m Mwmuut<br />

$o.wlie. S te/aft<br />

S tmlenl g'tw.Jtre

(<br />

DESERT COMMUNITY COLLEGE DISTRICT<br />

BOARD OF TRUSTEES<br />

Date <strong>of</strong> Meeting December 11 , 2009<br />

Area President<br />

TOPIC: Approval <strong>of</strong> <strong>the</strong> Certification <strong>of</strong> Signatures Form<br />

PROPOSAL<br />

Communication No.1<br />

AGENDA ITEM<br />

To approve <strong>the</strong> certification <strong>of</strong> signatures form verifying signatures <strong>of</strong> members <strong>of</strong> <strong>the</strong><br />

Governing Board and persons authorized to sign orders drawn on <strong>the</strong> funds <strong>of</strong> <strong>the</strong><br />

District and New Employee Authorization Transmittal. The individuals are as follows:<br />

Merle C. "Bud" Miller<br />

Rebecca Broughton<br />

John Marman<br />

Bonnie Stefan<br />

Charles Hayden, Jr.<br />

Jerry R. Patton<br />

Robert Blizinski<br />

Edwin Deas<br />

WadeW. Ellis<br />

BACKGROUND<br />

In accordance with <strong>the</strong> provisions <strong>of</strong> Education Code Sections 42633 and 85233, a<br />

certification <strong>of</strong> signatures form must be completed following <strong>the</strong> annual organization<br />

meeting <strong>of</strong> <strong>the</strong> Board. The annual organization meeting <strong>of</strong> <strong>the</strong> Board is on December<br />

11, 2009. The Certification <strong>of</strong> Signatures form verifies <strong>the</strong> signatures <strong>of</strong> members <strong>of</strong> <strong>the</strong><br />

governing board and persons authorized to sign orders drawn on <strong>the</strong> funds <strong>of</strong> <strong>the</strong><br />

District and New Employee Authorization Transmittals. In accordance with Education<br />

Code 42632, no person o<strong>the</strong>r than an <strong>of</strong>ficer or employee <strong>of</strong> <strong>the</strong> District can be<br />

authorized to sign orders.<br />

BUDGET IMPLICATIONS<br />

None.

RECOMMENDATION<br />

The President recommends that <strong>the</strong> Board <strong>of</strong> Trustees approve <strong>the</strong>se individuals to<br />

provide authorized signatures for <strong>the</strong> purposes <strong>of</strong> contractual obligations for <strong>the</strong> District.<br />

Prepared & Approved by:

CONFLICT OF INTEREST CODE FOR THE<br />

DESERT COMMUNITY COLLEGE DISTRICT<br />

The Political Refonn Act (Govemment Code Section 81000, et sC

CONFLICT OF INTEREST CODE DISCLOSURE CATEGORlES<br />

Disclosure Categories: The disclosure categories listed below identify <strong>the</strong> types <strong>of</strong><br />

investments, business entities, sources <strong>of</strong>incomc, or real property that <strong>the</strong> designated<br />

employees must disclose for each disclosure category to which he or she is assigned.<br />

Category 1:<br />

Persons in this category shall disclose aU interest in real property located ill .<br />

<strong>the</strong> jurisdiction or within two (2) miles <strong>of</strong> any land purchased or leased by <strong>the</strong><br />

Agency.<br />

Category 2:<br />

Persous in this category shall disclose all business positions, investments in, or<br />

income, including gifts, loans and travel payments, received from business entities that<br />

manufacture, provide or sell services andlor supplies, books, machinery, equipment.<br />

provisions or o<strong>the</strong>r property <strong>of</strong> <strong>the</strong> type utilized by <strong>the</strong> Agency.<br />

Category 3:<br />

Persons in this category shall disclose business positions, investments in, or<br />

income, including gifts, loans and travel payments received frol11 sources which arc<br />

contractors or subcontractors engaged in <strong>the</strong> performance <strong>of</strong> work or services <strong>of</strong> <strong>the</strong> type<br />

utilizcd by <strong>the</strong> Agency.<br />

Category 4: .<br />

Persons in this category shall disclose all business positions, investments in, or income,<br />

including gifts, loans and travel payments received from business entities that<br />

manufacture, provide or sell services and/or supplies, books, machinery or equipment <strong>of</strong><br />

<strong>the</strong> type utilized by <strong>the</strong> Department.

CONFLICT OF INTEREST CODE FOR THE DESERT COMMUNITY COLLEGE DISTRICT<br />

Designated Employees<br />

Board Members<br />

President<br />

2009-2010<br />

APPENDIX A<br />

DESIGNATED POSITIONS<br />

Executive Assistant and Supervisor <strong>of</strong> <strong>the</strong> SYpeHnlendenUPresident's Office<br />

Vice President, Business Affairs<br />

Vice President, Academic Affairs<br />

Vice President, Student Affairs<br />

Dean, Social Sciences & Arts<br />

Dean, Student Support Programs and Services<br />

Dean, Enrollment Services<br />

Dean, Ma<strong>the</strong>matics and Science<br />

Dean, Heallh Sciences and Early Childhood Education<br />

Dean, Communication<br />

Dean, Applied Sciences & Business<br />

Dean, Physical Education & Athletics<br />

Dean, Information Systems and Educational Technology<br />

Dean, Off Campus Programs<br />

Executive Director, Human Resources and Labor Relations<br />

Gean, Traifliflg-&-Gevelepmafll Executive Director, Institutional Effectiveness<br />

Director, Public Relations<br />

Director, Fiscal Services<br />

Director, Business Services<br />

Director, Financial Aid<br />

Disclosure<br />

Categories<br />

1, 2, 3<br />

1 , 2, 3<br />

4<br />

1, 2, 3<br />

1, 2, 3<br />

1, 2, 3<br />

4<br />

4<br />

4<br />

4<br />

4<br />

4<br />

4<br />

4<br />

4<br />

4<br />

1 , 2, 3<br />

2, 3<br />

4<br />

2, 3<br />

2, 3<br />

4

Director, Student Health & Disability Services 4<br />

Director, MaintenanGe & Gp8falieRS Facilities Services 2, 3, 4<br />

Director, Child Development Center 4<br />

Director, Admissions and Records 4<br />

Director, Systems Management & MIS Operations 4<br />

Director, Library 4<br />

Director, International Student Program 3, 4<br />

Director, Network Services & Telecommunications 4<br />

Director, Institutional Research 4<br />

Director, Student Life 4<br />

Director, Educational Technology & Web Services 4<br />

Director <strong>of</strong> Counseling Services 4<br />

Director, Nursing & Allied Health 4<br />

Director, Security & Emergency Preparedness 4<br />

Director, Advanced Transportation Technology State-wide Initiative 4<br />

Assistant Director, MaiRtenanGe-&-Gp8fatieRS Facilities Services 2, 3, 4<br />

Program Director, Advanced Transportation Technology Center 4<br />

Program Director, Workplace Learning Resources Center 4<br />

Supervisor, Custodial Services 2, 3<br />

Supervisor, Maintenance and Grounds 2, 3<br />

'Consultants All<br />

'Consultants must be included in <strong>the</strong> list <strong>of</strong> designated employees and must disclose pursuant to<br />

<strong>the</strong> broadest disclosure category in this code subject to <strong>the</strong> following limitation: The president<br />

may determine in writing that a particular consultant, although a "designated position", is hired to<br />

perform a range <strong>of</strong> duties that are limited in scope and thus is not required to comply fully with <strong>the</strong><br />

disclosure requirements described in this Section. Such wri/len determination shall include a<br />

description <strong>of</strong>/he consultant's duties and, based on that description, a statement <strong>of</strong>/he extent <strong>of</strong><br />

disclosure requirements. The president's determination is a public record and shall be retained<br />

for public inspection in <strong>the</strong> same manner and location as this conflict-<strong>of</strong>-interest code.

DESERT COMMUNITY COLLEGE DISTRICT AGENDA ITEM<br />

BOARD OF TRUSTEES<br />

Date <strong>of</strong> Meeting December 11. 2009 Area Business Affairs - Human Resources<br />

Communication No. £<br />

TOPIC: LEADERSHIP· NON·RENEWAL OF CONTRACTS<br />

PROPOSAL<br />

To approve <strong>the</strong> non-renewal <strong>of</strong> contracts, effective June 30, 2010, for <strong>the</strong> following<br />

Leadership employees listed by employee number:<br />

Employee number-41931<br />

Employee number-43175<br />

Employee number - 39540<br />

Employee number - 43328<br />

Employee number -- 2595<br />

BACKGROUND<br />

The above Leadership employees will be provided with a notice in accordance with <strong>the</strong><br />

provisions <strong>of</strong> <strong>the</strong>ir contract <strong>of</strong> employment and Education Code Section 72411. Their<br />

contracts <strong>of</strong> employment will not be renewed for <strong>the</strong> 2010-2011 academic year.<br />

BUDGET IMPLICATIONS<br />

The non-renewal <strong>of</strong> contracts, when taken toge<strong>the</strong>r with certain o<strong>the</strong>r proposals on<br />

Leadership positions, will result in overall savings to <strong>the</strong> General Fund Budget.<br />

RECOMMENDATION<br />

It is recommended that <strong>the</strong> non-renewal <strong>of</strong> contracts for <strong>the</strong> above Leadership<br />

employees be approved on <strong>the</strong> effective date indicated.<br />

Prepared by:<br />

Approved by:

DESERT COMMUNITY COLLEGE DISTRICT AGENDA ITEM<br />

BOARD OF TRUSTEES<br />

Date <strong>of</strong> Meeting December 11. 2009 Area Business Services-Human Resources<br />

TOPIC: LEADERSHIP - JOB DESCRIPTION<br />

PROPOSAL<br />

Communication No. 1<br />

To approve a new job description for <strong>the</strong> Leadership position, Title V Project Director.<br />

BACKGROUND<br />

The Title V Project Director is an Academic Administrator designated by <strong>the</strong> Board <strong>of</strong><br />

Trustees <strong>of</strong> <strong>the</strong> <strong>Desert</strong> Community <strong>College</strong> District. Under <strong>the</strong> direct supervision <strong>of</strong> <strong>the</strong><br />

Vice President <strong>of</strong> Academic Affairs, <strong>the</strong> Project Director is responsible for <strong>the</strong> leadership<br />

necessary to establish, implement, manage, report, maintain, coordinate, and analyze<br />

all aspects <strong>of</strong> <strong>the</strong> objectives <strong>of</strong> <strong>the</strong> Title V project. This will include making decisions<br />

and recommendations related to implementing <strong>the</strong> goals <strong>of</strong> <strong>the</strong> grant; assisting in <strong>the</strong><br />

hiring <strong>of</strong> project staff; coordinating <strong>the</strong> activities <strong>of</strong> both campuses; working closely with<br />

administrators, faculty, staff and consultants; developing and submitting reports to <strong>the</strong><br />

US Department <strong>of</strong> Education; and serving on strategic administrative committees. This<br />

position will oversee <strong>the</strong> activities <strong>of</strong> faculty and classified employees, as defined by <strong>the</strong><br />

project, in performing <strong>the</strong> work in a timely and productive manner.<br />

BUDGET IMPLICATIONS<br />

This position will be Y Rated through June 30, 2012 on <strong>the</strong> Leadership salary schedule<br />

and <strong>the</strong> salary will be funded 51 % from Categorical funding and 49% from <strong>the</strong> District<br />

General fund . In addition, 100% <strong>of</strong> <strong>the</strong> benefits will be categorically funded .<br />

RECOMMENDATION<br />

To approve <strong>the</strong> new job description for <strong>the</strong> Leadership position, Title V Project Director.<br />

Prepared by:<br />

Approved by:<br />

Affairs

DESERT COMMUNITY COllEGE DISTRICT<br />

TITLE V PROJECT DIRECTOR<br />

BASIC FUNCTION<br />

Under <strong>the</strong> direct supervision <strong>of</strong> <strong>the</strong> Vice President <strong>of</strong> Academic Affairs, <strong>the</strong> Project Director is<br />

responsible for <strong>the</strong> leadership necessary to establish, implement, manage, report, maintain,<br />

coordinate, and analyze all aspects <strong>of</strong> <strong>the</strong> objectives <strong>of</strong> <strong>the</strong> Title V project. This will include<br />

making decisions and recommendations related to implementing <strong>the</strong> goals <strong>of</strong> <strong>the</strong> grant;<br />

assisting in <strong>the</strong> hiring <strong>of</strong> project staff; coordinating <strong>the</strong> activities <strong>of</strong> both campuses; working<br />

closely with administrators, faculty, staff and consultants; developing and submitting reports<br />

to <strong>the</strong> US Department <strong>of</strong> Education; and serving on strategic administrative committees. This<br />

position will oversee <strong>the</strong> activities <strong>of</strong> faculty and classified employees, as defined by <strong>the</strong><br />

project, in performing <strong>the</strong> work in a timely and productive manner.<br />

REPRESENTATIVE DUTIES<br />

1. Serves as <strong>the</strong> administrator <strong>of</strong> <strong>the</strong> project, providing leadership and oversight on all<br />

Title V grant components at <strong>the</strong> COD and PDC campuses.<br />

2. Provides guidelines and direction in relation to <strong>the</strong> project with special focus on<br />

faculty and staff development.<br />

3. Directly supervises all employees related to <strong>the</strong> project, including continual review<br />

and evaluation <strong>of</strong> employee progress toward all projects.<br />

4. Serves as Title V liaison between project participants and <strong>College</strong> and University<br />

administrations.<br />

5. Manages <strong>the</strong> project budget and provides regular fiscal activity reports to <strong>the</strong> Vice<br />

President <strong>of</strong> Academic Affairs, and o<strong>the</strong>r administrators in a timely and efficient<br />

manner.<br />

6. Administers policies and procedures in collaboration with appropriate administrators<br />

in order to maintain appropriate record keeping and ensure that <strong>the</strong> project is<br />

meeting accurate reporting requirements.<br />

7. Facilitates maximum utilization <strong>of</strong> resources and personnel to reach objectives<br />

effectively.<br />

8. Monitors and evaluates progress <strong>of</strong> Title V components and <strong>the</strong>ir impact on <strong>the</strong><br />

institutions.<br />

9. Maintains positive working relationships with Program Officer in Washington D.C.<br />

10. Maintains current knowledge <strong>of</strong> Title V policies, rules, and regulations. Includes<br />

development <strong>of</strong> project manual and detailed implementation timelines.<br />

11. Establishes and maintains adequate information and training to <strong>the</strong> college and<br />

university communities in programs developed.<br />

POSITION<br />

This is a full-time Academic Administrator position that is responsible for coordinating <strong>the</strong><br />

successful implementation <strong>of</strong> a Title V Cooperative grant awarded to <strong>College</strong> <strong>of</strong> <strong>the</strong> <strong>Desert</strong> in<br />

partnership with <strong>the</strong> Palm <strong>Desert</strong> Campus (PDe) <strong>of</strong> California State University, San

Bernardino. The grant has three principal components. The first, mostly under <strong>the</strong><br />

supervision <strong>of</strong> PDC, will focus on providing counseling/advising and academic support<br />

services to assist more students to transfer from a community college to a university, to<br />

succeed at <strong>the</strong> university level and to graduate in a timely manner. The second component<br />

will create a Faculty Development Center to assist faculty and related staff to develop more<br />

appropriate strategies and methodologies in and out <strong>of</strong> <strong>the</strong> classroom to increase student<br />

learning and success. This grant will address <strong>the</strong> question: How can each institution most<br />

effectively engage faculty and staff in new teaching and learning strategies, as well as<br />

effective advising techniques, that lead to specifically defined student learning outcomes.<br />

The third component will aim at developing improved mechanisms for increasing support and<br />

funding for both institutions. In addition, this grand commits 20% <strong>of</strong> <strong>the</strong>se grant funds, half<br />

to each institution, to provide a financial aid endowment to foster university transfer and<br />

graduation. Continuation <strong>of</strong> this position is contingent upon grant funding.<br />

KNOWLEDGE AND ABILITIES<br />

Knowledge and experience in faculty and staff pr<strong>of</strong>essional development.<br />

Ability to work with internal and external participant in building and maintaining positive<br />

relationships.<br />

Physical ability to work effectively in an environment which is typical <strong>of</strong> this position.<br />

The ability to speak Spanish is strongly desired.<br />

EDUCATION AND EXPERIENCE<br />

Any combination equivalent to a Master's degree from an accredited institution <strong>of</strong> higher<br />

education in a related field <strong>of</strong> study. Strong expertise in <strong>the</strong> teaching/learning environment.<br />

Five (5) years <strong>of</strong> progressively responsible management experience required in higher<br />

education, preferably with similar programs, including demonstrated experience in training<br />

and supervision <strong>of</strong> employees. Strong background in report writing, formal communications<br />

and budget management. Strong interpersonal skills. Demonstrated experience in<br />

facilitating and collaborating work across college divisions and departments.<br />

LICENSES AND OTHER REQUIREMENTS<br />

Valid California driver's license, must have acceptable driving record and current vehicle<br />

insurance meeting State <strong>of</strong> California requirements.<br />

WORKING CONDITIONS<br />

Office environment. Constant interruptions. Requires some evening and weekend<br />

responsibilities.

DESERT COMMUNITY COLLEGE DISTRICT AGENDA ITEM<br />

BOARD OF TRUSTEES<br />

Date <strong>of</strong> Meeting December 11, 2009 Area Business Services-Human Resources<br />

TOPIC: LEADERSHIP - APPOINTMENT<br />

Communication No, §<br />

PROPOSAL<br />

To approve <strong>the</strong> Leadership appointment <strong>of</strong> Tony DiSalvo as TitleV Project Director,<br />

effective December 1, 2009 through June 30,2012.<br />

BACKGROUND<br />

Mr. DiSalvo has been Dean <strong>of</strong> <strong>the</strong> Communications Division since June 30, 2006. This<br />

appointment is <strong>the</strong> result <strong>of</strong> reorganization within <strong>the</strong> Office <strong>of</strong> Academic Affairs.<br />

BUDGET IMPLICATIONS<br />

As Mr. DiSalvo's salary will be grant funded for 51 %, this will result in a savings to <strong>the</strong><br />

District. Mr. DiSalvo's salary will remain on <strong>the</strong> Leadership salary schedule at Range<br />

XI, Step 9, through June 30, 2012.<br />

RECOMMENDATION<br />

It is recommended that <strong>the</strong> appointment <strong>of</strong> Tony DiSalvo be approved on <strong>the</strong> effective<br />

date indicted.<br />

Prepared by:<br />

Approved by:

DESERT COMMUNITY COLLEGE DISTRICT AGENDA ITEM<br />

BOARD OF TRUSTEES<br />

Date <strong>of</strong> Meeting December 11, 2009 Area Business Affairs - Fiscal Services<br />

TOPIC: Acceptance <strong>of</strong> 2008-2009 Audit Reports<br />

PROPOSAL<br />

Communication No, 1<br />

To accept <strong>the</strong> report <strong>of</strong> <strong>the</strong> District's auditors, Lund and Guttry LLP, for <strong>the</strong> 2008-2009<br />

fiscal year for <strong>the</strong> District, <strong>the</strong> <strong>Desert</strong> Community <strong>College</strong> District Auxiliary Services, and<br />

Measure B Bond Financial and Performance audits.<br />

BACKGROUND<br />

In accordance with State regulations, <strong>the</strong> District and its auxiliaries have undergone <strong>the</strong><br />

required annual audits. The reports are <strong>the</strong> result <strong>of</strong> auditor's review <strong>of</strong> finances,<br />

financial procedures, accounting controls and compliance with applicable State and<br />

Federal requirements. The reports are also filed with <strong>the</strong> required State agencies.<br />

BUDGET IMPLICATIONS<br />

None.<br />

RECOMMENDATION<br />

The President recommends <strong>the</strong> Board <strong>of</strong> Trustees accepts <strong>the</strong> 2008-2009 audit reports<br />

for <strong>the</strong> District, Auxiliary, and Measure B Bond Financial and Performance audits for<br />

study and discussion.<br />

Prepared by:<br />

Approved by:

DESERT COMMUNITY COLLEGE DISTRICT<br />

PALM DESERT, CALIFORNIA<br />

COUNTY OF RIVERSIDE<br />

INDEPENDENT AUDITORS' REPORT,<br />

FINANCIAL STATEMENTS AND<br />

SUPPLEMENTARY INFORMATION<br />

JUNE 30, 2009 AND 2008

Independent Auditors' Report<br />

Management's Discussion and Analysis<br />

Basic Financial Statements<br />

DESERT COMMUNITY COLLEGE DISTRICT<br />

Statements <strong>of</strong> Net Assets, June 30, 2009 and 2008<br />

AUDIT REPORT<br />

TABLE OF CONTENTS<br />

JUNE 30, 2009<br />

Statements <strong>of</strong> Revenues, Expenses and Changes in Net Assets, For <strong>the</strong><br />

Years Ended June 30, 2009 and 2008<br />

Statements <strong>of</strong> Cash Flows, For <strong>the</strong> Years Ended June 30, 2009 and 2008<br />

Statements <strong>of</strong> Fiduciary Net Assets, June 30, 2009 and 2008<br />

Statements <strong>of</strong> Changes in Fiduciary Net Assets, For <strong>the</strong> Years Ended<br />

June 30, 2009 and 2008<br />

Notes to <strong>the</strong> Financial Statements<br />

Required Supplementary Information<br />

Schedule <strong>of</strong> O<strong>the</strong>r Postemployment Benefits (OPEB) Funding<br />

Supplementary Information<br />

Independent Auditors' Report on Snpplementary Information<br />

Combining Statement <strong>of</strong> Net Assets - District, June 30, 2009<br />

Combining Statement <strong>of</strong> Net Assets - District, Jnne 30, 2008<br />

Combining Statements <strong>of</strong> Revenues, Expenses and Changes in Net Assets<br />

District, For <strong>the</strong> Year Ended June 30, 2009<br />

Combining Statements <strong>of</strong> Revenues, Expenses and Changes in Net Assets<br />

District, For <strong>the</strong> Year Ended June 30, 2008<br />

1-2<br />

3-18<br />

19<br />

20<br />

21-22<br />

23<br />

24<br />

25-48<br />

49<br />

50<br />

51-52<br />

53-54<br />

55-56<br />

57-58

DESERT COMMUNITY COLLEGE DISTRICT<br />

AUDIT REPORT<br />

TABLE OF CONTENTS<br />

JUNE 30, 2009<br />

Combining Statement <strong>of</strong> Fiduciary Net Assets, June 30, 2009<br />

Combining Statement <strong>of</strong> Fiduciary Net Assets, June 30, 2008<br />

Combining Statement <strong>of</strong> Changes in Fiduciary Net Assets, For <strong>the</strong> Year<br />

Ended June 30, 2009<br />

Combining Statement <strong>of</strong> Changes in Fiduciary Net Assets, For <strong>the</strong> Year<br />

Ended June 30, 2008<br />