Appellants' Reply Brief - Washington State Courts

Appellants' Reply Brief - Washington State Courts Appellants' Reply Brief - Washington State Courts

Appendix A

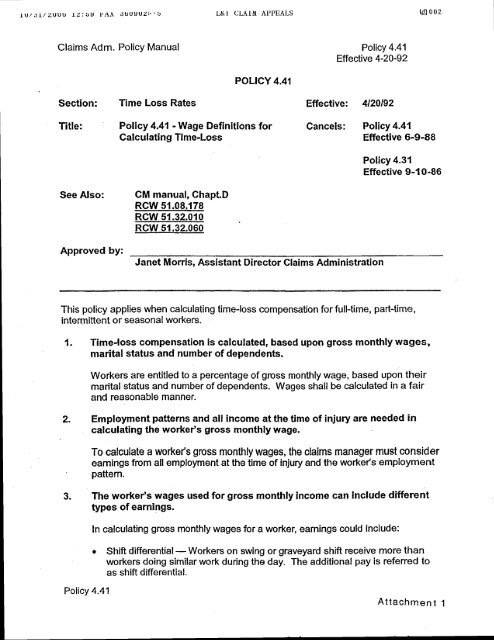

lU/Jl/ZUUb 1Z:SY PAh JbUYUZP'b Claims Adm. Policy Manual Section: Time Loss Rates LL(cJ CLAIM APPEALS POLICY 4.41 Title: Policy 4.41 - Wage Definitions for Calculating Time-Loss See Also: CM manual, ChaptD RCW 51.08.178 RCW 51.32.010 RCW 51.32.060 Approved by: Policy 4.41 Effective 4-20-92 Effective: 4120192 Cancels: Policy 4.41 Effective 6-9-88 Janet Morris, Assistant Director Claims Administration Policy 4.31 Effective 9-1 0-86 This policy applies when calculating time-loss compensation for full-time, part-time, intermittent or seasonal workers. 1 Time-loss compensation is calculated, based upon gross monthly wages, marital status and number of dependents. Workers are entitled to a percentage of gross monthly wage, based upon their marital status and number of dependents. Wages shall be calculated in a fair and reasonable manner. 2. Employment patterns and all income at the time of injury are needed in calculating the worker's gross monthly wage. To calculate a worker's gross monthly wages, the claims manager must consider earnings from all employment at the time of injury and the worker's employment pattern. 3. The worker's wages used for gross monthly income can include different types of earnings. Policy 4.41 In calculating gross monthly wages for a worker, earnings could include: Shift differential -Workers on swing or graveyard shift receive more than workers doing similar work during the day. The additional pay is referred to as shift differential. Attachment 1 - -

- Page 1 and 2: NO. 34504-8-11 COURT OF APPEALS, DI

- Page 3 and 4: Determine Earning Capacity Where A

- Page 5 and 6: Shelton v . Azar. 90 Wn . App . 923

- Page 7 and 8: I. OVERVIEW OF DEPARTMENT'S REPLY B

- Page 9 and 10: that the Board deducted from her gr

- Page 11 and 12: P.3d 583 (2001), the injured worker

- Page 13 and 14: equivalent could not be "fairly and

- Page 15 and 16: case. Hertzke v. Dep't ofRetirement

- Page 17 and 18: Employer's Quarterly Report of Hour

- Page 19 and 20: daily, weekly or monthly wage per R

- Page 21 and 22: Estate, 70 Wn. App. at 488; Lloyds

- Page 23 and 24: For example, a bookstore owner who

- Page 25 and 26: into a wage-equivalent (AB at 35-37

- Page 27 and 28: I. Case Law Analyzing The Fundament

- Page 29 and 30: expenditure was discretionary, but

- Page 31: cash to a bank account, and that th

- Page 35 and 36: 10/31/2006 13:OO FAX 360902""5 Clai

- Page 37 and 38: Claims Adm. Policy Manual Policy 4.

- Page 39 and 40: '- Insurance Services Policy Manual

- Page 41 and 42: Appendix C

- Page 43 and 44: (4) In cases where a wage has not b

lU/Jl/ZUUb 1Z:SY PAh JbUYUZP'b<br />

Claims Adm. Policy Manual<br />

Section: Time Loss Rates<br />

LL(cJ CLAIM APPEALS<br />

POLICY 4.41<br />

Title: Policy 4.41 - Wage Definitions for<br />

Calculating Time-Loss<br />

See Also: CM manual, ChaptD<br />

RCW 51.08.178<br />

RCW 51.32.010<br />

RCW 51.32.060<br />

Approved by:<br />

Policy 4.41<br />

Effective 4-20-92<br />

Effective: 4120192<br />

Cancels: Policy 4.41<br />

Effective 6-9-88<br />

Janet Morris, Assistant Director Claims Administration<br />

Policy 4.31<br />

Effective 9-1 0-86<br />

This policy applies when calculating time-loss compensation for full-time, part-time,<br />

intermittent or seasonal workers.<br />

1 Time-loss compensation is calculated, based upon gross monthly wages,<br />

marital status and number of dependents.<br />

Workers are entitled to a percentage of gross monthly wage, based upon their<br />

marital status and number of dependents. Wages shall be calculated in a fair<br />

and reasonable manner.<br />

2. Employment patterns and all income at the time of injury are needed in<br />

calculating the worker's gross monthly wage.<br />

To calculate a worker's gross monthly wages, the claims manager must consider<br />

earnings from all employment at the time of injury and the worker's employment<br />

pattern.<br />

3. The worker's wages used for gross monthly income can include different<br />

types of earnings.<br />

Policy 4.41<br />

In calculating gross monthly wages for a worker, earnings could include:<br />

Shift differential -Workers on swing or graveyard shift receive more than<br />

workers doing similar work during the day. The additional pay is referred to<br />

as shift differential.<br />

Attachment 1<br />

- -