Western Samoa Power System Planning Study - Asian Development ...

Western Samoa Power System Planning Study - Asian Development ...

Western Samoa Power System Planning Study - Asian Development ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

ASIAN DEVELOPMENT BANK<br />

WESTERN SAMOA POWER SYSTEM PLANNING STUDY<br />

T.A. NO . 1311 - SAM<br />

FINAL REPORT<br />

VOLUME 2 - APPENDICES & FIGURES<br />

ASIAN DEVELOPMENT BANK<br />

E,JIJ 2 G 1"1 `)<br />

91D POWER - mm - j- )<br />

NOVEMBER 1991 GIBB AUSTRALIA PTY LIMITED<br />

in association with JOHN WORRALL PTY LTD<br />

and COOPERS & LYBRAND ASSOCIATES LTD

12 November 1991<br />

Dear Sir,<br />

Yours faithfully,<br />

for GIBB AUSTRALIA F iY LIMITED<br />

P .J. COOPER<br />

En c1 .<br />

1 , 1 1 '. 1 . I • I : •<br />

I 1 . 1 1. , .,<br />

ITI :J .1ITED<br />

Pc, BOX ) : :' ('l : K I IN AC7F 21-U5<br />

-T : :L (Ik , )'w:FAA (rwll'h 1540<br />

RE : WESTERN SAMOA POWER SYSTEM PLANNING STUDY<br />

T .A. NO . 1311 - SAM<br />

FINAL REPORT<br />

We are pleased to forward twelve (12) copies of the above report, comprising :<br />

Volume 1 - Main Report<br />

Volume 2 - Appendices & Figures<br />

I I k' --' II I<br />

14 51A N L,-<br />

EID<br />

Note : 12 copies were also sent by<br />

Consultants to Government .<br />

J<br />

LOFMENT BANK<br />

\I A . A 1 . I 1' `<br />

I)<br />

.I<br />

n s r .<br />

PlkJ .c rcfcr u,<br />

C648/G<br />

I<br />

<strong>Asian</strong> <strong>Development</strong> Bank<br />

Distribution :<br />

6 ADS Avenue, . Programs East 3 (Mr . T . Watanabe)<br />

Mandaluyong,<br />

9 Records Section (Ms . L . Roa)<br />

Metro Manila PHILIPPINES<br />

3 .<br />

4 .<br />

Mr . J . E . Rockett<br />

Mr . S . R . Andrews<br />

(o .r .)<br />

A T TLNTtCN Mr . V . Krlshnaswamy<br />

Manager, <strong>Power</strong> Division (East)<br />

5 .<br />

6 .<br />

Mr . K . Sakai<br />

South Pacific Regional Office

WESTERN SAMOA POWER SYSTEM PLANNING STUDY<br />

APPENDIX A TERMS OF REFERENCE<br />

Figure B .1<br />

Figure B .2<br />

Figure B .3<br />

Figure 13 .4<br />

Figure B.5<br />

Figure B .6<br />

Figure B .7<br />

Figure B .8<br />

Figure B .9<br />

Figure 8 .10<br />

Figure B .11<br />

Figure B .12<br />

FINAL REPORT<br />

TABLE OF CONTENTS<br />

APPENDIX B LOAD CHARACTERISTICS<br />

8 .1 Introduction B/1<br />

13 .2 Data B/1<br />

B .3 Upolu Seasonal Load Characteristics B/1<br />

8 .4 Upolu Daily Load Curves B/2<br />

B .4 .1 Annual Peak Day B/3<br />

B .4 .2 Typical Weekday B13<br />

B .4 .3 Typical Weekend Days 6/4<br />

6 .5 Upolu Daily Load Duration Curves B/4<br />

B .6 Derived Upolu Annual Load Duration Curve B/4<br />

8 .7 Savai'i Seasonal Load Characteristics B/4<br />

B .8 Savai'i Daily Load Curves B/5<br />

Upolu Annual Peak Days<br />

Upolu Weekday Loads January 1988<br />

Upolu Weekday Loads March 1988<br />

Upolu Weekday Loads May 1988<br />

Upolu Weekday Loads August/Sept. 1988<br />

Upolu Saturday Loads 1988<br />

Upolu Sunday Loads 1988<br />

Upolu Load Duration Curves January 1988<br />

Upolu Load Duration Curves March 1988<br />

Upolu Load Duration Curves May 1988<br />

Upolu Load Duration Curves August/Sept . 1988<br />

Savai'i Weekday Loads - Four days in September 1989<br />

APPENDIX C RECONSTRUCTION OF EXISTING GENERATING PLANT<br />

C .1 General<br />

C .2 Tanugamanono <strong>Power</strong> Station<br />

C .3 Hydro Plant<br />

C3 .1 General<br />

C3.2 Fale-ole-Fee<br />

C3 .3 Lalomauga/Sauniatu<br />

C3 .4 Samasoni<br />

C3 .5 Alaoa<br />

C3 .6 Fuluasou<br />

A/1<br />

C/1<br />

C/1<br />

C/1<br />

C/1<br />

C/2<br />

C12<br />

C/3<br />

C/3<br />

C/4

TABLE OF CONTENTS (Cont)<br />

APPENDIX D REVIEW OF TECHNICAL MANPOWER D/1<br />

D .1 Organisation Chart D/1<br />

D .2 Level of Staffing D/1<br />

D .3 Policy of <strong>Samoa</strong>nisation D/1<br />

D .4 Recommendations D/2<br />

APPENDIX E FINANCIAL ANALYSIS<br />

Table 1 Summary of EPC's Financial Past Performance<br />

Table 2 Inflation Rate Assumptions<br />

Table 3 Forecasts of EPC's Sales and Generation 1988 to 2000<br />

Table 4 Diesel Fuel Price Forecasts and Forecasts of EPC Fuel Costs and Operating<br />

and Maintenance Costs<br />

Table 5 Summary of Loan Balances (Run A)<br />

Table 6 Summary of New Loans/Drawdowns (Run A)<br />

Table 7 Summary of Loan Repayments (Run A)<br />

Table 8 Summary of Loan Interest Payments (Run A)<br />

Run A Summary of Key Financial Indicators and Financial Statements<br />

Run B Summary of Key Financial Indicators and Financial Statement<br />

Run C Summary of Key Financial Indicators and Financial Statements<br />

Run D Summary of Key Financial Indicators and Financial Statements<br />

APPENDIX F GENERATION OPERATION MAINTENANCE PROCEDURES<br />

F.1 General F/1<br />

F .2 Tanugamanono <strong>Power</strong> Station F/1<br />

F .3 Tanugamanono <strong>Development</strong> Plan F/2<br />

APPENDIX G ORGANISATIONAL ISSUES : FINANCE & ACCOUNTING

FIGURES

WESTERN SAMOA POWER SYSTEM PLANNING STUDY<br />

DRAFT FINAL REPORT<br />

LIST OF FIGURES<br />

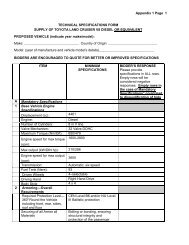

Figure 1 .1 <strong>Western</strong> <strong>Samoa</strong> - <strong>Power</strong> Generation and Distribution<br />

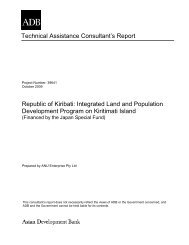

Figure 3 .1 Upolu Energy Generated<br />

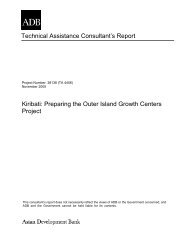

Figure 3 .2 Upolu Domestic Sales<br />

Figure 3 .3 Upolu Commercial Sales<br />

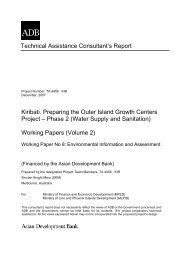

Figure 3.4 Upolu Industrial Sales<br />

Figure 3 .5 Upolu Hotel Sales<br />

Figure 3 .6 Upolu Religous & School Sales<br />

Figure 3.7 Long Term Energy Generated : Savai'i <strong>System</strong><br />

Figure 3.8 Energy Sales Savai'i <strong>System</strong>

GILBERT I5 i - ,<br />

ELLICE IS<br />

0<br />

p FIJI<br />

I<br />

I<br />

i<br />

WESTERN<br />

ti9~ SAMOA<br />

o`,~o ~<br />

C<br />

:q<br />

TONGA<br />

. . •<br />

E4<br />

r'1<br />

I<br />

PA C I F I C 0 C E A IN<br />

I<br />

APDLIMA<br />

10<br />

0 10 20<br />

GIBE AUSTRALIA<br />

Consulting Enpm.en<br />

0 a e ..21 C~ AC7 2ms<br />

LEGEND<br />

.2 Existing <strong>Power</strong> Stations<br />

1- SAMASONI<br />

2-RIUAa11J<br />

3-FALE OLE FEE<br />

L - AL"<br />

5-SAIMIATA ILALUM4LIGAI<br />

6-TANUGAMANOW IDIESELI<br />

7-ASAU IDIESEL)<br />

B-SALELOIA3A IDIESEL I<br />

9-FAGALGA IAFULILOI-under construction<br />

oil Potential Hydro •E lertnc <strong>Power</strong> Station Sites<br />

1D- IULDIDLELEI<br />

11-FA .ESE ELA<br />

12-LOTDFAGA HIGH HEAD<br />

T3- LDTOFAGA LOW HEAD<br />

14-TAFITOALA<br />

15-FLMSIA FALLS<br />

16-SOPOAGA<br />

1T-TI 'AVER<br />

1B-NAMO RIVER<br />

22KV DISTRIBUTION FEEDER<br />

6 .6KV DISTRIBUTION FEEDER<br />

22KV LINES CONSTRUCTED UNDER RURAL ELECTRIFICATION R20GRAM<br />

UPOLU ISLAND<br />

30 kilom°tr°s<br />

AtEA<br />

w<br />

WESTERN SAMOA PLANNING STUDY<br />

POWER GENERATION AND DISTRIBUTION<br />

FIGURE N 1 .1

150<br />

1 40 --<br />

130<br />

FIGURE 3 .1 : UPOLU ENERGY GENERATED<br />

TIME SERIES PROJECTION<br />

YEAR<br />

' +, LO i r PUN I c'pTRf , 1 0 t SHOUT RUN rYTR, j I I<br />

8 .7% AAGR<br />

4 .8% AAGR

23<br />

22<br />

G<br />

+ TAPIFF/CHST . EXTRAP<br />

I I I I I I I I<br />

FIGURE 3 .2 : UPOLU DOMESTIC SALES<br />

ELECTRIC POWER CORPORATION<br />

YEAR<br />

0 TIME SERIES EXTRA<br />

I I I I<br />

9<br />

I<br />

4

% -1<br />

f t ! I I I I I I ! I I I I I I I<br />

1982 1985<br />

+ GOP/TARIFF EXPTRAP .<br />

FIGURE 3 .3 : UPOLU COMMERCIAL SALES<br />

ELECTRIC POWER CORPORATION<br />

01<br />

1990<br />

YEAR<br />

0<br />

01<br />

1995<br />

O TIME SERIES EXTRAP_<br />

11<br />

2000

2 .5 -~- r i I<br />

1985<br />

© ./TARIFF IND EXTRAP .<br />

FIGURE 3 .4 : UPOLU INDUSTRIAL SALES<br />

ELECTRIC POWER CORPORATION<br />

I I I I I I I -'T I I 1 I !<br />

1990<br />

YEAR<br />

1995<br />

+ TIME SERIES EXTRAP .<br />

I I I I I I I<br />

2000

z<br />

L l<br />

c 1_8<br />

i<br />

w<br />

O " .7 -<br />

1 .5<br />

1<br />

1985<br />

+ TAF IF F/BEDS ` ExTRA,P .<br />

1 I I I i I<br />

FIGURE 3.5 : UPOLU HOTEL SALES<br />

ELECTRIC POWER CORPORATION<br />

I I I I I<br />

1990<br />

! f I i<br />

YEAR<br />

11,<br />

4<br />

I I I I I<br />

1995<br />

0 1TIAAE f"~RAFI<br />

I I I<br />

2000

U? 1 r,<br />

w H<br />

Q C<br />

(I?<br />

U)<br />

J<br />

0<br />

0<br />

cn 6<br />

w<br />

I<br />

1<br />

4<br />

L<br />

982<br />

I I I --- I<br />

1985<br />

+ , rD CAP'/ TAR[FF<br />

i I I I I I I I<br />

FIGURE 3 .6 : UPOLU RELIGIOUS & SCHOOL SALES<br />

I<br />

I<br />

ELECTRIC POWER CORPORATION<br />

-11<br />

10<br />

I I I<br />

i<br />

1990<br />

YEAR<br />

I 4 ITIME<br />

Al<br />

FRIES I F)

(<br />

10<br />

FIGURE 3 .7: LONG TERM ENERGY GENERATED : SAVAII SYSTEM<br />

YEAR<br />

I I I I I I I I I I I I I

7<br />

C-<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

1980<br />

E<br />

i i<br />

I I<br />

1985<br />

FIGURE 3 .8 : ENERGY SALES SAVAII SYSTEM<br />

f I I I f I I I I I I I I I<br />

I<br />

1990<br />

I I<br />

YEAR<br />

+ TIMESERIESEXTRAP 0 NoCUSTOMERS EXTRAP<br />

1995<br />

i t<br />

i<br />

2000

APPENDIX A<br />

TERMS OF REFERENCE

A . Objectives<br />

The objectives of the study are :<br />

The study will be carried out by a Consultant with previous experience in all aspects of the<br />

work . The scope of work to be undertaken by the Consultant under the technical assistance<br />

comprises the following<br />

1 . Load Forecasts<br />

(i)<br />

(i)<br />

review of the major changes in the Government's approach and strategies for<br />

economic development and assessment of their possible impact on the<br />

growth of prospective power demand ;<br />

review of load data and development of an appropriate methodology for load<br />

forecasting including a suitable framework for data collection, compilation and<br />

analysis in the context of (i) above and the changes in domestic and external<br />

economic situation ;<br />

A/ 1<br />

APPENDIX A<br />

TERMS OF REFERENCE<br />

(i) to formulate a least-cost generation and transmission expansion plan for EPC<br />

covering the next 15 years ;<br />

to develop a ten-year investment program based upon the expansion plan ;<br />

and<br />

(iii) to make recommendations designed to place EPC in a sound financial<br />

position .<br />

In addition, on-the-job training will be provided so that load forecasts can be updated by EPC<br />

staff .<br />

B . Scope of Work<br />

(iii) incorporate in the load forecasting methodology factors to accommodate the<br />

price elasticity of demand relative to probable tariff levels, and others, such<br />

as the per capita or per household income, consumer price index, and<br />

indicators of urbanization, as appropriate .

2. <strong>Planning</strong><br />

A/ 2<br />

(iv) review and update EPC's long-term load forecast for 1990 through 2005 ;<br />

(v) provide 'on-the-job' training for EPC staff in load forecasting procedures and<br />

methodology such that EPC staff can update the load forecasts as required .<br />

If the methodology involves computer software programs, a copy of these<br />

shall be provided to EPC together with instructions and source codes, if<br />

necessary ; and<br />

(v) prepare load duration curves suitable for the generation planning studies ;<br />

() review previous hydropower potential, pre-feasibility and feasibility studies and<br />

selection of candidate hydropower projects for the planning horizon ; review<br />

other potential generation sources, in addition to diesel, as candidates for<br />

developments ;<br />

(i) review existing transmission system development plans, and determine the<br />

technicalleconomic transmission voltage level appropriate for the system<br />

expansion ;<br />

evaluate the alternate sources of generation in terms of the country's capacity<br />

to meet added foreign exchange demands, and the availability of counterpart<br />

funds ;<br />

(iv) establish appropriate system reliability indices for system planning ;<br />

(v) carry out loss minimization studies to determine if minimum power factor<br />

requirements should be considered for industrial consumers, or if reactive<br />

compensation may be necessary ;<br />

(v) update and/or prepare cost estimates with details of foreign and local costs<br />

covering the entire project cycle - feasibility, design, engineering and<br />

construction - for the power generation and transmission options ;<br />

(vii) carry out system planning studies to develop least-cost generation programs<br />

for EPC's systems for the planning horizon utilizing computer programs ;<br />

(viii) carry out transmission studies to develop the least cost transmission<br />

expansion programs utilizing computer programs ;<br />

(ix) carry out sensitivity analysis for developing the least-cost power development<br />

program for the planning horizon ; and

C . Reports<br />

3 . Financial<br />

(i)<br />

A/3<br />

(x) prepare a comprehensive ten-year investment program (1991 - 2000) with<br />

details of foreign currency and local currency costs corresponding to the<br />

formulated power development program .<br />

examine current financial reports of EPC, review recent tariff study report, and<br />

consider other relevant available information to assess the current and<br />

prospective financial position of EPC ;<br />

prepare a 10-year financial projection for the utility based on the<br />

recommended power development program ;<br />

consider the funding requirements for the recommended expansion program<br />

to the year 2000, and investigate the potential sources of funds, both foreign<br />

exchange and local currency ; and<br />

(iv) make recommendations in regard to any financial restructuring, or other<br />

action that may be appropriate or desirable, in the light of the financial<br />

covenants to be met, the desirable debt/equity structure, and other relevant<br />

matters to ensure that EPC achieves a sound financial position .<br />

The following reports shall be prepared by the Consultant and submitted simultaneously to<br />

the Bank, the Government, and EPC -<br />

(i) a brief inception report describing the work completed in the first four weeks, to be<br />

submitted within five weeks of the start of work . The report should note any problems<br />

or difficulties that have arisen and any other matters, such as lack of data, etc., that<br />

may affect the progress of the study ;<br />

(i) a draft final report upon completion of the study, containing the findings and<br />

recommendations, and appropriate supporting documentation . This report is<br />

expected to be completed no later than 12 weeks after the start of the study and will<br />

be discussed at a tripartite meeting following review by the Government/EPC and the<br />

Bank ; and<br />

(iii) the final report incorporating, as appropriate, views and comments discussed at the<br />

tripartite meeting. The final report shall be submitted to the Bank and the<br />

Government/EPC within one month of the tripartite meeting .

D. Implementation<br />

It is estimated that the study will require about 6 man-months of specialist consultant services,<br />

and that the overall duration will be approximately 4 months . In order to complete the work<br />

in the time indicated, it is envisaged that the study team will comprise three or four specialists .<br />

The expertise of the team should encompass power utility economics, financial analysis, load<br />

forecasting, generation and transmission engineering and power system planning .<br />

E. Services to be Provided by EPC<br />

EPC will provide the following services and facilities at no cost to the consultant :<br />

() counterpart EPC staff will be assigned to assist the consultants during the study ;<br />

(i)<br />

A/ 4<br />

secretarial, and clerical services, copying, international and domestic telex/facsimile<br />

and telephone facilities :<br />

(iii) local transportation facilities for field work, as necessary ; and<br />

(iv) reasonable, air-conditioned office space with appropriate facilities, including<br />

telephone .

APPENDIX B<br />

LOAD CHARACTERISTICS

B .1 Introduction<br />

B.2 Data<br />

B /1<br />

APPENDIX B<br />

LOAD CHARACTERISTICS<br />

An assessment of the future energy and peak demand of the system and the capability of<br />

existing and proposed generating plant in meeting these requirements must take into account<br />

the characteristics of the system load, As part of this planning study load allocation<br />

modelling has been carried out by computer to determine the firm capacity available from<br />

various combinations of type and size of generating plant in future years .<br />

Given the time constraints of this study, and the lack of readily available reliable hydrological<br />

data, load matching is based on a series of typical daily load curves yearly indexed for load<br />

growth and monthly indexed for seasonal variation .<br />

Half hourly machine loads in kW are available from power station log sheets for both Upolu<br />

and Savaii . Unfortunately all log sheets are missing for 1989 as are the peak day log sheets<br />

for 1988 . The machine logs for Savaii have a number of serious inconsistencies .<br />

Monthly production reports recording weekly system peaks and monthly kWh production for<br />

each island are available and appear reasonably accurate .<br />

8 .3 Upolu Seasonal Load Characteristics<br />

As Upolu has a number of seasonal run of river hydro electric generators, daily load allocation<br />

modelling is required on a seasonal basis, to assess firm hydro capacity and the amount of<br />

hydro energy which can be used by the system at any time . It is thus necessary to project<br />

demand through the months of future years . Annual energy and peak demand for the system<br />

have been projected to year 2010, see Section 3 . It remains to relate the daily energy and<br />

peak demand in any month to the annual energy and peak of a year .<br />

For this exercise monthly load data for the years 1979 to 1989 were abstracted from EPC<br />

Monthly Generation Reports. See Table B . 1 . The set of figures given in Table B .1 for energy,<br />

load, and Monthly Load Factor represent a continuous time series of 11 x 12 sets of monthly<br />

figures.<br />

The data appear to have a relatively small seasonal movement with peak in all months being<br />

within 10% of the annual peak . The annual peak days cluster about the month of May, and<br />

the minimum monthly peaks cluster around January and February . It appears possible that<br />

seasonal demand may be a function of the length of the day which would be consistent with<br />

the peak occurring in the evening and being caused by a lighting load . However this

016'0 £96 -0 ZL6'0 086'0 000"t 1.16 - 0 616'0 816'0 486'0 0660 0660 £88'0 X30NI<br />

A1NINOIY<br />

.<br />

11V 1739 - 0 659'0 Z99"0 9990 639 0 0990 £49 0 829'0 M - 0 LZ9 0 9 '9 0 i 109'0 419'0 d114<br />

Vd HMN LZP'LE pESZ 04£3 OILZ V99Z Z8LZ L892 S89Z i Z69Z SSSZ sta I E68Z 9652 HM)I<br />

Wo 'AV L96 0 6680 916 . 0 1.96'0 486 0 8960 066'0 000-1 £66 0 1786 0 £86 0 6£6 0 156'0 XVri/NIW<br />

(INVIN XV 1 091'9 OLI8 0925 0959 0995 Z990 ZZL9 0515 1 ELLS 0995 0595 OOvO 0095 M)I6L61<br />

31V 419 0 0990 1 LL9 0 ZS9 0 P19 0 919 0 Z1'0 0 149 0' 609 - 0 009 0 059 0 : 049 0 0090 3-In<br />

Vd HM)I 186 . 0E 6692 Z69E 06LZ v19Z OZ9Z 191'Z 1092 I P9SZ LZSZ £LSE 0103 OLPZ HMH<br />

% 'AV 888'0 8060 868'0 0001 616'0 Z96 0 436 0 946 0 916'0 596- 0 OZ6'0 946'0 096'0 XV I/NIMI<br />

QNYI34 "XV1Y 091'9 0099 0418 AWS: 0495 O4S4 OZE4 05'x4 0665 0959 OSfS 0645 MX 0961<br />

11V 109"0 LZ9'0 818. 0 049"0 1£9'0 119'0 519'0 58 . 0 1£9'0 9£9 - 0 "9'0 1£9 . 0 899'0 =nn<br />

Vd HM)I 98L'6Z 6382 LBZZ ONE 90VZ 9923 0812 0842 0842 SW USE 88VZ 209E HM)I<br />

%'AV 956"0 896'0 LS6"0 S46'0 £48. 0 000. 1 496'0 £38'0 8£8 .0 496'0 £98'0 OL8"0 498. 0 XV$ !NIMI<br />

ONVW3('XVYY 009'8 0345 0969 0635 08 ZS r0009s 0049 0119 OS35 O8S 0619 0£45 0495 MX 1961<br />

d1Y 939 . 0 669'0 939'0 £99'0 9£9'0 1.99"0 829. 0 888 . 0 199'0 899"0 959'0 490 . 0 199 . 0 31'1<br />

Yd HM)I 084'0£ 1.193 1.££3 POLE £493 5893 8843 L£43 4092 8143 ELSE 91.93 0092 HM)I<br />

%'AV 0L6 . 0 0001 966'0 988'0 000"L 386'0 186 . 0 0001 686"0 936"0 806 . 0 946 - 0 418'O XVI'WNIMI<br />

ONYr13a •XVW 099'9 0999 0459 0845 1W 0945 068 309 . 0669 0919 0LZ9 0935 0805 MX 3264<br />

diV S19"0 259"0 019"0 099'0 58'0 OL90 499 - 0 819'0 819'0 849"0 419 0 LS9"0 £09'0 din<br />

Yd HMH 980'11 8442 S4tiZ 6ELZ 009Z OOL3 9843 0353 4393 4992 E99Z ELSE 9392 HM)I<br />

%'/1V 996"0 088'0 946'0 ZL8 . 0 LE6 . 0 448 . 0 818'0 986'0 096- 0 000'1 488. 0 486'0 ZL6'0 XVVWNIMI<br />

4NYW34 'XVI OPL'S 0909; - 0145 0899 08£9 0249 OL39 0055 06.99 tiA; 999 0985 . 080 MX £861<br />

dlY 609 . 0 399.0 L99 . O E99'0 LE9'0 L59 . 0 399 . 0 1£9'0 499'0 949 . 0 LWO 449.0 £49 . 0 Ain<br />

Yd HM)1 8L8'3£ 2493 L09Z 1.113 1.393 4181 0493 0493 £94Z 8£13 6883 998E ME HM)1<br />

% 'AV 966'0 088'0 046 . 0 968'0 046'0 996'0 106 . 0 416'0 036'0 196'0 198'0 0001 696'0 XVMWNWI<br />

ONVW30'XVI 091'9 098 0089 0195 OBLS 0288 0155 OEM 0998 0689 0464 WiF O362 M)In61<br />

diV P290 999.0 449 .0 MO EE9'O 999 .0 999 .0 199.0 019'0 699'0 699 . 0 699'0 199'0 4191<br />

Yd HMN 6SL'4E 6082 2853 066E ZOLZ ZO16 ME 9862 910E L083 090£ 4062 2363 HM)I<br />

% 'AV 5560 106"0 116"0 £16'0 146'0 000" 1 916'0 01.00 996"0 106- 0 0560 91.6 0 996'0 XYM1/NIVY<br />

.. ..........<br />

ONVw30 •XVIN 093 .9 0499 . 0019 O48S 0669 01 L9 0109 0909 0689 0029 01.19 0865 M)I9161<br />

dly 4$9 . 0 999'0 889'0 649'0 489.0 259'0 019'0 859'0 899'0 E99"0 399 0 L89 0 L89"0 3191<br />

Yd HMN L96'S£ 2063 BLBZ 1362 9163 690£ 918E 430£ Z£OE 140E 8801 130E 081E HMX<br />

% 'AV 196'0 1160 246"0 058'0 9L8'0 486"0 086"0 OL8'0 858'0 000'1. 986'0 L96 0 9L6'0 XVVWNIMI<br />

0NYIY30 'XYI OL£'9 0115' 0009 0509 OZZ9 0139 0129 0819 0019 OLEO 0919 0319 MM 9961<br />

d1Y 939"0 182"0 089"0 189"0 LL9'0 £19"0 448"0 449"0 159"0 649.0 189 . 0 149. 0 099'0 3' WI<br />

Vd HMX 846'86 680£ LL63 9131 1111 162£ 560£ 802£ ZLZE 0316 413E Z2 Z£ £1.E£ HMX<br />

% 'AV 148'0 698'0 416'0 118. 0 428'0 £48'0 856'0 OL6 0 186'0 898'0 998'0 666 . 0 0001 XVYWNIMI<br />

ONVY430 "XVYV 016'9 0689 08£9 05£9 0949 OL99 0899 08L9 OE99 0999 OL09 OZ69 .Q M)11881<br />

diV 048. 0 129 0 189'0 518'0 399 . 0 099"0 959 -0 Z99 0 E99"0 LL0'0 £49"0 £19 0 ZS9 - 0 4lrr<br />

Vd HM)I 662'14 1111 1.82£ 009£ 990E 819£ LIPS 6641 169E 686E 1.94E LOVE 344E HM)I<br />

%'AV 6960 946. 0 996 . 0 6L6'0 OLO'O 000 . 1 398'0 816'0 3L6'0 £96'0 698'0 L46'0 696'0 XVIY/NIPI<br />

ONVI30'XVWI OL6'1 0919 0401. OLLL 0911 -dTLE2' 0431. 0131 0911 0201. 0621. 0031 OOLL MX886L<br />

dlV L L 9'0 999'0 289 . 0 159 . 0 689'0 M , O 949' 0 199 . 0 299'0 949 . 0 999'0 399'0 499'0 =nn<br />

Vd HMN £16'14 LSE£ 1.94£ 419E 984E 1991 Z9 £E 094E 889E 654£ 1.39£ IM BOLE HMX<br />

% 'AV 606'0 882. 0 068'0 328"0 096'0 0001 018 . 0 L06"0 246 . 0 096"0 £40"0 096"0 896"0 XVI'WNIMI<br />

0NVW30 'XVMI 091'1 0889 0169 0£31. OL6L :iii % OZZL 0401. 01£1 0541. 02£1. OSPL 0191. MM 8861<br />

lYf1NNV NYf 63d LIM IdY AVM 1 Nflf 1 Air OflY ld3S 100 AON 030 OILVId3N39<br />

6816161.<br />

NOLLV-dOcf2IOD 'H 3MOd 3I2f.L3 19<br />

V.LVQ Qbo'l A'IHINOW moan :1 '9 l-lfVi

B .4<br />

Upolu dally load curves<br />

B /2<br />

interpretation is not supported by data from the Savaii system . From Table B .1 it can be seen<br />

that the intensity of the annual peak load as measured by the ratio of annual peak to average<br />

monthly peak, and the Annual Load Factor, have been remarkably stable over the eleven<br />

years considered .<br />

By definition a standard factor to relate a monthly peak to an annual peak must be a seasonal<br />

index, that is excluding irregular events . In order to produce a monthly index, the ratio of the<br />

monthly maximum demands to annual maximum demand were averaged for each calendar<br />

month over the eleven year period and then normalized to the month of highest average ratio .<br />

The resulting seasonal series for relating monthly peak to annual peak is given in Table B .2<br />

below :<br />

TABLE 8 .2 : SEASONAL VARIATION OF MONTHLY PEAK<br />

Month of Year Ratio of Monthly<br />

Maximum Demand<br />

January 0 .935<br />

February 0.963<br />

March 0.972<br />

April 0.98<br />

May 1 .000<br />

June 0 .977<br />

July<br />

August<br />

0 .979<br />

0.975<br />

September 0 .984<br />

October 0 .990<br />

November 0 .990<br />

December 0 .983<br />

Daily load curves relating to one week in each of the months of January, March, May, and<br />

August of 1988 and for the annual peak days from 1983 to 1988 were studied in detail, see<br />

Figures B.1 to B .7 . For 1988 the peak day log was missing and a near peak day was<br />

substituted . The 1988 weeks were selected as being reasonably representative of weekly<br />

loads in the year including the month of anticipated annual peak (May), the month of

B .4.1 Annual Peak Day<br />

B /3<br />

anticipated minimum daily peaks (January) and average load months of May and August .<br />

These months are also representative of the wet and humid months, e.g., January and March<br />

and the cooler and drier months of May and August .<br />

Annual peak day load characteristics are worthy of particular study as the financial return on<br />

the cost of equipment specifically installed to meet annual peak is extremely low. Demand<br />

control or modification policies, including planned load shedding, aimed at reducing annual<br />

peak may be very cost effective . The Upolu annual peak day load curves are given for<br />

1983/1988 in Figure B.1 .<br />

The probable effectiveness of demand control measures in Upolu may be limited by the<br />

flatness• of the daily peak. On annual peak weekdays load exceeds 90% of peak for eleven<br />

hours of the day. Also although the load on a peak day is much higher than near peak days<br />

the shape of the daily load duration curve remains similar . From Table B .2 it can be seen that<br />

the seasonal effect on peak is low . On the average over a 10 year period the lowest monthly<br />

peak is within 6.5% of the highest monthly peak . From Figure B .1, it is interesting to note that<br />

in two years, 1984 and 1988, the peak day occurred on a Saturday . This indicates that<br />

neither industrial nor commercial load contributes significantly to annual peak and therefore<br />

measures to modify the load demand of major customers may not significantly affect the<br />

annual peak .<br />

In the period from 1979 to 1989, the annual peak occurred most frequently in the month of<br />

May . In all years except one, the annual peak day occurred in the dry season when because<br />

of the seasonal reduction in run of river hydro generation, the Electric <strong>Power</strong> Corporation<br />

restricted the available plant capacity . Thus despite the difficulty of modifying the peak which<br />

probably comprises overwhelmingly domestic lighting load, successful control measures could<br />

bring useful investment cost relief to the Corporation .<br />

it may be inferred from Figure B .1 that the commercial and industrial day peak is growing with<br />

respect to the evening peak . This conclusion is not supported by an apparent historic trend<br />

to higher monthly load factor or to a higher annual load factor .<br />

B.4 .2 Typical Weekday<br />

The 20 typical weekday loads analyzed, see Figure B.2, B .3, B .4 & 8 .5 are similar in shape .<br />

Shortly before dawn the load steadily increases from about 50% of daily peak load to 90% of<br />

daily peak by 9 am. This early near peak continues, apart from a 10% dip in load between<br />

12 noon and 2 pm, until 4 .30 pm . The load then declines to about 65% of daily peak until the<br />

daily peak is reached about 8 p.m . After 8 p .m . the load declines slowly to about 50% of daily<br />

peak at midnight . This lower load level remains fairly constant until just prior to dawn when<br />

the daily cycle repeats . At times of low monthly peak it is possible for the daily peak to occur<br />

in the morning between 1 t am and noon. The cycle of load changes throughout each<br />

weekday and over the seasons is very consistent .

B .4 .3 Typical Weekend Days<br />

B /4<br />

On Saturdays, see Figure B .6, there is a low peak in the morning, probably related to<br />

commercial shopping activity, followed by a decline in load in the afternoon and then an<br />

evening daily peak at dusk . It is possible for the Saturday peak to be the monthly peak or<br />

indeed the annual peak . On Sundays, see Figure B.6, the load is dominated by the sharp<br />

evening peak occurring at dusk. On Saturdays, and also on Sundays, load shape is very<br />

consistent throughout differing seasons .<br />

B .5 Upolu Dally Load Duration Curves<br />

Normalized daily load duration curves were calculated for average weekdays where evening<br />

peak occurred, and for Saturdays and Sundays for the months of January, March, May and<br />

August 1988, see Figures 8 .8, B .9, 8 .10 and B .11 .<br />

B .6 Derived Upolu Annual Load Duration Curve<br />

An Annual Load Curve was estimated from the 1988 daily load data referred to above,<br />

proportioning weekdays and weekend days, adjusting peak to annual peak, and proportioning<br />

load until the load factor corresponded to the 1988 annual load factor. As the data represent<br />

different seasons and conditions of load it may be expected that the method would generate<br />

a shape close to the annual load duration curve, close enough in any event to provide an<br />

overview .<br />

B .7 Savell Seasonal Load Characteristics<br />

Monthly load data for the years 1980 to 1989 were abstracted from EPC monthly generation<br />

reports . See Table B .3. This set of figures represents a continuous time series of 10 by 12<br />

sets of monthly figures . The Salelologa and Asau systems were interconnected early in 1986 .<br />

The figures given in the table prior to 1986 are the summation of Asau and Salelologa log<br />

sheets.<br />

Since the interconnection of the two systems, which coincidentally added a considerable<br />

number of new customers in rural villages, the annual load factor has dropped to below 30%,<br />

and the annual peak load has risen to nearly twice the lowest monthly peak .<br />

The data appear to have a relatively weak seasonal movement with the annual peak occurring<br />

in five different months in the years considered . Within each year since interconnection of the<br />

systems the annual peak days have clustered about the month of December, with the annual<br />

minimum peak well spread, but perhaps represented by April . The load in Savaii is<br />

predominantly domestic lighting and it may be expected that electricity consumption would<br />

increase slightly as the day shortens in mid year . This is not evident from the data.

TABLE B .3 : SAVAII MONTHLY LOAD DATA<br />

ELECTRIC POWER CORPORATION<br />

1980/1989<br />

GENERATION DEC NOV OCT SEPT' AUG JLY JUN MAY APL MAR FEB JAN ANNUAL<br />

1989 KW' 720 547 781 593 662 : 560 507 513 505 832 893 MAX DEMAND<br />

MIN/MAX 0 .806 0 .000 0 .813 0 .852 0 .664 0 .741 • 1 .000 0 .627 0 .568 0.574 0-586 0 .932 0 .662 AV r<br />

KWH' 224 213 207 189 208 174 181 181 173 165 174 195 2,284 KWHPA<br />

MLF 0 .418 0 509 0 .345 0,471 0 .353 0 .282 0 .434 0-474 0.432 0 .513 0 .315 0 .292 AU<br />

1968 KW' 387 348 510 480 520 464 495 525 490 : : 33.5 455 ;^: : .-7-.2 :. . 725 MAX DEMAND<br />

MIN/MAX 0.534 0 .480 0 .703 0 .662 0 .717 0 .640 0.683 0.724 0 .676 0.462 0 .628 1 .000 0 .659 AV .,<br />

KWH • 143 101 152 120 102 185 158 146 129 138 121 184 1,658 KwsPA<br />

MLF 0.497 0 .403 0 .401 0 .347 0 .264 0 .478 0 .443 0 .374 0 .363 0.554 0 .398 0 .341 0 .261 ALP<br />

1947 KW' 705 %-f-<br />

. . . . . . . . . . . 628 654 598 638 660 641 612 592 664 788 MAX DEMAND<br />

MIN/MAX 0.897 1 .000 0 .618 0799 0.832 0 .758 0.812 0.840 0 .816 0.779 0 .753 0 .845 0 .812 Av. w<br />

KWH • 181 179 160 169 162 100 160 165 160 165 119 178 1,968 KW H PA<br />

MLF 0.345 0 .316 0 .444 0 .374 0 .312 0 428 0.348 0 .336 0 .347 0.340 0 .299 0 .360 0 .286 ALF<br />

1986 KW ?x 5 428 438 465 422 505 469 407 395 370 378 350 552 MAX DEMAND<br />

MIN/MAX 1 .000 0 .775 0 .793 0 .842 0 .764 0.915 0 .850 0 .737 0 .716 0 .670 0 .685 0 .634 0 .782 Av. r<br />

KWH 119 109 119 109 110 114 109 119 102 104 90 103 1,307 KWHPA<br />

MLF 0.290 0 .354 0 .385 0.326 0 .350 0 .303 0.323 0 .393 0 .359 0 .378 0 .354 0 .396 0 .270 ALF<br />

1985 KW :'t~,'' .:: 243 249 243 240 280 ;210 • 223 WA N/A 283 mAx DEMAND<br />

MINIMAX 1 .000 0 .859 0.880 0.859 0 .880 0 .000 0 .989 0 .000 0 .742 0 .788 N/A N/A 0 .583 AV. %<br />

KWH 101 .7 90 .94 95.12 87 .24 91 .61 88 .84 79.75 84.17 75 .5 76.59 NIA N/A 871 KWH PA<br />

MLF 0.483 0 .520 0.513 0.499 0 .494 0 .396 0 .499 0 .462 0 .351 ALF<br />

1984 KW - . s : 268 261 NIA 188 258 243 257 2.42 268 258 259 298 MAX DEMAND<br />

MINIMAX 1 .000 0 .890 0 .876 0 .000 0 .631 0 .866 0 .115 0 .862 0 .812 0 .866 0 .866 0.869 0 .780 Av. r<br />

KWH 77.71 71 .13 74.2 70 .05 71 .28 69 .95 67.65 72 .21 68 .96 70.88 85.71 73 .73 853 KWHPA<br />

MLF 0.350 0 .369 0 .382 0 .509 0 .364 0 .387 0 .378 0 .396 0 .369 0 .379 0.424 0 .327 Mf<br />

1983 KW N/A 266 267 193 192. NIA 255 268 276 289 268 £x#26 280 MAX DEMAND<br />

MIN/MAX 0 .000 0 .950 0 .964 0 .689 0 .688 0 .000 0 .946 0 .950 0.986 0 .961 0 .957 1000 0 .757 Av . r<br />

KWH 77.14 72 .25 73 .73 68 .78 72 .44 N/A 73.75 78 .45 74 .9 74 .92 68 .63 75 810 KWH PA<br />

MLF N/A 0 .377 0 .371 0 .495 0 .507 N/A 0 .387 0 .396 0.377 0 .374 0 .381 0.399 0 .330 ALF<br />

1982 KW 293 267 ZW 257 253 259 267 258 258 268 258 262 308 MAX DEMAND<br />

MIN/MAX 0 .961 0.867 1 .000 0 .834 0 .821 0 .841 0 .834 0 .841 0.838 0 .838 0 .838 0.851 0.863 Av. %<br />

KWH 79.94 75 .25 67 .16 71 .33 74.55 74 .18 72.33 76.42 71 .63 73.34 64.5 72.1 873 KWHPA<br />

MLF 0 .367 0.340 0 .322 0 .385 0 .398 0 .385 0 .391 0 .397 0,386 0 .382 0 .372 0 .370 0.323 ALF<br />

1981 KW 257 249 ¢ : 254 241 246 241 246 239 238 227 238 306 MAX DEMAND<br />

MIN/MAX 0 .840 0.814 1 .000 0 .830 0 .788 0 .804 0 .788 0 .804 0 .781 0 .742 0771 0771 0 .811 AV r<br />

KWH 71 .37 65 .15 70 .93 88.09 67 .04 68 .85 85.98 68 66.66 67 .81 58 .79 66.34 B03 KWNPA<br />

MLF 0 .347 0.383 0-312 0 .361 0 .374 0 .376 0 .380 0 .372 0.387 0 .402 0 .371 0-323 0 .300 ALF<br />

1980 KW 248 225 235 230 200 196 198 210 182 181 192 270 MAX DEMAND<br />

MIN/MAX 0 .919 0.833 0 .870 0 .852 1 .000 0 .741 0 .728 0.733 0 .778 0 .674 0 .670 0 .711 0 .792 AV w '<br />

KWH 87 .44 64 .14 6808 65 .52 71 .67 60 .35 53 .94 57 .56 55.85 54 .51 50 .2 63 .52 733 KWH PA<br />

MLF 0 .366 0.396 0 .389 0 .396 0 .357 0-406 0 .382 0 .391 0 .389 0 .403 0 .413 0 .445 0 .310 ALF<br />

NOTE ' DENOTES BOTH A ;AFI ANF) nALELOI'- • : A F:v!'.7FMSCCUMA N=G

B .8 Savail Daily Load Curves<br />

B l5<br />

Four typical daily load curves are shown in Figure B . 12 . These curves illustrate the very sharp<br />

evening peak caused by the domestic lighting load .The power station logs at Salelologa are<br />

most inaccurate and a number of the variations between various days may well be due to<br />

recording errors.<br />

In view of the inaccurate power station logs, and as there was no requirement for load<br />

allocation modelling studies in Savaii, neither typical daily load curves nor an annual load<br />

curve were derived .

1 2 3 4 5<br />

FIGURE B .1 : UPOLU ANNUAL PEAK DAYS<br />

1983/1989<br />

6 7 8 9 10 11 12 13 14 15 16 17 15 19 20 21<br />

TIME (NOUR5)<br />

22 23

c<br />

U-.<br />

U")<br />

J<br />

c<br />

C<br />

FIGURE B .2 : UPOLU WEEKDAY LOADS JANUARY 1988<br />

Monday 18 to Friday 22<br />

-<br />

DATE PEAK % OF<br />

ANNUAL PEAK<br />

DLF<br />

Monday 18 6300 85 77<br />

Tuesday 19 6530 89 76<br />

Wednesday 20 6210 84 76<br />

Thursday 21 6430 87 75<br />

Friday 22 6290 85 76

I<br />

2<br />

I<br />

3 4<br />

I<br />

5<br />

FIGURE B .3 : UPOLU WEEKDAY LOADS MARCH 1988<br />

I<br />

6<br />

I<br />

7<br />

I<br />

8<br />

Monday 7 to Friday 11<br />

DATE PEAK % OF<br />

ANNUAL PEAK<br />

DLF<br />

Monday 7 6700 91 71<br />

Tuesday 8 6890 93<br />

Wednesday 9 6570 89 75<br />

Thursday 10 DATA DISCARDED AS POSSIBLE LOAD SHEDDING<br />

Friday 11 6590 89 75<br />

I I I I I I I I I I I I I 1<br />

9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24<br />

TIME (HOURS)

4<br />

H-<br />

IO<br />

T<br />

FIGURE B .4 : UPOLU WEEKDAY LOADS MAY 1988<br />

Monday 16 to Friday 20<br />

I<br />

DATE PEAK % OF<br />

ANNUAL PEAK<br />

DLF<br />

Monday 16 6410 87 73<br />

Tuesday 17<br />

DATA DISCARDED<br />

Wednesday 18 5670 77 77<br />

Thursday 19 6300 85 76<br />

Friday 20 6530 89 74<br />

2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21<br />

TIME (HOURS)<br />

22<br />

1<br />

I<br />

23 24

ac<br />

0<br />

---<br />

1 2<br />

FIGURE B.5 : UPOLU WEEKDAY LOADS AUGUST/SEPT . 1988<br />

Monday 29 to Friday 2<br />

DATE PEAK % OF<br />

ANNUAL PEAK<br />

DLF<br />

Monday 29<br />

Tuesday 30<br />

6800<br />

7160<br />

92<br />

97<br />

74<br />

71<br />

Wednesday 31 6650 90 76<br />

Thursday 1 6950 94 73<br />

Friday 2 6970 95 .74 ,<br />

3 4 5 5 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21<br />

TIME (HOURS)<br />

22 23 24

F<br />

i<br />

-1 C<br />

I<br />

2 3<br />

FIGURE B .6 : UPOLU SATURDAY LOADS 1988<br />

Saturday 1611, 1213, 21/5, 3/9 .<br />

j DATE I PEAK % OF<br />

ANNUAL PEAK<br />

DLF<br />

Saturday 16/1 6800 92<br />

(Saturday 1213 7160 97 67<br />

Saturday 2115 6650 90 68<br />

Saturday 319 6950 94 70<br />

4 5 6 7<br />

8<br />

9 10 11 12 13 14 15 16 17 18 19 20 21 22 23<br />

TIME (HOURS)<br />

1<br />

24<br />

I<br />

1

.<br />

/<br />

---~-- ~~---r'--r'-~<br />

FIGURE . .~w~~" n~-~° ~~, ~°" UU~~~~ ~~o~~~ SUNDAY ~~~~~~~ LOADS 1988 "= .°~^<br />

! /<br />

Sunday 1711,1313,22/5,4/9 .<br />

DATE PEAK Sb OF DLF<br />

ANNUALPEAK<br />

Sunday lWl 500 73 68<br />

Sunday 1313 950 83 66<br />

Sunday 205 640 83<br />

1<br />

67<br />

1 Sunday 4/9 500 80 68<br />

2 3 4 5 6 7 8' 9 10 11 12 13 14 15 16 17 18 19 20 21 22<br />

TIME (HOURS)<br />

2Z' 24<br />

)

o<br />

~<br />

.<br />

L J~<br />

m<br />

~ A 5<br />

^ UU<br />

~~" ~~"~~~<br />

FIGUR . .*w~~ . "~-~~^~ E . LOAD<br />

Sunday<br />

(load factor 0 .68)<br />

(peak 5650)<br />

LOAD DURATION<br />

January1988<br />

~~UU~~~~~ ° CURVES<br />

Average weekday e"n&g peak<br />

(bad factor M)<br />

(peak 6530)<br />

r----r--r---~- --r---r--r--~---~<br />

D 0 .25 0 .5 0 .75 l<br />

UPIT time<br />

.

~<br />

.<br />

|<br />

c:~<br />

!Li<br />

.~r _<br />

~<br />

~ ~<br />

0 .5<br />

~~E<br />

-~-<br />

-_<br />

04 -<br />

2 . 2<br />

_ 1<br />

C . 1 -1<br />

.<br />

FIGURE<br />

~~~^ ~°^~ . UU~~U ~°" ~^~~~° KU LOAD ~~UU~~~~~ DURATION~<br />

CURVES<br />

S unday<br />

(ioad factor 0.67)<br />

(peak load 6150)<br />

March 19W<br />

Average weekday evening peak<br />

(load factor 0 .73)<br />

(peak load 6890)<br />

0.25 0 .5 0 .75 1<br />

UNIT Unne

Li!<br />

U . -t --1,<br />

I<br />

FIGURE B .10 : UPOLU LOAD DURATION CURVES<br />

Saturday<br />

(load factor 0.68)<br />

(peak load 6880)<br />

May 1988<br />

Sunday<br />

(load factor 0 .67)<br />

(peak load 6140)<br />

Average weekday evening peak<br />

(load factor 0.75)<br />

(peak load 7210)<br />

I I I I I I I I I I I I I I I I I I I 1 1 1<br />

C : 0 .25 0 .5 0 .75 1<br />

UNIT TIME

4<br />

r~<br />

I c~<br />

1 Saturday<br />

(load factor 0 .67)<br />

•C (peak load 6030)<br />

C .a<br />

I<br />

-+<br />

i<br />

FIGURE B .1 UPOLU LOAD DURATION CURVES<br />

AugusUSept.1988<br />

Sunday<br />

(load factor 0 .65)<br />

(peak load 5910)<br />

0 .25 0 .5<br />

Average weekday evening peak<br />

(load factor 0 .72)<br />

(peak load 7169)<br />

UNIT TIME<br />

I I I I<br />

0.75 I

1 6<br />

FIGURE B.12 : SAVAII WEEKDAY LOADS<br />

FOUR DAYS IN SEPTEMBER 1989<br />

Loads normalised to daily peak<br />

12<br />

HOURS<br />

18 24

APPENDIX C<br />

RECONSTRUCTION OF<br />

EXISTING GENERATING PLANT

C .1 GENERAL<br />

2<br />

C /1<br />

APPENDIX C<br />

RECONSTRUCTION OF EXISTING GENERATING PLANT<br />

This report on existing generating plant was prepared in March 1991 and reflects the<br />

condition of plant at that time .<br />

The condition of generating plant on both Upolu and Savai'i at March 1991 was very poor .<br />

Approximately 5MW of diesel plant in Upolu and Savaii was written off by EPC during 1990-91 .<br />

Three of the five hydro electric plants were out of service for most of 1990, while the output<br />

of the fourth was limited by mechanical problems .<br />

Two recent studies' 2 highlighted deficiencies In EPC maintenance of plant and made a<br />

number of recommendations to overcome these deficiencies. Had these recommendations<br />

been acted upon the major breakdowns which have occurred since these studies were carried<br />

out may have been averted .<br />

The situation with regard to generating plant in Upolu and Savai'i at present is indicated in<br />

Tables C1, C2, C3, C4 and C5 attached . The Tables include recommendations regarding<br />

action required for rehabilitation and estimates of costs . These Tables have been discussed<br />

In detail with the General Manager of the EPC . The cost estimates in these tables are<br />

preliminary, based on January 1991 datum, and exclude physical and price contingencies .<br />

The estimates include essential works necessary to return the plant to service and desirable<br />

works considered necessary to restore the plant to good operating condition .<br />

C .2 TANUGAMANONO POWER STATION<br />

At present there are eight EPC owned diesel generators at Tanugamanono <strong>Power</strong> Station,<br />

with total nameplate capacity of 12,650 kW. Three of these generators, comprising 4,472 kW,<br />

have recently been written off by EPC .<br />

C3. HYDRO PLANT<br />

C3.1 General<br />

At March 1991 there were five run-of-river hydro plants on Upolu . Four of these plants are<br />

located within 7 km of Apia, namely, Fale-ole-Fee, Alaoa, Fuluasou and Samasoni . The fifth<br />

plant, Lalomauga (or Sauniatu) is located some 40 km to the east of Apia . The Fale-ole-Fee<br />

' Kennedy & Donkin <strong>Power</strong> <strong>System</strong>s, EEC South Pacific Regional Energy Programme, <strong>Western</strong> <strong>Samoa</strong> Energy<br />

Conservation Project, June 1989 .<br />

Merz & McLellan, Asset Revaluation & Tariff <strong>Study</strong> for EPC, September 1990 .

C3 .2 Fale-ole-Fee<br />

3<br />

C /2<br />

and Fuluasou plants have been out of service for a considerable time, and the Alaoa and<br />

Lalomauga plants have operated at reduced output for most of 1990-91 . Only the Samasoni<br />

plant is capable of operating at its full capacity . The various plants and required<br />

reconstruction works are described below and summarised in Tables C4, C5 and C6 .<br />

The Fale-ole-Fee Scheme comprises two stream bed intakes (the Vaivase and Fale-ole-Fee)<br />

which divert water via their own headrace pipelines into a concrete headpond . A 3462 m long<br />

penstock of 670mm nominal diameter conveys water from the headpond to a power station<br />

at Alaoa. The scheme develops a gross static head of 332m through a single Pelton turbine<br />

producing 1640kW .<br />

Since its commissioning in 1982, the scheme has produced on average 5.0 GWh/year of<br />

energy (for years 1983-1989 inclusive) . The scheme has not operated since May 1990 . The<br />

single turbo-generator was severely damaged when shut down devices failed to operate<br />

following loss of load due to a 22kV feeder fault . The turbine shaft has been bent, turbine<br />

casing damaged, generator exciter casing broken, the generator foundations damaged, and<br />

switchgear inundated by water . Apparently the roof of the power station was removed by a<br />

high pressure water jet from the turbine, but has now been reinstated . Apart from the latter<br />

work, it appears that little action has been taken to rehabilitate the plant .<br />

While Fale ole Fee Is out of service, the cost of alternative diesel generation is estimated to<br />

be US$465,000/year, based on an economic price of diesel fuel of US$0 .2411itre3 , and it is<br />

recommended that urgent action be taken to restore the turbo generator .<br />

The access road to the Fale-ole-Fee intake has been cut by a landslip, and a section of the<br />

headrace pipeline has been washed away . These works should also be carried out before<br />

the scheme is returned to service . Various other reconstruction works shown in Table C2 are<br />

also recommended to restore the scheme .<br />

C3.3 Lalomauga/Saunlatu<br />

The scheme comprises two intakes on the east and west branches of the Falefa River, with<br />

separate headrace pipelines leading to a polyethylene lined concrete headpond . From the<br />

headpond, a headrace pipe, a 339m long tunnel and 720m long steel penstock convey the<br />

water to a power station at Lalomauga, developing a gross static head of 125m .<br />

The power station contains two horizontal-shaft Francis turbines, each generating 1760kW .<br />

This station has experienced continuing problems with overheating of main bearings since<br />

commissioning . No . 2 machine was out of service in 1990 due to a bearing failure . Both<br />

Based on Exchange Rate WS $2 .33 = US $ 1 .00

C3 .5 Alaoa<br />

C /3<br />

machines are operating with derated output . It has been reported that a major contributor to<br />

bearing difficulties has been the use of an incorrect grade of lubricating oil .<br />

The scheme was commissioned in 1985 and has produced 10 .4 GWh/yr on average over the<br />

period 1986-1989. For the 10 months to October 1990, the scheme has contributed only 5 .4<br />

GWh, and the reduction in output represents a significant cost to EPC in terms of alternative<br />

diesel generation .<br />

EPC also advised that there appears to be severe erosion of metal in the turbine casings and<br />

some erosion of the runners. In view of the extent of these problems, a turbine specialist will<br />

be required to examine the turbines and make recommendations for remedial works .<br />

The overvelocity valve at the head of the penstock has never been installed, and this work<br />

should be carried out as a matter of urgency. Various other works are also recommended<br />

as shown in Table No C3, including repair of the main inlet valves in the power station .<br />

C3 .4 Samasoni<br />

The Samasoni Hydro Scheme comprises a weir and intake which diverts water from the<br />

Vaisigano River directly into a headpond, together with a 3600m long penstock leading to the<br />

power station located 3 km from the centre of Apia The intake is located downstream of the<br />

Alaoa and Fale-ole-Fee power stations . The power station houses two horizontal shaft Turgo<br />

impulse turbines, each developing 900kW under a net head of 86m . The maximum output<br />

of the station is 1550kW . The scheme was completed in 1982, and has produced an average<br />

of 6.0 GWh/yr of energy over the period 1983-1989 .<br />

Samasoni is the only hydroelectric scheme in full operation . However the penstock requires<br />

maintenance and painting, valves should be overhauled and there is a continual problem with<br />

the stator windings which should be investigated and rectified . An electric sump pump is<br />

missing from the power station, and the backup jet pump operates continuously . This results<br />

in the waste of water from the penstock and a consequent loss of hydro energy .<br />

The Alaoa scheme comprises two intakes on the middle branches of the Vaisigano River, with<br />

separate headrace channels, 2700m and 250m long, leading to a concrete lined headpond .<br />

A steel penstock conveys water from the headpond to a power station which houses a single<br />

Turgo impulse turbine and generator producing 1000kW under a net head of 136m .<br />

The scheme was completed in 1957, and has produced 4 .0 GWh/year of energy on average<br />

over the period 1980-89 .

C /4<br />

The eastern intake is the main source of water supply to the scheme . The 2700 m long<br />

eastern headrace traverses several sections of very steep, unstable ground . Landslips are<br />

commonplace and the headrace is frequently out of service . A major slip in mid-1990 resulted<br />

in a repair cost of US$330,000 . A slip also occurred during the site visit in December 1990,<br />

which resulted in the loss of a 20m long section of headrace . While continual maintenance<br />

will be necessary throughout the life of the project some drainage and strengthening works<br />

should be carried out along the headrace to reduce the frequency of small slips and outage<br />

of the headrace. However, it would not be practicable to eliminate all slips along the<br />

headrace route .<br />

Other works required to rehabilitate the Alaoa scheme include an overhaul of the switchboard<br />

in the power station and cleaning out of the headpond. The latter comprises a concrete lined<br />

earthen basin, without any means of vehicular access . A suitable means of cleaning out the<br />

pond by dredging, pump or air lift should be devised . This apparatus should also be suitable<br />

for cleaning out other headponds, without the need for dewatering .<br />

C3 .6 Fuluasou<br />

The Fuluasou Scheme, which was commissioned In 1951, consists of a concrete weir on the<br />

Fuluasou River, and a steel penstock, approximately 2 .5 km long which conveys water to a<br />

power station at Tuanaimoto . Originally, a second hand Turgo turbine and 230 kW generator<br />

was installed in the power station . In 1985, a new Crossflow type turbine and generator of<br />

370 kW capacity were installed In a new building adjacent to the old power station, and the<br />

penstock was extended . The scheme develops a gross head of about 45m, and between<br />

1981 and 1986 its average output was 0 .8 GWh/year .<br />

The Fuluasou scheme has been out of service since May 1988, as a result of penstock<br />

rupture . This has been a recurring problem, and numerous repairs have been carried out on<br />

the penstock. The present condition of the penstock is very poor, it has been damaged by<br />

trees which have fallen across it, the penstock is broken in several locations, it is heavily pitted<br />

and corroded and several sections adjacent to the river are missing . The weir and intake gate<br />

operating mechanism have been damaged by logs . The pond formed by the weir is heavily<br />

silted up and contains numerous logs.<br />

The penstock is severely damaged, and will require either major repairs, replacement with a<br />

new steel pipeline, or lining with a polyethylene pipe which can be pulled through the old<br />

penstock in long sections . (The old penstock could be retained as a protective casing to the<br />

polyethylene liner.) The concrete deck and parapet of the weir would require repairs, and the<br />

gates, screens and gate chamber should be overhauled .<br />

In view of the cost of repair or reconstruction, and the relatively small amount of usable energy<br />

available (particularly following commissioning of Afulilo in 1992), rehabilitation of this scheme<br />

does not appear to be warranted . This view is confirmed by the least cost development<br />

analysis, see Section 5.

C /5<br />

TABLE C .6 : SUMMARY OF REHABILITATION COSTS (US$)<br />

(Hydro Electric Plant Only)<br />

Year 1991 1992<br />

Supply and Installation 599 1398<br />

Duty 20% CIF 108 252<br />

Engineering 105 105<br />

Contingencies 122 263<br />

Total 933 2017<br />

Foreign Costs 873 1877<br />

Local Costs 60 140

TABLE C 1 : TANUGAMANONO DIESEL STATION AS AT MARCH 1991<br />

UNIT NO . NAMEPLATE/ 1ST YEAR ACTION ESTIMATED<br />

& MAKE RATED IN SERVICE REQUIRED TO COST COMMENTS RECOMMENDATION<br />

kW REHABILITATE US$<br />

No . 4 MAN 1672/1200 1966 This m/c has badly scored journals on We agree m/c should be written off and<br />

crankshaft and EPC have written it off used as spares for No 5 .<br />

No. 5 MAN 1672/1200 1966<br />

Recent top overhaul<br />

No ti MAN 1456/1000 1973 Top overhaul recently carried out .<br />

Recommend this m/c be written off<br />

when next major work is required to be<br />

carried out<br />

Recommend this mic be written off<br />

when next major work is required to be<br />

carried out<br />

No 7 1800/1200 1979 M/C has broken crankcase and EPC We agree that m/c should be written off<br />

Niigata have written it off and used as spares for No . 8<br />

No 8 1800/1200 1979 Due for top overhaul Top overhaul being carried out<br />

Nugata<br />

No 9 2250/2000 1984 Overhaul by HSE recently completed .<br />

M irrlees<br />

No 10 1000/800 1988 Replace control panel, HSE nearing completion of<br />

Mirrlees/ rectify cooling major overhaul<br />

Blackstone problems .<br />

No 11 1000/800 1988 Piston seizure, big end damage<br />

Mirrlees/ and broken valve cages .<br />

Blackstone Written off .<br />

I<br />

Engineering<br />

Total

HYDRO<br />

PLANT<br />

INSTALLED<br />

CAPACITY<br />

kW<br />

1ST YEAR<br />

IN SERVICE<br />

TABLE C2 : HYDRO PLANT AS AT MARCH 1991<br />

ACTION REQUIRED<br />

TO REHABILITATE<br />

ESTIMATED<br />

COST<br />

US$<br />

COMMENTS RECOMMENDATION<br />

FALE OLE 1x1600 1982 Completely replace turbine, 1,300,000 Damage caused by protective devices not The loss of hydro energy from this plant<br />

FEE generator & switchboard in power operating following fault on feeder demands that urgent action be taken to<br />

station . reinstate .<br />

Modifications to overvelocity valve 10,000 This work outstanding for considerable<br />

time .<br />

Check & make repairs to penstock 180,000 Penstock requires checking following<br />

joints & paint . damage by trees .<br />

Reform road to intakes . Repair 25,000 Access road cut by landslip . Section of<br />

intakes and headrace pipeline,<br />

reinstate and modify screen at<br />

headpond . Clean out headpond<br />

headrace pipe washed away .<br />

Complete overhaul Fale-ole 100,000 Several functions of the supervisory If unable to achieve full function of<br />

Fee/Samasoni supervisory system, system appear to be inoperative. system, it should be replaced either with<br />

replace electronics as necessary . radio link or carrier similar to<br />

Lalomauga<br />

Engineering 161,500<br />

Total 1,776,500<br />

SAMASONI 2x900 1982 Penstock maintenance incl painting . 100,000<br />

Overhaul main inlet valves, and<br />

overflow valve . Clean headpond .<br />

50,000<br />

General maintenance to electrical 10,000<br />

Reinstall electric sump pump . 2,500 The turbine floor is below ground level,<br />

so seepage occurs . Backup jet pump<br />

operates continuously, resulting in loss<br />

of hydro energy<br />

Identify fault in stator windings and<br />

rectify<br />

Engineering 17,450<br />

Total 191,950<br />

12,000 Stator windings frequently burn out<br />

Reinstall sump pump as soon as possible

I<br />

HYDRO<br />

PLANT<br />

1ST YEAR<br />

IN SERVICE<br />

TABLE C 3 : HYDRO PLANT AS AT MARCH 1991<br />

ACTION REQUIRED<br />

TO REHABILITATE<br />

ESTIMATED<br />

COST<br />

US$<br />

COMMENTS RECOMMENDATION<br />

LALOMAUGA 2x1750 1985 Build up and machine generator 18,000 Carry out repair to flange and return No<br />

/SAUNIATU coupling flange 2 m/c to service as soon as possible .<br />

Check electrical control panels and 10,000 A number of panels are dirty and some<br />

supervisory controls . Adjust,<br />

repair, clean as necessary .<br />

instruments appear to be defective<br />

Check and repair main inlet valves 10,000 Main inlet valves are not operating .<br />

Valve pit half filled with water<br />

Repair valves as soon as possible .<br />

Install overvelocity valve on 12,500 This work has been outstanding since the Install valve as matter of urgency .<br />

penstock construction of the Sauniatu scheme .<br />

The absence of this valve poses a threat<br />

to the station<br />

Check lubricating oil system and<br />

repair leak etc .<br />

5,000<br />

Check and make necessary repairs 20,000 Penstock has been damaged by falling<br />

to penstock including replacement<br />

of damaged sections<br />

trees .<br />

Check and repair lining of head 30,000 Lining of headpond has small tears etc<br />

pond, check gate on surge and repairs should be carried out to<br />

chamber, repair trash screens prevent further damage<br />

Check tunnel . Remove grit and 5,000 The tunnel has not been checked since<br />

debris . commissioning<br />

Carry out mechanical inspection of 10,000 There is reported damage to turbine Recommend that extent of damage be<br />

machines to determine extent of<br />

cavitation and erosion of turbine<br />

casing and runners<br />

casings and runners due to metal erosion investigated and remedial action taken<br />

Engage services of turbine 15,000 Temporary cooling system has been This work should be carried out as soon<br />

specialist to overcome problems of installed . This should be made as possible to ensure continuing<br />

metal erosion and bearing<br />

overheating .<br />

permanent . operation of station .<br />

Engineering 13,550<br />

Total 149,050

HYDRO<br />

PLANT<br />

INSTALLED<br />

CAPACITY<br />

kW<br />

1ST YEAR<br />

IN SERVICE<br />

TABLE C4 : HYDRO PLANT AS AT MARCH 1991<br />

ACTION REQUIRED<br />

TO REHABILITATE<br />

ESTIMATED<br />

COST<br />

US$<br />

COMMENTS RECOMMENDATION<br />

ALAOA 1x1000 1957 Improvements to critical sections of 50,000 Reconstruction aimed at minimising Carry out rehabilitation works prior to<br />

east headrace frequency and severity of future damage<br />

to headrace .<br />

1992 wet season .<br />

Overhaul switchboard . Carry out<br />

general maintenance of electrical<br />

items .<br />

10,000<br />

Clean out headpond . 12,000<br />

Engineering 17,200 Allowance includes $10,000 to design<br />

Total 89,200 apparatus for cleaning out ponds .<br />

FULUASOU 1x370 1985 Reconstruct penstock by lining or 720,000 Penstock corroded and damaged by On basis of economic analysis,<br />

1x230 1951 replace with steel pipe . falling trees . recommend write off and investigate<br />

f<br />

Repairs to dam, gates, and intake .<br />

Clean out pond .<br />

Check electric switchboard &<br />

machines . 10,000<br />

Engineering 76,000<br />

Total 836,000<br />

30,000 Dam damaged by trees .<br />

relocation of turbo-generator .

TABLE CS : SALELOLOGA DIESEL POWER STATION AS AT MARCH 1991<br />

UNIT NO . CAPACITY 1ST YEAR ESTIMATED<br />

& MAKE<br />

IN SERVICE COST<br />

COMMENTS RECOMMENDATION<br />

kWe<br />

US$<br />

100 1978 Alternator on No . I engine block Write off.<br />

Yanmar rusted . Switchgear rain soaked .<br />

Spalling of concrete block .<br />

300 1976 Switchgear and alternator rain Write off,<br />

Cummins soaked . History of Unreliability .<br />

Ex Asau .<br />

100 1978 Alternator for No .l . Engine has Write off<br />

Yanmar many oil leaks . Switchgear rain<br />

soaked .<br />

380 1989 50000 Control panel wet during cyclone . Major overhaul .<br />

Cummins (Recon) Was operational, but subsequently<br />

damaged beyond repair .<br />

60 1978 Control panel water damaged . Write off<br />

Yanmar Many oil leaks on part load .<br />

60 1978 Control panel water damaged . Write off<br />

Yanmar Many oil leaks on part load .<br />

273 1954 2200 volt outdated switchgear rain Write off<br />

Mirrlees K8 soaked . Engine in poor mechanical<br />

condition . Cooling tower very<br />

rusted .<br />

Detroit 412 ? 20000 Ex Asau . Generator will not excite . Under<br />

repairs in American <strong>Samoa</strong> .

APPENDIX D<br />

REVIEW OF TECHNICAL MANPOWER

D .1 Organisation Chart<br />

The attached chart shows the organisation of the technical work force . Refer to Table D .1 for<br />

a summary of staff numbers .<br />

D .2 Level of Staffing<br />

D /1<br />

APPENDIX D<br />

REVIEW OF TECHNICAL MANPOWER<br />

Base tradesman numbers are considered adequate for the work required to be carried out,<br />

but there is a severe shortage of skilled supervisory tradesmen and engineers .<br />

Although tradesman numbers are adequate the level of skills of the average tradesman in<br />

<strong>Samoa</strong> is less than the equivalent in more developed countries . This places a much greater<br />

emphasis on technical expertise yet this is an area of weakness in the EPC .<br />

Training is necessary, but experience in <strong>Samoa</strong> indicates that training is a long term solution<br />

with not very marked immediate result .<br />

For generation work, the two main supervisory posts have been in the past the Deputy<br />

General Manager Engineering and Manager Generation . Both are now vacant with no evident<br />

candidates.<br />

Given the relatively poor quality of trades staff and first line supervisors, unless high calibre<br />

appointments are made to these two posts, EPC's operation and maintenance will not be<br />

significantly improved .<br />

Because of Government and Board's recent emphasis on <strong>Samoa</strong>nisation the EPC has not<br />

been able to recruit overseas staff to substitute for shortages of supervisory and skilled labour<br />

in <strong>Samoa</strong>. It appears that this policy may also apply to externally funded expatriates .<br />

D .3 Policy of <strong>Samoa</strong>nlsatlon<br />

We are advised that the Government and the EPC Board wish to immediately localise all<br />

positions within the EPC and intend to fill vacant positions with locals even it they are not<br />

suitably experienced and qualified for the position . We note that there are no expatriates<br />

currently employed in EPC . There are some indications of flexibility in that EPC's General<br />

Manager has stated that he intends to advertise the vacant post of Deputy General Manager<br />

Engineering both locally and overseas .

D .4 Recommendations<br />

D 12<br />

We believe the lack of skilled staffing imposed by the strict emphasis on <strong>Samoa</strong>nisation over<br />

recent years is a major contributing factor to the present condition of EPC plant and<br />

equipment . The cost to the economy of <strong>Western</strong> <strong>Samoa</strong> of the resultant frequent electricity<br />

interruptions has been immense . On the other hand, we note that expatriate labour is<br />

expensive, often insensitive and not uniformly satisfactory .<br />

A way must be found to satisfy political and social aspirations, yet at the same time avoid the<br />

deterioration of EPC's assets and decline in operational efficiency .<br />

TABLE D.1<br />

EPC STAFF LEVELS BY CLASSIFICATION<br />

Classification 1981 1982 1963 1984 1985 1986 1987 1988 1989 1990<br />

Professional 5 4 6 7 8 8 12 10 10 10<br />

Technical 85 73 60 44 54 55 53 52 57 56<br />

Semi Skilled 76 63 70 69 63 62 62 66 76 74<br />

Unskilled 64 51 44 44 61 63 59 44 63 79<br />

Clerical 64 50 60 45 53 53 48 45 43 39<br />

Total<br />

Competent technical staff are urgently required to plan, schedule and supervise maintenance<br />

and capital works. Furthermore, large contracts for supply of services or equipment should<br />

always be preceded with a detailed contract . EPC has committed large sums of money for<br />

the supply of services and equipment without adequate specifications . This means no one<br />

is sure what is the obligation of the supplier, the supplier is not sure what the EPC wants, and<br />

price is not minimized by competition .<br />

If technically competent and experienced appointees are not available from within <strong>Samoa</strong> it<br />

is recommended that the EPC should as a matter of urgency :<br />

1 . Engage Consultants<br />

294 241 240 220 229 231 234 217 231 258<br />

Plan, design, specify, and supervise all capital works and all large maintenance works<br />

using ethical <strong>Samoa</strong>n engineering consulting firms .

D /3<br />

In view of local concerns it should be a condition of appointment of such firms that<br />

neither the firm nor the principal is engaged in contracting and that they have no<br />

association with contractors or suppliers . In all cases consultants should be selected<br />

on merit using the following criteria :<br />

Technical competence and experience<br />

Availability of resources<br />

Ability to manage the project<br />

Professional integrity and independence<br />

It is believed that it is in the EPC's best interest to make their preliminary selection of<br />

consultants before considering financial aspects . It should be noted that this is the<br />

method used and required by the International Banks, and the European Community .<br />

It is recommended that the Corporation include a sum of at least US$100,000 in their<br />

annual budget for small consulting tasks and allow the General Manager to appoint<br />

who he considers to be the most suitable consultant for a particular task .<br />

2. Contract Operation and Maintenance of Tanugamanono <strong>Power</strong> Station<br />

The EPC is currently spending some US$2,770,000 on a large comparatively highly<br />

stressed diesel generator, and it is recommended that another such engine be<br />

ordered . The type of maintenance and care which has been given to the other diesel<br />

engines in the power station over the past few years will result in rapid disaster for the<br />

new engines .<br />

In view of the constraints of <strong>Samoa</strong>nisation it is proposed that the operation and<br />

maintenance of Tanugamanono be contracted to a firm experienced in diesel power<br />

station operation . This is not an unusual situation and there should be active<br />

competition in tendering for a contract . A careful performance specification of the<br />

works required would be needed . It is proposed that the operation and maintenance<br />

of the station would be for a fixed fee as this would be the simplest approach .<br />

Alternatively it would be possible to lease the power station to an operator, and to pay<br />

him for units produced and capacity provided . In both cases adequate penalty and<br />

cancellation clauses would be required in the contract .<br />

3 . Operation and Maintenance of Afulllo Hydro<br />

The US$25 million Afulilo Storage Hydro Electric scheme is currently under<br />

construction . Its importance both to the <strong>Samoa</strong>n economy, and to the electrical<br />

system require that it should receive more care than has been received by Fale ole<br />

Fee Hydro, or Sauniatu Hydro, or indeed any of the existing hydro electric schemes .

4 . Privatization<br />

D /4<br />

As with Tanugamanono, it is recommended that operation and maintenance of the<br />

Afulilo Hydro Project should be contracted out on a fixed annual fee basis .<br />

EPC's recent performance as a statutory corporation has been poor . In this respect<br />

the EPC has not been dissimilar to a number of other <strong>Western</strong> <strong>Samoa</strong>n statutory<br />

corporations . A case could be made that the poor performance of these corporations<br />

is related to their organizational structure .<br />

It is suggested that a property regulated private company would operate an electricity<br />

utility in a manner which would be more satisfactory to the electricity customers, and<br />

at the same time be less of a financial burden on the Government .<br />

Within the Pacific Islands it may be observed that the most efficient electricity utilities<br />

are operated by private companies .<br />

It would be possible either to lease or sell the Government ownership of the<br />

Corporation. The preparation of a tight regulatory contract with a private company<br />

would not be a difficult proposition .

APPENDIX E<br />

FINANCIAL ANALYSIS

FINANCIAL ANALYSIS<br />

Summary of Contents<br />

Table 1 Summary of EPC's Financial Past Performance<br />

Table 2 Inflation Rate Assumtions<br />

Table 3 Forecasts of EPC's Sales and Generation 1988 to 2001<br />

Table 4 Diesel Fuel Price Forecasts and Forecasts of EPC Fuel Costs<br />

and Operating and Maintenance Costs<br />

Table 5 Summary of Loan Balances (Run A)<br />

Table 6 Summary of New Loans/Drawdowns (Run A)<br />

Table 7 Summary of Loan Repayments (Run A)<br />

Table 8 Summary of Loan Interest Payments (Run A)<br />

Run A Summary of Key Financial Indicators and Financial<br />

Statements<br />

Run B Summary of Key Financial Indicators and Financial<br />

Statements<br />

Run C Summary of Key Financial Indicators and Fnancial<br />

Statements<br />

Run D Summary of Key Financial Indicators and Financial<br />

Statements<br />

APPENDIX E

WESTERN SAMOA : ELECTRICITY POWER CORPORATION FINANCIAL PERFORMANCE Page 1<br />

WS$ '000<br />

CALENDAR YEAR ENDING :- 1980 1981 1983 1985 1987 1988 1989 1990<br />

Profit and Loss Account<br />

Total Generation 31 .7 30 .6 32 .0 35 .9 40 .2 43 .0 44 .0 42 .0<br />

<strong>System</strong> Losses % 30 .5% 21 .4% 22 .6% 20 .5% 16 .4% 13 .9% 13 .6% 12 .1<br />

Total Energy Sales 24 .3 25 .2 26 .1 29 .8 33 .6 37 .0 38 .0 36 .9<br />

Average Tariff/kWh (WS sene) 19 .0 23 .0 28 .1 28 .1 28 .1 28 .1 28 .1 31 .0<br />

Increase in Average Tariff % - 21 .1% 22 .0% - - - - 11 .1%<br />

Total Revenue 3906 .6 4924 .0 6653 .7 8152 .8 9318 .0 10162 .2 10914 .9 11993 .2<br />

Total Operating Expenses 4144 .4 4894 .8 7137 .7 7404 .9 8537 .8 9202 .7 11625 .8 15309 .1<br />

Net Operating Income (237 .8) 29 .2 (484 .0) 747 .9 780 .2 959 .5 (710 .9) (3315 .9)<br />

Interest Expense 61 .4 362 .9 578 .0 1159 .8 824 .5 781 .0 848 .2 842 .5<br />

Net Income (299 .2) (333 .7) (1062 .0) (411 .9) (44 .3) 178 .5 (1559 .2) (4158 .4)<br />

Less Extraordinary Items 367 .6 611 .1 2011 .7 2410 .1 872 .4 (340 .0) 569 .6 1069 .9<br />

Net Income (Loss) (666 .8) (944 .8) (3073 .7) (2822 .0) (916 .7) 518 .5 (2128 .8) (5228 .3)<br />

Rate of Return % (2 .0%) 0 .2% 1 .6% 3 .0% 2 .3% 1 .4% (0 .9%) (3 .5%)<br />

:y<br />

b<br />

r1<br />

d<br />

x

WESTERN SAMOA : ELECTRICITY POWER CORPORATION FINANCIAL PERFORMANCE Page 2<br />

WS$ , 000<br />

CALENDAR YEAR ENDING :- 1980 1981 1983 1985 1987 1988 1989 1990<br />

SOURCE AND APPLICATION OF FUNDS :<br />

Sources of Funds<br />

Internal Cash Generation 740 .2 1127 .6 1014 .8 5593 .2 4546 .1 4920 .5 3993 .2 1392 .8<br />

Government Equity 559 .9 2085 .5 6725 .7 5638 .3 1134 .9 10937 .3 5039 .9 1268 .3<br />

Borrowings 2307 .9 2847 .8 1757 .9 1221 .9 978 .5 1242 .8 424 .4 5249 .9<br />

Other (Including Working Capital) 0 .0 2 .5 1151 .4 153 .5 569 .8 6 .4 20 .0 19 .4<br />

------- ------- ------- ------- ------- ------- ------- -------<br />