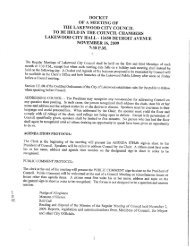

THE LAKEWOOD CITY COUNCIL CHAMBERS OCTOBER 18 2010 ...

THE LAKEWOOD CITY COUNCIL CHAMBERS OCTOBER 18 2010 ...

THE LAKEWOOD CITY COUNCIL CHAMBERS OCTOBER 18 2010 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

128 0306 CORPORATION<br />

COryoration means a mrpoation orjoint stock association or9anizetl<br />

under the laws of Ne United States the State of Ohio Or any ocher state<br />

tenitory orforeign rountry or dependency but does not include Subchapter S<br />

Corporations<br />

128 0307 EMPLOYEE<br />

Employee means onewho works forwages salary<br />

type ofwmpensation intheserviceofan employer<br />

commission orother<br />

128 0308 EMPLOYER<br />

Employer means an individual partnership association corporation<br />

govemmentbedy amt or agency or any other entity whetherornot or9anize<br />

for proft who of Nat employs one or more persons on a salary wage<br />

commission oroNer basis ofcompenutien<br />

128 0309 FISCALYEAR<br />

Fiscal year means an amounting period of twelvemonths or lessending<br />

onany day other Nan December31 128 03091 FUNDAMENTAL CHANGE<br />

Funtlamental change means any substantial alteration by an employer<br />

indudinq liquidations dissoluCion bankruptcy reorganizations such as merger<br />

consolidation acgmsition transferorchange m tlentity form ororganization<br />

128 0310 GROSS RECEIPTS<br />

Gross receipts means thetotal income from any source whatever<br />

128 03101 MANAGER<br />

Manager means any of Ne employer sofficers responsible persons<br />

employees having control or supervision and employees charr9getl wiN the<br />

responsibility offiling Ne return paying taxes and oNenmse comprying wiN Ne<br />

provisions ofthis chapter<br />

128 0311 NET PROFITS<br />

Net profts means a net gain from Ne operation of a business<br />

profession enterpnse or other activity after provision for all ordinary antl<br />

necessary ex enses eiNer paid or accrued in acmMance wiN the aaounting<br />

system used uy Ne taxpayer forfederal income tax purposes without deduction<br />

o taxes imposed by this chapter fedeal state antl other taxes based on<br />

income and inNe case ofan assouaton wilhouideduction of salaries paid to<br />

partnersand otherowners<br />

128 0312 NONRESIDENT<br />

Nonresident means an individual tlomiciled outside Ne City of<br />

Lakewood<br />

128 0313 NONRESIDENT UNINCORPORATED BUSINESS<br />

ENTTTY<br />

Nonresident unincorpoa edbusiness entity means an uninmrpoated<br />

business entity not having ari offce or place of business within Ne City of<br />

Lakewood<br />

128 0314 PERSON<br />

Person means every natural person partnership fiduciary association<br />

earnetl on and after January 1 1981 by nonresidents ofNe City<br />

forworkdone or services pertarmed or<br />

renderteyd within the Ciry<br />

c i On the portionaabuable ervthl 1981 ofBallrtPtdent<br />

d 1<br />

contluctea in me uq<br />

2 On Ne portieA of Ne distributive share of<br />

saeinuarv L 1981 of a t<br />

2<br />

uninwrPOa eqousinesseuu y r<br />

e On Ne portion attnbutableta Ne Ory ofthe net profits earned on b<br />

and after anuary 1 1981 of all mrpoatlonp derived from sales<br />

made work done services pertormed orrendered and business or<br />

other attivNes conducted in Ne City whether or not such<br />

corpoations have an office orPlace of business intheGty Ord<br />

p<br />

43 80 Approvetl byvoters 11480<br />

f On Ne portlonaNbutable to this municipality pursuant to Ne<br />

2<br />

i fnance and canying<br />

consumer s accqunts<br />

128 0502 EFFECTIVE PERIOD<br />

Such tax shall be levied rollected and with<br />

paid respell NNe salaries<br />

wages commissions and otrnet wmpensabon including lottery winnings<br />

oP businesses<br />

oinand afterroJatnuary SP1981<br />

pofessionsorotheractrvtleeezmed<br />

or corporation Whenever used in any clause prescribing and<br />

theterm person as applied to any unincorpoate entity<br />

partners or members thereof and as applied to corporations the officers<br />

thereof<br />

the<br />

DETERMINATION OFALLOCATION OFTAX<br />

or<br />

impshII meanathe<br />

328 0315 PLACE OFBUSINESS<br />

Place of business means any bona fde offce other than a mere<br />

statutoryoffce factory warehouse orother space which is occupied and used<br />

by the N aver m carrying u orthrough<br />

oeese lad min attenldance dually one<br />

ormare ofhis regular employ 9 Y<br />

128 0316 RESIDENT<br />

Resident means an individual domitiled inthe Cityof Lakewood butshall<br />

not include those individuals attending an accredited college or university on a<br />

full rime basiswho reside withinthe Gty sateen weel or less tluring thetaxable<br />

year<br />

128 031 RESIDENT UNINCORPORATED BUSINESS ENTITY<br />

Resident unincorpoated business entity<br />

means an unincorporated<br />

business entity having an office or place of business within Ne Cry of<br />

Lakewood<br />

128 03171 SCORPORATION<br />

S Corpoation orSubchapter S Co nation means any associatlon<br />

Internal RevenueCefor its tdaxable yearrer 5ofChapter 1 ofSubtitle A ofthe<br />

128 03<strong>18</strong> TAXABLE INCOME<br />

Taxable income means wages salaries and othercompensadon paid by<br />

an or<br />

employer employers before any tleduGion and orNe net profds from Ne<br />

opeabon of a business profession or otheren erpnse or activity atl1ustetl in<br />

lotterownnin sh tamtibvand gaming winngs Taxable income shall include<br />

ry 9 9 9<br />

128 0319 TAXABLE YEAR<br />

Taxable year means Ne calendaryear orthe fiscal yearupon Ne basis<br />

ofwhich Ne net profits aretp be computed antler this chapter and m Ne case<br />

of a factional part of a year theperiod forwhich such return isrequiretl N be<br />

made<br />

128 0320 TAXPAYER<br />

Taxpayer means a person whether an individual partnership<br />

assocationor any corpoation orother entry required hereunder to file a<br />

return<br />

or pay a tax<br />

IMPOSITION OFINCOME TAX<br />

128 0501 RATE ANDINCOME TAXABLE<br />

An annual tax For theprpuses specified In Section 128 0101 shall be<br />

imposed on and after anuary 1 1981 at Ne ateof one and one halfpercent<br />

12 per annumupon Nefollowing<br />

a On all salaries wages o<br />

indutling lottery wimm gs gamblnnandgami9winningseearned 9<br />

on and after anuary 1 1981 by residentsoftheGty<br />

b On all salaries wages commissions and oNer compensation<br />

allocation percena9 th of<br />

payroll and sales<br />

or0leaPed bynthe Nzpayer adlthe value ioflsuch<br />

re determinetl by multlplying Ne annual rental<br />

and other compensation paid tluring the taxable<br />

128<br />

0703 TOTALALLOCATION<br />

Add togeNer Ne percentages tletermined inaccordance wiN subsections<br />

and