THE LAKEWOOD CITY COUNCIL CHAMBERS OCTOBER 18 2010 ...

THE LAKEWOOD CITY COUNCIL CHAMBERS OCTOBER 18 2010 ...

THE LAKEWOOD CITY COUNCIL CHAMBERS OCTOBER 18 2010 ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

MUNICIPALITY OR IN ANY MUNICIPALITY THAT DOES NOT LEVY AN<br />

INCOME TAX ON NET PROFITS <strong>THE</strong>REFROM HOWEVER A LOSS FROM<br />

<strong>THE</strong> OPERATION OFA BUSINESS MAY NOT BE USED TO OFFSET <strong>THE</strong><br />

INCOME ON ATAXPAYER SW2AND OR 1099 FORMS<br />

128 110REPORTING ANET LOSS<br />

ANY BUSINESS PROFESSION ASSOCIATION OR CORPORATION<br />

REPORTING A NEi LOSS ISSUBJECT TO <strong>THE</strong> FILING REQUIREMENTS<br />

OFTHIS CHAPTER<br />

128 13PAYMENT OF TAX<br />

128 1301 PAYMENT OF TAX ON FILING OF RETURNS<br />

a The taxpayer making a reNrn shall at the time of fling thereof<br />

pay to the Administrator the amount of taxes shown as tlue<br />

thereon provided however that<br />

1 Where any portion of the tax so due has been deducted at<br />

Ne source pursuantto the provisions of Section 128 1302<br />

or<br />

2 Where any portionof Netax has been paid by NeNxpayer<br />

pursuantto theprovisions ofSec IOn128 1303 or<br />

3 Where an income tax has been pald on Ne same income to<br />

another munidpality credit forNe amount so tletluctetl or<br />

paid or aeda re Ne extent provided for in Section<br />

128 1902 shall be tleducted from Ne amount shown to be<br />

due and only Ne balance ifany shall bedue andpayable at<br />

thetime offiling Ne return<br />

b A taxpayer who has overpaid theamount oftaxto which Ne Cty is<br />

entitled under Ne provisions of this chapter may have such<br />

overpayment applied against any subsequent liability hereunder<br />

or at his election indicated on Ne return such overpaymentor<br />

part thereof shall be refunded providetl that no adtlitional taxes or<br />

refunds of lessNan erne FIVE dollars15 00shall be wllecred<br />

orrefunded<br />

c Ifany employer which Is liable for tax obligations imposed by this<br />

chapter undergoes a funtlamenNl change then Ne employer and<br />

its manager shall be liable far taxes due up re the date of the<br />

fundamental change Taxes antl foal tax returns shall be tlue<br />

immediatelyafierthe funtlamenNl change Anysuccessor employer<br />

shall wihhold from any purchase price that Nesuttessor owes to<br />

Ne predecessor an amount suficient to pay all unpaid taxes<br />

interest and penalty which the predecessor employer owes<br />

pursuant to Nis chapter The suuessor employer shall make such<br />

withholding until such time Natthepretlecesmr employer has paid<br />

Ilabledirectly to Nis municipality for payment ofsuch trust<br />

whether actually collected by such employer ornat Any tax<br />

deducted antl withheld is N be consitlered paitl to Nis<br />

municipalitywhetherornotNe employeractually remits Ne<br />

tax to this municipality far purposes of determining<br />

employee payments orcredits<br />

2 All managers shall be personalty liable re the extent of the<br />

tax interest antl penalty jointly and severallyfor failure to<br />

file Ne employer s reNrn of to pay Ne employers tax<br />

interest andpenatry asrequired under this Uapter<br />

3 No change In structure by an employer including a<br />

fundamental change discharges im managers from liability<br />

farNe employees or managers failure m remitfuntlsheld<br />

intrustNfilea tax reNrn or re pay Nxes<br />

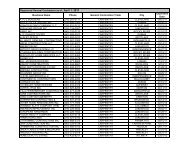

f ON OR BEFORE FEBRUARY 28 OF EACHYEAR BEGINNING<br />

WITH <strong>THE</strong> YEAR 1986 EACH EMPLOYER SHALL FILE A<br />

WITHHOLDING RETURN SETTING FORTH <strong>THE</strong> NAMES<br />

ADDRESSES AND SOCIAL SECURITY NUMBERS OF ALL<br />

EMPLOYEES FROM WHOSE COMPENSATION <strong>THE</strong> TAX WAS<br />

WITHHELD DURING TXE PRECEDING CALENDAR YEAR<br />

<strong>THE</strong> AMOUNT OF TAX WITHHELD FROM HIS OR HER<br />

EMPLOYEES ANDSUCH O<strong>THE</strong>R INFORMATION AS MAY BE<br />

REQUIRED BY <strong>THE</strong> ADMINISTRATOR ALLPAYMENTS NOT<br />

SUBIECT TO WITHHOLDING SHALL BE REPORTED ON A<br />

FORM REQUIRED BY<strong>THE</strong> ADMINISTRATOR<br />

g ON OR BEFORE FEBRUARY 28 OF EACH YEAR ALL<br />

INOMDUALS BUSINESSES EMPLOYERS BROKERS OR<br />

O<strong>THE</strong>R WHO ENGAGE PERSONS EI<strong>THE</strong>R ON A FEE OR<br />

COMM75570N BASIS OR AS INDEPENDENT CONTRACTORS<br />

AND NOT EMPLOYEES THOSE WHO ARE NOT SUBJECT TO<br />

WITHHOLDING MUST PROVIDE TXE MUNICIPALITY WITH<br />

COPIES OF ALL 3099 MISCELLANEOUS INCOME FORMS<br />

AND OR A LISTOFNAMESADDRESSES SOCIALSECURITY<br />

NUMBERS OR FEDERAL IDENTIFICATION NUMBERS AND A<br />

TOTAL AMOUNT OF EARNINGS PAYMENTS BONUSES<br />

COMMISSIONSAND OR FEES PAID TOEACH PERSON<br />

h ALL EMPLOYERS THAT PROWDE ANY CONTRACTUAL<br />

SERWCE WITHIN <strong>THE</strong> <strong>CITY</strong> AND WHO EMPLOY<br />

SUBCONTRACTORSIN CON1UNCfION WITH THAT SERVICE<br />

SHALL PRIOR TO COMMENCEMENT OF <strong>THE</strong> SERVICE<br />

PROWDE <strong>THE</strong> CIN <strong>THE</strong> NAMES AND ADDRESSES OF <strong>THE</strong><br />

SUBCONTRACTORS <strong>THE</strong> SUBCONTRACTORS SHALL BE<br />

RESPONSIBLE FOR ALL INCOME TAX EMPLOYER<br />

REQUIREMENTS UNDERTHIS GXAPTER<br />

such taxesinterest and Ifthe successor Fails m withholtl<br />

penalties<br />

such amount Nen the successor antl in a personal manner the<br />

successor smanager shall be jointly and severally<br />

payment ofsuchtaxesinterest and penalty<br />

liable for the<br />

128 1302COLLECTION ATSOURCE<br />

a In accordance with rules antl regulations prescrlbetl by the<br />

Administatoq each employer wihin or doing business within the<br />

Cty shall deduct at the time of the payment of such INCOME<br />

salary wages commission or other compensatlon the bx of one<br />

and one halfpercent12per annum ofNe gross INCOME<br />

salaries wages commissions oroNer compensatlon due by Ne<br />

employer N each employee andshall on or before thelastday of<br />

each month make a return and pay to the Administrator the<br />

amount oftaxeswdeducted during theprevious month However<br />

iftheamount of the tax wdeducted by an employerin anyerie<br />

meath is less Nan one hundred dollars 100 00PER MONTH<br />

BASED ON <strong>THE</strong> PREWOUS TAX YEAR S QUARTERLY<br />

AVERAGE the employer may defer Ne filing of a return and<br />

payment of theamount deductetl until Ne last day of Ne monN<br />

following the end of Ne calendar quarteri eecarred<br />

b Such returns shall be on a form or forms prescribed oraaeptable to the Administrator and shall be subject to the rules and<br />

regulations prescribed Nerefor by the AdministatorThe employer<br />

shall be liable for Ne payment of the tax required N be detlucted<br />

and Wrthheltl whether or not such taxes have in fact been<br />

withheM<br />

c The employer in collecting Ne tax shall be deemed to hold the<br />

same until payment is made by such employer to the Cty as a<br />

trustee for Ne benefit ofthe Cry and amsuch tax collected by<br />

such employer from his employees shall until Ne sameis paid to<br />

Ne Cry bedeemed a trustfuntl inthe hands ofsuchemployer<br />

d No person shall be requiredto withhold Ne tax on wages orocher<br />

compensatlon paid tlomestic servants employetl by him exclusively<br />

inor about such person sresidence even Nough such residence is<br />

intheCity butsuch employee shall be subject to all of the<br />

requirements ofthis chapter<br />

e M Obf tl<br />

1 Every manager is deemed re be a imstee ofthis municipality<br />

in collecting funds and holding Ne tax requiretl under<br />

ordinance to bewithheld and thefuntlsso collected by such<br />

withholding aredeemed re be trustfuntls Every manager is<br />

128 1303 DECLARATIONS OF INCOME NOT COLLECTED AT<br />

SOURCE<br />

Ca<br />

EVERYPERSON WHO<br />

ANTICIPATES ANY TAXABLE TNLOME WHICH IS NOT SUBJECT TO<br />

SECTION 128 1902AND OR FROM WHICHTAX WILL NOT BE FULLY<br />

WITHHELD AT WKEWOOD S TAX RATE OR WHO ENGAGES IN ANY<br />

BUSINESS PROFESSION ENTERPRISE OR ACTIVITY SUBJECT TO<strong>THE</strong><br />

TAX IMPOSED BY SECTION 128 05 SHALL FILE A DECLARATION<br />

SETTING FORTH SUCH ESRMATED INCOME OR <strong>THE</strong> ESRMATED<br />

PROF3T OR LOSS FROM SULH BUSINESS ACTNITY TOGE<strong>THE</strong>R WITR<br />

<strong>THE</strong> ESTIMATED TAX DUE <strong>THE</strong>REON IF ANY AND SHALL MAKE <strong>THE</strong><br />

EBTIMATED PAYMENTS REQUIRED HEREIN<br />

b Iftheestimated tax forthecurrent year less thetax to be withheld<br />

and less sueh <strong>THE</strong> tax credit ALLOWED IN SECTION 128 1902 ameuats te<br />

net mere IS LESS Nan one huntlretl dollars 100 00no dedaafion or<br />

paymentofesfimated tax is required<br />

128 1304 FILING OFDECLARATION<br />

a The dxlaatlon required by Section 128 1303 shall be fled on or<br />

before Ne Aprif IS of each year during Ne effeQiveperiod set<br />

forth in Section 128 0502 or withinSaar ma ONE HUNDRED<br />

FrvE 105 DAYS of the date thetaxpayer becomes subject to<br />

tax forNe frstime<br />

b Those taxpayers reporting on a fsgl year basis shall file a<br />

declaration on or before the fiReenN day of Ne fourth monN<br />

fallowing Ne entl ofsuchfscal year orperiod<br />

128 1305 FORM OFDECLARATION<br />

a The dedaationrequired by Seciion 128 1303 shall be fletl upon a<br />

form furnished by orobtainable from Ne Adminisbarer OR ON AN<br />

ACCEPTABLE GENERIC FORM AS DEFINED IN THIS<br />

CHAPTER<br />

redit shall<br />

be taken far theCity bx to he withheld from any portion ofsuN<br />

income antl cretlitshall be taken fortax re be paidor wdhheltl and<br />

remitted to another taxing munidpality in accordance with the<br />

provisions ofSection126 1902