Change of Guards - The Real Estate and Housing Developers ...

Change of Guards - The Real Estate and Housing Developers ...

Change of Guards - The Real Estate and Housing Developers ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

President<br />

Dato’ Michael Yam Kong Choy<br />

Serai Saujana Development Sdn Bhd<br />

Immediate Past President<br />

Datuk Ng Seing Liong<br />

Kota Kelang Development Sdn Bhd<br />

Most Recent Past President<br />

Dato’ Jeffrey Ng Tiong Lip<br />

Urban Hallmark Properties Sdn Bhd<br />

Deputy President<br />

Dato’ Fateh Isk<strong>and</strong>ar bin<br />

Tan Sri Dato’ Mohamed Mansor<br />

Glomac Enterprise Sdn Bhd<br />

Vice-President/<br />

Perak Branch Chairman<br />

Dato’ Francis Lee Yew Hean<br />

Antap Enterprises Sdn Bhd<br />

Vice-President<br />

Tn Hj Muztaza Mohamad<br />

Fairview Development Sdn Bhd<br />

Vice-President<br />

Dato’ Soam Heng Choon<br />

RB L<strong>and</strong> Sdn Bhd<br />

Secretary-General/<br />

Kedah/Perlis Branch Chairman<br />

Dato’ Ricque Liew Yin Chew<br />

Paramount Property (Utara) Sdn Bhd<br />

Deputy Secretary-General<br />

Dato’ Jamaludin Osman<br />

Isl<strong>and</strong> & Peninsular Bhd<br />

towards sustainable development<br />

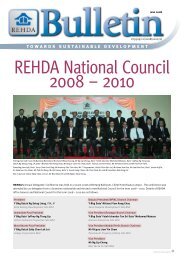

<strong>Change</strong> <strong>of</strong> <strong>Guards</strong><br />

the top property developers around the country convened at<br />

REHDA’s Annual Delegates' Conference 2010 on 19 June 2010 to<br />

review the term period <strong>of</strong> 2009/2010, <strong>and</strong> this time with the<br />

additional agenda <strong>of</strong> electing a new National Council lineup.<br />

Delegates were hosted to a specially arranged dinner on<br />

18 June 2010, where outgoing President Datuk Ng Seing Liong<br />

addressed the delegates, thanking them for their support <strong>and</strong><br />

cooperation throughout his years <strong>of</strong> presidency. Having served<br />

the maximum tenure <strong>of</strong> two terms, it was time to pass the baton.<br />

National Council members for the term 2010/2012 were<br />

elected <strong>and</strong> announced at the ADC, <strong>and</strong> a new lineup <strong>of</strong> <strong>of</strong>fice<br />

bearers were formed, headed by the new REHDA President Dato’<br />

Michael KC Yam. <strong>The</strong> new National Council lineup is as follows:<br />

National Treasurer<br />

Mr Teh Boon Ghee<br />

IGB Corporation Bhd<br />

EXCO Members<br />

Datuk Eddy Chen Lok Loi<br />

Cekap Corporation Bhd<br />

Penang Branch Chairman<br />

Dato’ Jerry Chan Fook Sing<br />

Asas Mutiara Sdn Bhd<br />

Mr Anthony Cho Tian Han<br />

Kamra Jaya Sdn Bhd<br />

Johor Branch Chairman<br />

Mr Simon Heng Kwang Hock<br />

Property Village Berhad<br />

Kelantan Branch Chairman<br />

Dato’ Sekarnor Che Omar<br />

Strata Merge (M) Sdn Bhd<br />

Melaka Branch Chairman<br />

Datuk Gwee Yew Kiat<br />

Naga Jaguh Development Sdn Bhd<br />

Negeri Sembilan Branch Chairman<br />

Mr S. Sivanyanam<br />

Mega 3 <strong>Housing</strong> Sdn Bhd<br />

Pahang Branch Chairman<br />

Mr Cheoh Chee Guan<br />

Brilliant Foresight Sdn Bhd<br />

Selangor Branch Chairman<br />

Mr Ngian Siew Siong<br />

Sunway City Berhad<br />

Terengganu Branch Chairman<br />

Mr Woo Mun Kit<br />

Citiraya Development Sdn Bhd<br />

Wilayah Persekutuan (KL)<br />

Chairman<br />

Mr Tong Nguen Khoong<br />

Bukit Kiara Properties Sdn Bhd<br />

Council Members<br />

Tan Sri Datuk Chan Sau Lai<br />

Beneton Properties Sdn Bhd<br />

Dato’ Johan Ariffin<br />

Mitral<strong>and</strong> Properties Sdn Bhd<br />

Mr Che King Tow<br />

Rimau Properties Sdn Bhd<br />

Mr Albert Lai Tuck Yew<br />

Comfort Enterprises Sdn Bhd<br />

Mr Ng Lip Chong<br />

Nee Yan & Co Sdn Bhd<br />

june 2010<br />

pp9309/12/2010 (026294)<br />

Mr Poh Pai Kong<br />

Tradewinds Corporation Bhd<br />

Mr Soh Hong<br />

Chin Pek Soo & Sons Sdn Bhd<br />

Mr Tiah Oon Ling<br />

Integrated Development Sdn Bhd<br />

En Wan Hashimi Albakri<br />

Sime Darby Property Bhd

2 | editorial<br />

Greetings,<br />

REHDA congratulates <strong>and</strong> warmly welcomes the<br />

new National Council lineup for the term 2010/2012,<br />

where some new faces are expected to add<br />

vibrancy <strong>and</strong> progressiveness to the Association.<br />

Whilst they may be new members to the Council,<br />

they have already actively participated in the<br />

Association’s activities prior to their election into<br />

the National Council.<br />

Throughout the month <strong>of</strong> May, the respective<br />

REHDA Branch members sat at their Annual General<br />

Meetings (AGM) to elect their new committee<br />

members. REHDA also welcomes the four newly<br />

elected Branch Chairmen <strong>and</strong> forward to them our<br />

best wishes – Mr Tong Nguen Khoong <strong>of</strong> Bukit Kiara<br />

Properties (Wilayah Persekutuan (KL) Branch), Mr<br />

Ngian Siew Siong <strong>of</strong> Sunway City Berhad (Selangor<br />

Branch), Mr Simon Heng Kwang Hock <strong>of</strong> Property<br />

Village Berhad (Johor Branch), Mr S. Sivanyanam <strong>of</strong><br />

Mega 3 <strong>Housing</strong> Sdn Bhd (Negeri Sembilan<br />

Branch).<br />

REHDA also congratulates the Branch Chairmen<br />

who have retained their seats, thanking them for<br />

years <strong>of</strong> faithful service – Dato’ Francis Lee Yew<br />

Hean <strong>of</strong> Antap Enterprises Sdn Bhd (Perak Branch),<br />

Datuk Gwee Yew Kiat <strong>of</strong> Naga Jaguh Development<br />

Sdn Bhd (Melaka Branch), Dato’ Jerry Chan Fook<br />

Sing <strong>of</strong> Asas Mutiara Sdn Bhd (Penang Branch), Mr<br />

Cheoh Chee Guan <strong>of</strong> Brilliant Foresight Sdn Bhd<br />

(Pahang Branch), Mr Woo Mun Kit <strong>of</strong> Citiraya<br />

Development Sdn Bhd (Terengganu Branch), Dato’<br />

Ricque Liew Yin Chew <strong>of</strong> Paramount Property<br />

(Utara) Bhd (Kedah/Perlis Branch), Dato’ Sekarnor<br />

Che Omar <strong>of</strong> Strata Merge.<br />

<strong>The</strong> Association looks forward to new<br />

beginnings, new aspirations <strong>and</strong> new achievements<br />

in the days to come.<br />

This issue <strong>of</strong> REHDA Bulletin will also delineate<br />

the details <strong>of</strong> Selangor’s definition <strong>of</strong> Bumiputera<br />

released recently (Page 3 <strong>and</strong> 10), as well as<br />

include main points on the Draft Guidelines for GST<br />

on Property (Page 4, 5 <strong>and</strong> 8).<br />

We wish you happy reading.<br />

contents<br />

cover story<br />

> <strong>Change</strong> <strong>of</strong> <strong>Guards</strong> 1<br />

announcement<br />

> SELANGOR: Bumiputera Defined 3 & 10<br />

industry matters<br />

> Goods <strong>and</strong> Services Tax (GST) for<br />

Property Development 4, 5 & 8<br />

branch news<br />

> REHDA Branches Elect <strong>The</strong>ir Leaders 6 & 7<br />

> Discussion with Datuk B<strong>and</strong>ar Kuala Lumpur 9<br />

rehda institute<br />

> REHDA Property Leader Forum 2010 10<br />

> Green Solutions for Property Development<br />

Conference 2010 (GSPD 2010) 10<br />

> REHDA Institute <strong>and</strong> Danajamin Talk 10<br />

diary<br />

> May 2010 9<br />

editorial<br />

committee<br />

chairman<br />

Dato’ Michael KC Yam<br />

members<br />

Datuk Eddy Chen<br />

Pn Rusnani Abd Rahman<br />

Ms Debbie Loh<br />

rehda bulletin is published by<br />

<strong>Real</strong> <strong>Estate</strong> & <strong>Housing</strong> <strong>Developers</strong>’<br />

Association Malaysia<br />

No. 50G-3, 50H-3, 50I-3, Kelana Mall<br />

Jalan SS6/14, Kelana Jaya,<br />

47301 Petaling Jaya, Selangor<br />

Tel: 03-7803 2978<br />

Fax: 03-7803 5285 03-7805 1206<br />

E-mail: secretariat@rehda.com<br />

Website: www.rehda.com<br />

producer<br />

Trix Sdn Bhd (267962-p)<br />

77c, Jalan ss22/23, Damansara Jaya<br />

47400 Petaling Jaya, Selangor Darul Ehsan<br />

Tel: 03-7729 5066 Fax: 03-7729 5077<br />

printer<br />

Pencetak Weng Fatt Sdn Bhd (19847-w)<br />

Lot 6, Lorong Kilang A, Off Jalan Kilang<br />

46050 Petaling Jaya, Selangor Darul Ehsan<br />

Tel: 03-7783 9231 Fax: 03-7783 9250<br />

Whilst every effort is made to ensure the accuracy <strong>of</strong> the<br />

contents published, REHDA Malaysia shall not be held<br />

liable for any reproduction, omission, error or inaccuracy<br />

<strong>of</strong> this publication.

SELANGOR: Bumiputera Defined<br />

the Director <strong>of</strong> the L<strong>and</strong> <strong>and</strong> Mines Office <strong>of</strong> the State <strong>of</strong> Selangor has issued the circular<br />

No. 5/2010 to specify the guidelines on eligibility for purchasing property allocated for the<br />

bumiputera. <strong>The</strong> article below is a reproduction <strong>of</strong> the circular.<br />

Garis P<strong>and</strong>uan Berhubung Kriteria Individu dan Syarikat bagi Permohonan Kebenaran<br />

untuk Memiliki Hartanah di bawah Kuota Bumiputera di Negeri Selangor<br />

1. Tujuan<br />

Pekeliling ini disediakan sebagai garis p<strong>and</strong>uan kepada Pentadbir Tanah Daerah<br />

dan Jabatan-jabatan Kerajaan dalam Negeri Selangor berhubung criteria<br />

individu dan syarikat Bumiputera bagi permohonan kebenaran untuk memiliki<br />

hartanah di bawah kuota Bumiputera di Negeri Selangor.<br />

2. Latar Belakang<br />

2.1 Selaras dengan perwakilan kuasa oleh Majlis Mesyuarat Kerajaan Negeri<br />

melalui keputusan Mesyuarat MMKN ke 12/2008 pada 28hb Mei 2008 dan<br />

30hb Mei 2008 dan Warta Kerajaan Negeri Selangor No. 3378 bertarikh 4hb<br />

Disember 2008, permohonan untuk mendapatkan pengesahan status<br />

Bumiputera bagi individu/syarikat untuk pembelian hartanah di Negeri<br />

Selangor diputuskan di peringkat Pengarah Tanah dan Galian Selangor.<br />

2.2 Berdasarkan permohonan yang diterima, didapati terdapat keperluan untuk<br />

satu dasar dirangka bagi mentakrifkan istilah Bumiputera dalam<br />

mengendalikan permohonan kebenaran untuk memiliki hartanah di bawah<br />

kuota Bumiputera di Negeri Selangor, tanpa seseorang individu atau<br />

syarikat membuat permohonan untuk pengesahan status Bumiputera.<br />

2.3 Sehubungan itu, kertas dasar berhubung perkara ini telah dibentangkan<br />

dalam Mesyuarat Jawatankuasa Tetap Pembangunan Tanah dan Sumber<br />

Alam pada 24 November 2009 dan selanjutnya diluluskan oleh Majlis<br />

Mesyuarat Kerajaan Negeri yang disahkan melalui keputusan Mesyuarat<br />

MMKN ke 6/2010 pada 10hb Februari 2010.<br />

3. Kriteria Kelayakan Individu dan Syarikat bagi Permohonan Kebenaran untuk<br />

Memiliki Hartanah di bawah Kuota Bumiputera di Negeri Selangor<br />

3.1 Kelayakan seseorang individu atau sesebuah syarikat untuk memiliki<br />

hartanah di bawah kuota Bumiputera di Negeri Selangor adalah<br />

berdasarkan Perlembagaan Persekutuan Malaysia dan peruntukan undangundang<br />

berikut:<br />

3.1.1 Orang “Melayu” di bawah Perkara 160 (2), Perlembagaan<br />

Persekutuan;<br />

3.1.2 “Anak negeri” Sabah di bawah Perkara 161A (6) (b) Perlembagaan<br />

Persekutuan dan Seksyen 2 (1) Interpretation (Definition <strong>of</strong><br />

Native) Ordinance Sabah (Sabah Cap. 64);<br />

3.1.3 “Anak negeri” Sarawak di bawah Perkara 161A (6) (a) dan 161A (7)<br />

Perlembagaan Persekutuan;<br />

3.1.4 Orang Asli Semenanjung Malaysia di bawah Perkara 160 (2)<br />

Perlembagaan Persekutuan dan Seksyen 3 Akta Orang Asli 1954<br />

(Akta 134);<br />

3.2 Bagi mempertimbangkan permohonan kebenaran untuk memiliki hartanah<br />

di bawah kuota Bumiputera di Negeri Selangor, kelayakan sebagai<br />

Bumiputera adalah berdasarkan keturunan dan fakta berikut:<br />

3.2.1 Melayu iaitu:<br />

3.2.1.1 Seseorang yang menganut agama Islam;<br />

3.2.1.2 Lazim bertutur bahasa Melayu;<br />

3.2.1.3 Mengamalkan adat istiadat Melayu; dan<br />

3.2.1.4 Lahir sebelum Hari Merdeka di Persekutuan atau<br />

Singapura/ibu atau bapanya; atau<br />

3.2.1.5 Berdomisil di Persekutuan atau Singapura pada Hari<br />

Merdeka; atau<br />

3.2.1.6 Seseorang anak yang ibu atau bapanya lahir sebelum Hari<br />

Merdeka di Persekutuan atau Singapura/datuk neneknya,<br />

atau ibu atau bapanya yang berdomisil di Persekutuan atau<br />

Singapura pada Hari Merdeka; dan<br />

3.2.1.7 Dapat mengemukakan sijil kelahiran berkaitan.<br />

announcement<br />

| 3<br />

3.2.2 Anak negeri Sabah iaitu:<br />

3.2.2.1 Seseorang warganegara Malaysia yang merupakan anak<br />

atau cucu kepada seorang daripada suatu ras asli bagi<br />

Sabah, dan telah lahir (sama ada atau tidak pada atau<br />

selepas Hari Malaysia) sama ada di Sabah atau dengan<br />

bapanya berdomisil di Sabah pada masa kelahiran itu;<br />

atau<br />

3.2.2.2 Seseorang yang menetap di Sabah dan telah tinggal di<br />

Sabah di kalangan anak negeri Sabah, yang mana ibu atau<br />

bapa atau datuknya adalah negeri Sabah, atau<br />

3.2.2.3 Seseorang yang menetap di Sabah terdiri daripada<br />

kalangan orang Suluk, Kagayan, Simonol, Sibutu atau<br />

Ubian atau penduduk asli Negeri Sarawak atau Negeri<br />

Brunei yang telah tinggal berterusan selama tiga (3) tahun<br />

sebelum dari tarikh beliau mengisytiharkan dirinya<br />

sebagai anak negeri, mempunyai kelakuan yang baik<br />

semasa tinggal di Sabah dan tidak tertakluk oleh<br />

Immigaration Act 1959/63. Kecuali salah seorang ibu<br />

bapanya terdiri daripada kalangan anak negeri yang<br />

tinggal dan diketahui dikebumikan di Sabah, masa<br />

kelayakan mesti dikurangkan kepada dua (2) tahun; atau<br />

3.2.2.4 Seseorang yang menetap di Sabah yang merupakan<br />

penduduk asli Republik Indonesia atau Sulu dari<br />

kepulauan Filipina atau Malaya atau Singapura telah<br />

tinggal dan menjadi penduduk selama lima (5) tahun dari<br />

tarikh beliau mengisytiharkan dirinya sebagai anak negeri,<br />

berkelakuan baik semasa tinggal di Sabah dan tidak<br />

tertakluk kepada Immigration Act 1959/63; dan sekiranya<br />

dikehendaki,<br />

3.2.2.5 dapat mengemukakan sijil atau dokumen daripada<br />

Mahkamah Anak Negeri yang mengisytiharkan beliau atau<br />

ibu atau bapa atau datuk moyangnya sebagai anak negeri<br />

Sabah.<br />

3.2.3 Anak negeri Sarawak iaitu:<br />

3.2.3.1 seseorang warganegara Malaysia yang tergolong dalam<br />

salah satu daripada ras Bukitan, Bisayah, Dusun, Dayak<br />

Laut, Dayak Darat, Kadayan, Kalabit, Kayan, Kenyah<br />

(termasuk Sabup dan Sipeng), Kajang (termasuk Sekapan,<br />

Kejaman, Lahanan, Punan, Tanjong dan Kanowit), Lugat,<br />

Lisum, Melayu, Melano, Murut, Penan, Sian, Tagal, Tabun<br />

dan Ukit; dan sekiranya dikehendaki,<br />

3.2.3.2 dapat mengemukakan salinan warta daripada Mahkamah<br />

Bumiputera yang mengisytiharkan beliau atau ibu atau<br />

bapa atau datuk moyangnya sebagai anak Negeri<br />

Sarawak.<br />

3.2.4 Orang Asli Semenanjung Malaysia iaitu:<br />

3.2.4.1 Mana-mana orang yang bapanya ialah anggota kumpulan<br />

etnik orang asli, yang bercakap bahasa orang asli dan<br />

lazimnya mengikut cara hidup orang asli dan adat dan<br />

kepercayaan orang asli, dan termasuk seorang keturunan<br />

melalui jurai lelaki orang itu;<br />

3.2.4.2 Mana-mana orang daripada mana-mana kaum yang<br />

diambil sebagai anak angkat semasa bayi oleh orang asli<br />

yang telah dibesarkan sebagai orang asli, lazimnya<br />

bercakap bahasa orang asli, lazimnya mengikut cara hidup<br />

orang asli dan adat dan kepercayaan orang asli dan ialah<br />

anggota suatu masyarakat orang asli; atau<br />

more on page 10,

4 | industry matters<br />

Goods <strong>and</strong> Services Tax (GST)<br />

for Property Development<br />

the goods <strong>and</strong> services tax (GST) is scheduled to be<br />

implemented in Malaysia by mid-2011, taking over the<br />

current sales tax system. <strong>The</strong> Royal Malaysian Customs<br />

has taken the initiative to provide a set <strong>of</strong> draft<br />

guidelines for REHDA’s feedback. <strong>The</strong> main points <strong>of</strong> the<br />

draft guidelines are reproduced below.<br />

A. INTRODUCTION<br />

1. This Industry Guide provides information on how<br />

the Goods <strong>and</strong> Services Tax (GST) works for<br />

property developers. It will address the GST<br />

treatment on activities <strong>of</strong> property developers,<br />

including housing developers licensed under<br />

<strong>Housing</strong> <strong>Developers</strong> (Control <strong>and</strong> Licensing) Act<br />

1966, <strong>and</strong> any person engaged in or undertaking a<br />

property development.<br />

B. GENERAL OPERATION OF GST<br />

1. <strong>The</strong> Goods <strong>and</strong> Services Tax (GST) is a tax on the<br />

final consumption <strong>of</strong> goods <strong>and</strong> services. Unlike<br />

the existing consumption tax i.e. Sales Tax system,<br />

which is a single stage tax at manufacturers level,<br />

the GST is a multi stage tax. Payment <strong>of</strong> tax is<br />

made in stages on the value added by the<br />

intermediaries in the production <strong>and</strong> distribution<br />

chain. <strong>The</strong> tax is ultimately passed to the final<br />

consumer. <strong>The</strong>refore, the tax itself is not a cost to<br />

the intermediaries <strong>and</strong> does not appear as an<br />

expense item in their financial statements.<br />

2. A person who is registered under the Malaysian<br />

GST is required to charge the GST on his output <strong>of</strong><br />

taxable supply <strong>of</strong> goods <strong>and</strong> services made to his<br />

customers. He is allowed to claim as credit any GST<br />

incurred on his purchases which are inputs to his<br />

business <strong>of</strong> making taxable supply <strong>of</strong> goods <strong>and</strong><br />

services. Thus, double taxation will be avoided as<br />

only the value added at each stage is taxed.<br />

C. OVERVIEW OF INDUSTRY<br />

1. Property developers buy l<strong>and</strong>, plan, create,<br />

develop, design <strong>and</strong> market real property.<br />

<strong>Developers</strong> work with many different people along<br />

each step <strong>of</strong> the development <strong>of</strong> property.<br />

<strong>Developers</strong> work with financiers, federal <strong>and</strong> state<br />

authorities, local authorities, contractors, <strong>and</strong><br />

lawyers, engineers, surveyors, architects <strong>and</strong><br />

others.<br />

2. <strong>Real</strong> estate refers to l<strong>and</strong> <strong>and</strong> everything attached<br />

to it, whether on or below the surface. L<strong>and</strong><br />

includes buildings, trees, vegetation <strong>and</strong> other<br />

structures <strong>and</strong> objects in, under or over it. <strong>Real</strong><br />

property is the rights to use real estate <strong>and</strong><br />

includes activities concerned with ownership, use<br />

<strong>and</strong> transfers <strong>of</strong> immovable property.<br />

D. OVERVIEW OF GST TREATMENT<br />

ON INDUSTRY<br />

1. <strong>The</strong> supply <strong>of</strong> l<strong>and</strong> <strong>and</strong> building for commercial,<br />

administrative <strong>and</strong> industrial purpose is subject to<br />

GST, while for agriculture <strong>and</strong> residential property<br />

including residential house the supply is exempted.<br />

<strong>The</strong> classification <strong>of</strong> l<strong>and</strong> is based on the conditions<br />

<strong>of</strong> use stated in the l<strong>and</strong> title.<br />

2. <strong>The</strong> sale <strong>and</strong> disposal <strong>of</strong> property involving a<br />

transfer <strong>of</strong> ownership or title is regarded as a supply<br />

<strong>of</strong> goods. In the case <strong>of</strong> taxable supply <strong>of</strong> completed<br />

unit, GST is charged on the whole value <strong>of</strong> the<br />

property when the l<strong>and</strong> is made available to the<br />

purchaser, that is on the date <strong>of</strong> conveyance. In the<br />

case <strong>of</strong> taxable supply <strong>of</strong> real property under<br />

construction, GST is charged on each <strong>and</strong><br />

successive interim or periodic payment. A<br />

transaction which involves a transfer <strong>of</strong> possession<br />

such as a lease <strong>and</strong> rental <strong>of</strong> property is regarded as<br />

a supply <strong>of</strong> services. GST is imposed on each<br />

successive lease or rental payment.<br />

3. Where a developer charges his title to the lender to<br />

get a loan (whether mortgage or lien) such action is<br />

not regarded as a supply <strong>and</strong> is not subject to GST.<br />

<strong>The</strong> act <strong>of</strong> entering or lifting <strong>of</strong> caveat is not a supply<br />

by the lender or borrower.<br />

4. Where the lender sells l<strong>and</strong> under power <strong>of</strong> sale in<br />

satisfaction <strong>of</strong> debt or foreclosures on the l<strong>and</strong> <strong>of</strong><br />

the developer, the developer is regarded as making<br />

a supply but the tax will be accounted by the lender.<br />

5. All supplies are regarded as out <strong>of</strong> scope in relation<br />

to charges <strong>and</strong> fees imposed by the Government to<br />

real estate such as quit rent, premium, survey fees<br />

(conducted) by Survey Department), registration <strong>of</strong><br />

titles <strong>and</strong> other payment. <strong>The</strong> assessment rates<br />

imposed by the local authorities are also out <strong>of</strong><br />

scope <strong>of</strong> GST.<br />

FREQUENTLY ASKED QUESTIONS<br />

1. Registration<br />

Q1: As a developer, I supply both commercial<br />

<strong>and</strong> residential properties. Am I liable to be<br />

registered?<br />

A1: All developers engaged in or undertaking<br />

property development, whether they are<br />

companies, statutory bodies, societies,<br />

partnerships or individuals are liable to be<br />

registered if their annual turnover involving<br />

taxable supplies in the past 12 months or<br />

within future 12 months exceeds the<br />

threshold. Taxable supplies include the sale,<br />

lease <strong>and</strong> rental <strong>of</strong> non-residential property<br />

(exempt supplies), <strong>and</strong> the value <strong>of</strong> property<br />

put to private or non-business use.<br />

Q2: If my annual turnover <strong>of</strong> taxable supplies does<br />

not exceed the threshold, can I apply to be<br />

registered?<br />

A2: You may apply for voluntary registration, but<br />

once you registered you must remain registered<br />

for a minimum <strong>of</strong> two years.<br />

2. Supplies<br />

Q3: What are the supplies which are subjected to<br />

GST in the real estate industry?<br />

A3: <strong>The</strong> supplies which are subjected to GST include<br />

the supplies <strong>of</strong> all buildings except residential<br />

housing/building.<br />

Q4: In the course <strong>of</strong> undertaking a property<br />

development project, I have to surrender part<br />

<strong>of</strong> my l<strong>and</strong>/property back to the State<br />

Authority without monetary considerations to<br />

be used for educational, religious, charitable<br />

or public purpose. <strong>The</strong>se supplies include<br />

roads, police station, schools, recreational<br />

areas <strong>and</strong> other public amenities. Are these<br />

supplies subject to GST?<br />

A4: No, these are non supplies <strong>and</strong> hence are not<br />

subject to GST. <strong>The</strong>y are provided to the<br />

authorities without monetary consideration in<br />

the course <strong>of</strong> undertaking the property<br />

development to supplement the main<br />

development. <strong>The</strong>y form part <strong>of</strong> the cost <strong>of</strong><br />

business <strong>and</strong> is costed into the price <strong>of</strong> the main<br />

development.<br />

Q5: I also have to transfer the infrastructure <strong>of</strong><br />

utility services such as substations, sewerage<br />

treatment plant <strong>and</strong> water tank to the<br />

respective utilities provider for a purely<br />

nominal charge. Are these transfers/supplies<br />

subject to GST?<br />

A5: No, these are non supplies <strong>and</strong> hence are not<br />

subject to GST. <strong>The</strong>y are transferred to the<br />

utilities providers at a purely nominal charge.<br />

<strong>The</strong> utility providers are henceforth required to<br />

maintain those infrastructure.<br />

Q6: In relation to the question above, what<br />

constitutes my taxable <strong>and</strong> exempt supplies?<br />

A6: Your supply consist <strong>of</strong> supplies <strong>of</strong> the main<br />

development that you charge your purchasers.<br />

Your taxable supply is the sale <strong>of</strong> the commercial<br />

buildings. Your exempt supply is the sale <strong>of</strong> your<br />

residential housing.<br />

Q7: I provide administrative services such as<br />

providing endorsement <strong>of</strong> deed <strong>of</strong> assignment.<br />

Are such administrative fees subject to GST?<br />

A7: Yes, administrative fees incurred such as<br />

endorsing the deed <strong>of</strong> assignment are subject to<br />

GST because administrative fees are st<strong>and</strong>ard<br />

rated supplies.<br />

Q8: I charge interest for late payment. Is this<br />

interest payment subject to GST?<br />

A8: Interest payment related to late payment is<br />

regarded as a penalty <strong>and</strong> is considered to be<br />

out <strong>of</strong> scope. <strong>The</strong>refore, it is not subject to GST.

Q9: Is the conversion premium imposed by the<br />

Federal <strong>and</strong> State Authority subject to GST?<br />

A9: No, the conversion premium <strong>and</strong> all other<br />

premium <strong>and</strong> fees imposed by the Federal<br />

<strong>and</strong> State Authority related to real estate is<br />

regarded as out <strong>of</strong> scope <strong>and</strong> is not subject to<br />

GST.<br />

3. Time <strong>of</strong> Supply <strong>and</strong> Accounting Period<br />

Q10: When <strong>and</strong> how do I account for GST for<br />

supplies <strong>of</strong> uncompleted non-residential<br />

property under progressive payment<br />

contracts?<br />

A10: You have to account for GST at the various<br />

stages <strong>of</strong> the progressive/scheduled payment<br />

based on the earlier <strong>of</strong> the following:<br />

a. When tax invoice is issued; or<br />

b. When payment is received.<br />

Example 1:<br />

A purchaser enters into an agreement to buy<br />

a commercial building which is under<br />

construction. <strong>The</strong> sales price <strong>of</strong> the building is<br />

RM300,000.00. <strong>The</strong> payment is scheduled<br />

for 4 successive interval payments <strong>and</strong> the<br />

respective amounts to be paid is as follows:<br />

Scheduled Payment Period Amount<br />

1st payment (1 April) RM40,000.00<br />

2nd payment (1 July) RM60,000.00<br />

3rd payment (1 October 2006) RM80,000.00<br />

4th payment (1 Jan) RM120,000.00<br />

<strong>The</strong> developer subsequently issues a tax<br />

invoice at each successive period. <strong>The</strong> GST<br />

chargeability is as follows:<br />

1st interval (April 1st)<br />

Tax invoice = RM40,000.00<br />

GST (40,000 X 4%) = RM1,600.00<br />

2nd interval<br />

Tax invoice = RM60,000.00<br />

GST (60,000 X 4%) = RM2,400.00<br />

3rd interval<br />

Tax invoice = RM80,000.00<br />

GST (80,000 X 4%) = RM3,200.00<br />

4th interval<br />

Tax invoice = RM120,000.00<br />

GST (120,000 X 4%) = RM4,800.00<br />

<strong>The</strong> developer accounts for GST based on the<br />

date the tax invoice is issued. Assuming you<br />

are on a monthly taxable period, if you issue<br />

a tax invoice on 1st April, you have to account<br />

for GST in your April GST return.<br />

Q11: Do I have to account for GST on receipt <strong>of</strong><br />

payment for a booking fee?<br />

A11: You do not have to account for GST on receipt<br />

<strong>of</strong> payment <strong>of</strong> booking fee because it is not<br />

regarded as part payment for the supply <strong>of</strong><br />

real property. However, if you receive<br />

payment upon signing <strong>of</strong> Sales <strong>and</strong> Purchase<br />

Agreement, that payment will form part<br />

payment for the sale <strong>of</strong> real property <strong>and</strong> will<br />

be subject to GST.<br />

Q12: When do I have to account for GST on the sale<br />

<strong>of</strong> a completed non-residential property?<br />

A12: If the contract requires a purchaser to pay upon<br />

signing <strong>of</strong> Sales <strong>and</strong> Purchase (S&P) Agreement<br />

<strong>and</strong> a final payment, you have to account for<br />

GST:<br />

At the stage when S&P is signed<br />

GST should be accounted at the earlier <strong>of</strong> the<br />

following:<br />

a. When a tax invoice is issued; or<br />

b. When the payment is received.<br />

At the transfer stage<br />

GST should be accounted at the earliest <strong>of</strong> the<br />

following:<br />

a. When a tax invoice is issued;<br />

b. When payment <strong>of</strong> the balance <strong>of</strong> the<br />

purchase price is received;<br />

c. When the property is made available to the<br />

purchaser; or<br />

d. When the transfer is effected.<br />

4. Place <strong>of</strong> Supply<br />

Q13: If I am a developer registered in Malaysia <strong>and</strong><br />

sells non-residential properties in Malaysia,<br />

do I have to account for GST on my supplies?<br />

A13: Yes, all non-residential properties disposed in<br />

Malaysia by property developer registered in<br />

Malaysia will be subjected to GST.<br />

Q14: If I am registered in Langkawi <strong>and</strong> supply nonresidential<br />

property in Langkawi, do I have to<br />

account for GST?<br />

A14: Langkawi is regarded as a Designated Area (DA).<br />

Supplies within DA are disregarded. Hence they<br />

are not subject to GST.<br />

Q15: If I am registered in Langkawi <strong>and</strong> supply nonresidential<br />

property outside Langkawi<br />

(outside DA), do I have to account for GST?<br />

A15: Yes, these supplies are subject to GST.<br />

Q16: If a developer outside Designated Area in<br />

Malaysia supply non-residential property in<br />

the Designated Area, is the supply subject to<br />

GST?<br />

A16: No, the supply is not subject to GST. <strong>The</strong> supply<br />

is disregarded. However, if the developer makes<br />

a supply <strong>of</strong> residential property in the<br />

Designated Area, he is regarded as making an<br />

exempt supply.<br />

5. Input Tax Credit<br />

Q17: Is the input tax incurred for the entire property<br />

development incorporating residential,<br />

commercial <strong>and</strong> industrial units recoverable?<br />

A17: No, only the input tax on goods <strong>and</strong> services<br />

which are used or will be used wholly on making<br />

taxable supplies is recoverable. You should<br />

identify the inputs that are directly attributable<br />

to making taxable supplies <strong>and</strong> claim that<br />

portion. In this case, only the input tax for inputs<br />

used wholly in making commercial <strong>and</strong><br />

industrial buildings is recoverable. Other<br />

residual input tax is apportioned between the<br />

taxable <strong>and</strong> exempt supplies.<br />

industry matters<br />

| 5<br />

Q18: Can I claim input tax for the supplies<br />

incidental to the supply <strong>of</strong> the main<br />

development project? For example,<br />

l<strong>and</strong>scaping, roads, school, police station<br />

<strong>and</strong> other public amenities?<br />

A18: Yes, you can claim input tax incurred on<br />

such works which is attributable to the<br />

supply <strong>of</strong> the main development (making<br />

commercial, industrial buildings <strong>and</strong><br />

residential houses). However, you can only<br />

recover the input tax acclaim which is<br />

attributable to taxable supplies <strong>of</strong><br />

commercial <strong>and</strong> industrial buildings. You<br />

cannot recover input tax attributable to the<br />

supply <strong>of</strong> residential house because it is an<br />

exempt supply.<br />

Q19: Is the entire residual input tax incurred<br />

on goods <strong>and</strong> services recoverable?<br />

A19: No, only the portion <strong>of</strong> residual input tax<br />

which is attributable to making taxable<br />

supplies is recoverable.<br />

Q20: In relation to the answer above, how<br />

should I claim my residual input tax?<br />

A20: <strong>The</strong> residual input tax that relates to both<br />

taxable <strong>and</strong> exempt supplies should be<br />

apportioned to ascertain the portion <strong>of</strong><br />

input tax that is recoverable.<br />

Example 2:<br />

DEF Developer Sdn Bhd carries out a<br />

development project consisting <strong>of</strong> 200 units<br />

<strong>of</strong> residential houses, 20 units <strong>of</strong><br />

commercial building <strong>and</strong> 10 units <strong>of</strong><br />

industrial building. (<strong>The</strong>se units are<br />

regarded as the main development). For the<br />

relevant taxable period, the value <strong>of</strong> the<br />

residential houses is RM5,000,000 <strong>and</strong> the<br />

value <strong>of</strong> the commercial <strong>and</strong> industrial<br />

buildings is RM3,000,000. In the course <strong>of</strong><br />

carrying out this project, the developer also<br />

supply basic amenities such as roads,<br />

footpaths, drains <strong>and</strong> communal parking.<br />

<strong>The</strong> residual input tax incurred in supplying<br />

these residual inputs is RM4,000 in that<br />

taxable period. <strong>The</strong> residual input tax<br />

recoverable in that taxable period (using the<br />

turnover method) is as follows:<br />

Value <strong>of</strong> Supplies Amount<br />

Value <strong>of</strong> residential input RM80,000.00<br />

Total value <strong>of</strong> taxable<br />

supplies<br />

RM5,000,000.00<br />

Total value <strong>of</strong> exempt<br />

supplies<br />

RM3,000,000.00<br />

Residual input tax incurred RM3,200.00<br />

Residual input tax recoverable:<br />

Total Value <strong>of</strong> Taxable Supplies Total<br />

= Input Tax X<br />

Value <strong>of</strong> Taxable <strong>and</strong> Exempt Supplies<br />

= RM3,200 X (RM5,000,000)<br />

RM8,000,000<br />

= RM2,000.00<br />

<strong>The</strong> residual input tax recoverable is RM2,000.00.<br />

more on page 8,

6 | branch news<br />

REHDA Branches Elect <strong>The</strong>ir Leaders<br />

New Branch Committee Members 2010–2012<br />

SELANGOR BRANCH<br />

Branch Chairman<br />

Mr Ngian Siew Siong<br />

Sunway City Berhad<br />

Immediate Past<br />

Branch Chairman<br />

Dato’ Fateh Isk<strong>and</strong>ar bin<br />

Tan Sri Dato’ Mohamed Mansor<br />

Glomac Enterprise Sdn Bhd<br />

Most Recent Past<br />

Branch Chairman<br />

Tn Hj Muztaza bin Hj Mohamad<br />

Fairview Development Sdn Bhd<br />

Deputy Branch Chairman<br />

Mr Che King Tow<br />

Rimau Properties Sdn Bhd<br />

Branch Secretary<br />

Mr Ng Boon Chan<br />

B<strong>and</strong>ar Sepadu Sdn Bhd<br />

Assistant Branch Secretary<br />

Puan Hajjah Junaidah<br />

bte Mohd Shazilli<br />

Central Spectrum (M) Sdn Bhd<br />

Branch Treasurer<br />

Ir Tiah Oon Ling<br />

Integrated Development Sdn Bhd<br />

Branch Committee Members<br />

Datuk Eddy Chen Lok Loi<br />

Cekap Corporation Bhd<br />

Datuk Ng Seing Liong<br />

Kota Kelang Development Sdn Bhd<br />

Mr Stanley Teh Guan Kok<br />

Chuan Aik Development Sdn Bhd<br />

Mr Vincent Khoo Peng Keong<br />

Klang Development Sdn Bhd<br />

Dato’ David Tan <strong>The</strong>an Thye<br />

Malayapine <strong>Estate</strong>s Sdn Bhd<br />

Encik Mohd Saleh Kailany<br />

Sime UEP Development Sdn Bhd<br />

Mr Khor Chap Jen<br />

B<strong>and</strong>ar Setia Alam Sdn Bhd<br />

JOHOR BRANCH<br />

Branch Chairman<br />

Mr Simon Heng Kwang Hock<br />

Property Village Berhad<br />

Immediate Past<br />

Branch Chairman<br />

Mr Lee Kim Chai<br />

Panoramic <strong>Housing</strong> Devt. Sdn Bhd<br />

Selangor Branch AGM<br />

Past Branch Chairman<br />

Mr Steven Shum Wing On<br />

Tanah Sutera Development Sdn Bhd<br />

Deputy Branch Chairman<br />

Mr Koh Moo Hing<br />

Tanah Sutera Development Sdn Bhd<br />

Branch Secretary<br />

Mr Siew Fook Wah<br />

Leisure Farm Corporation Sdn Bhd<br />

Assistant Branch Secretary<br />

Ms Hoe Mee Ling<br />

Bukit Indah (J) Sdn Bhd<br />

Branch Treasurer<br />

Mr Vincent Chong Kin Meng<br />

Keck Seng (M) Berhad<br />

Branch Committee Members<br />

Dato’ Steve Chong Yoon On<br />

Austin Heights Sdn Bhd<br />

Mr Choo Hock Sing<br />

Daiman Development Berhad<br />

Mr Wong Boon Lang<br />

Bazar Ria Sdn Bhd<br />

Mr Wong Kuen Kong<br />

Dynasty View Sdn Bhd<br />

Branch Committee Members<br />

Mr Tan Ban Meng<br />

Himpunan Kurnia Sdn Bhd<br />

En Mustaza bin Musa<br />

Matrix Concepts Sdn Bhd<br />

Branch Honorary Advisors<br />

Dato’ A. Ponniah<br />

Property Mart Sdn Bhd<br />

Dato’ Hj Mohd Khalid bin Harun<br />

Housec<strong>of</strong>f Sdn Bhd<br />

Tn Hj Yaacob bin Hj Hussin<br />

Bagan Pinang Development Sdn Bhd<br />

Mr T Yogeswaran<br />

United Properties Co-Operation<br />

Sdn Bhd<br />

NEGERI SEMBILAN BRANCH<br />

PERAK BRANCH<br />

Branch Chairman<br />

Dato’ Francis Lee Yew Hean<br />

Antap Enterprises Sdn Bhd<br />

Immediate Past<br />

Branch Chairman<br />

Mr MK Rajah<br />

Perak <strong>Real</strong> <strong>Estate</strong>s Sdn Bhd<br />

Deputy Branch Chairman<br />

Mr Raymond Chan Chee Keong<br />

Syarikat Larut Jaya Sdn Bhd<br />

Branch Chairman<br />

Branch Secretary<br />

Mr S. Sivanyanam<br />

Mega 3 <strong>Housing</strong> Sdn Bhd<br />

Mr San Chak Chun<br />

Jebong <strong>Housing</strong> Development<br />

Most Recent Past<br />

Sdn Bhd<br />

Branch Chairman<br />

Assistant Branch Secretary<br />

Dato’ Soam Heng Choon<br />

RB L<strong>and</strong> Sdn Bhd<br />

Mr Soh Hong<br />

Chin Pek Soo & Sons Sdn Bhd<br />

Past Branch Chairman<br />

Branch Treasurer<br />

Mr Ng Lip Chong<br />

Nee Yan & Co Sdn Bhd<br />

Dato’ Hj Mohamed Razali<br />

bin Khalid<br />

Deputy Chairman<br />

Buntong Maju Sdn Bhd<br />

Ms Jenny Wang Lee Peng<br />

Branch Patrons<br />

Wingress Sdn Bhd<br />

Mr Moses Tay Moh Seh<br />

Honorary Branch Secretary Dilim Builders Sdn Bhd<br />

En Mohd Sabri Ismail<br />

Branch Committee Members<br />

Bagan Pinang Development Sdn Bhd Mr Ng Poh Heng<br />

Assistant Branch<br />

CNT Builders Sdn Bhd<br />

Honorary Secretary<br />

Mr Yeow Boo Teik<br />

Mr Alan Lai Chien Kong<br />

Kemajuan Perbakti Sdn Bhd<br />

Prosperity Development Sdn Bhd Mr Danny Chong Khong Shoong<br />

Branch Treasurer<br />

Mr Desmond Yap Poh Seng<br />

Prestajaya Sdn Bhd<br />

Kejutaan L<strong>and</strong> Sdn Bhd<br />

Mr Bernard Tan Chor Hwa<br />

Meru Valley Resort Bhd<br />

Mr Chan Nam<br />

Namcom Development Sdn Bhd<br />

Melaka Branch Committee<br />

Mr Chan Hoong Mun<br />

Peng Yong Properties Sdn Bhd<br />

Mr Looi Teik Aun<br />

Rimawar Sdn Bhd<br />

Mr Wani Choong Moh Guan<br />

Sri Kancil Development Sdn Bhd<br />

Mr Lau Eng Pun<br />

Taiko Properties Sdn Bhd<br />

Mr Tony Khoo Boon Chuan<br />

Tumbuh Merata Sdn Bhd<br />

MELAKA BRANCH<br />

Branch Chairman<br />

Datuk Gwee Yew Kiat<br />

Naga Jaguh Development Sdn Bhd<br />

Immediate Past<br />

Branch Chairman<br />

Datuk Peter Lim Cheow Seng<br />

Yonsen Construction Sdn Bhd<br />

Deputy Branch Chairman<br />

Mr Tay Sin Wah<br />

Salient Development Sdn Bhd<br />

Branch Secretary<br />

Mr Anthony Cho Tian Han<br />

Kamra Jaya Sdn Bhd<br />

Assistant Branch Secretary<br />

Datuk Ngoh King Hua<br />

Gr<strong>and</strong> City Development Sdn Bhd<br />

Branch Treasurer<br />

Dato’ Ng Choon Koon<br />

Wawasan Intact Development<br />

Sdn Bhd<br />

Branch Committee Members<br />

Mr Ngoh Chun How<br />

NKS Development Sdn Bhd<br />

Mr Poh Geok Seng<br />

PB <strong>Real</strong>ty Sdn Bhd<br />

Datuk Peter Lim Cheow Seng<br />

Yonsen Construction Sdn Bhd<br />

PENANG BRANCH<br />

Branch Chairman<br />

Dato’ Jerry Chan Fook Sing<br />

Asas Mutiara Sdn Bhd<br />

Immediate Past<br />

Branch Chairman<br />

Dato’ Eddy Choong Ewe Beng<br />

Hock Hin Bros. Sdn Bhd<br />

Recent Past Branch Chairman<br />

Dato’ Ong Gim Huat<br />

Kim Mansions Sdn Bhd

Throughout the month <strong>of</strong> May, the respective REHDA Branch members sat at their<br />

Annual General Meetings (AGM) to elect their new committee members.<br />

Deputy Branch Chairman<br />

Mr Albert Lai Tuck Yew<br />

Comfort Enterprise Sdn Bhd<br />

Honorary Branch Secretary<br />

Mr Teh Kiak Seng<br />

Tambun Indah Sdn Bhd<br />

Assistant Honorary<br />

Branch Secretary<br />

Mr Toh Chin Leong<br />

IJM Properties Sdn Bhd<br />

Honorary Treasurer<br />

Mr Lau Eng Sim<br />

MWE Properties Sdn Bhd<br />

Branch Committee Members<br />

Mr Ron Loh Chin Chuen<br />

Ivory Square Sdn Bhd<br />

Dr Lee Ville<br />

Konturjaya Sdn Bhd<br />

Mr Cheah Kheng Hooi<br />

Sin Chor Chit Construction Sdn Bhd<br />

Mr Chan Fock Seng<br />

Chong Co & Hwa Sing Development<br />

Sdn Bhd<br />

Mr Ooi Wei Chong<br />

Tanjung Park Development Sdn Bhd<br />

Mr David Fong Chin Chong<br />

Heavenly Heritage Sdn Bhd<br />

WILAYAH PERSEKUTUAN (KL)<br />

BRANCH<br />

Branch Chairman<br />

Mr Tong Nguen Khoong<br />

Bukit Kiara Properties Sdn Bhd<br />

Immediate Past<br />

Branch Chairman<br />

Dato’ Michael Yam Kong Choy<br />

Serai Saujana Development Sdn Bhd<br />

Most Recent Past<br />

Branch Chairman<br />

Mr Teh Boon Ghee<br />

IGB Corporation Sdn Bhd<br />

Deputy Branch Chairman<br />

Mr Tan Ching Meng<br />

MSL Properties Sdn Bhd<br />

Branch Secretary<br />

En Wan Hashimi Albakri<br />

Sime Darby Properties Sdn Bhd<br />

Assistant Branch Secretary<br />

En Nazarudin Ab Rahim<br />

KIP L<strong>and</strong> Sdn Bhd<br />

Branch Treasurer<br />

Dato’ Lawrence Low Wui Keong<br />

CRSC Property Sdn Bhd<br />

Branch Committee Members<br />

Tan Sri Dato’ Hj M. Ariffin Yusuf<br />

Primabina Development Sdn Bhd<br />

Mr Poh Pai Kong<br />

Tradewinds Corporation Bhd<br />

Mr Chan Wing Kwong<br />

Bolton Berhad<br />

Mr Lum Tuck Ming<br />

Sunrise Berhad<br />

Pn Myrzela Sabtu<br />

Naza TTDI Sdn Bhd<br />

Mr Chan Kin Meng<br />

Beneton Properties Sdn Bhd<br />

Mr Ter Leong Yap<br />

Sunsuria Development Sdn Bhd<br />

PAHANG BRANCH<br />

Branch Chairman<br />

Mr Cheoh Chee Guan<br />

Brilliant Foresight Sdn Bhd<br />

Immediate Past<br />

Branch Chairman<br />

Mr Jonathan Kok Keng Fai<br />

Macinda Sdn Bhd<br />

Recent Past Branch Chairman<br />

Mr Chin Yoke Kan<br />

Tunas Manja Development &<br />

Construction Sdn Bhd<br />

Deputy Branch Chairman<br />

Mr Chua Say Chai<br />

Ming Hooi Development Sdn Bhd<br />

Branch Secretary<br />

Mr Wong Kok Loon<br />

Wong Fook Construction Sdn Bhd<br />

Assistant Branch Secretary<br />

En Mohd Asri bin Mohamad Ripin<br />

PASDEC Corporation Sdn Bhd<br />

Branch Treasurer<br />

Mr Darren Pang Kwei Seen<br />

Perumahan Satelit Jaya Sdn Bhd<br />

Branch Committee Members<br />

Dato’ Ng Leong Hai<br />

Special Selection Sdn Bhd<br />

Mr Ong Thian Yew<br />

Greenlast <strong>Housing</strong> Devt. Sdn Bhd<br />

Mr Loo Chin Yew<br />

Eastern Fame Sdn Bhd<br />

Mr Hiew Yun Fong<br />

Elephant Engineering Sdn Bhd<br />

Wilayah Persekutuan (KL) Branch Committee<br />

Mr David Choi Beng Kuan<br />

CKC Developments Sdn Bhd<br />

Ms Chong Yen Ni<br />

Hui Tat Builders Sdn Bhd<br />

TERENGGANU BRANCH<br />

Branch Chairman<br />

Mr Woo Mun Kit<br />

Citiraya Development Sdn Bhd<br />

Deputy Branch Chairman<br />

En Rashidi bin Dato’ Hj Abd Wahab<br />

Tanjong Development Sdn Bhd<br />

Branch Secretary<br />

Tn Hj Zainuddin bin Abu Bakar<br />

Pembinaan ANZ Sdn Bhd<br />

Assistant Branch Secretary<br />

Puan Wan Siti Hajar<br />

bt Wan Embong<br />

Konsortium Perumahan Rakyat<br />

Terengganu<br />

Branch Treasurer<br />

Mr Chong Fah Ming<br />

Trek Development Sdn Bhd<br />

branch division news<br />

Branch Committee Members<br />

Mr Loh Wai Keat<br />

Keatyew Development Sdn Bhd<br />

Dato’ Syed Zulkiflee<br />

bin Syed Abdullah<br />

Syarikat Sakan Sdn Bhd<br />

Ms Lee Suan Mooi<br />

Kubang Pasu Development Sdn Bhd<br />

Mr Tey Hock Seng<br />

Kota Setar L<strong>and</strong> Sdn Bhd<br />

En Zuber bin Ahmad<br />

Aima Development Sdn Bhd<br />

En Zawawi bin Wahab<br />

Plenitude Heights Sdn Bhd<br />

Mr Ooi Cheng Soon<br />

Eternal Development Sdn Bhd<br />

Mr Khow Meng Hooi<br />

Unikor Enterprise (K) Sdn Bhd<br />

Ms Angie Ng Mooi Choo<br />

OSK Properties Sdn Bhd<br />

Mr Lim Chang Chow<br />

Sri Awona Sdn Bhd<br />

KEDAH/PERLIS BRANCH<br />

KELANTAN BRANCH<br />

Branch Chairman<br />

Dato’ Sekarnor Che Omar<br />

Branch Chairman<br />

Strata Merge (M) Sdn Bhd<br />

Dato’ Ricque Liew Yin Chew Deputy Branch Chairman<br />

Paramount Property (Utara) Sdn Bhd Mr Ong Thim Kuang<br />

Immediate Past<br />

Vimaco Enterprise Sdn Bhd<br />

Branch Chairman<br />

Branch Secretary<br />

Dato’ Wira Hj Tajudin<br />

Tn Hj Mohd Basir bin Junoh<br />

bin Hj Hashim<br />

Berkat Makmur Jaya Development<br />

Eupe Kemajuan Sdn Bhd<br />

Sdn Bhd<br />

Most Recent Past<br />

Assistant Branch Secretary<br />

Branch Chairman<br />

Mr Oie Poh Choon<br />

Dato’ Haji Abdul Halim<br />

Df Prima Build & Development<br />

bin Haji Che Din<br />

Sdn Bhd<br />

Aima Development Sdn Bhd<br />

Branch Treasurer<br />

Deputy Branch Chairman En Mohd Adib Abd Satar<br />

Mr Rick Cheng Wooi Seong<br />

Nusajaza Development Sdn Bhd<br />

Encomas Sdn Bhd<br />

Branch Committee Members<br />

Branch Secretary<br />

Dato’ Samsuri bin Awang Mat<br />

Mr Yeoh Su Guan<br />

Dataran Fajar Development<br />

Jesin Development Sdn Bhd<br />

Sdn Bhd<br />

Branch Treasurer<br />

Mr Lee Hor Yin<br />

Nepta Development Sdn Bhd<br />

Mr Khor Pho Juan<br />

KPJ Development Sdn Bhd<br />

En Zulkarnain bin Mohamed<br />

Daxmaster Sdn Bhd<br />

Assistant Branch Secretary En Mohd Radzi bin Mohd Zain<br />

Ms Beh Suan Sim<br />

SPP Development Sdn Bhd<br />

Ambangan Heights Sdn Bhd<br />

Mr Alan Teng<br />

Pembinaan Medan Megah Sdn Bhd<br />

Kelantan Branch Committee<br />

| 7

8 | industry matters<br />

, continued from page 5 Goods <strong>and</strong> Services Tax (GST) for Property Development<br />

Q21: Instead <strong>of</strong> the turnover method, can I claim<br />

my input tax using alternative method such<br />

as floor space or input method?<br />

A21: To use an alternative method, you have to<br />

apply to the Customs Department.<br />

Q22: Can the Director-General <strong>of</strong> Customs direct<br />

me to use an alternative method <strong>of</strong><br />

apportionment other than the st<strong>and</strong>ard<br />

method (turnover method)? Can the direction<br />

be backdated?<br />

A22: Yes, the Director-General <strong>of</strong> Customs can direct<br />

you to use an alternative method <strong>of</strong> apportion<br />

such as gross floor area or quantities <strong>of</strong> output.<br />

However, such direction becomes effective<br />

from the date it is given or later, but cannot be<br />

backdated.<br />

Q23: Can I claim input tax on speculative supplies<br />

which are incurred in the course <strong>of</strong><br />

investigating potential projects?<br />

A23: Where the l<strong>and</strong> has not been acquired, the<br />

input tax incurred on speculative supplies such<br />

as consultant/pr<strong>of</strong>essional fees, finders fees,<br />

feasibility studies should be regarded as<br />

residual input tax, <strong>and</strong> input tax can be<br />

claimed accordingly. In the later stage, where<br />

l<strong>and</strong> is acquired <strong>and</strong> you are making a supply,<br />

you can attribute the input tax to either taxable<br />

(if making non residential supplies) or exempt<br />

supplies (if making residential supplies), or<br />

apportion the input tax (if making mixed<br />

supplies).<br />

6. Retention Amount<br />

Q24: When the customer pays a deposit to a<br />

lawyer who acts as the developer’s agent,<br />

does the deposit trigger a tax point?<br />

A24: Yes, the tax point is triggered when the deposit<br />

amount is received.<br />

Q25: When the customer pays a deposit to a<br />

lawyer acting the capacity <strong>of</strong> stakeholder,<br />

does the deposit trigger a tax point?<br />

A25: No, the tax point is not triggered until the<br />

money is released by the stakeholder to the<br />

developer.<br />

Q26: When can your client claim input tax on<br />

retention sum?<br />

A26: When the retention sum is released to you <strong>and</strong><br />

you issue him a tax invoice.<br />

7. Liquidated Damages<br />

Q27: Do liquidated damages involving late<br />

delivery charges have any GST implication?<br />

A27: No, liquidated damages involving late delivery<br />

charges do not have GST implications because<br />

they are not payment for a supply.<br />

Q28: If I have to pay liquidated damages <strong>and</strong> at<br />

the same time charge the client for another<br />

supply, can I set the amount <strong>of</strong>f each other?<br />

A28: No, you cannot reduce the value <strong>of</strong> your taxable<br />

supplies by setting the amounts <strong>of</strong>f each other<br />

because they are in respect <strong>of</strong> two different<br />

supplies. You have to account separately. In<br />

case the supply to the client is taxable, you<br />

have to charge GST in respect <strong>of</strong> the supply.<br />

8. Transitional Issues<br />

Q29: Are contracts signed before the GST<br />

implementation liable for GST?<br />

A29: Taxable property completed <strong>and</strong> delivered<br />

after the GST implementation date is subject<br />

to GST even though the contracts were<br />

signed before the GST implementation date.<br />

Q30 In the case <strong>of</strong> property are contracts signed<br />

which span the transitional period (pre<strong>and</strong><br />

post-GST implementation date) liable<br />

for GST?<br />

A30: <strong>The</strong> value <strong>of</strong> the portion <strong>of</strong> property made<br />

available before GST implementation is not<br />

subject to GST. However the value <strong>of</strong> the<br />

property on the portion to be delivered after<br />

GST implementation date will be subjected to<br />

GST. In other words, for semi completed<br />

property (those under construction subject to<br />

periodic payment), GST is applicable only on<br />

the value <strong>of</strong> the portion made available after<br />

GST implementation date.<br />

Example 3:<br />

(Assumption: GST to be implemented on<br />

1 July 2011)<br />

KL Sdn Bhd signs a contract with JK Sdn Bhd<br />

to buy a commercial building. <strong>The</strong> contract is<br />

scheduled to begin on 16 July 2010 <strong>and</strong><br />

completed by 30 July 2011. Under the<br />

contract <strong>of</strong> agreement, KL Sdn Bhd will<br />

receive an amount as provided under the<br />

progress payment schedule. KL Sdn Bhd will<br />

invoice JK Sdn Bhd middle <strong>of</strong> each month. On<br />

15 July 2011, KL Sdn Bhd lodges a claim<br />

amounting to RM200,000.00 for value added<br />

to the building between 15 June to 14 July<br />

2011.<br />

<strong>The</strong> GST due for value added <strong>of</strong> building after<br />

GST implementation is as follows:<br />

GST = RM200,000.00 X 15/30 X 4% = RM4,000.00<br />

Total period involved in valuation = 30 days<br />

Period after GST implementation = 15 days<br />

For the period from 15 July till 30 July, that is<br />

the period during GST implementation, the<br />

total value <strong>of</strong> the remaining portion <strong>of</strong> the<br />

building delivered is subject to GST.<br />

Assuming the value is RM120,000, the GST =<br />

RM120,000 X 4% = RM4,800.00.<br />

Q31: What are the consequences if I do not make<br />

a provision to include the element <strong>of</strong> GST in<br />

my contract?<br />

A31: Failure to include the GST provision may<br />

make the developer unable to recover the<br />

GST from the client.<br />

Q32: Do I have to account for GST on property<br />

completed before GST era but sold only<br />

after GST era?<br />

A32: Property completed before GST<br />

implementation but sold only after GST<br />

implementation period will be subject to GST.<br />

Completed property refers to property issued<br />

with a Certificate <strong>of</strong> Practical Completion or a<br />

Certificate <strong>of</strong> Completion <strong>and</strong> Compliance.<br />

9. Other Issues<br />

Q33: Do I have to account for GST if my project is<br />

ab<strong>and</strong>oned?<br />

A33: During the period the project is ab<strong>and</strong>oned,<br />

you may not be making a taxable supply in<br />

respect <strong>of</strong> the ab<strong>and</strong>oned property <strong>and</strong><br />

therefore you do not have to account for GST.<br />

However, if you received any payment or<br />

issued any invoice during this period, you<br />

have to account for it. If you had issued a tax<br />

invoice <strong>and</strong> accounted for it but did not<br />

receive payment within 6 months, you can<br />

recover the GST as bad debt relief.<br />

Q34: I make payment to my contractor to<br />

compensate him for losses due to<br />

temporary suspension <strong>of</strong> work. Is the<br />

payment paid for temporary suspension <strong>of</strong><br />

work requested by me subject to GST?<br />

A34: Payment for compensation for losses to<br />

contractor due to temporary suspension <strong>of</strong><br />

work requested by you is not subject to GST.<br />

Q35: I supply materials <strong>and</strong> utilities <strong>and</strong> loan<br />

workers to contractors for use in my<br />

project. Can I contra the value <strong>of</strong> the<br />

materials, utilities <strong>and</strong> workers I supply to<br />

the contractor from value <strong>of</strong> the<br />

construction services supplied to me?<br />

A35: No. <strong>The</strong>se two are regarded as two different<br />

supplies. You have to charge GST for the full<br />

value <strong>of</strong> the materials, utilities, workers<br />

service you supply to the contractor. Similarly<br />

the contractor will have to charge you the full<br />

value <strong>of</strong> the construction services supplied to<br />

you.<br />

10. Further Assistance <strong>and</strong> Information<br />

For further assistance <strong>and</strong> information, please contact<br />

our <strong>of</strong>ficers at our GST <strong>of</strong>fice.<br />

ROYAL MALAYSIAN CUSTOMS<br />

GST Unit, Level 9 South<br />

Ministry <strong>of</strong> Finance Complexes<br />

Precinct 2<br />

62592 Wilayah Persekutuan Putrajaya<br />

Tel: 03-8882 2420<br />

Fax: 03-8882 2132<br />

THIS IS A DRAFT COPY AND IS SUBJECT TO<br />

FURTHER AMENDMENTS

Wilayah Persekutuan (KL) Branch<br />

REHDA Wilayah Persekutuan (KL) Branch<br />

held a discussion with Datuk B<strong>and</strong>ar Kuala<br />

Lumpur on 7th May 2010 at DBKL<br />

Headquarters, Kuala Lumpur to discuss<br />

current industry issues pertaining to the<br />

property sector. Y Bhg Datuk Seri Ahmad Fuad<br />

bin Ismail, Datuk B<strong>and</strong>ar Kuala Lumpur chaired<br />

the meeting which was attended by senior<br />

<strong>of</strong>ficials from the Ministry <strong>of</strong> Federal<br />

Territories & Urban Wellbeing, Pejabat<br />

Pengarah Tanah dan Galian Wilayah<br />

Persekutuan (PPTGWP), DBKL <strong>and</strong> REHDA WP.<br />

Some <strong>of</strong> the main areas <strong>of</strong> discussion include:<br />

• Improvement in DBKL OSC implementation<br />

<strong>and</strong> introducing OSC Online;<br />

• Improvement in the Planning Approval<br />

Applications process including hillslope<br />

development guideline, new Development<br />

Charge <strong>and</strong> procedures, new Kaedah 5 <strong>and</strong><br />

carpark requirements for developments<br />

near transit stations;<br />

May 2010<br />

date events date events<br />

4<br />

7<br />

10–11<br />

11<br />

12<br />

14<br />

18<br />

19<br />

MHLG – Meeting to Discuss “Projek Perintis Pelaksanaan<br />

Sistem Pengumpulan & Penggunaan Semula Air Hujan<br />

(SPAH)”. Attended by Ir Ng Lip Khong <strong>and</strong> En Muhammad<br />

Hanafi.<br />

Attorney-General’s Chambers – Workshop on Drafting <strong>of</strong><br />

Subsidiary Legislation. Attended by Datuk Ng Seing Liong, JP<br />

as panelist.<br />

KeTTHA – Bengkel Pelan Induk Kecekapan Tenaga Negara.<br />

Attended by Dato’ Ricque Liew Yin Chew <strong>and</strong> Ir Ng Lip Khong.<br />

Ministry <strong>of</strong> Foreign Affairs – Briefing with<br />

Non-Government Organisations <strong>and</strong> Civil Society<br />

Organisations on Civil Rights. Attended by<br />

En Muhammad Hanafi.<br />

PEMANDU – National Key Economic Activities (NKEA)<br />

Workshop. Attended by Dato’ Fateh Isk<strong>and</strong>ar, Pn Rusnani<br />

Abd Rahman <strong>and</strong> Ms Debbie Loh.<br />

EXCO Meeting.<br />

National Hydraulics Research Institute <strong>of</strong> Malaysia <strong>of</strong> the<br />

Ministry <strong>of</strong> Natural Resources <strong>and</strong> Environment – Workshop<br />

on River Reserve Zones in Malaysia. Attended by Mr Tiah<br />

Oon Ling.<br />

Building Management Association <strong>of</strong> Malaysia – Meeting <strong>of</strong><br />

the Protem Executive Committee. Attended by Datuk Eddy<br />

Chen Lok Loi.<br />

MHLG – SPAH Site Visit to B<strong>and</strong>ar Utama. Attended by<br />

Dato’ Ricque Liew, Mr Ng Lip Chong <strong>and</strong> Ir Ng Lip Khong.<br />

Discussion with Datuk B<strong>and</strong>ar Kuala Lumpur<br />

• Quality <strong>of</strong> building architecture in Kuala<br />

Lumpur including encouraging ‘Green<br />

Building’, ‘Connectivity’ between<br />

buildings, promoting Solid Waste<br />

Management System <strong>and</strong> beautifying<br />

‘River Corridors’;<br />

• Promote new development concept for<br />

shophouses;<br />

• Construction site operation hours;<br />

• Draft Kuala Lumpur City Plan 2020;<br />

• Review <strong>of</strong> Bumiputra quota policy <strong>and</strong><br />

release <strong>of</strong> unsold Bumiputra quota units;<br />

• Proposed equitable formula for share unit<br />

allocation for strata developments;<br />

• Proposed legislation for En-Bloc<br />

(Collective Sale)<br />

developments;<br />

• Application for<br />

Subdivision <strong>of</strong><br />

Interaction between Datuk<br />

B<strong>and</strong>ar Kuala Lumpur <strong>and</strong><br />

REHDA WP.<br />

19<br />

20<br />

21<br />

22<br />

24<br />

24–26<br />

25<br />

diary / branch news<br />

| 9<br />

Meeting with MASB <strong>and</strong> Malaysia Institute <strong>of</strong> Accountants on<br />

IFRIC 15. Attended by Mr Soo Chan Fai, Datuk Ng Seing Liong,<br />

Ms Wong Sheue Yann, Mr Shivan<strong>and</strong>ha Chellapah, Mr Soo<br />

Kok Wong, Ms Karen Seow, Mr Tang Kin Kheong, Mr Pascal<br />

Jauffret <strong>and</strong> Ms Sar Sau Yee.<br />

CIDB – Task Force Meeting on Green Technology for<br />

Construction Industry. Attended by En Wan Hashimi Albakri.<br />

JPBD – Expert Talk on Low Carbon Society for Built<br />

Environment <strong>and</strong> Green Technology. Attended by<br />

Mr Tan Ching Meng.<br />

National Council Meeting at Rehda Secretariat.<br />

Friendly Golf Dinner at Klang Seafood Restaurant,<br />

P<strong>and</strong>amaran, Klang.<br />

SPAN Meeting. Attended by Mr Ng Lip Chong, Mr S.<br />

Sivanyanam, Mr Tiah Oon Ling, Pn Rusnani Abd Rahman <strong>and</strong><br />

En Muhammad Hanafi.<br />

JPBD – NKRA Safe City: Committee Meeting <strong>and</strong> Workshop on<br />

House Security Features <strong>and</strong> Crime Prevention Checklist<br />

Through Environmental Design (CPTED). Attended by<br />

En Shahar Mohd Shah from Sime Darby Properties Sdn Bhd,<br />

Pn Rusnani Abd Rahman <strong>and</strong> Mr Soon Teck Giap from REHDA<br />

Wilayah Persekutuan (KL).<br />

MPC – Focus Group Meeting on Registering Property.<br />

Attended by Dato’ Ricque Liew Yin Chew.<br />

Building (Strata Application) prior to<br />

Building Plan approval <strong>and</strong> upfront<br />

payment <strong>of</strong> strata application fees to<br />

Board <strong>of</strong> L<strong>and</strong> Surveyors;<br />

• Proposed Briefing <strong>and</strong> Site Visits to<br />

Development Projects in Kuala Lumpur;<br />

<strong>and</strong><br />

• Proposed Official Study Visit between<br />

DBKL <strong>and</strong> REHDA WP.<br />

<strong>The</strong> Branch continues to hold regular<br />

dialogues with the Ministry <strong>and</strong> its Agencies to<br />

enhance their public delivery service system<br />

towards its vision <strong>of</strong> becoming a World-Class<br />

nation by the year 2020.n

10 | announcement / rehda institute<br />

, continued from page 3<br />

SELANGOR: Bumiputera Defined<br />

3.2.4.3 Anak daripada mana-mana penyatuan antara<br />

seorang perempuan orang asli dengan seorang<br />

lelaki daripada suatu kaum lain, dengan syarat<br />

bahawa anak itu lazimnya bercakap bahasa orang<br />

asli, lazimnya mengikut cara hidup orang asli dan<br />

adat dan kepercayaan orang asli dan masih lagi<br />

menjadi anggota suatu masyarakat orang asli.<br />

3.3 Sehubungan itu, criteria bagi individu yang boleh dipertimbangkan<br />

ialah:<br />

3.3.1 Sekiranya pembelian secara tunggal, pemohon adalah<br />

berketurunan Melayu, anak Negeri Sabah/Sarawak atau<br />

orang Asli Semenanjung Malaysia;<br />

3.3.2 Sekiranya pemohon tidak memenuhi kelayakan sebagai<br />

Bumiputera, ibu atau bapa pemohon atau sekiranya perlu,<br />

datuk atau nenek atau moyang pemohon, adalah<br />

berketurunan Melayu, anak Negeri Sabah/Sarawak atau<br />

orang Asli Semenanjung Malaysia;<br />

3.3.3 Sekiranya pembelian secara bersama, suami/isteri adalah<br />

berketurunan Melayu, anak Negeri Sabah/Sarawak atau<br />

orang Asli Semenanjung Malaysia;<br />

3.3.4 Sekiranya pemohon lahir di luar Negara, pemohon adalah<br />

warganegara Malaysia dan ibu atau bapa atau suami/isteri<br />

adalah berketurunan Melayu, anak Negeri Sabah/Sarawak<br />

atau orang Asli Semenanjung Malaysia.<br />

3.4 Kriteria bagi syarikat yang boleh dipertimbangkan selaras dengan<br />

Surat Pekeliling Perbendaharaan Bil. 4 Tahun 1995 ialah dengan<br />

memenuhi kesemua syarat-syarat berikut:<br />

3.4.1 Majoriti atau sekurang-kurangnya 51% daripada pemilik<br />

saham syarikat dimiliki oleh Bumiputera di mana pemilikan<br />

saham individu Bumiputera hendaklah melebihi saham<br />

individu bukan Bumiputera;<br />

3.4.2 Majoriti atau sekurang-kurangnya 51% daripada ahli<br />

Lembaga Pengarah syarikat terdiri daripada individu<br />

Bumiputera;<br />

3.4.3 Majoriti atau sekurang-kurangnya 51% daripada pekerja<br />

syarikat hendaklah terdiri daripada individu Bumiputera;<br />

3.4.4 Jawatan Ketua Eksekutif, Pengarah Urusan atau Pengurus<br />

Besar dan jawatan-jawatan penting lain (key post)<br />

hendaklah dipegang oleh individu Bumiputera;<br />

3.4.5 Pengurusan Kewangannya hendaklah dikuasai oleh majoriti<br />

Bumiputera; dan<br />

3.4.6 Carta organisasi dan fungsi pengurusan syarikat hendaklah<br />

menunjukkan penguasaan sepenuhnya oleh Bumiputera;<br />

3.5 Bagi tujuan permohonan, senarai semak adalah seperti di<br />

LAMPIRAN A dan B.<br />

3.6 Sekiranya permohonan diluluskan, pemohon adalah layak<br />

memiliki hartanah di bawah kuota Bumiputera di Negeri Selangor<br />

dan kelulusan tersebut tidak dengan sendirinya mengiktiraf<br />

pemohon sebagai Bumiputera.<br />

4. Tarikh Kuatkuasa dan Pemakaian<br />

4.1 Pekeliling ini berkuat kuasa pada tarikh ia dikeluarkan.<br />

(DATO’ ABD NASIR BIN HASSAN)<br />

Pengarah Tanah dan Galian<br />

Negeri Selangor Darul Ehsan<br />

Bertarikh: 22 Mac 2010<br />

Nota:<br />

* Lampiran A dan B boleh diperolehi dari Pejabat Pengarah Tanah dan<br />

Galian, Negeri Selangor Darul Ehsan.<br />

REHDA Property Leader Forum 2010<br />

rehda Property Leader Forum was held on 23 to 24 April 2010 at Sunway<br />

Resort <strong>and</strong> Spa, Subang Jaya. <strong>The</strong> forum was <strong>of</strong>ficiated by the then Minister<br />

<strong>of</strong> <strong>Housing</strong> <strong>and</strong> Local Government, YB Dato’ Sri Kong Cho Ha.<br />

<strong>The</strong> forum was well attended by 110 delegates from various developer<br />

companies <strong>and</strong> featured several prominent speakers such as Matthias<br />

Gelber, Dato’ Dr Ken Yeang,<br />

Senator Dato’ Abdul Rahim Abdul<br />

Rahman among others.<br />

Several papers pertaining to<br />

property market including green<br />

<strong>and</strong> sustainable building, impact<br />

<strong>of</strong> high income economy on<br />

property industry trends <strong>and</strong> the<br />

property market outlook were<br />

presented during the forum.<br />

Green Solutions for Property Development<br />

Conference 2010 (GSPD 2010)<br />

the Green Solution for Property Development Conference was organised on<br />

17 May 2010 at Sime Darby Convention Centre by Earoph Malaysia <strong>and</strong> REHDA<br />

Institute; <strong>and</strong> co-organised by Sime Darby Property Bhd. <strong>The</strong> conference was<br />

<strong>of</strong>ficially launched by YB Dato’ Seri Kong Cho Ha, the then Minister <strong>of</strong><br />

<strong>Housing</strong> <strong>and</strong> Local Government.<br />

<strong>The</strong> conference attracted a total <strong>of</strong> 328 participants <strong>and</strong> exhibitors. <strong>The</strong><br />

conference started with the multimedia presentation to raise awareness <strong>of</strong><br />

the effect <strong>of</strong> climate change due to the release <strong>of</strong> green house gas. A number<br />

<strong>of</strong> prominent speakers presented their papers including Matthias Gelber: the<br />

greenest man <strong>of</strong> the planet (2008), Ar Jason Pomeroy, Ar Dr Tan Loke Mun<br />

<strong>and</strong> several other industry consultants.<br />

<strong>The</strong> conference was Malaysia's first carbon neutral property development<br />

conference <strong>and</strong> the organisers had taken steps to ensure the conference<br />

achieve its carbon neutral target. <strong>The</strong>se included carpooling by delegates,<br />

paperless conference notes, a bulb-exchange program to replace inefficient<br />

energy bulbs at participants’ homes <strong>and</strong> several other related activities.<br />

<strong>The</strong> conference also recorded its own history with a live webcast to<br />

participants from Penang, Malacca, Indonesia, Japan <strong>and</strong> middle East, thanks<br />

to technology providers, Cisco <strong>and</strong> Sime Darby IT.<br />

REHDA Institute <strong>and</strong> Danajamin Talk<br />

rehda Institute <strong>and</strong> Danajamin Nasional Berhad (Malaysia’s first Financial<br />

Gurantee Insurer) hosted a luncheon talk on 24 May 2010 at Sime Darby<br />

Convention Centre.<br />

<strong>The</strong> talk themed, “Danajamin: Your Source to Alternative Financial”, was<br />

attended by 22 participants to register for the talk. Danajamin’s Chief Executive,<br />

Mr Khoo Boon Hock, had briefed participants on how to qualify for<br />

Danajamin’s guarantee to raise bond to finance property development<br />

projects.n