building a STRONGER foundation - Cemex

building a STRONGER foundation - Cemex

building a STRONGER foundation - Cemex

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

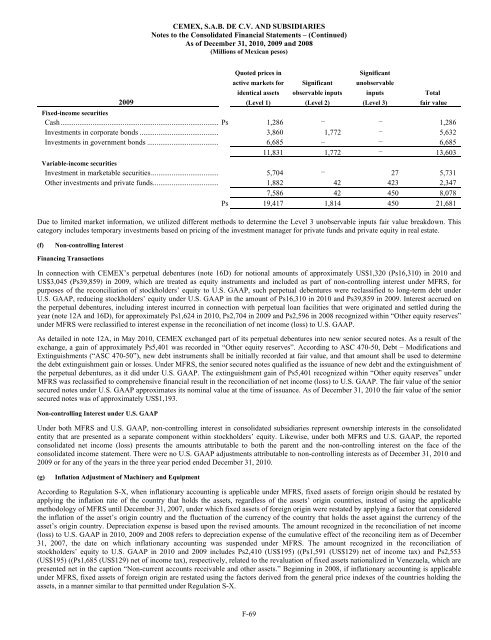

CEMEX, S.A.B. DE C.V. AND SUBSIDIARIES<br />

Notes to the Consolidated Financial Statements – (Continued)<br />

As of December 31, 2010, 2009 and 2008<br />

(Millions of Mexican pesos)<br />

Quoted prices in<br />

active markets for<br />

identical assets observable inputs inputs<br />

Total<br />

2009<br />

(Level 1)<br />

(Level 2) (Level 3) fair value<br />

Fixed-income securities<br />

Cash.................................................................................... Ps 1,286 – – 1,286<br />

Investments in corporate bonds .......................................... 3,860 1,772 – 5,632<br />

Investments in government bonds ...................................... 6,685 – – 6,685<br />

11,831 1,772 – 13,603<br />

F-69<br />

Significant<br />

Significant<br />

unobservable<br />

Variable-income securities<br />

Investment in marketable securities.................................... 5,704 – 27 5,731<br />

Other investments and private funds................................... 1,882 42 423 2,347<br />

7,586 42 450 8,078<br />

Ps 19,417 1,814 450 21,681<br />

Due to limited market information, we utilized different methods to determine the Level 3 unobservable inputs fair value breakdown. This<br />

category includes temporary investments based on pricing of the investment manager for private funds and private equity in real estate.<br />

(f) Non-controlling Interest<br />

Financing Transactions<br />

In connection with CEMEX’s perpetual debentures (note 16D) for notional amounts of approximately US$1,320 (Ps16,310) in 2010 and<br />

US$3,045 (Ps39,859) in 2009, which are treated as equity instruments and included as part of non-controlling interest under MFRS, for<br />

purposes of the reconciliation of stockholders’ equity to U.S. GAAP, such perpetual debentures were reclassified to long-term debt under<br />

U.S. GAAP, reducing stockholders’ equity under U.S. GAAP in the amount of Ps16,310 in 2010 and Ps39,859 in 2009. Interest accrued on<br />

the perpetual debentures, including interest incurred in connection with perpetual loan facilities that were originated and settled during the<br />

year (note 12A and 16D), for approximately Ps1,624 in 2010, Ps2,704 in 2009 and Ps2,596 in 2008 recognized within “Other equity reserves”<br />

under MFRS were reclassified to interest expense in the reconciliation of net income (loss) to U.S. GAAP.<br />

As detailed in note 12A, in May 2010, CEMEX exchanged part of its perpetual debentures into new senior secured notes. As a result of the<br />

exchange, a gain of approximately Ps5,401 was recorded in “Other equity reserves”. According to ASC 470-50, Debt – Modifications and<br />

Extinguishments (“ASC 470-50”), new debt instruments shall be initially recorded at fair value, and that amount shall be used to determine<br />

the debt extinguishment gain or losses. Under MFRS, the senior secured notes qualified as the issuance of new debt and the extinguishment of<br />

the perpetual debentures, as it did under U.S. GAAP. The extinguishment gain of Ps5,401 recognized within “Other equity reserves” under<br />

MFRS was reclassified to comprehensive financial result in the reconciliation of net income (loss) to U.S. GAAP. The fair value of the senior<br />

secured notes under U.S. GAAP approximates its nominal value at the time of issuance. As of December 31, 2010 the fair value of the senior<br />

secured notes was of approximately US$1,193.<br />

Non-controlling Interest under U.S. GAAP<br />

Under both MFRS and U.S. GAAP, non-controlling interest in consolidated subsidiaries represent ownership interests in the consolidated<br />

entity that are presented as a separate component within stockholders’ equity. Likewise, under both MFRS and U.S. GAAP, the reported<br />

consolidated net income (loss) presents the amounts attributable to both the parent and the non-controlling interest on the face of the<br />

consolidated income statement. There were no U.S. GAAP adjustments attributable to non-controlling interests as of December 31, 2010 and<br />

2009 or for any of the years in the three year period ended December 31, 2010.<br />

(g) Inflation Adjustment of Machinery and Equipment<br />

According to Regulation S-X, when inflationary accounting is applicable under MFRS, fixed assets of foreign origin should be restated by<br />

applying the inflation rate of the country that holds the assets, regardless of the assets’ origin countries, instead of using the applicable<br />

methodology of MFRS until December 31, 2007, under which fixed assets of foreign origin were restated by applying a factor that considered<br />

the inflation of the asset’s origin country and the fluctuation of the currency of the country that holds the asset against the currency of the<br />

asset’s origin country. Depreciation expense is based upon the revised amounts. The amount recognized in the reconciliation of net income<br />

(loss) to U.S. GAAP in 2010, 2009 and 2008 refers to depreciation expense of the cumulative effect of the reconciling item as of December<br />

31, 2007, the date on which inflationary accounting was suspended under MFRS. The amount recognized in the reconciliation of<br />

stockholders’ equity to U.S. GAAP in 2010 and 2009 includes Ps2,410 (US$195) ((Ps1,591 (US$129) net of income tax) and Ps2,553<br />

(US$195) ((Ps1,685 (US$129) net of income tax), respectively, related to the revaluation of fixed assets nationalized in Venezuela, which are<br />

presented net in the caption “Non-current accounts receivable and other assets.” Beginning in 2008, if inflationary accounting is applicable<br />

under MFRS, fixed assets of foreign origin are restated using the factors derived from the general price indexes of the countries holding the<br />

assets, in a manner similar to that permitted under Regulation S-X.