building a STRONGER foundation - Cemex

building a STRONGER foundation - Cemex

building a STRONGER foundation - Cemex

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

CEMEX, S.A.B. DE C.V. AND SUBSIDIARIES<br />

Notes to the Consolidated Financial Statements – (Continued)<br />

As of December 31, 2010, 2009 and 2008<br />

(Millions of Mexican pesos)<br />

In addition, a deferred charge for an amount of Ps215 was recognized by the seller under U.S. GAAP and is being amortized over the<br />

estimated useful life of the asset beginning in 2009. The amortization expense recognized for U.S. GAAP purposes in the statement of<br />

operations as of December 31, 2010 and 2009 was Ps2 and Ps21, respectively.<br />

Of the total net income tax expense of approximately Ps2,531 in 2010, income tax benefit of approximately Ps3,420 in 2009 and income tax<br />

expense of approximately Ps7,861 in 2008, included in the reconciliation of net income (loss) to U.S. GAAP, income tax expense of<br />

approximately Ps559 in 2010, income tax benefit of approximately Ps2,421 in 2009 and income tax expense of approximately Ps2,657 in<br />

2008, are related to deferred income taxes.<br />

Current Income Taxes<br />

In addition to the reconciling items mentioned above related to deferred income taxes, according to MFRS D-4, current income taxes are<br />

presented in the income statement. For U.S. GAAP purposes, current income taxes generated by items recognized directly in equity are<br />

recognized in equity, considering also intra-period tax allocation. The reconciliation of net income (loss) to U.S. GAAP for the years ended<br />

December 31, 2010, 2009 and 2008, includes a tax expense of approximately Ps4,883, a tax benefit of approximately Ps3,353 and a tax<br />

expense of approximately Ps5,091, respectively, for the reclassification of current income taxes from net income (loss) under MFRS to equity<br />

under U.S. GAAP.<br />

In connection with changes to the tax consolidation regime in Mexico (notes 2N and 15A) under MFRS based on Interpretation 18, during<br />

2010 and 2009, CEMEX recognized a credit of approximately Ps2,911 and a charge of approximately Ps2,245 against retained earnings,<br />

respectively, for the partial cancellation in 2010 and the initial recognition in 2009 of the liability portion related to: a) the difference between<br />

the sum of the equity of the controlled entities for tax purposes and the equity for tax purposes of the consolidated entity; b) dividends from<br />

the controlled entities for tax purposes to CEMEX, S.A.B. de C.V.; and c) other transactions between the companies included in the tax<br />

consolidation that represented the transfer of resources within the group. Under U.S. GAAP, the tax effects of a new tax law enactment are<br />

recognized in the income statement for the period, therefore, the credit in 2010 and the charge in 2009 to retained earnings mentioned above<br />

were reclassified to income tax expense in the statements of operations for the years ended December 31, 2010 and 2009, respectively.<br />

Employees' Statutory Profit Sharing (“ESPS”)<br />

Until December 31, 2007, for purposes of U.S. GAAP, CEMEX recorded a deferred tax liability related to ESPS in Mexico using the asset<br />

and liability method at the statutory rate of 10%. As mentioned in note 2M, beginning January 1, 2008, deferred ESPS under MFRS is<br />

calculated and recognized under the asset and liability method. As a result, the reconciling item as of December 31, 2007 under U.S. GAAP<br />

was eliminated in the reconciliation of net income (loss) to U.S. GAAP in the year 2008.<br />

(d) Accounting for Uncertainty in Income Taxes<br />

Pursuant to ASC 740 under U.S. GAAP, CEMEX defines the confidence level that a tax position taken or expected to be taken must meet in<br />

order to be recognized in the financial statements. ASC 740-10-25-6 requires that the tax effects of a position must be recognized only if it is<br />

“more-likely-than-not” to be sustained based on its technical merits as of the reporting date. In making this assessment, CEMEX has assumed<br />

that the tax authorities will examine each position and have full knowledge of all relevant information. Each position has been considered on<br />

its own, regardless of its relation to any other broader tax settlement. The more-likely-than-not threshold represents a positive assertion by<br />

management that CEMEX is entitled to the economic benefits of a tax position. If a tax position is not considered more-likely-than-not to be<br />

sustained, no benefits of the position are to be recognized. Moreover, the more-likely-than-not threshold must continue to be met in each<br />

reporting period to support continued recognition of a benefit.<br />

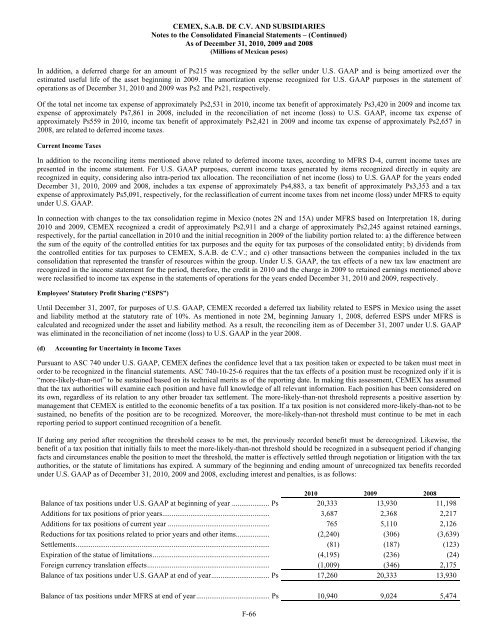

If during any period after recognition the threshold ceases to be met, the previously recorded benefit must be derecognized. Likewise, the<br />

benefit of a tax position that initially fails to meet the more-likely-than-not threshold should be recognized in a subsequent period if changing<br />

facts and circumstances enable the position to meet the threshold, the matter is effectively settled through negotiation or litigation with the tax<br />

authorities, or the statute of limitations has expired. A summary of the beginning and ending amount of unrecognized tax benefits recorded<br />

under U.S. GAAP as of December 31, 2010, 2009 and 2008, excluding interest and penalties, is as follows:<br />

2010 2009 2008<br />

Balance of tax positions under U.S. GAAP at beginning of year .................... Ps 20,333 13,930 11,198<br />

Additions for tax positions of prior years......................................................... 3,687 2,368 2,217<br />

Additions for tax positions of current year ...................................................... 765 5,110 2,126<br />

Reductions for tax positions related to prior years and other items.................. (2,240) (306) (3,639)<br />

Settlements....................................................................................................... (81) (187) (123)<br />

Expiration of the statue of limitations.............................................................. (4,195) (236) (24)<br />

Foreign currency translation effects................................................................. (1,009) (346) 2,175<br />

Balance of tax positions under U.S. GAAP at end of year............................... Ps 17,260 20,333 13,930<br />

Balance of tax positions under MFRS at end of year....................................... Ps 10,940 9,024 5,474<br />

F-66