Teller Skills Customer Service Fundamentals

Teller Skills Customer Service Fundamentals

Teller Skills Customer Service Fundamentals

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Teller</strong> Money Handling and Balancing Tips<br />

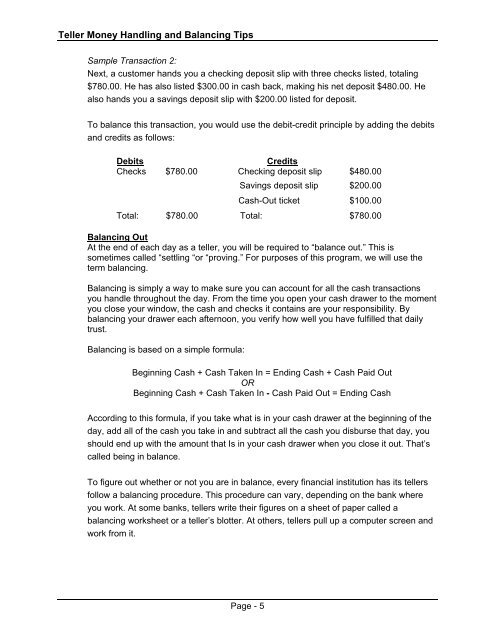

Sample Transaction 2:<br />

Next, a customer hands you a checking deposit slip with three checks listed, totaling<br />

$780.00. He has also listed $300.00 in cash back, making his net deposit $480.00. He<br />

also hands you a savings deposit slip with $200.00 listed for deposit.<br />

To balance this transaction, you would use the debit-credit principle by adding the debits<br />

and credits as follows:<br />

Debits Credits<br />

Checks $780.00 Checking deposit slip $480.00<br />

Savings deposit slip $200.00<br />

Cash-Out ticket $100.00<br />

Total: $780.00 Total: $780.00<br />

Balancing Out<br />

At the end of each day as a teller, you will be required to “balance out.” This is<br />

sometimes called “settling “or “proving.” For purposes of this program, we will use the<br />

term balancing.<br />

Balancing is simply a way to make sure you can account for all the cash transactions<br />

you handle throughout the day. From the time you open your cash drawer to the moment<br />

you close your window, the cash and checks it contains are your responsibility. By<br />

balancing your drawer each afternoon, you verify how well you have fulfilled that daily<br />

trust.<br />

Balancing is based on a simple formula:<br />

Beginning Cash + Cash Taken In = Ending Cash + Cash Paid Out<br />

OR<br />

Beginning Cash + Cash Taken In - Cash Paid Out = Ending Cash<br />

According to this formula, if you take what is in your cash drawer at the beginning of the<br />

day, add all of the cash you take in and subtract all the cash you disburse that day, you<br />

should end up with the amount that Is in your cash drawer when you close it out. That’s<br />

called being in balance.<br />

To figure out whether or not you are in balance, every financial institution has its tellers<br />

follow a balancing procedure. This procedure can vary, depending on the bank where<br />

you work. At some banks, tellers write their figures on a sheet of paper called a<br />

balancing worksheet or a teller’s blotter. At others, tellers pull up a computer screen and<br />

work from it.<br />

Page - 5