- Page 1 and 2:

Lawyer’s Manual on Domestic Viole

- Page 3 and 4:

Victim Who Needs Child Support i La

- Page 5 and 6:

Summary of Contents Part I: Introdu

- Page 7 and 8:

Table of Contents Summary of Conten

- Page 9 and 10:

Contents vii 7. Moving On: UCCJEA,

- Page 11 and 12:

Contents ix Hearsay Exceptions: Exc

- Page 13 and 14:

Contents xi 20. Helping Immigrant V

- Page 15:

ALEXIS MCNAUGHTON KNOX 1983 - 2006

- Page 19 and 20:

The Evolution of the Justice System

- Page 21 and 22:

Evolution of the Justice System’s

- Page 23 and 24:

Evolution of the Justice System’s

- Page 25:

Notes Evolution of the Justice Syst

- Page 28 and 29:

10 Dorchen A. Leidholdt For all of

- Page 30 and 31:

12 Dorchen A. Leidholdt Center, Sak

- Page 32 and 33:

14 Dorchen A. Leidholdt can take ma

- Page 34 and 35:

16 Dorchen A. Leidholdt In the cour

- Page 36 and 37:

18 Dorchen A. Leidholdt Legal Issue

- Page 38 and 39:

20 Dorchen A. Leidholdt eye-witness

- Page 40 and 41:

22 Dorchen A. Leidholdt questions i

- Page 42 and 43:

24 Dorchen A. Leidholdt the help sh

- Page 45 and 46:

As a lawyer you may find yourself h

- Page 47 and 48:

Danger and Safety 29 however, is no

- Page 49 and 50:

Appendix Safety Planning Checklist

- Page 51 and 52:

Safety Planning Checklist continued

- Page 53:

Notes Danger and Safety 35 1. Jacqu

- Page 57 and 58:

Victim Who Needs Child Support 39 4

- Page 59 and 60:

Litigating Family Offense Proceedin

- Page 61 and 62:

Litigating Family Offense Proceedin

- Page 63 and 64:

Litigating Family Offense Proceedin

- Page 65 and 66:

Litigating Family Offense Proceedin

- Page 67 and 68:

Litigating Family Offense Proceedin

- Page 69 and 70:

Litigating Family Offense Proceedin

- Page 71 and 72:

Notes Litigating Family Offense Pro

- Page 73:

Litigating Family Offense Proceedin

- Page 77 and 78:

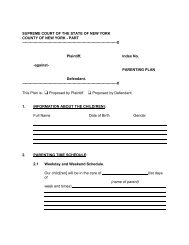

Custody disputes occur frequently i

- Page 79 and 80:

Litigating Custody and Visitation 6

- Page 81 and 82:

Litigating Custody and Visitation 6

- Page 83 and 84:

Primary Caretaker Litigating Custod

- Page 85 and 86:

Litigating Custody and Visitation 6

- Page 87 and 88:

Litigating Custody and Visitation 6

- Page 89 and 90:

Litigating Custody and Visitation 7

- Page 91 and 92:

Litigating Custody and Visitation 7

- Page 93 and 94:

Litigating Custody and Visitation 7

- Page 95 and 96:

Litigating Custody and Visitation 7

- Page 97 and 98:

Litigating Custody and Visitation 7

- Page 99 and 100:

The Law Regarding Child Welfare and

- Page 101 and 102:

Representing Domestic Violence Vict

- Page 103 and 104:

Representing Domestic Violence Vict

- Page 105 and 106:

Representing Domestic Violence Vict

- Page 107 and 108:

Representing Domestic Violence Vict

- Page 109 and 110:

Respondent Mothers Representing Dom

- Page 111 and 112:

Representing Domestic Violence Vict

- Page 113 and 114:

Representing Domestic Violence Vict

- Page 115 and 116:

Representing Domestic Violence Vict

- Page 117 and 118:

This article is a practical guide f

- Page 119 and 120:

Moving On: UCCJEA, The Hague Conven

- Page 121 and 122:

Moving On: UCCJEA, The Hague Conven

- Page 123 and 124: Moving On: UCCJEA, The Hague Conven

- Page 125 and 126: Moving On: UCCJEA, The Hague Conven

- Page 127 and 128: Moving On: UCCJEA, The Hague Conven

- Page 129 and 130: Moving On: UCCJEA, The Hague Conven

- Page 131 and 132: Moving On: UCCJEA, The Hague Conven

- Page 133 and 134: Moving On: UCCJEA, The Hague Conven

- Page 135 and 136: Notes Moving On: UCCJEA, The Hague

- Page 137 and 138: Moving On: UCCJEA, The Hague Conven

- Page 139 and 140: The Uniform Child Custody Jurisdict

- Page 141 and 142: UCCJEA and Domestic Violence: A Cas

- Page 143 and 144: Safety Issues UCCJEA and Domestic V

- Page 145 and 146: UCCJEA and Domestic Violence: A Cas

- Page 147 and 148: Notes UCCJEA and Domestic Violence:

- Page 149 and 150: The Hague Convention on the Civil A

- Page 151 and 152: Civil Aspects of International Chil

- Page 153 and 154: Civil Aspects of International Chil

- Page 155 and 156: Conclusion Civil Aspects of Interna

- Page 157 and 158: Domestic Violence and Money 10 Repr

- Page 159 and 160: Victim Who Needs Child Support 141

- Page 161 and 162: Victim Who Needs Child Support 143

- Page 163 and 164: Victim Who Needs Child Support 145

- Page 165 and 166: Victim Who Needs Child Support 147

- Page 167 and 168: Address Confidentiality Victim Who

- Page 169 and 170: Negotiating an Agreement When an Ag

- Page 171 and 172: Victim Who Needs Child Support 153

- Page 173: Victim Who Needs Child Support 155

- Page 177 and 178: Victim Who Needs Child Support 159

- Page 179 and 180: Counsel and Expert Fees Victim Who

- Page 181 and 182: Victim Who Needs Child Support 163

- Page 183 and 184: Victim Who Needs Child Support 165

- Page 185 and 186: Notes Victim Who Needs Child Suppor

- Page 187: Part IV Criminal Justice

- Page 190 and 191: 172 Lisa Fischel-Wolovick of an ord

- Page 192 and 193: 174 Lisa Fischel-Wolovick Primary A

- Page 194 and 195: 176 Lisa Fischel-Wolovick called th

- Page 196 and 197: 178 Lisa Fischel-Wolovick Notes 1.

- Page 199 and 200: Intimate Partner Sexual Violence 12

- Page 201 and 202: When Domestic Violence Victims Are

- Page 203 and 204: When Domestic Violence Victims Are

- Page 205 and 206: When Domestic Violence Victims Are

- Page 207 and 208: When Domestic Violence Victims Are

- Page 209 and 210: Notes When Domestic Violence Victim

- Page 211 and 212: Although stalking is a crime under

- Page 213 and 214: Crimes of Stalking Taking Stalking

- Page 215 and 216: Taking Stalking Seriously 197 stari

- Page 217 and 218: Taking Stalking Seriously 199 Assis

- Page 219 and 220: Conclusion Taking Stalking Seriousl

- Page 221: Taking Stalking Seriously 203 23. F

- Page 224 and 225:

206 Elizabeth Cronin Moreover, vict

- Page 226 and 227:

208 Elizabeth Cronin assault cases

- Page 228 and 229:

210 Elizabeth Cronin sounds like so

- Page 230 and 231:

212 Elizabeth Cronin hearsay rules

- Page 232 and 233:

214 Elizabeth Cronin Davis does not

- Page 234 and 235:

216 Elizabeth Cronin Medical Expert

- Page 236 and 237:

218 Elizabeth Cronin Notes 1. Peopl

- Page 238 and 239:

220 Elizabeth Cronin 34. Nieves, su

- Page 241:

Part V Economics and Collateral Iss

- Page 244 and 245:

226 Emily Ruben Grounds When a batt

- Page 246 and 247:

228 Emily Ruben Orders of Protectio

- Page 248 and 249:

230 Emily Ruben Effective November

- Page 250 and 251:

232 Emily Ruben Also, since domesti

- Page 252 and 253:

234 Emily Ruben Conclusion There ar

- Page 254 and 255:

236 Emily Ruben 19. Harley v Harley

- Page 256 and 257:

238 Wendy R. Weiser and Deborah A.

- Page 258 and 259:

240 Wendy R. Weiser and Deborah A.

- Page 260 and 261:

242 Wendy R. Weiser and Deborah A.

- Page 262 and 263:

244 Wendy R. Weiser and Deborah A.

- Page 264 and 265:

246 Wendy R. Weiser and Deborah A.

- Page 266 and 267:

248 Wendy R. Weiser and Deborah A.

- Page 268 and 269:

250 Wendy R. Weiser and Deborah A.

- Page 270 and 271:

252 Wendy R. Weiser and Deborah A.

- Page 273 and 274:

In addition to the physical and emo

- Page 275 and 276:

Public Assistance and Housing 257 B

- Page 277 and 278:

Public Assistance and Housing 259 s

- Page 279 and 280:

The Domestic Violence Liaison (DVL)

- Page 281 and 282:

Public Assistance and Housing 263 p

- Page 283 and 284:

Public Assistance and Housing 265 m

- Page 285 and 286:

Public Assistance and Housing 267 o

- Page 287 and 288:

Public Assistance and Housing 269 Y

- Page 289 and 290:

Public Assistance and Housing 271 P

- Page 291 and 292:

Public Assistance and Housing 273 f

- Page 293 and 294:

Public Assistance and Housing 275 l

- Page 295 and 296:

Public Assistance and Housing 277 D

- Page 297 and 298:

Conclusion Public Assistance and Ho

- Page 299 and 300:

Public Assistance and Housing 281 7

- Page 301 and 302:

Public Assistance and Housing 283 1

- Page 303 and 304:

Public Assistance and Housing 285 9

- Page 305 and 306:

Public Assistance and Housing 287 5

- Page 307 and 308:

84. Id. 85. Id. Public Assistance a

- Page 309 and 310:

Public Assistance and Housing 291 1

- Page 311 and 312:

Public Assistance and Housing 293 P

- Page 313 and 314:

Public Assistance and Housing 295 r

- Page 315 and 316:

Identifying Domestic Violence Despi

- Page 317 and 318:

Domestic Violence and Tort Remedies

- Page 319 and 320:

Domestic Violence and Tort Remedies

- Page 321 and 322:

Conclusion Domestic Violence and To

- Page 323:

Domestic Violence and Tort Remedies

- Page 327 and 328:

The fundamental issues confronting

- Page 329 and 330:

Representing Immigrant Victims of D

- Page 331 and 332:

Representing Immigrant Victims of D

- Page 333 and 334:

Representing Immigrant Victims of D

- Page 335 and 336:

Could the Victim be a US Citizen Al

- Page 337 and 338:

Representing Immigrant Victims of D

- Page 339 and 340:

Representing Immigrant Victims of D

- Page 341 and 342:

Representing Immigrant Victims of D

- Page 343 and 344:

Representing Immigrant Victims of D

- Page 345 and 346:

Representing Immigrant Victims of D

- Page 347 and 348:

Asylum and Related Remedies Represe

- Page 349 and 350:

Representing Immigrant Victims of D

- Page 351 and 352:

Representing Immigrant Victims of D

- Page 353 and 354:

Representing Immigrant Victims of D

- Page 355 and 356:

Representing Immigrant Victims of D

- Page 357 and 358:

ASISTA http://www.asistaonline.org

- Page 359 and 360:

Representing Immigrant Victims of D

- Page 361 and 362:

Notes Representing Immigrant Victim

- Page 363 and 364:

Representing Immigrant Victims of D

- Page 365 and 366:

Representing Immigrant Victims of D

- Page 367 and 368:

Representing Immigrant Victims of D

- Page 369 and 370:

Representing Immigrant Victims of D

- Page 371 and 372:

Representing Immigrant Victims of D

- Page 373 and 374:

Helping Immigrant Victims of Domest

- Page 375 and 376:

Helping Immigrant Victims Access Fe

- Page 377 and 378:

Helping Immigrant Victims Access Fe

- Page 379 and 380:

Helping Immigrant Victims Access Fe

- Page 381 and 382:

Helping Immigrant Victims Access Fe

- Page 383 and 384:

Helping Immigrant Victims Access Fe

- Page 385:

Helping Immigrant Victims Access Fe

- Page 388 and 389:

370 Dorchen A. Leidholdt Traffickin

- Page 390 and 391:

372 Dorchen A. Leidholdt Before you

- Page 392 and 393:

374 Dorchen A. Leidholdt such as sw

- Page 394 and 395:

376 Dorchen A. Leidholdt keeping he

- Page 396 and 397:

378 Dorchen A. Leidholdt FGM is roo

- Page 398 and 399:

380 Dorchen A. Leidholdt Notes 1. T

- Page 400 and 401:

382 Dorchen A. Leidholdt 17. See In

- Page 403 and 404:

22 Advocating for Youth in Domestic

- Page 405 and 406:

Distrust of Authority Advocating fo

- Page 407 and 408:

Advocating for Youth in Domestic Vi

- Page 409 and 410:

Advocating for Youth in Domestic Vi

- Page 411 and 412:

Advocating for Youth in Domestic Vi

- Page 413 and 414:

Advocating for Youth in Domestic Vi

- Page 415 and 416:

Advocating for Youth in Domestic Vi

- Page 417 and 418:

Notes Advocating for Youth in Domes

- Page 419 and 420:

23 Domestic Violence in the Lesbian

- Page 421 and 422:

Domestic Violence in the LGBT Commu

- Page 423 and 424:

Domestic Violence in the LGBT Commu

- Page 425 and 426:

Domestic Violence in the LGBT Commu

- Page 427 and 428:

Domestic Violence in the LGBT Commu

- Page 429 and 430:

Notes Domestic Violence in the LGBT

- Page 431 and 432:

Domestic Violence in the LGBT Commu

- Page 433 and 434:

Domestic Violence in the LGBT Commu

- Page 435 and 436:

Domestic Violence in the LGBT Commu

- Page 437:

Domestic Violence in the LGBT Commu

- Page 441 and 442:

Appendices Power and Control Wheel

- Page 443 and 444:

Appendix B Immigrant Power and Cont

- Page 445:

Appendix D Lesbian/Gay Power and Co

- Page 449 and 450:

Contributors Liberty Aldrich is the

- Page 451:

Hilary Sunghee Seo is Co-Director o