BAGGAGE DECLARATION FORM - ARRIVAL Welcome to Peru ...

BAGGAGE DECLARATION FORM - ARRIVAL Welcome to Peru ...

BAGGAGE DECLARATION FORM - ARRIVAL Welcome to Peru ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

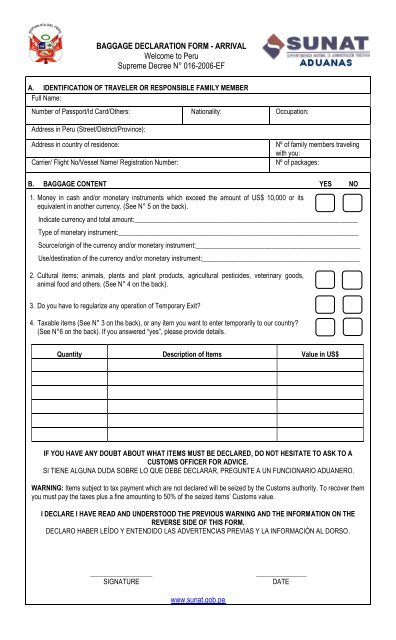

A. IDENTIFICATION OF TRAVELER OR RESPONSIBLE FAMILY MEMBER<br />

Full Name:<br />

Number of Passport/Id Card/Others:<br />

Address in <strong>Peru</strong> (Street/District/Province):<br />

<strong>BAGGAGE</strong> <strong>DECLARATION</strong> <strong>FORM</strong> - <strong>ARRIVAL</strong><br />

<strong>Welcome</strong> <strong>to</strong> <strong>Peru</strong><br />

Supreme Decree N° 016-2006-EF<br />

Nationality: Occupation:<br />

Address in country of residence: Nº of family members traveling<br />

with you:<br />

Carrier/ Flight No/Vessel Name/ Registration Number: Nº of packages:<br />

B. <strong>BAGGAGE</strong> CONTENT YES NO<br />

1. Money in cash and/or monetary instruments which exceed the amount of US$ 10,000 or its<br />

equivalent in another currency. (See N° 5 on the back).<br />

Indicate currency and <strong>to</strong>tal amount:_________________________________________________________________<br />

Type of monetary instrument:______________________________________________________________________<br />

Source/origin of the currency and/or monetary instrument:________________________________________________<br />

Use/destination of the currency and/or monetary instrument:______________________________________________<br />

2. Cultural items; animals, plants and plant products, agricultural pesticides, veterinary goods,<br />

animal food and others. (See N° 4 on the back).<br />

3. Do you have <strong>to</strong> regularize any operation of Temporary Exit?<br />

4. Taxable items (See N° 3 on the back), or any item you want <strong>to</strong> enter temporarily <strong>to</strong> our country?<br />

(See N°6 on the back). If you answered “yes”, please provide details.<br />

Quantity Description of Items Value in US$<br />

IF YOU HAVE ANY DOUBT ABOUT WHAT ITEMS MUST BE DECLARED, DO NOT HESITATE TO ASK TO A<br />

CUSTOMS OFFICER FOR ADVICE.<br />

SI TIENE ALGUNA DUDA SOBRE LO QUE DEBE DECLARAR, PREGUNTE A UN FUNCIONARIO ADUANERO.<br />

WARNING: Items subject <strong>to</strong> tax payment which are not declared will be seized by the Cus<strong>to</strong>ms authority. To recover them<br />

you must pay the taxes plus a fine amounting <strong>to</strong> 50% of the seized items’ Cus<strong>to</strong>ms value.<br />

I DECLARE I HAVE READ AND UNDERSTOOD THE PREVIOUS WARNING AND THE IN<strong>FORM</strong>ATION ON THE<br />

REVERSE SIDE OF THIS <strong>FORM</strong>.<br />

DECLARO HABER LEÍDO Y ENTENDIDO LAS ADVERTENCIAS PREVIAS Y LA IN<strong>FORM</strong>ACIÓN AL DORSO.<br />

_____________________ _________________<br />

SIGNATURE DATE<br />

www.sunat.gob.pe

1. CUSTOMS CONTROL AND <strong>DECLARATION</strong>:<br />

All travelers are subject <strong>to</strong> Cus<strong>to</strong>ms control, including both the individual and his/her belongings<br />

(Supreme Decree No 016-2006-EF). The Cus<strong>to</strong>ms Authority is empowered <strong>to</strong> examine travelers and/or<br />

<strong>to</strong> inspect their baggage or packages.<br />

The responsible family member may provide only one declaration form per family group when traveling<br />

accompanied by his/her parents, spouse, and/or children under 18 years old.<br />

2. ITEMS EXEMPT FROM CUSTOMS DUTIES:<br />

Items that travelers may reasonably need during their trip and that due <strong>to</strong> their nature and quantity are<br />

not presumed <strong>to</strong> be used for commercial purposes. The following items are exempt from cus<strong>to</strong>ms duties:<br />

Traveler’s personal effects:<br />

Clothing and adornment items; <strong>to</strong>iletry; medicines; 01<br />

unit or 01 set of sport items; books, magazines and<br />

printed documents; 01 portable electronic hair device;<br />

01 shaver or electric razor (*);<br />

Other portable items for traveler’s personal use:<br />

01 musical wind or string instrument;<br />

01 broadcasting recep<strong>to</strong>r or sound reproduction<br />

device, even with a recorder or equipment containing<br />

them and up <strong>to</strong> 20 compact discs;<br />

01 conventional or digital camera;<br />

01 non-professional video camera (*);<br />

01 DVD player;<br />

Up <strong>to</strong> 10 pho<strong>to</strong>graphic films; 01 external hard drive for<br />

computer; 02 memory cards for digital camera, video<br />

camera and/or videogame, only if you carry these<br />

devices with you; 02 USB flash drives (pen drive); 10<br />

videocassettes for portable video camera; 10 digital<br />

disks for video or videogames;<br />

01 electronic domestic videogame;<br />

01 electronic agenda or tablet (*);<br />

01 computer with its own energy source (*);<br />

02 mobile phones (*);<br />

01 electronic calcula<strong>to</strong>r;<br />

Cigarettes and Liquors: Travelers over 18 years<br />

old are allowed <strong>to</strong> enter up <strong>to</strong> 20 cigarette packages<br />

or 50 cigars or 250 grams of cut <strong>to</strong>bacco or <strong>to</strong>bacco<br />

fiber for smoking, and up <strong>to</strong> 03 liters of liquor.<br />

Pets: 01 live domestic pet that shall be authorized<br />

by SENASA upon arrival.<br />

Disabled or ill travelers: Auxiliary means and<br />

equipment necessary for traveler’s medical control<br />

and mobilization.<br />

Other items: Items for traveler’s personal use or<br />

consumption and gifts which due <strong>to</strong> their quantity or<br />

diversity are not presumed <strong>to</strong> be used for<br />

commercial purposes, which <strong>to</strong>tal value does not<br />

exceed US$ 500.<br />

(*)Only for travelers over 7 years old.<br />

3. ITEMS SUBJECT TO CUSTOMS DUTIES:<br />

Travelers may bring in<strong>to</strong> the country other items not included in the above list which value does not<br />

exceed US$ 1,000 per trip and up <strong>to</strong> US$ 3,000 per calendar year, for which they shall pay a fee of 14%<br />

over their Cus<strong>to</strong>ms value; provided that due <strong>to</strong> their quantity, nature or diversity, they are not presumed<br />

<strong>to</strong> be used for commercial or industrial purposes.<br />

4. RESTRICTED OR PROHIBITED ITEMS:<br />

In order <strong>to</strong> bring restricted items (agricultural, wildlife, and cultural heritage products, weapons and<br />

ammunitions, etc.) in<strong>to</strong> the country, travelers must obtain appropriate authorization from the relevant<br />

entity. Not declaring these items upon their arrival or departure may result in administrative and/or penal<br />

sanctions. Items not allowed <strong>to</strong> be brought in<strong>to</strong> the country include: used clothing and footwear not<br />

considered as part of the traveler’s baggage, foreign beverages named "Pisco", among others, which will<br />

be subject <strong>to</strong> seizure.<br />

5. OBLIGATION TO DECLARE CURRENCY AND/OR MONETARY INSTRUMENTS:<br />

Currency and/or monetary instruments over US$ 10,000 (ten thousand U.S. dollars) or its equivalent in<br />

another currency must be declared. Failure <strong>to</strong> declare will result in seizure without prejudice of<br />

administrative and/or penal actions (Art. 28° and 31° in the 27693 Act, Financial Intelligence Unit). For<br />

such purpose, travelers must request SUNAT – ADUANAS a written evidence of their declaration.<br />

6. TEMPORARY ACTIVITIES :<br />

Travelers are allowed <strong>to</strong> temporarily enter <strong>to</strong> our country the following items for up <strong>to</strong> 12 months prior<br />

presentation of Entry/Temporary Exit Declaration and a bond deposit for an amount equivalent <strong>to</strong> import<br />

taxes: <strong>to</strong>ols and equipments necessary for professional or technicians’ activities that come <strong>to</strong> provide<br />

services, provided they are able <strong>to</strong> be identified and individualized. A non-resident traveler is allowed <strong>to</strong><br />

temporarily enter sport items <strong>to</strong> perform activities related <strong>to</strong> adventure <strong>to</strong>urism without a bond deposit. To<br />

regularize Temporary Operations, a traveler must appear before the Cus<strong>to</strong>ms authority with due<br />

anticipation before leaving the country.<br />

www.sunat.gob.pe