Munich Re Group Changing Gear gg

Munich Re Group Changing Gear gg

Munich Re Group Changing Gear gg

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

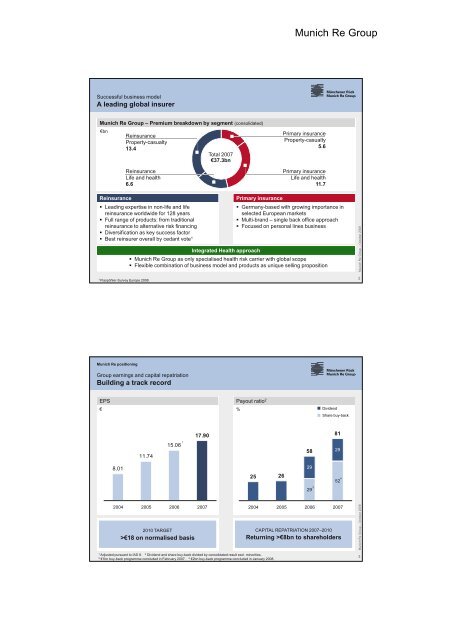

Successful business model<br />

A leading global insurer<br />

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> – Premium breakdown by segment (consolidated)<br />

€bn<br />

<strong>Re</strong>insurance<br />

Property-casualty<br />

13.4<br />

Total 2007<br />

€37.3bn<br />

<strong>Re</strong>insurance<br />

Life and health<br />

6.6<br />

1 Flaspöhler-Survey Europe 2008.<br />

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong><br />

Primary insurance<br />

Property-casualty<br />

56 5.6<br />

Primary insurance<br />

Life and health<br />

11.7<br />

<strong>Re</strong>insurance Primary insurance<br />

Leading expertise in non-life and life<br />

Germany-based with growing importance in<br />

reinsurance worldwide for 128 years<br />

selected European markets<br />

Full range of products: from traditional<br />

Multi-brand – single back office approach<br />

reinsurance to alternative risk financing<br />

Diversification as key success factor<br />

Best reinsurer overall by cedant vote<br />

Focused on personal lines business<br />

1<br />

<strong>Munich</strong> <strong>Re</strong> positioning<br />

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> as only specialised health risk carrier with global scope<br />

Flexible combination of business model and products as unique selling proposition<br />

<strong>Group</strong> earnings and capital repatriation<br />

Building a track record<br />

EPS<br />

€<br />

8.01<br />

11.74<br />

15.06<br />

Integrated Health approach<br />

17.90<br />

2004 2005 2006 2007<br />

2010 TARGET<br />

>€18 on normalised basis<br />

1<br />

Payout ratio 2<br />

1 Adjusted pursuant to IAS 8. 2 Dividend and share buy-back divided by consolidated result excl. minorities.<br />

3 €1bn buy-back programme concluded in February 2007. 4 €2bn buy-back programme concluded in January 2008.<br />

%<br />

25<br />

26<br />

58<br />

29<br />

29<br />

3<br />

Dividend<br />

Share buy-back<br />

81<br />

29<br />

52<br />

2004 2005 2006 2007<br />

CAPITAL REPATRIATION 2007–2010<br />

<strong>Re</strong>turning >€8bn to shareholders<br />

4<br />

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> – October 2008<br />

2<br />

<strong>Munich</strong> <strong>Re</strong> <strong>Group</strong> – October 2008<br />

3