Products Termsheet rms Structured Fixed Te - jpv.ch

Products Termsheet rms Structured Fixed Te - jpv.ch

Products Termsheet rms Structured Fixed Te - jpv.ch

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Private Individuals 044 332 66 68<br />

Institutional Investors and Banks 044 335 76 00<br />

Conversations on these telephone lines may be<br />

recorded.<br />

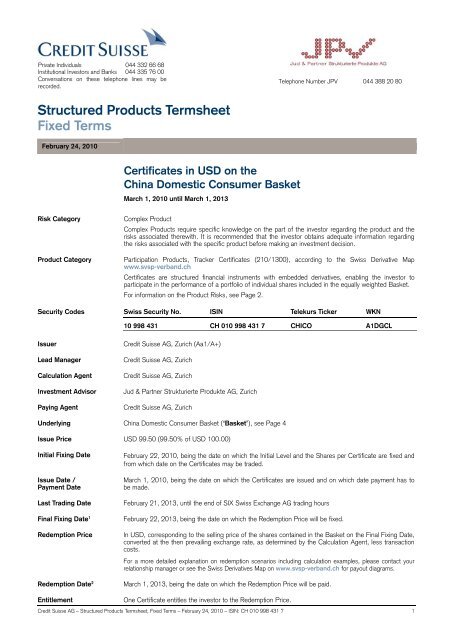

<strong>Structured</strong> <strong>Products</strong> <strong><strong>Te</strong><strong>rms</strong>heet</strong><br />

<strong>Fixed</strong> <strong>Te</strong><strong>rms</strong><br />

February 24, 2010<br />

Risk Category<br />

Certificates in USD on the<br />

China<br />

Domestic Consumer Basket<br />

Mar<strong>ch</strong> 1, 2010 until Mar<strong>ch</strong> 1, 2013<br />

Complex Product<br />

<strong>Te</strong>lephone Number JPV 044 388 20 80<br />

Complex <strong>Products</strong> require specific knowledge on the part of the investor regarding<br />

the product and the<br />

risks associated therewith. It is recommended that the investor obtains adequate<br />

information regarding<br />

the risks associated with the specific product before making an investment decision.<br />

Product Category<br />

Participation Prod ucts, Tracker Certifica tes (210/1300), according to the Swiss Derivative Map<br />

www.svsp-verband.<strong>ch</strong><br />

Certificates are structured financial instruments with embedded<br />

derivatives, enabling the investor to<br />

participate in the performance<br />

of a portfolio of individual shares included in the equally weighted Basket.<br />

For information on the Product Risks, see Page 2.<br />

Security Code s Swiss Security<br />

No. ISIN <strong>Te</strong>lekurs Ticker WKN<br />

Issuer<br />

10 998 431 CH 010 998 431 7 CHICO A1DGCL<br />

Credit Suisse AG, Zuri<strong>ch</strong> (Aa1/A+)<br />

Lead Manager Credit Suisse AG, Zuri<strong>ch</strong><br />

Calculation Agent Credit Suisse AG, Zuri<strong>ch</strong><br />

Investment Advisor<br />

Paying Agent<br />

Credit<br />

Suisse AG, Zuri<strong>ch</strong><br />

Underlying<br />

China Domestic Consumer Basket (“Basket”), see Page 4<br />

Issue Price USD 99.50 (99.50% of USD 100.00)<br />

Initial Fixing Date February 22, 2010, being the date on whi<strong>ch</strong> the Initial Level and the Shares per Certificate<br />

are fixed and<br />

from whi<strong>ch</strong> date on the Certificates may be traded.<br />

Issue Date /<br />

Mar<strong>ch</strong> 1, 2010, being the date on whi<strong>ch</strong> the Certificates are issued and on whi<strong>ch</strong> date payment has to<br />

Payment Date be made.<br />

Last Trading<br />

Date February 21, 2013, until the end of SIX Swiss<br />

Ex<strong>ch</strong>ange AG trading hours<br />

Final Fixing Date 1<br />

Redemption Price<br />

Redemption Date 2<br />

Entitlement<br />

Jud & Partner Strukturierte Produkte AG, Zuri<strong>ch</strong><br />

February 22, 2013, being the date on whi<strong>ch</strong> the Redemption Price will be fixed.<br />

In USD, corresponding to the selling price of the shares contained in the Basket on the Final Fixing Date,<br />

converted at the then prevailing ex<strong>ch</strong>ange rate, as determined by the Calculation Agent, less transaction<br />

costs.<br />

For a more detailed explanation on redemption scenarios including calculation examples, please contact your<br />

relationship manager or see the Swiss Derivatives Map on www.svsp-verband.<strong>ch</strong> for payout diagrams.<br />

Mar<strong>ch</strong> 1, 2013, being the date on whi<strong>ch</strong> the Redemption Price will be paid.<br />

One Certificate entitles the investor to the Redemption Price.<br />

Credit Suisse AG – <strong>Structured</strong> <strong>Products</strong> <strong><strong>Te</strong><strong>rms</strong>heet</strong>, <strong>Fixed</strong> <strong>Te</strong><strong>rms</strong> – February 24, 2010 – ISIN: CH 010 998 431 7 1

Ratio 1 Certificate represents 1 China Domestic Consumer Basket in USD<br />

Payout None<br />

Trading / Listing Credit Suisse AG, Zuri<strong>ch</strong>, provides a secondary market under normal market conditions. Listing will be<br />

applied<br />

for on the SIX Swiss Ex<strong>ch</strong>ange AG.<br />

Minimum Trading Lot<br />

Issue Size 200'000 Certificates (may be increased or decreased at any time)<br />

Clearing<br />

Documentation The fixed <strong><strong>Te</strong><strong>rms</strong>heet</strong> shall include the information required for a simplified prospectus<br />

pursuant to<br />

Article 5 of the Federal Act<br />

on Collective Investment S<strong>ch</strong>emes. Until the te<strong>rms</strong> are fixed, they are<br />

indicative and may, therefore, be amended. The information contained in the simplified prospectus<br />

is of<br />

summary nature. Following the Initial Fixing Date, the listing prospectus with the full te<strong>rms</strong> of the<br />

Certificates may be obtained directly from Credit Suisse AG, VVYC 3 Transaction Advisory Group,<br />

Uetlibergstrasse 231, CH-8070 Zuri<strong>ch</strong>.<br />

Publication The fixed <strong><strong>Te</strong><strong>rms</strong>heet</strong><br />

and all material <strong>ch</strong>anges during the lifetime of the Certificates may be obtained from<br />

your relationship manager upon request and will also be published on:<br />

www.credit-suisse.com/structuredinvestments<br />

or www.credit-suisse.com/structuredproducts<br />

Indicative trading prices may also be obtained on Reuters CSZEQ00 and Bloomberg CSZE.<br />

Form of Certificates<br />

Governing Law /<br />

Jurisdiction<br />

Tax Considerations<br />

The following statements and discussions of certain Swiss tax considerations relevant<br />

to the pur<strong>ch</strong>ase,<br />

ownership and disposition of Certificates are of a general nature only and do not address all potential tax<br />

consequences of an investment in Certificates under Swiss law. This summary is based on treaties,<br />

laws,<br />

regulations,<br />

rulings and decisions currently in effect, all of whi<strong>ch</strong> are subject to <strong>ch</strong>ange. It does not<br />

address the tax consequences of the Certificates in any jurisdiction other than Switzerland.<br />

Tax treatment depends on the individual tax situation of ea<strong>ch</strong> investor and may be subject<br />

to <strong>ch</strong>ange.<br />

Potential investors will, therefore, need to consult their own tax advisors to determine<br />

the special tax<br />

consequences of the pur<strong>ch</strong>ase, ownership and sale or other disposition of a Certificate.<br />

In particular, the<br />

precise tax treatment of a holder of a Certificate needs to be determined for ea<strong>ch</strong> issue with reference to<br />

the full te<strong>rms</strong> of the Certificates, as specified in the listing prospectus, under the law and practice at the<br />

relevant time.<br />

The investors shall be liable for all current and future taxes and<br />

duties as a consequence of an investment<br />

in Certificates. The income tax treatment as depicted below is applicable to individual persons with tax<br />

residence in Switzerland and private assets. Swiss withholding tax and Swiss stamp<br />

taxes are applicable<br />

to all investors; however, specific rules apply with respect to certain types of investors<br />

and transactions.<br />

No Swiss withholding tax, no Swiss stamp tax at issuance (primary market) and<br />

no Swiss securities<br />

transfer stamp tax on secondary market transactions of the Certificates.<br />

The discount of 0.50% (USD 0.50) on the Issue Price is subject to Swiss income tax for Swiss resident<br />

private investors.<br />

This product is not subject to EU withholding tax for Swiss paying agents. [TK-Code 9; “out of scope”]<br />

Credit Suisse AG expressly excludes all liability<br />

in respect of any tax implications.<br />

Issuer Risk The investment product’s retention of value is dependent not only on the development of the value<br />

of the<br />

Underlying, but also on the creditworthiness of the Issuer, whi<strong>ch</strong> may <strong>ch</strong>ange<br />

over the term of the<br />

investment product. This investment product is a direct, unsubordinated, unconditional<br />

and unsecured<br />

obligation of the Issuer and ranks equally with all other direct, unconditional and unsecured<br />

obligations of<br />

the Issuer. The Issuer is licensed as a bank pursuant to the Federal Act on Banks and Saving Banks and<br />

as a securities dealer pursuant to the Federal Act on Stock Ex<strong>ch</strong>anges and Securities<br />

Trading and is<br />

subject to supervision by<br />

the Swiss Financial Market Supervisory Authority (FINMA).<br />

Product Risks<br />

1 Certificate<br />

SIX SIS AG, Euroclear Bank S.A. and Clearstream Banking<br />

Uncertificated Securities<br />

Swiss Law / Zuri<strong>ch</strong><br />

Potential Loss: These Certificates are derivative financial instruments. The potential loss of an<br />

investment in a Certificate is similar to a direct investment in the corresponding shares of the Basket, i.e.<br />

could result in a substantial loss of the invested capital.<br />

The investors have no recourse to the shares contained in the Basket representing the Certificates.<br />

Owning the Certificates is not the same as owning the Underlying. Accordingly, <strong>ch</strong>anges in the market<br />

value of the Underlying may not result in a comparable <strong>ch</strong>ange in the market value of the Certificates.<br />

This investment product includes investments in Emerging Markets. Emerging Markets are<br />

located in countries that possess one or more of the following <strong>ch</strong>aracteristics: A certain degree of political<br />

instability, relatively unpredictable financial markets and economic growth patterns, a financial market that<br />

is still at the development stage or a weak economy. Emerging markets investments usually result in<br />

Credit Suisse AG – <strong>Structured</strong> <strong>Products</strong> <strong><strong>Te</strong><strong>rms</strong>heet</strong>, <strong>Fixed</strong> <strong>Te</strong><strong>rms</strong> – February 24, 2010 – ISIN: CH 010 998 431 7 2

higher risks su<strong>ch</strong> as political risks, economical risks, credit risks, ex<strong>ch</strong>ange rate risks, market liquidity<br />

risks, legal risks, settlement risks, market risks, shareholder risk and creditor risk.<br />

Currency Risk: The investor may be exposed to currency risks, because (i) the underlying assets<br />

of the<br />

investment product are denominated in other currencies than the nominal of the investment<br />

product or (ii)<br />

the investment product is denominated in another currency than that of the country in whi<strong>ch</strong> the investor<br />

is resident. The value of the investment may therefore increase or decrease,<br />

based on currency<br />

fluctuations.<br />

Liquidity Risk: Credit Suisse AG, Zuri<strong>ch</strong>, will endeavor to provide a secondary market, but is under<br />

no<br />

legal obligation to do so. Upon investor demand Credit Suisse AG, Zuri<strong>ch</strong>, will provide<br />

bid/offer prices for<br />

the Certificates, depending on actual market conditions. There will be a price difference<br />

between bid and<br />

offer prices (spread).<br />

The Certificates will be listed on the SIX Swiss Ex<strong>ch</strong>ange AG. Other dealers are not likely to make a<br />

secondary market for the Certificates, the price at whi<strong>ch</strong> the investor may be able to<br />

trade the Certificates<br />

is likely to depend on the bid and offer prices.<br />

This risk disclosure<br />

notice cannot disclose all the risks. The Investor should, therefore,<br />

consult the listing prospectus with the full te<strong>rms</strong> and the “Special Risks in<br />

Securities Trading”<br />

risk disclosure bro<strong>ch</strong>ure (whi<strong>ch</strong> is available on the Swiss Bankers Association’s website:<br />

www.swissbanking.org/en/home/shop.htm or may be obtained from<br />

your relationship<br />

manager upon request).<br />

Important Notices By entering into a transaction with the Issuer or any of its affiliates, the investor acknowledges having<br />

read and understood the following te<strong>rms</strong>:<br />

The Issuer is acting solely as an arm’s length contractual counterparty and neither the Issuer nor any<br />

affiliate is acting as the financial adviser or fiduciary of the investor unless it has agreed to do so in<br />

writing.<br />

This document is issued solely for information purposes and for the recipient’s sole use. It does not<br />

constitute an offer or invitation to enter into any type of financial transaction. The Issuer<br />

has no obligation<br />

to issue this investment product. The information and views contained in this document<br />

are those of the<br />

Issuer and/or are derived from sources believed to be reliable. This document constitutes<br />

Marketing<br />

Material and is not the result of a financial analysis and, therefore, not subject to the “Directives on the<br />

Independence<br />

of Financial Resear<strong>ch</strong>” (Swiss Bankers Association). The content of this document,<br />

therefore, does not fulfill the legal requirements for the independence of financial<br />

analyses and there is<br />

no restriction on trading prior to publication of financial resear<strong>ch</strong>.<br />

This investment product does not constitute a participation in a collective investment<br />

s<strong>ch</strong>eme. Therefore,<br />

it is not supervised by the Swiss Financial Market Supervisory Authority (FINMA) and the investor does<br />

not benefit from the specific investor protection provided<br />

under the Federal Act on Collective Investment<br />

S<strong>ch</strong>emes. The prospectus requirements of Art. 652a / Art. 1156 of the Swiss Code<br />

of Obligations are<br />

not applicable.<br />

In connection with this transaction, the Issuer and/or its affiliates may pay<br />

to third parties, or<br />

receive from third parties as part of their compensation<br />

or otherwise, one-time or recurring<br />

remunerations (e.g. placement or holding fees). In receiving payments by third<br />

parties, the Issuer’s<br />

and/or its affiliates’ interests may be adverse to those of the holders of this investment<br />

product and su<strong>ch</strong><br />

payments could therefore adversely affect the investor’s return on the investment<br />

product. Further<br />

information may be requested from your bank / relationship manager.<br />

Where not explicitly otherwise stated, the Issuer has no duty to invest in the underlying assets and<br />

investors have no recourse to the underlying assets or to any payouts on the underlying<br />

assets. The price<br />

of the investment product will reflect the customary fees and costs <strong>ch</strong>arged on the level of the underlying<br />

assets (e.g. index calculation fees, management fees, administration fees). Certain<br />

built-in costs are<br />

likely to adversely affect the value of the investment product prior to maturity.<br />

This investment product is a complex structured financial instrument and involves a high degree of risk. It<br />

is intended only for investors who understand and are capable of assuming all risks involved. Before<br />

entering into any transaction, an investor should determine if this product suits<br />

his or her particular<br />

circumstances and should independently assess (with his or her professional advisers) the specific risks<br />

(maximum loss, currency risks, etc.) and the legal, regulatory, credit, tax and accounting consequences.<br />

The Issuer makes no representation as to the suitability or appropriateness of this investment product for<br />

any particular investor or as to the future performance of this investment product.<br />

This document does<br />

not replace a personal conversation with your relationship manager, whi<strong>ch</strong> is recommended<br />

by the bank<br />

before the investment decision. Please request your relationship manager to provide you with any<br />

available, additional information regarding this investment product su<strong>ch</strong> as the full te<strong>rms</strong> or the fact sheet.<br />

Historical data on the performance<br />

of the investment product or the Underlying assets is no indication of<br />

future performance. No representation or warranty is made that any indicative performance or return<br />

indicated will be a<strong>ch</strong>ieved in the future. Neither this document nor any copy thereof may be sent, taken<br />

into or distributed in the United States or to any U. S. person or in any other jurisdiction except under<br />

circumstances that will result in compliance with the applicable laws thereof. This document may not be<br />

reproduced either in whole or in part, without the written permission of the Issuer.<br />

1 The Final Fixing Date may be extended depending on the liquidity of the individual shares included in the Basket, at the absolute discretion of the<br />

Calculation Agent, in accordance with the listing prospectus of the Certificates.<br />

2 The Redemption Date is subject to the occurrence of any Market Disruption Event and/or Extraordinary Event and/or Modification of the Basket in<br />

accordance with the listing prospectus of the Certificates.<br />

Credit Suisse AG – <strong>Structured</strong> <strong>Products</strong> <strong><strong>Te</strong><strong>rms</strong>heet</strong>, <strong>Fixed</strong> <strong>Te</strong><strong>rms</strong> – February 24, 2010 – ISIN: CH 010 998 431 7 3

Composition<br />

of the Basket<br />

Company Bloomberg ISIN Ex<strong>ch</strong>ange Initial Initial Level<br />

Ticker Weight in USD*<br />

Shares per<br />

Certificate<br />

DENWAY MOTORS LTD 203 HK HK0203009524 Hong Kong SE 1/30 0.5586 5.967196<br />

GREAT WALL MOTOR CO. LTD –H- 2333 HK CNE100000338 Hon g Kong SE 1/30 1.4978 2.225543<br />

TSINGTAO BREWERY CO. LTD –H- 168 HK CNE1000004K1 Hon g Kong SE 1/30 4.7136 0.707179<br />

CHINA RESOURCES ENTERPRISES LTD 291 HK HK0291001490 Hon g Kong SE 1/30 3.4628 0.962609<br />

HENGAN INT. GROUP CO. LTD 1044 HK KYG4402L1510 Hon g Kong SE 1/30 6.7600 0.493097<br />

WANT WANT CHINA 151 HK KYG9431R1039 Hong Kong SE 1/30 0.6580 5.065885<br />

CHINA MENGNIU DAIRY CO LTD 2319 HK KYG210961051 Hon g Kong SE 1/30 3.0453 1.094571<br />

TINGYI (CAYMAN ISLANDS) HOLDING CORP. 322 HK KYG8878S1030 Hon g Kong SE 1/30 2.3011 1.448553<br />

CHINA FOODS LTD 506 HK BMG2154F1095 Hon g Kong SE 1/30 0.8593 3.879313<br />

CHINA YURUN FOOD GROUP LTD 1068 HK BMG211591018 Hon g Kong SE 1/30 2.8188 1.182543<br />

361 DEGREES INTERNATIONAL LTD 1361 HK KYG884931042 Hon g Kong SE 1/30 0.7972 4.181266<br />

ANTA SPORTS PRODUCTS LTD 2020 HK KYG040111059 Hong Kong SE 1/30 1.3692 2.43443<br />

BOSIDENG INTERNATIONAL HOLDINGS LTD 3998 HK KYG126521064 Hon g Kong SE 1/30 0.1999 16.677565<br />

LI NING CO. LTD 2331 HK KYG5496K1242 Hon g Kong SE 1/30 3.1917 1.044383<br />

PORTS DESIGN LTD 589 HK BMG718481242 Hong Kong SE 1/30 2.7183 1.226261<br />

XTEP INTERNATIONAL HOLDINGS LTD 1368 HK KYG982771092 Hon g Kong SE 1/30 0.6794 4.906303<br />

GOME ELECTRICAL APPL. HOLDING LTD 493 HK BMG3978C1249 Hon g Kong SE 1/30 0.3296 10.114127<br />

WUMART STORES INC. –H- 8277 HK CNE100000544 Hon g Kong SE 1/30 1.8471 1.804608<br />

LIANHUA SUPERMARMET HLDGS CO. LTD -H- 980 HK CNE1000003P2 Hon g Kong SE 1/30 2.9439 1.132276<br />

HENGDELI HOLDINGS LTD 3389 HK KYG450 481083 Hon g Kong SE 1/30 0.3755 8.878006<br />

NEW WORLD DEPT. STORE CHINA LTD 825 HK KYG6500710 98 Hon g Kong SE 1/30 0.8848 3.767157<br />

PARKSON RETAIL GROUP LTD 3368 HK KYG6937011 56 Hon g Kong SE 1/30 1.5179 2.196035<br />

AJISEN (CHINA) HOLDINGS LTD 538 HK KYG0192S10 93 Hon g Kong SE 1/30 0.9113 3.657771<br />

LITTLE SHEEP GROUP LTD 968 HK KYG550691011 Hong Kong SE 1/30 0.5077 6.565331<br />

CHINA DONGXIANG (GROUP) CO. LTD 3818 HK KYG2112Y1098 Hong Kong SE 1/30 0.6405 5.204453<br />

CHINA TRAVEL INT. INV. HONG KONG LTD 308 HK HK0308001558 Hong Kong SE 1/30 0.2610 12.769236<br />

CHINA NEPSTAR CHAIN DRUGSTORE LTD SP. ADR NPD US US16943C1099 NYSE 1/30 6.7748 0.492019<br />

WUXI LITTLE SWAN CO. LTD –B- 200418 CS CNE000000LG0 Shenzen SE 1/30 0.9576 3.480794<br />

KONKA GROUP CO. LTD -B- 200016 CS CNE000000347 Shenzen SE 1/30 0.4705 7.083912<br />

YANTAI CHANGYU PIONEER WINE CO. LTD –B- 200869 CH CNE000000T59 Shenzen SE 1/30 8.2066 0.406178<br />

* Initial USD / HKD FX-Rate = 7.7639<br />

Selling Restrictions<br />

U.S.A. and U.S. Persons<br />

The Certificates may not be offered, sold or delivered within the United States of America or to U.S. Persons at any time.<br />

United Kingdom<br />

Credit Suisse AG has represented and agreed that: (a) it has only communicated or caused to be communicated and will only communicate or cause to<br />

be communicated<br />

an invitation or inducement to engage in investment activity (within the meaning of Section 21 of the FSMA) received by it in<br />

connection with the issue or sale of the Certificates in circumstances in whi<strong>ch</strong> Section 21(1) of the FSMA does not apply to the Issuer; and (b) it has<br />

complied and will comply with all applicable provisions of the FSMA with respect to anything done by it in relation to the Certificates<br />

in, from or otherwise<br />

involving the United Kingdom.<br />

European Economic Area<br />

The Certificates may not be offered to the public in any jurisdiction in circumstances whi<strong>ch</strong> would require the Issuer of the Certificates to prepare or<br />

register any further prospectus or offering document relating to the Certificates in su<strong>ch</strong> jurisdiction, in particular where the Issuer would be required to do<br />

so under the EU Directive 2003/71 concerning prospectuses to be published when securities are offered to the public or admitted to trading in the<br />

European Economic Area (the Prospectus Directive) or any legislative, regulation or other measure implementing the Prospectus Directive.<br />

People’s Republic of China<br />

The Certificates may not be offered or sold in the People’s Republic<br />

of China.<br />

Hong Kong<br />

Unless permitted under the securities law of Hong Kong, no advertisement, invitation, or documents relating to the Certificates have been, or will be,<br />

issued or held in any person's possession for purpose of issue, other than with respect to Certificates intended to be disposed of to persons outside Hong<br />

Kong or to be disposed of in Hong Kong only to persons whose business involves the acquisition, disposal or holding of securities, whether as principal or<br />

agent.<br />

Credit Suisse AG – <strong>Structured</strong> <strong>Products</strong> <strong><strong>Te</strong><strong>rms</strong>heet</strong>, <strong>Fixed</strong> <strong>Te</strong><strong>rms</strong> – February 24, 2010 – ISIN: CH 010 998 431 7 4