PDF, 265 KB - Thrift Savings Plan

PDF, 265 KB - Thrift Savings Plan

PDF, 265 KB - Thrift Savings Plan

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

TSP-76 does not pertain to beneficiary participant (spouse) accounts since beneficiary<br />

participants are not eligible to request a TSP financial hardship in-service withdrawal.<br />

II. Changes to Form TSP-76<br />

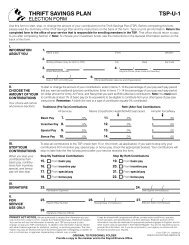

A. This form is designed to be read by an optical scanner. When printing or reproducing<br />

the form, make sure that copies are not resized or distorted. Participants<br />

completing the form should print legibly, inside the boxes, using black or dark<br />

blue ink and simple block letters.<br />

B. Section I (Information About You). This section should be completed in its entirety.<br />

However, if a participant neglects to check the box for “Civilian Account<br />

or “Uniformed Services Account,” but has only one TSP account, the financial<br />

hardship in-service withdrawal request will still be processed. If a participant has<br />

both a civilian and a uniformed services TSP account, and does not check the<br />

box for the account from which he/she is requesting the withdrawal, the request<br />

will not be processed. If a participant has both civilian and uniformed services<br />

accounts, and wishes to take a financial hardship in-service withdrawal from<br />

both accounts, the participant must submit a separate Form TSP-76 for each<br />

withdrawal request. A single form cannot be used for both requests.<br />

Note: The new Form TSP-76 does not have address fields as did earlier versions.<br />

Any correspondence related to the form will be sent to the participant’s TSP address<br />

of record.<br />

Also, unless the participant requests to have the financial hardship in-service withdrawal<br />

paid by direct deposit, a check will be sent to his/her address of record.<br />

Agencies/services should educate participants on procedures to update<br />

a TSP address of record before participants submit applications for<br />

financial hardship in-service withdrawals.<br />

C. Section II (Married FERS and Uniformed Services Participants). Unlike previous<br />

versions of the form, the new TSP-76 does not include check boxes for marital<br />

status. FERS and uniformed services participants who are married or legally separated<br />

must complete this section to provide information about a spouse. The<br />

spouse must sign the form in this section, and the signature must be notarized.<br />

To request an exception to the spousal requirements, participants must provide<br />

the spouse’s Social Security number, and submit a valid Form TSP-16, Exception to<br />

Spousal Requirements (Civilian) or a TSP-U-16 (uniformed services). If an exception<br />

has been granted within the past 90 days, participants must still provide the<br />

spouse’s Social Security number so that the TSP can verify the exception.<br />

D. Section III (Married CSRS Participants). This section is for CSRS participants who<br />

are married or legally separated to provide information about a spouse; the TSP<br />

must notify the participant’s spouse of his/her financial hardship withdrawal. No<br />

signature or notarization is required in this section.<br />

- 2 -