Annual Review 2008 - Hyposwiss Privatbank AG

Annual Review 2008 - Hyposwiss Privatbank AG

Annual Review 2008 - Hyposwiss Privatbank AG

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

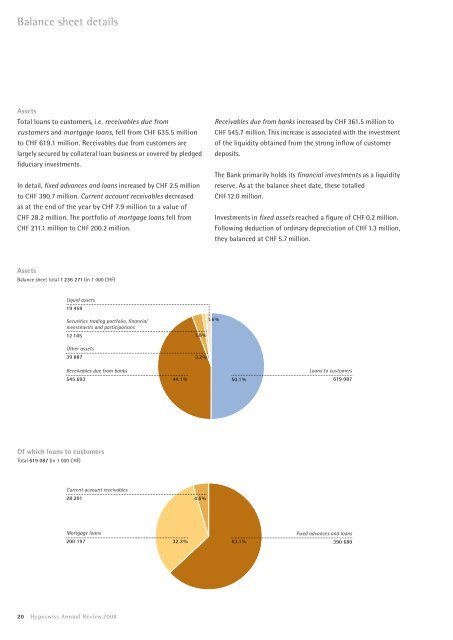

Balance sheet details<br />

Assets<br />

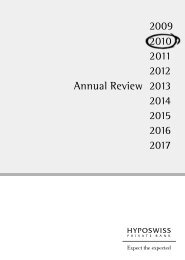

Total loans to customers, i.e. receivables due from<br />

customers and mortgage loans, fell from CHF 635.5 million<br />

to CHF 619.1 million. Receivables due from customers are<br />

largely secured by collateral loan business or covered by pledged<br />

fiduciary investments.<br />

In detail, fixed advances and loans increased by CHF 2.5 million<br />

to CHF 390.7 million. Current account receivables decreased<br />

as at the end of the year by CHF 7.9 million to a value of<br />

CHF 28.2 million. The portfolio of mortgage loans fell from<br />

CHF 211.1 million to CHF 200.2 million.<br />

Assets<br />

Balance sheet total 1 236 271 (in 1 000 CHF)<br />

Liquid assets<br />

19 459<br />

Receivables due from banks<br />

545 693<br />

Of which loans to customers<br />

Total 619 087 (in 1 000 CHF)<br />

Securities trading portfolio, financial<br />

investments and participations<br />

12 145<br />

Mortgage loans<br />

200 197 32.3 %<br />

20 <strong>Hyposwiss</strong> <strong>Annual</strong> <strong>Review</strong> <strong>2008</strong><br />

1.0 %<br />

Other assets<br />

39 887 3.2 %<br />

44.1 %<br />

Current account receivables<br />

28 201 4.6 %<br />

Receivables due from banks increased by CHF 361.5 million to<br />

CHF 545.7 million. This increase is associated with the investment<br />

of the liquidity obtained from the strong inflow of customer<br />

deposits.<br />

The Bank primarily holds its financial investments as a liquidity<br />

reserve. As at the balance sheet date, these totalled<br />

CHF 12.0 million.<br />

Investments in fixed assets reached a figure of CHF 0.2 million.<br />

Following deduction of ordinary depreciation of CHF 1.3 million,<br />

they balanced at CHF 5.7 million.<br />

1.6 %<br />

50.1 %<br />

63.1 %<br />

Loans to customers<br />

619 087<br />

Fixed advances and loans<br />

390 689