Basel III rules published - White & Case

Basel III rules published - White & Case

Basel III rules published - White & Case

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Basel</strong> <strong>III</strong> <strong>rules</strong> <strong>published</strong><br />

(iii) Countercyclical capital buffer<br />

This additional buffer of up to 2.5% of common equity Tier 1 or other fully loss-absorbing capital will have to be built up in periods of rapid<br />

aggregate credit growth which, in the opinion of national authorities, aggravates system-wide risk. The countercyclical capital buffer can<br />

be released during a downturn and, if in effect, would be an extension of the capital conservation buffer.<br />

(iv) Additional requirements for systemically important financial institutions<br />

Systemically important financial institutions could be subject to additional requirements reflecting the greater risks to financial stability that<br />

their failure would present. Work on this will continue in 2011 and areas under consideration may include capital surcharges and the<br />

introduction of contingent capital or “bail-in” debt.<br />

(v) Leverage ratio<br />

A non-risk-weighted minimum leverage ratio of Tier 1 capital to total exposures (including on-balance sheet and off-balance sheet items)<br />

will be introduced to address concerns about leverage in the financial system and back up the risk-based requirements outlined above,<br />

which may be affected by modelling errors. A minimum ratio of 3% will be tested.<br />

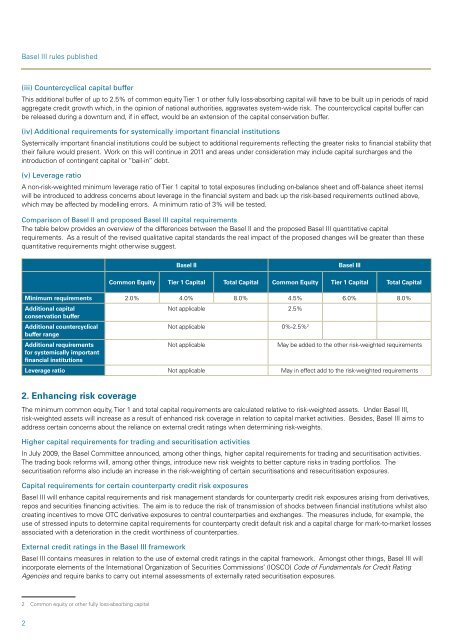

Comparison of <strong>Basel</strong> II and proposed <strong>Basel</strong> <strong>III</strong> capital requirements<br />

The table below provides an overview of the differences between the <strong>Basel</strong> II and the proposed <strong>Basel</strong> <strong>III</strong> quantitative capital<br />

requirements. As a result of the revised qualitative capital standards the real impact of the proposed changes will be greater than these<br />

quantitative requirements might otherwise suggest.<br />

2. Enhancing risk coverage<br />

The minimum common equity, Tier 1 and total capital requirements are calculated relative to risk-weighted assets. Under <strong>Basel</strong> <strong>III</strong>,<br />

risk-weighted assets will increase as a result of enhanced risk coverage in relation to capital market activities. Besides, <strong>Basel</strong> <strong>III</strong> aims to<br />

address certain concerns about the reliance on external credit ratings when determining risk-weights.<br />

Higher capital requirements for trading and securitisation activities<br />

In July 2009, the <strong>Basel</strong> Committee announced, among other things, higher capital requirements for trading and securitisation activities.<br />

The trading book reforms will, among other things, introduce new risk weights to better capture risks in trading portfolios. The<br />

securitisation reforms also include an increase in the risk-weighting of certain securitisations and resecuritisation exposures.<br />

Capital requirements for certain counterparty credit risk exposures<br />

<strong>Basel</strong> <strong>III</strong> will enhance capital requirements and risk management standards for counterparty credit risk exposures arising from derivatives,<br />

repos and securities financing activities. The aim is to reduce the risk of transmission of shocks between financial institutions whilst also<br />

creating incentives to move OTC derivative exposures to central counterparties and exchanges. The measures include, for example, the<br />

use of stressed inputs to determine capital requirements for counterparty credit default risk and a capital charge for mark-to-market losses<br />

associated with a deterioration in the credit worthiness of counterparties.<br />

External credit ratings in the <strong>Basel</strong> <strong>III</strong> framework<br />

<strong>Basel</strong> <strong>III</strong> contains measures in relation to the use of external credit ratings in the capital framework. Amongst other things, <strong>Basel</strong> <strong>III</strong> will<br />

incorporate elements of the International Organization of Securities Commissions’ (IOSCO) Code of Fundamentals for Credit Rating<br />

Agencies and require banks to carry out internal assessments of externally rated securitisation exposures.<br />

2<br />

<strong>Basel</strong> II <strong>Basel</strong> <strong>III</strong><br />

Common Equity Tier 1 Capital Total Capital Common Equity Tier 1 Capital Total Capital<br />

Minimum requirements 2.0% 4.0% 8.0% 4.5% 6.0% 8.0%<br />

Additional capital<br />

conservation buffer<br />

Not applicable 2.5%<br />

Additional countercyclical<br />

buffer range<br />

Not applicable 0%-2.5% 2<br />

Additional requirements<br />

for systemically important<br />

financial institutions<br />

Not applicable May be added to the other risk-weighted requirements<br />

Leverage ratio Not applicable May in effect add to the risk-weighted requirements<br />

2 Common equity or other fully loss-absorbing capital