Annual Report 2006 - Tamar European Industrial Fund

Annual Report 2006 - Tamar European Industrial Fund

Annual Report 2006 - Tamar European Industrial Fund

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Notes to the Accounts<br />

5. Taxation (continued)<br />

The group applicable income tax rate represents a blended rate across the tax jurisdictions in which the group<br />

operates.<br />

The Company is exempt from Guernsey taxation on dividend income derived outside Guernsey under the Income<br />

Tax (Exempt Bodies) (Guernsey) Ordinance, 1989. A fixed annual fee of £600 is payable to the States of Guernsey in<br />

respect of this exemption. No charge to Guernsey taxation will arise on capital gains.<br />

The Directors intend to conduct the Company’s affairs such that the management and control is not exercised in<br />

the United Kingdom and so that the Company does not carry on any trade in the United Kingdom. Accordingly, the<br />

Company will not be liable for United Kingdom taxation on its income or gains other than certain income deriving from a<br />

United Kingdom source. The Company’s subsidiaries are subject to local income tax on income arising on the property<br />

portfolio after deduction of its allowable debt financing costs and other allowable expenses, dependent upon the<br />

residence of each subsidiary.<br />

As noted in accounting policy note 1(e), deferred income tax is not recognised on temporary differences at the time of<br />

initial recognition arising from transactions treated as asset acquisitions. This policy is different from that used in the<br />

pro-forma financial information contained in the prospectus dated 8 September <strong>2006</strong> which recognised deferred tax on<br />

such differences on the balance sheet in order to calculate net assets per share.<br />

6. Dividends<br />

An interim dividend of 1.5 pence per share, totalling £2,100,000 will be paid on 25 April 2007 to shareholders on the<br />

register on 10 April 2007. Although this payment relates to the period ended 31 December <strong>2006</strong>, under International<br />

Financial <strong>Report</strong>ing Standards it will be accounted for in the year ending 31 December 2007, being the year during<br />

which it becomes unconditionally payable.<br />

7. Earnings per share<br />

The earnings per Ordinary Share are based on the net profit for the period of £4,897,000 and on 140,000,000 Ordinary<br />

Shares, being the weighted average number of shares in issue during the period.<br />

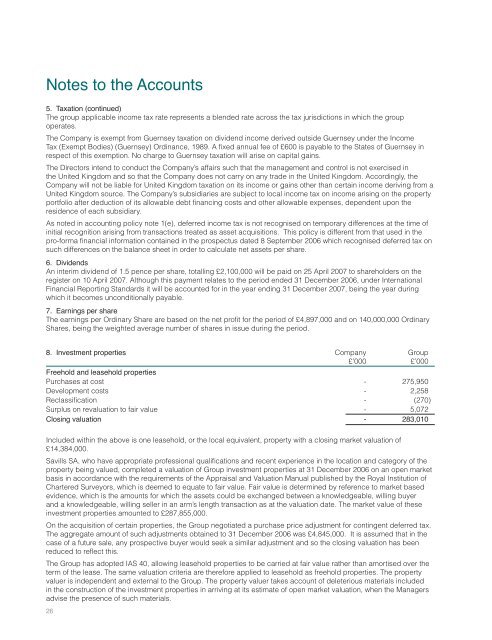

8. Investment properties Company Group<br />

£’000 £’000<br />

Freehold and leasehold properties<br />

Purchases at cost - 275,950<br />

Development costs - 2,258<br />

Reclassification - (270)<br />

Surplus on revaluation to fair value - 5,072<br />

Closing valuation - 283,010<br />

Included within the above is one leasehold, or the local equivalent, property with a closing market valuation of<br />

£14,384,000.<br />

Savills SA, who have appropriate professional qualifications and recent experience in the location and category of the<br />

property being valued, completed a valuation of Group investment properties at 31 December <strong>2006</strong> on an open market<br />

basis in accordance with the requirements of the Appraisal and Valuation Manual published by the Royal Institution of<br />

Chartered Surveyors, which is deemed to equate to fair value. Fair value is determined by reference to market based<br />

evidence, which is the amounts for which the assets could be exchanged between a knowledgeable, willing buyer<br />

and a knowledgeable, willing seller in an arm’s length transaction as at the valuation date. The market value of these<br />

investment properties amounted to £287,855,000.<br />

On the acquisition of certain properties, the Group negotiated a purchase price adjustment for contingent deferred tax.<br />

The aggregate amount of such adjustments obtained to 31 December <strong>2006</strong> was £4,845,000. It is assumed that in the<br />

case of a future sale, any prospective buyer would seek a similar adjustment and so the closing valuation has been<br />

reduced to reflect this.<br />

The Group has adopted IAS 40, allowing leasehold properties to be carried at fair value rather than amortised over the<br />

term of the lease. The same valuation criteria are therefore applied to leasehold as freehold properties. The property<br />

valuer is independent and external to the Group. The property valuer takes account of deleterious materials included<br />

in the construction of the investment properties in arriving at its estimate of open market valuation, when the Managers<br />

advise the presence of such materials.<br />

26<br />

Notes to the Accounts<br />

8. Investment properties (continued)<br />

The Group has entered into leases on its property portfolio as lessor (see note 19 for further information). No one<br />

property accounts for more than 15 per cent of the gross assets of the Group. The 10 largest properties per open<br />

market value are shown on page 10. The only leasehold property which the Group holds as lessee has more than 30<br />

years remaining on the lease term.<br />

There are no restrictions on the realisability of the Group’s investment properties or on the remittance of income or<br />

proceeds of disposal. However, the Group’s investments comprise <strong>European</strong> commercial property, which may be<br />

difficult to realise as described in Liquidity risk, note 17. The majority of leases are on a full repairing basis and as such<br />

the Group is not liable for costs in respect of repairs, maintenance or enhancements to its investment properties.<br />

9. Investment in subsidiary undertakings<br />

The Company owns 100 per cent of the issued ordinary share capital of KEIF Luxembourg Sarl and KEIF Luxembourg<br />

Scandi Sarl, both companies incorporated in Luxembourg whose principal business is that of intermediary holding<br />

companies.<br />

Significant subsidiaries of KEIF Luxembourg Sarl and KEIF Luxembourg Scandi Sarl include:<br />

Country of Incorporation Ownership<br />

KEIF Norge AS Norway 100<br />

KEIF Sweden AB Sweden 100<br />

Feldrien Investments BV The Netherlands 100<br />

10. Deferred tax assets and liabilities<br />

(a) Recognised deferred tax assets and liabilities<br />

Deferred tax assets and liabilities are attributable to the following items:<br />

Group Group<br />

Assets Liabilities<br />

£’000 £’000<br />

Investment property – on revaluation surplus - (2,583)<br />

Tax loss carry-forwards 159 -<br />

159 (2,583)<br />

(b) Unrecognised deferred tax assets and liabilities<br />

At 31 December <strong>2006</strong>, deferred tax liabilities of £29,948,000 on temporary differences at the time of initial recognition<br />

arising from transactions treated as asset acquisitions have not been recognised in accordance with IAS 12. Included<br />

within this is an amount of £2,135,000 which is potentially payable under the initial acquisition agreement in the event of<br />

certain subsidiaries being sold in the future.<br />

27