Annual Report 2006 - Tamar European Industrial Fund

Annual Report 2006 - Tamar European Industrial Fund

Annual Report 2006 - Tamar European Industrial Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

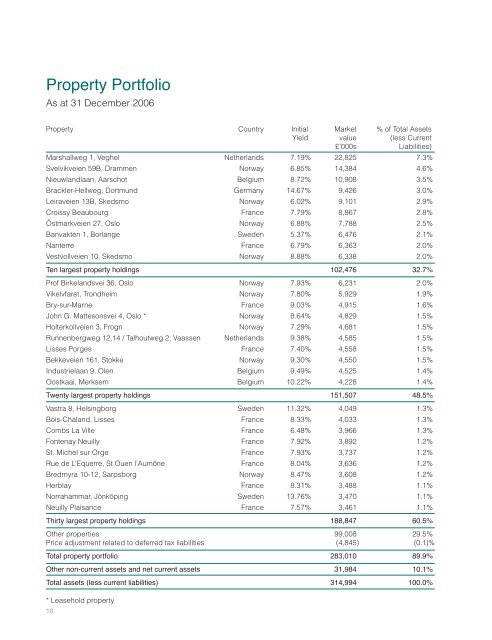

Property Portfolio<br />

As at 31 December <strong>2006</strong><br />

Property Country Initial Market % of Total Assets<br />

Yield value (less Current<br />

£’000s Liabilities)<br />

Marshallweg 1, Veghel Netherlands 7.19% 22,825 7.3%<br />

Svelvikveien 59B, Drammen Norway 6.85% 14,384 4.6%<br />

Nieuwlandlaan, Aarschot Belgium 8.72% 10,908 3.5%<br />

Brackler-Hellweg, Dortmund Germany 14.67% 9,426 3.0%<br />

Leiraveien 13B, Skedsmo Norway 6.02% 9,101 2.9%<br />

Croissy Beaubourg France 7.79% 8,867 2.8%<br />

Östmarkveien 27, Oslo Norway 6.88% 7,788 2.5%<br />

Banvakten 1, Borlange Sweden 5.37% 6,476 2.1%<br />

Nanterre France 6.79% 6,363 2.0%<br />

Vestvollveien 10, Skedsmo Norway 8.88% 6,338 2.0%<br />

Ten largest property holdings 102,476 32.7%<br />

Prof Birkelandsvei 36, Oslo Norway 7.93% 6,231 2.0%<br />

Vikelvfaret, Trondheim Norway 7.80% 5,929 1.9%<br />

Bry-sur-Marne France 9.03% 4,915 1.6%<br />

John G. Mattesonsvei 4, Oslo * Norway 8.64% 4,829 1.5%<br />

Holterkollveien 3, Frogn Norway 7.29% 4,681 1.5%<br />

Runnenbergweg 12,14 / Talhoutweg 2, Vaassen Netherlands 9.38% 4,585 1.5%<br />

Lisses Porges France 7.40% 4,558 1.5%<br />

Bekkeveien 161, Stokke Norway 9.30% 4,550 1.5%<br />

Industrielaan 9, Olen Belgium 9.49% 4,525 1.4%<br />

Oostkaai, Merksem Belgium 10.22% 4,228 1.4%<br />

Twenty largest property holdings 151,507 48.5%<br />

Vastra 8, Helsingborg Sweden 11.32% 4,049 1.3%<br />

Bois-Chaland, Lisses France 8.33% 4,033 1.3%<br />

Combs La Ville France 6.48% 3,966 1.3%<br />

Fontenay Neuilly France 7.92% 3,892 1.2%<br />

St. Michel sur Orge France 7.93% 3,737 1.2%<br />

Rue de L’Equerre, St Ouen l’Aumône France 8.04% 3,636 1.2%<br />

Bredmyra 10-12, Sarpsborg Norway 8.47% 3,608 1.2%<br />

Herblay France 8.31% 3,488 1.1%<br />

Norrahammar, Jönköping Sweden 13.76% 3,470 1.1%<br />

Neuilly Plaisance France 7.57% 3,461 1.1%<br />

Thirty largest property holdings 188,847 60.5%<br />

Other properties 99,008 29.5%<br />

Price adjustment related to deferred tax liabilities (4,845) (0.1)%<br />

Total property portfolio 283,010 89.9%<br />

Other non-current assets and net current assets 31,984 10.1%<br />

Total assets (less current liabilities) 314,994 100.0%<br />

* Leasehold property<br />

10<br />

Board of Directors<br />

Giles Weaver (Chairman)<br />

Aged 60, is currently Chairman of Charter Pan-<strong>European</strong> Trust PLC and Helical Bar PLC. He is a nonexecutive<br />

director of Aberdeen Asset Management PLC, Gartmore SICAV, Anglo & Overseas PLC, Investec<br />

High Income Trust PLC, Isotron PLC, James Finlay Ltd., ISIS Property Trust 2 Ltd. and Henderson Far East<br />

Income Trust plc. He was formerly chairman of Murray Johnstone Ltd. and a director of Ivory & Sime PLC.<br />

Jonathan Gamble<br />

Aged 39, is currently a director of Asset Risk Consultants Limited, which provides investment consulting<br />

services. He has worked professionally in London, Australia and Singapore as a dealer for Morgan Stanley<br />

and Société Générale before moving to Guernsey. He serves on the boards of a number of companies.<br />

Helen Green<br />

Aged 44, is a chartered accountant and a partner in Saffery Champness, a UK top 20 firm of chartered<br />

accountants. She joined the firm in 1984, qualified as a chartered accountant in 1988 and became a<br />

partner in the London office in 1997. Since November 2000 she has been based in the Guernsey office<br />

where she is a client liaison director responsible for trust and company administration. Helen serves on the<br />

boards of a number of companies in various jurisdictions.<br />

John Kennedy<br />

Aged 55, has over 30 years’ experience in the property market. He is Chairman of Kenmore and has<br />

worked professionally in Scotland, Australia and the West Indies. He qualified as a chartered surveyor in<br />

1973, formed Kenmore Investments Limited 20 years ago and ran his own building company before turning<br />

exclusively to commercial property trading, development and investment. He is a prior winner of Property<br />

Week Personality of the Year and Entrepreneur of the Year.<br />

Christopher Spencer<br />

Aged 56. Christopher Spencer qualified as a chartered accountant in London in 1975. Following two years<br />

post qualification work in Bermuda he moved to Guernsey. Mr Spencer, who specialised in audit and<br />

fiduciary work, was managing partner/director of the Guernsey Practice of Pannell Kerr Forster (Guernsey)<br />

Limited and Praxis Fiduciaries Limited from 1990 until his retirement in May 2000. Mr Spencer is a nonexecutive<br />

Director of a number of hedge funds, funds of hedge funds and other investment and insurance<br />

companies.<br />

11