Section 02 Loans & Expenses Unit 04 Cars - Practical Money Skills

Section 02 Loans & Expenses Unit 04 Cars - Practical Money Skills

Section 02 Loans & Expenses Unit 04 Cars - Practical Money Skills

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

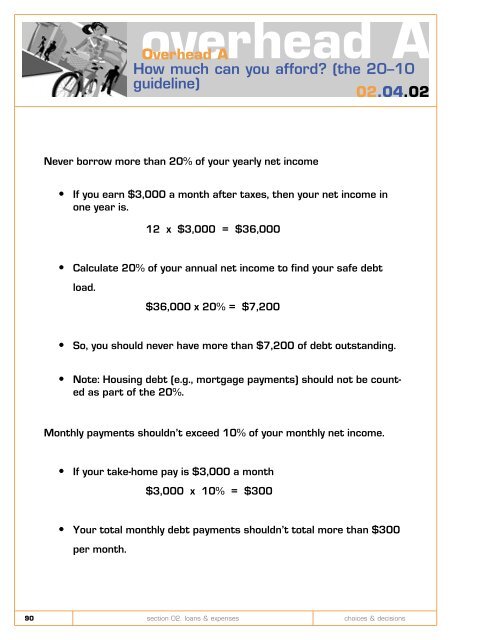

Never borrow more than 20% of your yearly net income<br />

If you earn $3,000 a month after taxes, then your net income in<br />

one year is.<br />

12 x $3,000 = $36,000<br />

Calculate 20% of your annual net income to find your safe debt<br />

load.<br />

$36,000 x 20% = $7,200<br />

So, you should never have more than $7,200 of debt outstanding.<br />

Note: Housing debt (e.g., mortgage payments) should not be counted<br />

as part of the 20%.<br />

Monthly payments shouldn’t exceed 10% of your monthly net income.<br />

If your take-home pay is $3,000 a month<br />

$3,000 x 10% = $300<br />

Your total monthly debt payments shouldn’t total more than $300<br />

per month.<br />

overhead A<br />

Overhead A<br />

How much can you afford? (the 20–10<br />

guideline)<br />

<strong>02</strong>.<strong>04</strong>.<strong>02</strong><br />

90 section <strong>02</strong>. loans & expenses<br />

choices & decisions