Terma A/S Annual Report 2010/11

Terma A/S Annual Report 2010/11

Terma A/S Annual Report 2010/11

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

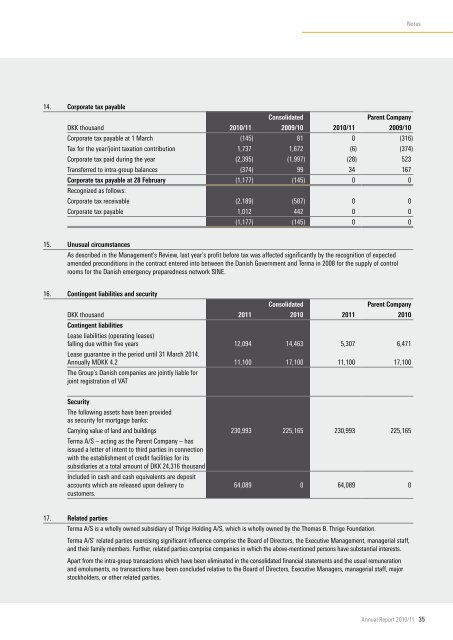

14. Corporate tax payable<br />

Consolidated Parent Company<br />

DKK thousand <strong>2010</strong>/<strong>11</strong> 2009/10 <strong>2010</strong>/<strong>11</strong> 2009/10<br />

Corporate tax payable at 1 March (145) 81 0 (316)<br />

Tax for the year/joint taxation contribution 1,737 1,672 (6) (374)<br />

Corporate tax paid during the year (2,395) (1,997) (28) 523<br />

Transferred to intra-group balances (374) 99 34 167<br />

Corporate tax payable at 28 February (1,177) (145) 0 0<br />

Recognized as follows:<br />

Corporate tax receivable (2,189) (587) 0 0<br />

Corporate tax payable 1,012 442 0 0<br />

(1,177) (145) 0 0<br />

15. Unusual circumstances<br />

As described in the Management’s Review, last year’s profit before tax was affected significantly by the recognition of expected<br />

amended preconditions in the contract entered into between the Danish Government and <strong>Terma</strong> in 2008 for the supply of control<br />

rooms for the Danish emergency preparedness network SINE.<br />

16. Contingent liabilities and security<br />

Consolidated Parent Company<br />

DKK thousand<br />

Contingent liabilities<br />

Lease liabilities (operating leases)<br />

20<strong>11</strong> <strong>2010</strong> 20<strong>11</strong> <strong>2010</strong><br />

falling due within five years<br />

Lease guarantee in the period until 31 March 2014.<br />

12,094 14,463 5,307 6,471<br />

<strong>Annual</strong>ly MDKK 4.2<br />

The Group’s Danish companies are jointly liable for<br />

joint registration of VAT<br />

<strong>11</strong>,100 17,100 <strong>11</strong>,100 17,100<br />

Security<br />

The following assets have been provided<br />

as security for mortgage banks:<br />

Carrying value of land and buildings<br />

<strong>Terma</strong> A/S – acting as the Parent Company – has<br />

issued a letter of intent to third parties in connection<br />

with the establishment of credit facilities for its<br />

subsidiaries at a total amount of DKK 24,316 thousand<br />

Included in cash and cash equivalents are deposit<br />

230,993 225,165 230,993 225,165<br />

accounts which are released upon delivery to<br />

customers.<br />

64,089 0 64,089 0<br />

17. Related parties<br />

<strong>Terma</strong> A/S is a wholly owned subsidiary of Thrige Holding A/S, which is wholly owned by the Thomas B. Thrige Foundation.<br />

<strong>Terma</strong> A/S’ related parties exercising significant influence comprise the Board of Directors, the Executive Management, managerial staff,<br />

and their family members. Further, related parties comprise companies in which the above-mentioned persons have substantial interests.<br />

Apart from the intra-group transactions which have been eliminated in the consolidated financial statements and the usual remuneration<br />

and emoluments, no transactions have been concluded relative to the Board of Directors, Executive Managers, managerial staff, major<br />

stockholders, or other related parties.<br />

Notes<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2010</strong>/<strong>11</strong> 35