Jordan Microfinance Institutions' Financial Viability to ... - EuroJournals

Jordan Microfinance Institutions' Financial Viability to ... - EuroJournals

Jordan Microfinance Institutions' Financial Viability to ... - EuroJournals

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

127 European Journal of Economics, Finance And Administrative Sciences - Issue 42 (2011)<br />

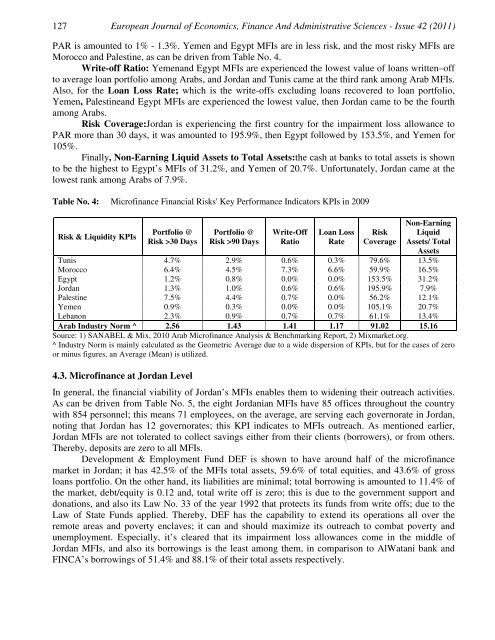

PAR is amounted <strong>to</strong> 1% - 1.3%. Yemen and Egypt MFIs are in less risk, and the most risky MFIs are<br />

Morocco and Palestine, as can be driven from Table No. 4.<br />

Write-off Ratio: Yemenand Egypt MFIs are experienced the lowest value of loans written–off<br />

<strong>to</strong> average loan portfolio among Arabs, and <strong>Jordan</strong> and Tunis came at the third rank among Arab MFIs.<br />

Also, for the Loan Loss Rate; which is the write-offs excluding loans recovered <strong>to</strong> loan portfolio,<br />

Yemen, Palestineand Egypt MFIs are experienced the lowest value, then <strong>Jordan</strong> came <strong>to</strong> be the fourth<br />

among Arabs.<br />

Risk Coverage:<strong>Jordan</strong> is experiencing the first country for the impairment loss allowance <strong>to</strong><br />

PAR more than 30 days, it was amounted <strong>to</strong> 195.9%, then Egypt followed by 153.5%, and Yemen for<br />

105%.<br />

Finally, Non-Earning Liquid Assets <strong>to</strong> Total Assets:the cash at banks <strong>to</strong> <strong>to</strong>tal assets is shown<br />

<strong>to</strong> be the highest <strong>to</strong> Egypt’s MFIs of 31.2%, and Yemen of 20.7%. Unfortunately, <strong>Jordan</strong> came at the<br />

lowest rank among Arabs of 7.9%.<br />

Table No. 4: <strong>Microfinance</strong> <strong>Financial</strong> Risks' Key Performance Indica<strong>to</strong>rs KPIs in 2009<br />

Risk & Liquidity KPIs<br />

Portfolio @<br />

Risk >30 Days<br />

Portfolio @<br />

Risk >90 Days<br />

Write-Off<br />

Ratio<br />

Loan Loss<br />

Rate<br />

Risk<br />

Coverage<br />

Non-Earning<br />

Liquid<br />

Assets/ Total<br />

Assets<br />

Tunis 4.7% 2.9% 0.6% 0.3% 79.6% 13.5%<br />

Morocco 6.4% 4.5% 7.3% 6.6% 59.9% 16.5%<br />

Egypt 1.2% 0.8% 0.0% 0.0% 153.5% 31.2%<br />

<strong>Jordan</strong> 1.3% 1.0% 0.6% 0.6% 195.9% 7.9%<br />

Palestine 7.5% 4.4% 0.7% 0.0% 56.2% 12.1%<br />

Yemen 0.9% 0.3% 0.0% 0.0% 105.1% 20.7%<br />

Lebanon 2.3% 0.9% 0.7% 0.7% 61.1% 13.4%<br />

Arab Industry Norm ^ 2.56 1.43 1.41 1.17 91.02 15.16<br />

Source: 1) SANABEL & Mix, 2010 Arab <strong>Microfinance</strong> Analysis & Benchmarking Report, 2) Mixmarket.org.<br />

^ Industry Norm is mainly calculated as the Geometric Average due <strong>to</strong> a wide dispersion of KPIs, but for the cases of zero<br />

or minus figures, an Average (Mean) is utilized.<br />

4.3. <strong>Microfinance</strong> at <strong>Jordan</strong> Level<br />

In general, the financial viability of <strong>Jordan</strong>’s MFIs enables them <strong>to</strong> widening their outreach activities.<br />

As can be driven from Table No. 5, the eight <strong>Jordan</strong>ian MFIs have 85 offices throughout the country<br />

with 854 personnel; this means 71 employees, on the average, are serving each governorate in <strong>Jordan</strong>,<br />

noting that <strong>Jordan</strong> has 12 governorates; this KPI indicates <strong>to</strong> MFIs outreach. As mentioned earlier,<br />

<strong>Jordan</strong> MFIs are not <strong>to</strong>lerated <strong>to</strong> collect savings either from their clients (borrowers), or from others.<br />

Thereby, deposits are zero <strong>to</strong> all MFIs.<br />

Development & Employment Fund DEF is shown <strong>to</strong> have around half of the microfinance<br />

market in <strong>Jordan</strong>; it has 42.5% of the MFIs <strong>to</strong>tal assets, 59.6% of <strong>to</strong>tal equities, and 43.6% of gross<br />

loans portfolio. On the other hand, its liabilities are minimal; <strong>to</strong>tal borrowing is amounted <strong>to</strong> 11.4% of<br />

the market, debt/equity is 0.12 and, <strong>to</strong>tal write off is zero; this is due <strong>to</strong> the government support and<br />

donations, and also its Law No. 33 of the year 1992 that protects its funds from write offs; due <strong>to</strong> the<br />

Law of State Funds applied. Thereby, DEF has the capability <strong>to</strong> extend its operations all over the<br />

remote areas and poverty enclaves; it can and should maximize its outreach <strong>to</strong> combat poverty and<br />

unemployment. Especially, it’s cleared that its impairment loss allowances come in the middle of<br />

<strong>Jordan</strong> MFIs, and also its borrowings is the least among them, in comparison <strong>to</strong> AlWatani bank and<br />

FINCA’s borrowings of 51.4% and 88.1% of their <strong>to</strong>tal assets respectively.