Geschäftsbericht 2008 - NordFinanz Bank AG

Geschäftsbericht 2008 - NordFinanz Bank AG

Geschäftsbericht 2008 - NordFinanz Bank AG

Sie wollen auch ein ePaper? Erhöhen Sie die Reichweite Ihrer Titel.

YUMPU macht aus Druck-PDFs automatisch weboptimierte ePaper, die Google liebt.

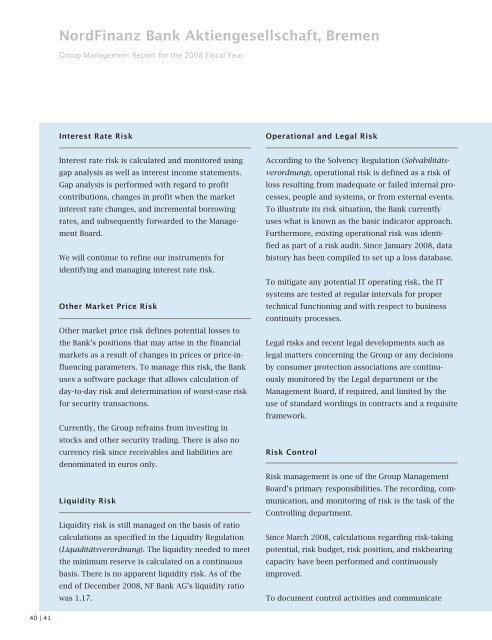

40 | 41<br />

<strong>NordFinanz</strong> <strong>Bank</strong> Aktiengesellschaft, Bremen<br />

Group Management Report for the <strong>2008</strong> Fiscal Year<br />

Interest Rate Risk<br />

Interest rate risk is calculated and monitored using<br />

gap analysis as well as interest income statements.<br />

Gap analysis is performed with regard to profit<br />

contributions, changes in profit when the market<br />

interest rate changes, and incremental borrowing<br />

rates, and subsequently forwarded to the Management<br />

Board.<br />

We will continue to refine our instruments for<br />

identifying and managing interest rate risk.<br />

Other Market Price Risk<br />

Other market price risk defines potential losses to<br />

the <strong>Bank</strong>’s positions that may arise in the financial<br />

markets as a result of changes in prices or price-influencing<br />

parameters. To manage this risk, the <strong>Bank</strong><br />

uses a software package that allows calculation of<br />

day-to-day risk and determination of worst-case risk<br />

for security transactions.<br />

Currently, the Group refrains from investing in<br />

stocks and other security trading. There is also no<br />

currency risk since receivables and liabilities are<br />

denominated in euros only.<br />

Liquidity Risk<br />

Liquidity risk is still managed on the basis of ratio<br />

calculations as specified in the Liquidity Regulation<br />

(Liquiditätsverordnung). The liquidity needed to meet<br />

the minimum reserve is calculated on a continuous<br />

basis. There is no apparent liquidity risk. As of the<br />

end of December <strong>2008</strong>, NF <strong>Bank</strong> <strong>AG</strong>’s liquidity ratio<br />

was 1.17.<br />

Operational and Legal Risk<br />

According to the Solvency Regulation (Solvabilitäts-<br />

verordnung), operational risk is defined as a risk of<br />

loss resulting from inadequate or failed internal processes,<br />

people and systems, or from external events.<br />

To illustrate its risk situation, the <strong>Bank</strong> currently<br />

uses what is known as the basic indicator approach.<br />

Furthermore, existing operational risk was identified<br />

as part of a risk audit. Since January <strong>2008</strong>, data<br />

history has been compiled to set up a loss database.<br />

To mitigate any potential IT operating risk, the IT<br />

systems are tested at regular intervals for proper<br />

technical functioning and with respect to business<br />

continuity processes.<br />

Legal risks and recent legal developments such as<br />

legal matters concerning the Group or any decisions<br />

by consumer protection associations are continuously<br />

monitored by the Legal department or the<br />

Management Board, if required, and limited by the<br />

use of standard wordings in contracts and a requisite<br />

framework.<br />

Risk Control<br />

Risk management is one of the Group Management<br />

Board’s primary responsibilities. The recording, communication,<br />

and monitoring of risk is the task of the<br />

Controlling department.<br />

Since March <strong>2008</strong>, calculations regarding risk-taking<br />

potential, risk budget, risk position, and riskbearing<br />

capacity have been performed and continuously<br />

improved.<br />

To document control activities and communicate