- Page 1 and 2:

Statistisk Arbog årbog 1996 Statis

- Page 3 and 4:

Forord Statistisk årbog arbog 1996

- Page 5 and 6:

Indholdsfortegnelse Indhoidsfortegn

- Page 7 and 8:

Signatur- »'» Gentagelse forklari

- Page 9 and 10:

Statistisk Arbog årbog i 100 it.

- Page 11 and 12:

Bilande og kolonier Statistisk drbo

- Page 13 and 14:

. . 5 304 Befolkningen Befolkningsu

- Page 15 and 16:

Retsvæsen Retsvmsen Domfmldelser D

- Page 17 and 18:

Socialv2esen Socialvæsen Social si

- Page 19 and 20:

Arbejdet Arbejdsstyrke og ledighed

- Page 21 and 22:

Erhvervene Handvmrk Hândværk og i

- Page 23 and 24:

Handelen med udlandet Samfundsokono

- Page 25 and 26:

Emnegrupper (Liste over emnegrupper

- Page 27 and 28:

Areal, klima og miljo miljø Afsnit

- Page 29 and 30:

Tabel I. Danmarks areal, folketal o

- Page 31 and 32:

Tabel 3. Areal og folketal for land

- Page 33 and 34:

kortenes I alt - - Tabel 6. Antal o

- Page 35 and 36:

Tabel 10. Meteorologiske forhold. N

- Page 37 and 38:

Tabel 12. I Luftens indhold of af s

- Page 39 and 40:

. . 109 Tabel 14. Luftens indhold a

- Page 41 and 42:

perioden Tabel 18. IB. Transportsek

- Page 43 and 44:

I Tabel 24. Genanvendelse af papir

- Page 45 and 46:

øvrigt Tabel 28. Olie- Olie— og

- Page 47 and 48:

Tabel 3 I. Den offentlige sektors m

- Page 49 and 50:

Tabel 33. Den offentlige sektors mi

- Page 51 and 52:

- - 12,0 0,7 - - - - - - - - - - -

- Page 53 and 54:

Bolig Et eller flere værelser vrel

- Page 55 and 56:

Oplysninger om anden offentliggorel

- Page 57 and 58:

i i Tabel 42. Folketal i I byer og

- Page 59 and 60:

Tabel 44. Folketal efter køn kon o

- Page 61 and 62:

Tabel 46. Folketal I i byer med ove

- Page 63 and 64:

Tabel 46. Folketal i byer med over

- Page 65 and 66:

Tabel 46. Folketal i byer med over

- Page 67 and 68:

Tabel 47. (s. 66-68) Folketal og ar

- Page 69 and 70:

I alt Tabel 48. Amternes folketal e

- Page 71 and 72:

I alt alt Tabel 5 S I I. . Udenland

- Page 73 and 74:

Tabel SS. Gennemsnitlig alder ved f

- Page 75 and 76:

12. Kvinder Under 1 är lår 10 1-4

- Page 77 and 78:

Tabel 59. Døde Dade pr. 1.000 pers

- Page 79 and 80:

. . . . . . - Manufacture . - . . .

- Page 81 and 82:

I I Tabel 66. Ind- og udvandring ef

- Page 83 and 84:

Tabel 70. Vielser, fødte fodte og

- Page 85 and 86:

alt I Tabel 74. Husstande efter ant

- Page 87 and 88:

Tabel 78. Befolkningsprognose på p

- Page 89 and 90:

Tabel 82. Befolkningens boligforsyn

- Page 91 and 92:

Tabel 84. Boliger regionalt fordelt

- Page 93 and 94:

Tabel 88. Husstande fordelt efter b

- Page 95 and 96:

pct. Tabel 90. Folketingsvalgene. O

- Page 97 and 98:

Tabel 92. Folketingsvalget )s. (s.

- Page 99 and 100:

Tabel 93. Folketingsvalg. Stemme- o

- Page 101 and 102:

I Tabel 95. Amtskommunale valg. Ove

- Page 103 and 104:

Tabel 97. Amtskommunale valg. Stemm

- Page 105 and 106:

I Tabel 100. Kommunale valg 16. nov

- Page 107 and 108:

I Tabel 102. I Valg til Europa-parl

- Page 109 and 110:

Uddannelse og kultur Afsnittet inde

- Page 111 and 112:

Uddannelsesniveauer Forskoleniveau

- Page 113 and 114:

Tabel 10S. 105. Befolkningens uddan

- Page 115 and 116:

Tabel 107. Almene uddannelser Gener

- Page 117 and 118:

Tabel 108. Erhvervsuddannelser og v

- Page 119 and 120:

Tabel 108. Erhvervsuddannelser og v

- Page 121 and 122:

Tabel 108. Erhvervsuddannelser og v

- Page 123 and 124:

Tabel III. Ill. Is. (s. 123-124) 12

- Page 125 and 126:

Tabel 112. Uddannelse og beskaeftig

- Page 127 and 128:

Tabel 1 II I 3. Arbejdsmarkedsuddan

- Page 129 and 130:

I Tabel 1116. 16. Statens Uddannels

- Page 131 and 132:

Tabel I 20. Trossamfund med vielses

- Page 133 and 134:

alt Tabel 123. Biblioteker Librarie

- Page 135 and 136:

I alt Tabel 127. Dagblade Daily new

- Page 137 and 138:

Tabel I 30. Gennemsnitlig daglig se

- Page 139 and 140:

I i Tabel 134. Biografer Cinemas 19

- Page 141 and 142:

Tabel I 38. Besøg Besog på pi mus

- Page 143 and 144:

Tabel 140. Rigsarkivet og landsarki

- Page 145 and 146:

41 i Tabel 144. Offentlige nettodri

- Page 147 and 148:

Gennem udtræk udtrk fra fra Rigspo

- Page 149 and 150:

Hæfte Hmfte Kriminalforsorgen Opkl

- Page 151 and 152:

I Tabel 147. Sociale udgifter Socia

- Page 153 and 154:

Tabel 149. Modtagere af indkomsters

- Page 155 and 156:

Tabel 1 I 53. S3. Dagforanstaltning

- Page 157 and 158:

Tabel I 157. Modtagere of af hjmlp

- Page 159 and 160:

I i Tabel 161. Modtagere of at soci

- Page 161 and 162:

alt i . . Tabel I 164. Afgørelser

- Page 163 and 164:

I alt alt Tabel 168. Sygehuse Hospi

- Page 165 and 166:

5 Tabel Ill. Tabel 171. Laboratorie

- Page 167 and 168:

Tabel 175. Apoteker Pharmacies 1985

- Page 169 and 170:

Tabel 179. Anmeldte og opkiarede op

- Page 171 and 172:

I Tabel ISO. 180. Tiltalefrafald ai

- Page 173 and 174:

I I Tabel 183. Domfældelser Domfae

- Page 175 and 176:

Jyderup, Tabel I 187. Kriminalforso

- Page 177 and 178:

Tabel 190. Strafferetsplee. Straffe

- Page 179 and 180:

Arbejdsmarked Afsnittet omfatter op

- Page 181 and 182:

Arbejdsstilling Arbejdsstyrke Arbej

- Page 183 and 184:

Tabel 194. Befolkningen efter branc

- Page 185 and 186:

Tabel 198. I Befolkningen efter kan

- Page 187 and 188:

Tabel 200. Beskzeftigede Beskæftig

- Page 189 and 190:

Transportvirksomhed, postog telekom

- Page 191 and 192:

Tabel 203. Lonmodtagerorganisatione

- Page 193 and 194:

Tabel 205. Det samlede personale i

- Page 195 and 196:

I Tabel 207. Ledighedsberorte efter

- Page 197 and 198:

Tabel 2210. Den gennemsnitlige arbe

- Page 199 and 200:

Tabel 212. 2. Ledighedsberørte Led

- Page 201 and 202:

Dunmark. Tabel 2214. Statsanerkendt

- Page 203 and 204:

Tabel 2217. I Arbejdsulykker fordel

- Page 205 and 206:

Indkomst, forbrug og priser Afsnitt

- Page 207 and 208:

Definitioner og ordforklaringer Arb

- Page 209 and 210:

Tabel 219. Samlet familieindkomst T

- Page 211 and 212:

Tabel 222. Familieindkomstmassen ef

- Page 213 and 214:

Tabel 224. Personindkomst for lønm

- Page 215 and 216:

Tabel 227. Personindkomstmassen eft

- Page 217 and 218:

Tabel 229. (s. Is. 217-222) Gennems

- Page 219 and 220:

Tabel 229. Gennemsnitlig personindk

- Page 221 and 222:

Tabel 229. Gennemsnitlig personindk

- Page 223 and 224:

Tabel 230. Fortjeneste opdelt efter

- Page 225 and 226:

I Tabel 232. Fortjeneste opdelt eft

- Page 227 and 228:

Tabel 234. Lonstatistik for kommuna

- Page 229 and 230:

Tabel 236. Indkomster og forbrug mv

- Page 231 and 232:

Tabel 238. Indkomster og forbrug mv

- Page 233 and 234:

Tabel 240. Forbrugets fordeling eft

- Page 235 and 236:

Tabel 242. Forbrugets fordeling eft

- Page 237 and 238:

Tabel 243. Forbrugets fordeling eft

- Page 239 and 240:

Tabel 245. Forbrugets fordeling i p

- Page 241 and 242:

. . . . . Luxury, . . . Danish Tabe

- Page 243 and 244:

Indkomst, Tabel 250. Nettoprisindek

- Page 245 and 246:

Tabel 2S2. 252. Engros- og ravarepr

- Page 247 and 248:

Tabel 253. Forbrugerprisindeks. Ars

- Page 249 and 250:

Landbrug Afsnittet daekker dækker

- Page 251 and 252:

Hugsten Fiskeri Opgorelsen Opgørel

- Page 253 and 254:

Tabel 256. Landbrug. Hovedtal Agric

- Page 255 and 256:

Tabel 259. Landbrugsbedrifter efter

- Page 257 and 258:

Tabel 263. Det dyrkede areals anven

- Page 259 and 260:

86 Tabel 267. Landbrugets husdyrhol

- Page 261 and 262:

Tabel 269. Landbrugets husdyrhold e

- Page 263 and 264:

Tabel 271. Produktion og eksport of

- Page 265 and 266:

Tabel 274. Mængde- Mmngde- og pris

- Page 267 and 268:

Tabel 276. Landbrugets bruttofaktor

- Page 269 and 270:

Tabel 278. Landbrugets renteudgifte

- Page 271 and 272:

Tabel 281. Skovarealet procentvis f

- Page 273 and 274:

Tabel 285. Saltvandsfiskeriet Salt-

- Page 275 and 276:

Industri og energi Afsnittet giver

- Page 277 and 278:

Faglig enhed En gruppe af al et fir

- Page 279 and 280:

Tabel 288. Industriens oms2etning o

- Page 281 and 282:

saltiage, Tabel 290. Industriens sa

- Page 283 and 284:

Tabel 290. Industriens salg af vare

- Page 285 and 286:

Tabel 290. Industriens salg af vare

- Page 287 and 288:

alt Tabel 292. Regnskabsstatistik f

- Page 289 and 290:

firmaer Tabel 294. Industriens ener

- Page 291 and 292:

. . - Bitumen, Naturgas Brænde Brm

- Page 293 and 294:

Bygge- og anlægsvirksomhed anlmgsv

- Page 295 and 296:

Ejendoms I henhold til loy lov nr.

- Page 297 and 298:

Tabel 298. Bygningsbestand Building

- Page 299 and 300:

Tabel 300. Boligbyggeri Residential

- Page 301 and 302:

Tabel 304. Beskæftigede Beskmftige

- Page 303 and 304:

Tabel 307. Vurderingsresultater ved

- Page 305 and 306:

I Tabel 309. Ejendomssalg Sales of

- Page 307 and 308:

Tabel 3 I II. I. Gennemsnitlig arli

- Page 309 and 310:

Faerdselsuheldsstatistikken Færdse

- Page 311 and 312:

Tabel 3312. I jernbaner Jernbaner R

- Page 313 and 314:

Tabel 3314. Skibsfart på pa størr

- Page 315 and 316:

Tabel 3 I 17. Regnskabsstatistik fo

- Page 317 and 318:

Tabel 321. Bestand of af motorkoret

- Page 319 and 320:

Tabel 324. Biltrafik på pa hovedve

- Page 321 and 322:

Tabel 328. Godstransporten fra og t

- Page 323 and 324:

I Tabel 3332. 32. Dræbte Drzebte o

- Page 325 and 326:

Tabel 335. Flybestand Civil aircraf

- Page 327 and 328:

Tabel 3339. 39. Forudarrangerede fe

- Page 329 and 330:

Tabel 342. Overnatninger på pa cam

- Page 331 and 332:

Beskæftigelsen Beskftigelsen omfat

- Page 333 and 334:

Fuldtidsbeskæftigede beskmftigede

- Page 335 and 336:

Tabel 346. Arbejdssteder, beskmftig

- Page 337 and 338:

Tabel 346. Arbejdssteder, beskmftig

- Page 339 and 340:

Tabel 347. Arbejdssteder efter stor

- Page 341 and 342:

Tabel 347. Arbejdssteder efter stor

- Page 343 and 344:

ATP-ordningen Tabel 349. Arbejdsste

- Page 345 and 346:

Tabel 3S2. Momsregistrerede virksom

- Page 347 and 348:

Tabel 354. Momsregistrerede virksom

- Page 349 and 350:

Tabel 3355. SS. Momsregistrerede vi

- Page 351 and 352:

Tabel 3356. S6. Regnskabsopgorelse

- Page 353 and 354:

Udenrigshandel Afsnittet omfatter o

- Page 355 and 356:

Generaihandel Generalhandel Opgøre

- Page 357 and 358:

Tabel 3359. S9. Indforsel fordelt e

- Page 359 and 360:

- - - . - 4930 - - - - - Tabel 360.

- Page 361 and 362:

. - - - - - - - - - Tabel 360. Indf

- Page 363 and 364:

- - - Tabel 360. Indforsel og udfor

- Page 365 and 366:

Tabel 361. (s. 364-367) Udenrigshan

- Page 367 and 368:

Tabel 361. Udenrigshandelen fordelt

- Page 369 and 370:

(efter produktionsgrene) Ste Storbr

- Page 371 and 372:

(efter produktionsgrene) Afrika Asi

- Page 373 and 374:

Penge- og kapitalmarked Afsnittet o

- Page 375 and 376:

Obligationer Efter Værdipapircentr

- Page 377 and 378:

Tabel 367. Danmarks Nationalbanks r

- Page 379 and 380:

Tabel 369. Pengeinstitutternes inde

- Page 381 and 382: Tabel 372. Realkreditinstitutterne

- Page 383 and 384: alt Tabel 375. Livsforsikringsselsk

- Page 385 and 386: Tabel 377. Skadesforsikring efter b

- Page 387 and 388: Tabel 380. Pensionskasser Pension f

- Page 389 and 390: alt Tabel 383. Aktleindeks Aktieind

- Page 391 and 392: Tabel 388. Tvangsauktioner, konkurs

- Page 393 and 394: Europmiske Europæiske Omfatter på

- Page 395 and 396: Tabel 390. udviklingen Udviklingen

- Page 397 and 398: En del offentlige institutioner er

- Page 399 and 400: Renteudgifter my. mv. Omfatter såv

- Page 401 and 402: Tabel 392. Den samlede offentlige s

- Page 403 and 404: Tabel 39S. 395. Den offentlige sekt

- Page 405 and 406: I I Tabel 397. Den offentlige sekto

- Page 407 and 408: Tabel 399. Statens finanser. Sammen

- Page 409 and 410: Tabel 400. Statens finanser. Specif

- Page 411 and 412: Tabel 400. Statens finanser. Specif

- Page 413 and 414: Tabel 400. Statens finanser. Specif

- Page 415 and 416: Tabel 402. Subsidier Subsidies 1991

- Page 417 and 418: i Tabel 405. Indkomstoverforsler ti

- Page 419 and 420: Tabel 408. Kommunernes og amternes

- Page 421 and 422: Tabel 410. Likvide beholdninger og

- Page 423 and 424: I alf I alt Tabel 411. I . (s. 422-

- Page 425 and 426: I alt Tabel 411. I . Is (s. 422427)

- Page 427 and 428: Tabel 411. I . Is. (s. 422-427) Kom

- Page 429 and 430: i Tabel 415. S. De enkelte sociale

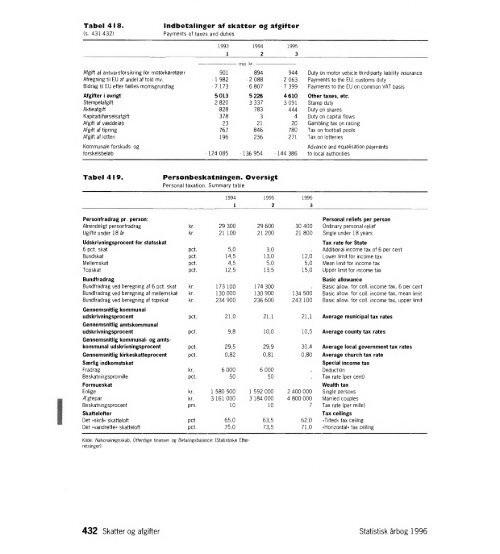

- Page 431: - 1 - 1 Tabel 418. Indbetalinger af

- Page 435 and 436: Tabel 421. Den kommunale beskatning

- Page 437 and 438: Tabel 421. Den kommunale beskatning

- Page 439 and 440: Tabel 421. Den kommunale beskatning

- Page 441 and 442: Tabel 424. Bistand til udviklingsla

- Page 443 and 444: j Tabel 425. Bilateral bistand ford

- Page 445 and 446: affinaderi og pa på en made, måde

- Page 447 and 448: Lønninger Lonninger og arbejdsgive

- Page 449 and 450: hvusehvld Tabel 427. Bruttofaktorin

- Page 451 and 452: Tabel 430. Bruttoinvesteringer Gros

- Page 453 and 454: Tabel 433. Lon Løn og arbejdsgiver

- Page 455 and 456: Tabel 435. Input-output multiplikat

- Page 457 and 458: Tabel 437. Erhvervenes beskmftigels

- Page 459 and 460: Tabel 438. Areal, folkemængde folk

- Page 461 and 462: Tabel 442. Fertilitets- og reproduk

- Page 463 and 464: de 1991/92 20 63 Tabel 446. Lagting

- Page 465 and 466: - . . Number - . . Slaughterings: T

- Page 467 and 468: Tabel 4S 455. S. Færøernes Fmroer

- Page 469 and 470: Tabel 459. Færøske Fmroske pengei

- Page 471 and 472: Tabel 462. Den færøske f2eroske l

- Page 473 and 474: Tabel 464. Meteorologiske forhold p

- Page 475 and 476: I Tabel 467. Gronlands Grønlands b

- Page 477 and 478: I Tabel 470. Dodsårsager Dodsirsag

- Page 479 and 480: I I Tabel 473. valg Valg til Grønl

- Page 481 and 482: I Tabel 477. Medicinalpersonale og

- Page 483 and 484:

Tabel 480. Bødeafg. Bodeafg. og do

- Page 485 and 486:

Tabel 484. Registrerede skibe i Gro

- Page 487 and 488:

Tabel 488. Grønlands Gronlands var

- Page 489 and 490:

Tabel 491. Gronlandske Grønlandske

- Page 491 and 492:

Tabel 493. Realokonomisk fordeling

- Page 493 and 494:

Tabel 495. skattepligtig Skatteplig

- Page 495 and 496:

Internationale oversigter Afsnittet

- Page 497 and 498:

Andre: International Road Federatio

- Page 499 and 500:

92377 Tabel 499. Areal og folkemæn

- Page 501 and 502:

Tabel 499. Areal og folkemængde fo

- Page 503 and 504:

. . . 100 . . . 90 . - 86 286 Tabel

- Page 505 and 506:

- - - Tabel 502. (s. Is. 504-509) F

- Page 507 and 508:

Tabel 502. (S. (s. 504-509) Folkem

- Page 509 and 510:

Haiphong Yemen - Adeleide Tonga Sal

- Page 511 and 512:

Tabel 504. Folkemængde, Folkemmngd

- Page 513 and 514:

- - . - - - . . . . -. Tabel Tabe1

- Page 515 and 516:

I -. Tabel 508. Udgifter til social

- Page 517 and 518:

I alt alt alt Tabel 5 1 I 1. I. Bes

- Page 519 and 520:

de Tabel S 51 I 3. Arbejdsloshed Ar

- Page 521 and 522:

Tabel S 51 I S. 5. Skibsbestand Sto

- Page 523 and 524:

. . 47 Tabel 516. 5 1 Verdensartikl

- Page 525 and 526:

Tabel 516. (s. 522-526) Verdensarti

- Page 527 and 528:

Tabel S 5 I 7. Produktion af of ele

- Page 529 and 530:

Tabel 519. Eksport fordelt på pa v

- Page 531 and 532:

Import til Spanien Forbunds U.K. Pa

- Page 533 and 534:

Tabel 522. Bruttonationalprodukt Br

- Page 535 and 536:

Tabel 524. Erhvervsfordeling af of

- Page 537:

Tabel S26. 526. Effektiv rente af o

- Page 540 and 541:

DB93 kraft alt Erhvervsgrupperingsb

- Page 542 and 543:

Erhvervsgrupperings-bilag (NACE/DB9

- Page 544 and 545:

saltlage, Varenomenklatur-bilag (SI

- Page 546 and 547:

Varenomenklatur (SITC) SITC sITc nr

- Page 548 and 549:

Varenomenklatur (SITC) SITC nr. Com

- Page 550 and 551:

Omsmtningsforhold Omsætningsforhol

- Page 552 and 553:

-, by height 88 Consensual unions 8

- Page 554 and 555:

Lakes 33 Land -use -, 32 Land value

- Page 556 and 557:

Television broadcasting 138, 137 -,

- Page 558 and 559:

-,- dodshyppighed dødshyppighed 76

- Page 560 and 561:

-, momsregistrerede enheder, branch

- Page 562 and 563:

-, varegrupper, værdi vrdi 357-358

- Page 564 and 565:

P Papir 43 Papir- og grafisk indust

- Page 566 and 567:

I Tandlæger Tandlger 164 -, Færø

- Page 568 and 569:

Danmarks Statistiks publikationer T

- Page 570 and 571:

Brevkort Kommentarer/forslag til St