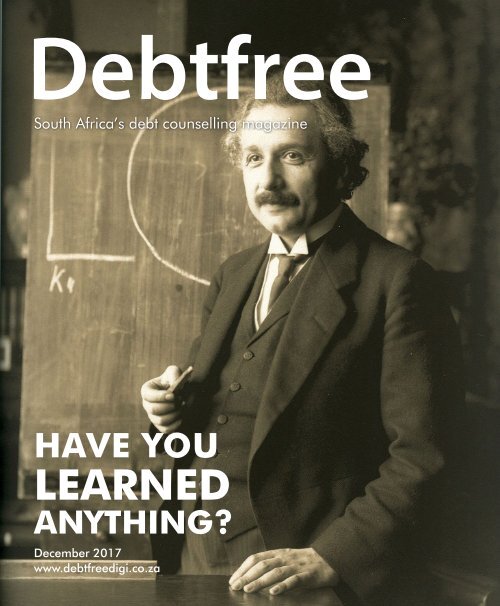

Debtfree Magazine December 2017

SA's Free Debt Counselling & Debt Review Industry Magazine: December 2017 issue. We ask if consumers under debt review are learning or will they repeat past mistakes? We also look back at 2017 and review the NCR Conference and interview a Debt Counsellor...and more

SA's Free Debt Counselling & Debt Review Industry Magazine: December 2017 issue. We ask if consumers under debt review are learning or will they repeat past mistakes? We also look back at 2017 and review the NCR Conference and interview a Debt Counsellor...and more

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

South Africa’s debt counselling magazine<br />

HAVE YOU<br />

LEARNED<br />

ANYTHING?<br />

<strong>December</strong> <strong>2017</strong><br />

www.debtfreedigi.co.za

Picture the scene; you are<br />

enjoying a pleasant evening with<br />

your friend when they start to tell<br />

you about how business is tough<br />

and their debts are mounting.<br />

They feel stressed because their<br />

clients don’t have money to spend<br />

and are buying less. You stand<br />

there knowing that debt review<br />

could be the solution they are<br />

looking for but you feel weird to<br />

talk about finances.<br />

After all, as a nation we don’t like to<br />

reveal that we are having troubles<br />

ourselves. We love to project an<br />

appearance of well being. That’s<br />

half the reason we all get into<br />

financial trouble: Spending money<br />

to look good and have the latest<br />

gadgets we don’t really need in<br />

order to impress other people.<br />

So, you ask yourself: has debt<br />

review made my life better? Have I<br />

benefitted from the process? Should<br />

I share my dirty little debt review<br />

secret with others?<br />

Think back to when you first started<br />

the debt review process? How<br />

stressed were you? How bad was it?<br />

Think how far you have come in just<br />

a short time. The process works and<br />

can help consumers become better<br />

equipped to handle their finances.<br />

Or does it?<br />

We discuss the aspect of consumer<br />

education while under debt review<br />

in this issue. We ask if your Debt<br />

Counsellor has been training you,<br />

equipping you for future financial<br />

success. Have you actually learned<br />

anything while under debt review?<br />

We also talk about <strong>2017</strong> as we<br />

look back at some stand out events<br />

locally and internationally. We<br />

can’t cover them all but we have<br />

chosen some events which have<br />

shaped the country and industry this<br />

year - Including the NCR’s annual<br />

conference, which we review.

The truth is that debt review has<br />

helped more people this year than<br />

ever before. The number of new<br />

applications remains high and<br />

more and more consumers are able<br />

to get their clearance certificates<br />

saying they no longer have debt or<br />

are over indebted. Debt review is<br />

helping hundreds of thousands of<br />

consumers to get out of debt or at<br />

least get a handle on their debt.<br />

FROM<br />

THE<br />

E<br />

D<br />

IT<br />

O<br />

RSDESK<br />

With over 1 200 000 views during<br />

<strong>2017</strong> of our various issues of this<br />

magazine, we are happy that we are<br />

helping spread the news about debt<br />

review and how it can help people.<br />

If you are under debt review then<br />

why not recommend it to others?<br />

You probably don’t realize it but your<br />

friends are taking strain. They need<br />

help and you may hold the key to<br />

them taking back control. Don’t get<br />

swept up in the <strong>December</strong> holidays<br />

gift madness and ignore the big<br />

picture. Why not share the love this<br />

year and help others get debt free?

SURE<br />

Credit ProteCtion – debt review<br />

Applied to go under debt review?<br />

Restructuring your monthly expenses?<br />

why not insure all your accounts on the one Credit Protection?<br />

benefits offered<br />

• death – we settle the account<br />

• temporary disability – we pay your<br />

installment for 12 months<br />

• Permanent disability – we settle<br />

the account<br />

• Critical illness – we pay your<br />

installment for 3 months<br />

• retrenchment – we pay your<br />

installment for 12 months<br />

At a rate of R2.95 per R1000<br />

unsecured/short-term credit<br />

and R2.00 per R1000 on<br />

Mortgages, you can now<br />

insure your debt for less<br />

without compromising on the<br />

best benefits available.<br />

For further information please<br />

speak to your Broker alternatively<br />

contact your regional ONE office.<br />

0861 266 562<br />

admin.debt@one.za.com<br />

TERMS & cONDITIONS APPLY<br />

ONE Insurance Underwriting Managers (PTY) LTD Reg No. 1996/008987/07<br />

Authorised Financial Services Provider FSP8783 VAT No. 4370160501<br />

Underwritten by:<br />

A Member of A member of the Group

HAVE YOU LEARNED<br />

ANYTHING?<br />

C<br />

O<br />

NTENTS<br />

REVIEW OF<br />

<strong>2017</strong><br />

DEBT<br />

COUNSELLOR<br />

PROFILE<br />

SERVICE<br />

DIRECTORY<br />

DISCLAIMER<br />

<strong>Debtfree</strong> <strong>Magazine</strong> considers its sources reliable<br />

and verifies as much information as possible.<br />

However, reporting inaccuracies can occur,<br />

consequently readers using this information do<br />

so at their own risk. <strong>Debtfree</strong> <strong>Magazine</strong> makes<br />

content available with the understanding that<br />

the publisher is not rendering legal services or<br />

financial advice. Although persons and companies<br />

mentioned herein are believed to be reputable,<br />

neither <strong>Debtfree</strong> <strong>Magazine</strong> nor any of its<br />

employees, sales executives or contributors accept<br />

any responsibility whatsoever for their activities.<br />

<strong>Debtfree</strong> <strong>Magazine</strong> contains material supplied to<br />

us by advertisers which does not necessarily reflect<br />

the views and opinions of the <strong>Debtfree</strong> <strong>Magazine</strong><br />

team. No person, organization or party can copy<br />

or re-produce the content on this site and/or<br />

magazine or any part of this publication without<br />

a written consent from the editors’ panel and the<br />

author of the content, as applicable. <strong>Debtfree</strong><br />

<strong>Magazine</strong>, authors and contributors reserve their<br />

rights with regards to copyright of their work.

HAVE YOU<br />

LEARNED<br />

ANYTHING?<br />

For most consumers, the debt review process is a<br />

temporary solution to a temporary financially<br />

stressed situation. Many people enter the<br />

process and after as little as 3 years are able<br />

to leave the process as their situation changes<br />

for the better (or they fall into old habits and<br />

miss a payment, ending the protection of the<br />

debt review process). The question is: do they<br />

leave the process better equipped to handle<br />

their finances in the future?

“ ”<br />

Do zey leave ze process better<br />

equipped to handle zeir finances<br />

in ze future?

HAVE YOU LEARNED ANYTHING?<br />

Getting help from a NCR registered, professional Debt Counsellor is vital<br />

in solving complicated debt problems. Most consumers who enter debt<br />

review will tell you that getting the protection of the National Credit Act is<br />

a great relief, after months of having been harassed by credit providers<br />

and collections agents.<br />

The name “Debt Counsellor” however implies that you will be counseled<br />

on your debt habits. Much like any sort of addiction, (over)spending on<br />

credit can be a very hard habit to break. The switch to a cash lifestyle<br />

is beneficial but can be very tough. Debt review is not easy and your<br />

Debt Counsellor can either help you through the transition or leave you to<br />

muddle through on your own. How they treat you can make or break your<br />

chances of success.

consumer their court order.<br />

HAVE YOU LEARNED ANYTHING?<br />

FOCUS ON THE<br />

COURT ORDER<br />

Most Debt Counsellors tend to focus on helping consumers get a debt<br />

restructuring court order.<br />

This has become the case, due to the unnecessary push back by credit<br />

providers desperate for every last drop of cash they can get every month<br />

from consumers to appease their accountants. This greedy focus on bean<br />

counting has drastically hurt the process. Other forms of collection have<br />

much greater scope for allowances and leeway than the debt review<br />

departments of most major credit providers have been given. This has<br />

lead to some ridiculous situations where credit providers even complain<br />

when they are paid too much each month.<br />

Early abuse by credit providers of NCA Section 86(10) where they tried<br />

to remove consumers from debt review also pushed the need to focus on<br />

initial dealings with consumers rather than ongoing support and training.<br />

These habits forced on Debt Counsellors years ago still have affects today<br />

which lead to almost all the Debt Counsellors energy going into getting a

HAVE YOU LEARNED ANYTHING?<br />

REDUCED AFTER<br />

CARE FEES LEAD<br />

TO REDUCED<br />

AFTER CARE<br />

The small amount of money allocated each month toward after<br />

care fees and the 24 month drop in after care fees allocated to Debt<br />

Counsellors has reduced after care service to consumers.<br />

This shouldn’t come as a surprise. People tend to focus on profitable aspects<br />

of any job. The NCR have recently been thinking of further reducing after<br />

care income to Debt Counsellors which will naturally lead to even less<br />

after care for consumers. This does not bode well for the process.

HAVE YOU LEARNED ANYTHING?<br />

LACK OF<br />

CONSUMER<br />

EDUCATION<br />

Ironically, one of the things the NCR would like to see is, consumers<br />

being educated about debt and how credit works.<br />

Interestingly however, the concept of consumer education or even<br />

counselling does not exist in the section of the NCA about debt review.<br />

Debt Counsellors have no legal obligation to educate their clients. Rather<br />

the Act only discusses the role of the National Credit Regulator in educating<br />

consumers. This falls squarely on their shoulders.<br />

The NCR recently announced that over the last 10 years they have managed<br />

to engage and do some form of education with 400 000 consumers out of<br />

the 9 million plus consumers who are many months behind on repaying<br />

their credit and out of the over 20 million credit users. Perhaps the name<br />

Debt Counsellor is a slightly misleading one and implies something that<br />

the professional is not obliged to do.

HAVE YOU LEARNED ANYTHING?<br />

LACK OF<br />

EDUCATION<br />

LEADS TO<br />

BAD BEHAVIOR<br />

Debt Counsellors soon find that, due to focusing on other matters, not<br />

educating their clients and not communicating with them regularly<br />

leads to consumers falling out the process and failing to benefit from<br />

debt review.

This means that the Debt Counsellor does a lot of work and sees little<br />

financial return. For example, lack of communication can lead to a lack<br />

of trust in the process. Then even one misleading collections call from<br />

a commission hungry collections agent, from a recognized creditor, can<br />

lead to consumers not paying their debt review payment. They then have<br />

to be removed from the process.<br />

These consumers are then left feeling cheated by a poorly executed debt<br />

review process which they themselves have broken. They are not likely to<br />

recommend it to others and may begin to complain about their former<br />

Debt Counsellor. This is why the best debt counselling firms take time to<br />

help their clients grow and learn during the process.

HAVE YOU LEARNED ANYTHING?<br />

ARE YOU<br />

GETTING<br />

SMARTER?<br />

So, ask yourself if you have used the time that you have been under<br />

debt review to (1) ignore your debt and let someone else take over your<br />

financial future or (2) have you been getting smarter and learning<br />

about financial matters?<br />

Reportedly, SA has one of the lowest financial education standards in the<br />

entire world. Financial literacy in SA is basically pathetic and as products<br />

of this, sadly inferior, financial education most of us suffer as a result. Why<br />

make bad decisions, we sign anything that gets put in front of us and we<br />

don’t ask enough questions or demand a high level of service.

If you ended up in debt review because you never knew that interest was an<br />

amount extra you would have to pay over what you borrowed from the bank<br />

then you are not alone. Millions of South Africans don’t understand interest.<br />

The question is: do you want to leave debt review after a number of years<br />

and stumble back into the same old bad habits and traps that tripped you<br />

up before? If so, you will soon need debt review once again.

Sign Up Now To Use DReX<br />

http://www.consumerfriend.co.za/drex-registration/

HAVE YOU LEARNED ANYTHING?<br />

LEARN TO<br />

BUDGET!<br />

Most consumers are handed a vague, somewhat generic budget at<br />

the start of their debt review by their Debt Counsellor, or worse, by<br />

one of their assistants.<br />

The figures may not make much sense or even be that realistic (unless they<br />

really know their stuff). These figures may not be discussed with you at all.<br />

If this is the last time you did or saw a budget then you need to learn to<br />

figure out how to do a budget. Can you ask your Debt Counsellor to train<br />

you?

HAVE YOU LEARNED ANYTHING?<br />

LEARN TO<br />

HOLD A FAMILY<br />

FINANCIAL<br />

DISCUSSION!<br />

When beginning debt review many couples are horrified at the debt<br />

their partners have accumulated without them realizing it. It can<br />

place a huge strain on a relationship and is one of the causes that<br />

many people never get help in the first place.<br />

Have you learned to open up and be honest about spending, debt and<br />

discussing your financial goals and desires?

A lack of communication about financial matters will quickly send you back<br />

into serious problems the moment you leave debt review. Are you holding<br />

a fun family discussion about your finances once a month - chatting about<br />

the budget that you should be doing?<br />

If not, then now is the time to try it out. Keep it simple. Serve some nice<br />

snacks (maybe a fun meal like hotdogs or burgers) and keep things happy<br />

and light. Maybe do it on the day after you get your PDA statement each<br />

month.<br />

Doing this regularly gives everyone the chance to contribute, communicate<br />

and work together as a team against your debt (not blame each other). It<br />

creates a safe space to discuss debt and your financial goals.

STUCK<br />

USING<br />

ANCIENT<br />

TECHNOLOGY?<br />

Contact Maximus on 011 451 0041

HAVE YOU LEARNED ANYTHING?<br />

LEARN TO<br />

SAVE!<br />

You may think that being under debt review means you will not be<br />

saving anything. This is completely wrong.<br />

Your Debt Counsellor will have added savings towards annual expenses<br />

into your monthly budget. They know you have to save towards these<br />

expenses. It is important that you learn to stick to these savings amounts<br />

or your debt review will fail within the first year.<br />

The savings amounts may be small but you need to make sure they are<br />

regularly set aside. These savings may cover things like: servicing your<br />

car, new tyres for the car, paying your annual TV license, school clothes<br />

and books in January. Learn to save and not just spend every last penny<br />

because it is available.

HAVE YOU LEARNED ANYTHING?<br />

LEARN TO GET<br />

EVERYTHING<br />

IN WRITING!<br />

If you ever had one of those collections calls where they told you that<br />

everything would be fine as long as you just paid x… only to have<br />

another person call you the next week with a different story, you will<br />

have learnt the need to put things down in writing.<br />

You may have wished you did it in the past but have you learnt to do so<br />

now? Do you have all the info about your Debt Counsellor, the debt review<br />

arrangement and your monthly obligations in writing?

If not, it is time you sorted that out. From now on you should get everything<br />

in writing. Get into the habit of sending people emails and keeping records<br />

and backups confirming telephone conversations. It is amazing how a<br />

credit provider can lose a recording of a conversation they really don’t<br />

want to find.

We offer back office services to Debt Counsellors including:<br />

17.1, 17.2, Capturing CoBs, sending your proposals and<br />

helping handle court or NCT applications.<br />

Our full call centre and payment division can help you<br />

reduce your overheads and cut staff expenses.<br />

Cell: 083 232 1908 | Tel: 086 722 7405 | Email: elmarie@dcoperations.co.za<br />

www.dcoperations.co.za

HAVE YOU LEARNED ANYTHING?<br />

LEARN TO<br />

GET ORGANIZED!<br />

It is tempting to just let your Debt Counsellor keep records of everything<br />

and to expect them to always be available to you. But what if they<br />

are not?<br />

What if the Debt Counsellor dies or goes out of business? What if their<br />

office burns down or their computers get fried?<br />

It is a good habit to become a good record keeper. Not only should you<br />

keep copies of everything you should learn to categorize and store this<br />

information in a way that makes it easier to find years later. Don’t delay in<br />

doing this. Start today.

HAVE YOU LEARNED ANYTHING?<br />

LEARN TO READ<br />

EVERYTHING!<br />

When you owed money and the bank threatened to take away your<br />

assets you may have been horrified that you signed in your original<br />

contract that you would pay for them to sue you.<br />

There were probably a dozen other clauses that you never even noticed as<br />

you just signed the papers set before you. In debt review it is important to<br />

get away from this bad habit. If your Debt Counsellor or your attorney asked<br />

you to sign an affidavit for court, make sure you have read it thoroughly<br />

and understand it. Get into the habit of asking for clarification. There is no<br />

benefit to signing anything people shove in front of your nose.

Jothie Bechoo<br />

ATTORNEYS & DEBT<br />

COUNSELLOR<br />

Taking care of all your legal needs<br />

Specialising in Debt Review Applications<br />

for Debt Counsellors/Attorneys<br />

Our offices personally attends to debt<br />

review applications in the following<br />

courts:<br />

Durban<br />

Pinetown<br />

Chatsworth<br />

Verulam<br />

Ntuzuma<br />

We aim to have debt review orders<br />

granted at the first court appearance<br />

We avoid unnecessary adjournments<br />

Our fees are reasonable<br />

We have six years’ experience in Debt<br />

Review applications<br />

We assist clients in Rescission of Debt<br />

Review orders & administration orders<br />

Suite 7 Gladstone Court<br />

103 Smiso Nkwanyana [Goble] Road<br />

Morningside<br />

Durban<br />

Tel: 031 303 1004<br />

Mobile: 076 835 2810<br />

Email: jbechoo@jb-attorneys.co.za<br />

Also specializes in:<br />

Deceased Estates, Wills, Divorces, Ante Nuptial Contracts, Correspondent Attorney, Rescissions

HAVE YOU LEARNED ANYTHING?<br />

DEBT REVIEW<br />

IS A TIME FOR<br />

PERSONAL<br />

GROWTH<br />

If you go through the entire debt review process and come out with<br />

the same level of financial awareness and habits you had before hand<br />

then you will soon be back calling on your past Debt Counsellor for<br />

help again.

Make sure you apply your mind to growing as a consumer during the debt<br />

review process. Take advantage of the time to learn good financial habits<br />

that will help you for years to come no matter what your financial situation.<br />

If you have a good Debt Counsellor they will help you even though they<br />

do not have to and it makes no financial sense to do so. Be sure to ask a<br />

potential debt counselling firm if they offer any sort of after care and what<br />

that will be.<br />

If your Debt Counsellor has not been helping you recently then why not<br />

make contact and ask for some counselling? Maybe they can review your<br />

budget with you (the one you have worked on yourself and think is how<br />

best to spend your available funds).<br />

Read a book, read <strong>Debtfree</strong> <strong>Magazine</strong>, watch the news, follow a blog<br />

or twitter accounts about finances. Benefit from the advice of others and<br />

learn to separate the good advice from the silly. Educating yourself is key.<br />

Learn now, so that you never have to repeat the mistakes of the past.

ROUNDUP

THE YEAR HAS COME AND GONE.<br />

<strong>2017</strong> was a complicated and exciting year for debt review. Thousands of<br />

Debt Counsellors found their registration had lapsed and their clients were<br />

moved to other firms. The NCR found out they may have to do debt review<br />

themselves next year and the NCT launched their online system.

The year was a financially tough one for both governments and companies<br />

local and international. Even the weather seemed to be ganging up on<br />

South Africa and the Caribbean. Financially, it was not a great year locally.<br />

Inflation and ever increasing prices, along with consumers having less<br />

money to spend, hit retailers and businesses hard. Even SARS wasn’t able<br />

to collect what was needed.<br />

Political and business scandals both amused and horrified the country. We<br />

take a look back at <strong>2017</strong> and look at some of the good, the bad and the<br />

ugly world events that impacted on the economy and debt review.

JAN<br />

Lack of clarity over DCRS future<br />

funding and management<br />

dominate industry discussions<br />

Debt Counselling Community<br />

Support charity (DCCS) gives<br />

out back to school hampers to<br />

families across SA<br />

Donald Trump inaugurated as<br />

45th President of the USA – let<br />

the handshakes and lack of wall<br />

building begin. (ps. You’re Fired!)

FEB<br />

NCR announce they are looking<br />

for an actuary to review new<br />

proposed Debt Counselling Fees<br />

NCR cancel Workshop very last<br />

minute leaving travelling Credit<br />

Providers and DCs stranded and<br />

angry<br />

British MPs officially vote to leave<br />

the EU (Brexit)<br />

Joost Vd Westhuizen Dies of<br />

motor neurone disease aged 45

SA’s Favorite Public Voting<br />

Results announced:<br />

Boutique Debt Counsellors:<br />

Debt Mend (Gauteng);<br />

Debt Finesse (KZN),<br />

Consumer Debt Support (WC)<br />

SA’s Favourite Large Debt<br />

Counselling Firm:<br />

Consumer Debt Help<br />

SA’s Favourite National Debt<br />

Counselling Firm:<br />

Debt Busters<br />

SA’s Favourite VAF provider:<br />

MFC<br />

SA’s Favourite PDA:<br />

Hyphen PDA<br />

SA’s Favourite Bank:<br />

Standard Bank<br />

Pravin Gordhan gives his last<br />

budget speech (he didn’t know it<br />

at the time)

MAR<br />

FNB host Debt Counsellors at<br />

Conference<br />

NCR finally hold delayed Debt<br />

Counsellor workshop (announce<br />

DC fees being reviewed)<br />

NCR and ABSA agree to R10<br />

Million Fine over R699 car<br />

scheme (valued at R2.8 Billion)<br />

US President Trump once again<br />

tries to ban travelers from Muslim<br />

countries. Federal Courts block<br />

the ban<br />

Infamous Midnight SA Cabinet<br />

Shake up (known as “the night of<br />

long knives”) Ratings downgrades<br />

follow<br />

NCR raid unregistered Credit<br />

Providers<br />

NCT revoke Eagle Loans<br />

Registration

APR<br />

1st Online DCASA webinar<br />

hosted<br />

NCR call for comment on<br />

Call Centre Debt Counselling<br />

operations<br />

NCT launch online automated<br />

filing system for debt review cases<br />

S&P downgrade SA credit Rating<br />

Book The Republic of Gupta: A<br />

Story of State Capture released

MAY<br />

NCR win case vs Edcon at NCT<br />

over club fees<br />

NCR refer Mr Price to NCT over<br />

club fees<br />

NCR go After Pawn Your Car &<br />

Drive it Schemes<br />

DC Partner Event in Cape. They<br />

announce iDocs integration and<br />

massive donation to DCCS<br />

Drought declared in Western<br />

Cape (worst in 113 years)<br />

WannaCry global Cyber<br />

Ransomware attack<br />

James Bond Actor, Sir Roger<br />

Moore dies, aged 89

JUN<br />

Debt Review Awards in JHB.<br />

Capitec, Consumer Friend,<br />

Hyphen PDA and IDM win<br />

industry peer review.<br />

Alison Magrath appointed<br />

new Credit Bureau Association<br />

Executive Manager<br />

Lewis dodge NCR club fee case at<br />

NCT<br />

Debt Therapy bring appeal<br />

case over Nedbank v Jones<br />

interpretation in W Cape Courts<br />

(which would eventually be won)

USA announces it is withdrawing<br />

from Paris Climate Agreement<br />

(bye bye planet)<br />

Bahrain, Saudi Arabia, UAE,<br />

Yemen, Maldives and Egypt sever<br />

ties with Qatar over support of<br />

terrorists<br />

65.6 Million people displaced<br />

around the world in ongoing<br />

refugee crisis<br />

Supreme Court in Venuzuela<br />

attacked by rogue police<br />

helicopter pilot<br />

Facebook announces 2 Billion<br />

monthly users<br />

North Korea fires provocative<br />

Intercontinental Ballistic Missile<br />

into Sea of Japan

JUL<br />

Debt Counsellor, Deborah<br />

Solomon wins 3 yr case vs NCR at<br />

Tribunal<br />

6000sq km iceberg breaks off<br />

Larsen C Ice Shelf in Antarctica<br />

(global warming anyone?)<br />

National Consumer Commission<br />

holds public hearings about time<br />

share abuses<br />

World’s most popular song<br />

Despacito streamed 4.6 Billion<br />

times (and counting)<br />

Annual renewals of registration<br />

for NCA registrants (1/3rd of<br />

Debt Counsellors registration<br />

lapsed)<br />

Bill Gates drops to second richest<br />

man in the world for 12 hours<br />

before retaking the title.<br />

NCR take Foschini to NCT over<br />

club fees

AUG<br />

DCASA hold their annual<br />

Conference in JHB<br />

New Cheaper Maximum Credit<br />

Life rates come into affect<br />

Category 4 Hurricane Harvey<br />

Hits Texas; Category 5 Hurricane<br />

Irma becomes the world’s most<br />

powerful Atlantic hurricane

NCR begin to issue annual<br />

certificates by email and post to<br />

desperate Debt Counsellors<br />

USA impose sanctions on Russia<br />

over 2016 election interference<br />

SA President Zuma wins noconfidence<br />

vote by a narrow<br />

margin of only 21 votes<br />

Grace Mugabe uses diplomatic<br />

immunity to escape assault<br />

charges in SA<br />

Solar Eclipse<br />

22 186 cases of Swine Flu<br />

reported in India

SA Athletics team win big at<br />

London IAAF World<br />

Championships (among others<br />

Manyonga, Van Niekerk and<br />

Semenya take medals)<br />

Mayweather vs McGregor Boxing<br />

Match<br />

Violence in Myanmar - 370 000<br />

forced to flee

SEP<br />

NCR publish proposed Fee<br />

Structure for Debt Counselling<br />

proposing a reduction in income<br />

Samson Vs Mars court case<br />

ruling undoes damage caused by<br />

negative Nedbank v Jones ruling<br />

interpretations<br />

Capitec host their first conference<br />

for Debt Counsellors in<br />

Stellenbosch<br />

All Blacks Beat Boks 57 – 0 in<br />

Auckland

Shoprite hit with R1 Million fine<br />

by NCT<br />

Hurricane Irma makes landfall<br />

causing chaos for over 7 million<br />

families and many deaths<br />

Playboy founder Hugh Hefner<br />

Dies Aged 91, survived by his 31<br />

year old wife<br />

Puerto Rico hit by hurricane.<br />

All electrical power wiped out<br />

country wide<br />

Saudi Arabia become last country<br />

in the world to remove ban on<br />

women drivers<br />

Bell Pottinger Scadal Breaks-<br />

Racist campaigns run to help<br />

distract from Gupta State Capture<br />

allegations

OCT<br />

NCR go after VW Financial<br />

Services and BMW Financial<br />

Services for ‘on the road’ fees<br />

(mostly ignored)<br />

Consumer Friend change their<br />

contact details<br />

KPMG caught in anti Gupta<br />

frenzy

R3 Billion in tax funds used in<br />

bailout of SAA<br />

Shooting in Las Vegas kills 58<br />

people and injures 489<br />

New York Times publishes sexual<br />

harassment article on Hollywood<br />

producer Harvey Weinstein. Huge<br />

influx of revelations from other<br />

actors and actresses follow that<br />

rocks Hollywood glitterati. Similar<br />

accusations sweep through US<br />

political circles<br />

Plague outbreak in Madagascar<br />

Marburg virus outbreak in<br />

Uganda<br />

Another SA Cabinet reshuffle<br />

Lackluster Mini Budget offers little<br />

substance

NOV<br />

Parliamentary Portfolio<br />

Committee announce proposed<br />

Bill to amend NCA to include<br />

NCR run debt review for poor<br />

DCASA AGM – Mr Tony Richards<br />

announces he will not be on<br />

NEC after 11 years, Mr Paul Slot<br />

announces he won’t serve as<br />

DCASA President in 2018.<br />

Consumer Friend’s DReX system<br />

goes live for Debt Counsellors<br />

S & P finally rate SA as “junk”<br />

(Local Currency rating)

11 Saudi Princes arrested along<br />

with others on corruption charges<br />

World largest retailer Alibaba<br />

does $25.3 billion in sales on one<br />

day<br />

Zimbabwean Vice President<br />

fired. Grace gets the job briefly.<br />

Military moves into capital.<br />

President Mugabe at first refuses<br />

to step down, in TV appearance,<br />

but soon his resignation is<br />

announced during impeachment<br />

proceedings. Emmerson<br />

Mnangagwa becomes new<br />

President<br />

Prince Harry engaged to actress<br />

Meghan Markle (Rachel from<br />

Suits)

DEC<br />

NCR Conference held in Cape<br />

Town –Debt Counsellors, PDAs<br />

and Credit Providers attend<br />

US Supreme Court Rule in favour<br />

of Trump travel ban on 6 Muslim<br />

countries<br />

Bitcoin value spikes suddenly<br />

Iraq announce victory against ISIS

Star Wars: The Last Jedi launches<br />

(just days before Suadi Arabia lifts<br />

35yr ban on Cinemas)<br />

President Zuma faced with R6 Mil<br />

in legal fees after losing court<br />

battles against state capture<br />

inquiry<br />

Steinhoff accounting fraud<br />

scandal hits press<br />

ANC elect Cyril Ramaphosa as<br />

party President

PROFESSIONAL DEBT<br />

COUNSELLING ATTORNEYS<br />

TEL: 021 872 1968<br />

11 MARKET STREET, PAARL<br />

www.steyncoetzee.co.za

All professionals have professional indemnity if the unforeseen<br />

happens. Do you as a professional Debt Counselor have<br />

professional indemnity as stipulated by the ethical code?<br />

contact us today for more information<br />

086 111 2882<br />

TELEPHONE 0861 112 882 FACSIMILE 086 605 9751 MOBILE 082 449 6856 EMAIL andre@in2insurance.co.za<br />

www.in2insurance.co.za<br />

MELIORLEAF WON’T<br />

LOAD YOUR PREMIUMS<br />

OR REPUDIATE A<br />

LEGITIMATE CLAIM<br />

Specialist insurance for people in debt<br />

review. Ask your debt counsellor.<br />

CALL US NOW 0861 635 467<br />

www.meliorleaf.co.za

NCR<br />

CONFERENCE<br />

<strong>2017</strong><br />

The National Credit Regulator (NCR) held their annual conference<br />

in Cape Town this year. The conference was themed as a ‘Reflection<br />

and Celebration‘ of debt review. The NCR and National Credit Act<br />

turned 10 years old half way through the year and there was plenty<br />

of history to look back over during the speeches. Speakers at the<br />

conference ranged from Magistrates to Debt Counsellors, Credit<br />

Providers, the NCT and NCR themselves. Credit Providers and even<br />

some Debt Counsellors flew from other parts of the country to attend.

Both the NCR’s acting Head of Debt<br />

Review, Mr Ngoako Mabeba and<br />

Senior Legal Advisor, Ms Nthupang<br />

Magolego addressed the audience<br />

as the day began. Statistics show<br />

that debt review is working but<br />

could be doing even more to help<br />

the economy and those in financial<br />

trouble. Time was given to reviewing<br />

some of the major legal victories<br />

(and loses) that the NCR has been<br />

involved with including enforcement<br />

action against Debt Counsellors<br />

and Credit Providers. Surprisingly<br />

the speeches even touched on Debt<br />

Intervention as envisioned in the<br />

recent proposed NCA amendment<br />

bill. Ms Magolego (NCR Senior<br />

Legal Advisor) described it simply as<br />

debt review done by the NCR.<br />

...Surprisingly the speeches even<br />

touched on Debt Intervention as<br />

envisioned in the recent proposed<br />

NCA amendment bill...<br />

It was highlighted that in the nearly<br />

4000 education programmes the<br />

NCR has held over the last 10 years<br />

they have helped educate 403 108<br />

consumers (out of the +-21 Million<br />

credit users) with information about<br />

the NCA and in many cases debt<br />

review.<br />

Rob Easton-Berry (Credit Provider)<br />

spoke very openly about the 2009<br />

NCR Task Team, which gave rise

to many of the common practices<br />

within debt review today. He<br />

discussed the need at the time and<br />

the way solutions were reached in<br />

a short time through many hours<br />

of hard negotiation and sometimes<br />

confrontation. He ended his speech<br />

by predicting hard times ahead<br />

economically for the country. He<br />

said that Debt Counsellors need to<br />

be ready and have systems in place<br />

to handle more clients than ever.<br />

The NCT briefly touched on their<br />

functions within the framework of<br />

the NCA. They mentioned their new<br />

automated system and how that is<br />

designed to help them cope with<br />

the dramatic increase in cases for<br />

debt review they have been flooded<br />

with over the last few years. The<br />

audience were very positive about<br />

the travelling motion courts the NCT<br />

have been operating country wide.<br />

Debt Counsellor Alan Manshon<br />

looked back at how debt review has<br />

changed and highlighted some of<br />

the current challenges. Unlike many<br />

of the previous speakers he asked<br />

his audience to get involved and<br />

comment. There were many laughs,<br />

some pained groans and even

forehead slapping as Alan took<br />

the audience through a decade of<br />

almost constant change within the<br />

industry.<br />

The (PDASA) Payment Distribution<br />

Association of South Africa were<br />

represented by DC Partner’s<br />

Herman de Jager. He begged the<br />

NCR to look into the issue of PDA<br />

fees and payment turnaround<br />

times. He warned that the industry<br />

will struggle greatly in the future if<br />

PDAs are forced out of business by<br />

non sustainable costing models. His<br />

sentiments received an enthusiastic<br />

and supportive round of applause<br />

from the concerned audience.<br />

...the industry will struggle<br />

greatly in the future if PDAs are<br />

forced out of business by non<br />

sustainable costing models...<br />

Local Western Cape Magistrate<br />

Nyati called on the NCR to help<br />

educate more consumers. She<br />

then took some time to discuss<br />

applications for debt review locally<br />

in the Western Cape. She thanked<br />

the NCR for the invite and said that<br />

she and her colleagues who had<br />

attended had found it interesting<br />

to sit among Debt Counsellors and<br />

see the way they think and the issues<br />

raised. They hope to engage more<br />

with the industry in the future for<br />

further insights.

Mr Peter Michaels of the NCR closed<br />

out the day as he spoke about<br />

things like registration and lapsing<br />

of registrations prior to a question<br />

and answer session. It was revealed<br />

that another 300 Debt Counsellors<br />

registration was to lapse shortly. This<br />

means that the number of previously<br />

registered Debt Counsellors will<br />

now be halved in the country since<br />

the increased annual renewal fees<br />

began. Many questions were asked<br />

and this provided the chance for<br />

industry role players to comment<br />

and take note of concerns of those<br />

in the audience.<br />

The event was well supported<br />

(though some had to leave during<br />

the conference to go to mosque<br />

since it was held on a Friday) and<br />

the audience was generally positive<br />

about the day. Both Debt Counsellors<br />

and Credit Providers benefitted<br />

from getting to meet face to face<br />

and engage with one another about<br />

current challenges (such as end<br />

balance differences). The NCR can<br />

chalk this one up as a great success.

Die Republiek van<br />

SKYT AFRICA<br />

Hi daar mense,<br />

Ek het in verlede maand se berig n oorsig gedoen van die afgelope<br />

jaar en weereens tot die besef gekom dat die nie help om te tob en<br />

talm oor die verlede nie, wat verby is is verby en daar is niks wat ek<br />

of jy kan doen om die horlosie terug te draai nie. Daar is dinge wat<br />

nou weg is soos die motorvervaardiger Chevrolet, die ouer garde sal<br />

onthou in die 60’s en 70’s het ons almal iemand geken wat n Chevy<br />

gery het asook die advertensieklingel “braaivleis, rugby, sonneskyn<br />

en Chevrolet”, hartseer maar dit is die lewe – nostalgie.<br />

Die regerende party het sopas n nuwe leier gekies en die finansiële markte<br />

het positief daarop reageer, die huidige President van die land bly egter<br />

nog in sy amp tot die volgende verkiesing, genoeg oor poletiek!<br />

Teen hierdie tyd het al die skoolgaande kinders hulle rapporte gekry,<br />

sommige het geslaag met onderskeidings, sommige met bogemiddelde

punte en dan is daar die wat nie die paal gehaal het nie. Ek wil hierdie<br />

maand met jou gesels oor rapporte. N rapport is n samevatting en oorsig<br />

van prestasie of onderprestasie deur die jaar. Elkeen van ons behoort vir<br />

onsself n rapport op te stel, n eerlike rapport oor die afgelope jaar. Waar<br />

het ek presteer en hoekom en waar het ek onderpresteer en hoekom?<br />

Was ek ten alle tye n regverdige mens in my doen en late of het ek soms<br />

toegelaat dat my emosies die oorhand kry/ Hierdie tydskrif is uitsluitlik<br />

vir die doel van finansiële welstand en dit is onbetwisbaar dat geldelike<br />

druk ons irrasioneel laat optree, ons blameer wyd en syd sonder om self<br />

ondersoek te doen en dit is waarom n rapport ons kan help om te verstaan,<br />

is daar areas wat kan verbeter en nog belangriker het ek geslaag of het<br />

ek gefaal?<br />

Om, soos die oumense gesê het, te dop is nie die einde van die wêreld<br />

nie solank ek daaruit leer en die nodige aksieplanne in plek sit wat n<br />

verbetering sal verseker. Selfkastyding en bejammering gaan nie die

oplossing wees nie so ook nie om blaam te verskuif nie, dit is jou rapport<br />

en jou punte en dit is in jou hande om positiewe veranderinge te beplan,<br />

in te stel en deur te voer.<br />

Indien jou rapport hierdie jaar toon daar is ruimte vir verbetering streef<br />

daarna om die nodige aanpassings te doen, jy is dit aan jouself en jou<br />

familie verskuldig. Mag elkeen van julle met lof slaag op volgende jaar se<br />

rapport, indien jy onder skuldberadering is en vasgebyt het, gee jouself n<br />

klop op die skouer, jy slaag met lof omdat jy die regte besluit gemaak het<br />

en die probleem positief en daadwerklik benader het.<br />

Lekker vakansie almal!<br />

Groetnis.<br />

Christo Hattingh<br />

Kyk gerus my LinkedIn profile:<br />

https://www.linkedin.com/in/christo-hattingh-351a52130/<br />

* Seriously please do let us know if you found this article to be<br />

funny/offensive/amusing/interesting feedback@debtfreedigi.co.za

South Africa’s<br />

leading Debt Counsellors<br />

Click through to<br />

www.creditmatters.co.za<br />

or call our national call centre on<br />

086 111 6197

NCPDA2<br />

R E G . 2 0 0 8 / 0 1 8 7 4 1 / 0 7<br />

PAYMENT DISTRIBUTION AGENCY<br />

TRANSPARENCY<br />

INTEGRITY<br />

COMPLIANCE<br />

COMPANY BACKGROUND<br />

On 28 August 2008, DC Partner began<br />

distributing funds newly appointed by the<br />

National Credit Regulator as a accredited<br />

Payment Distribution Agent.<br />

DC Partner’s business has continued to<br />

steadily grow ever since 2008 and is a<br />

financially strong company that strives for<br />

excellent service to our customers.<br />

DC Partner is one of only three NCR<br />

accredited PDA’s in South Africa and its<br />

operations are based out of the scenic town<br />

of George in the beautiful Southern Cape,<br />

with satellite offices in Pretoria and Cape<br />

Town. At present, the company employs<br />

roughly 100 people. DC Partner has a high<br />

level of commitment and quality control.<br />

SECURE DISTRIBUTION OF DEBT<br />

REVIEW FUNDS<br />

DC Partner takes pride in providing accurate<br />

and timely distributions. After all, the ability<br />

to accurately and speedily distribute funds<br />

from consumers to credit providers forms the<br />

cornerstone of the debt review cycle.<br />

Distributions are strictly done according to<br />

the distribution plan provided by the relevant<br />

debt counselor.

W H Y C H O O S E D C P A R T N E R A S P D A ?<br />

A client relationship officer is assigned for EACH<br />

Debt Counsellor – Single point of contact &<br />

communication!<br />

We assist to follow up on default clients, unpaid<br />

funds and unidentified deposits.<br />

National representation – Frequent face to face visits<br />

to your office by skilled, trained agents.<br />

Automated e-mails which can be sent directly from<br />

our system – 17.1, 17.2, proposals, cascades etc.<br />

Systematized client statements for each distribution<br />

sent as e-mail or sms.<br />

Daily Distributions on all clients.<br />

24 Hour access to our system (Including distribution<br />

data) from any PC, Cell Phone or tablet with internet<br />

access.<br />

Individual, dedicated business bank account for each<br />

debt counsellor.<br />

Multiple management review reports accessible<br />

directly to manage your debt review business and<br />

processes.<br />

HEAD OFFICE:<br />

59 VICTORIA STREET, GEORGE<br />

TEL: 044 873 4530 EMAIL: PDA@DCPARTNER.CO.ZA<br />

WWW.DCPARTNER.CO.ZA

MANAGING DIRECTOR<br />

T | 086 111 3749<br />

CHRIS@ZERODEBT.CO.ZA<br />

WWW.ZERODEBT.CO.ZA<br />

CHRIS CRAVEN

Why did you get<br />

involved in the<br />

industry?<br />

What did you do<br />

before becoming<br />

a DC?<br />

I had various business interests in<br />

the financial sector and became<br />

interested in debt counselling in<br />

2009. We formed Zero Debt and<br />

began offering debt review services<br />

back in 2009.<br />

As a team, we identified the needs<br />

of people who were over-indebted –<br />

essentially the need to protect their<br />

assets and have their instalments and<br />

interest rates reduced to an amount<br />

that was within their means. The<br />

debt review process meets this need<br />

for our clients and inevitably helps<br />

to solve their financial dilemma. The<br />

debt review process was back then,<br />

and still is, the most effective way<br />

to reduce instalments and interest<br />

rates while retaining assets.

PROFILE | CHRIS CRAVEN | ZERODEBT<br />

What area (of SA)<br />

do you practice in?<br />

Zero Debt offers debt review services<br />

throughout South Africa.<br />

Where do you find<br />

new business?<br />

We market nationally in the media<br />

and online and generate a lot of<br />

business through referrals.<br />

What makes your<br />

business a success?<br />

Our service solves a problem. We<br />

focus on reducing interest rates by<br />

getting acceptances from creditors<br />

– an agreement our clients would<br />

not be able to attain, without<br />

our involvement. We also pride<br />

ourselves in retaining the best staff<br />

in the industry, who administer the<br />

entire process.

END<br />

Do you think the<br />

proposed NCA<br />

amendments bill<br />

address all the<br />

current needs of<br />

the industry?<br />

The proposed NCA amendments<br />

bill is aimed to assist extreme low<br />

income consumers. Currently the<br />

Debt Counsellors cannot assist<br />

these members as proposals for<br />

repayment will not solve in terms<br />

agreed by Credit Providers.<br />

What is the biggest<br />

challenge facing<br />

your consumers at<br />

the moment?<br />

Inflation, along with the rising cost<br />

of living. This makes it difficult for<br />

consumers as they have to constantly<br />

adjust their budget throughout the<br />

process.<br />

What advice do you<br />

have for consumers<br />

under debt review?<br />

My advice is to trust in the process,<br />

and stay with us until your debt is fully<br />

paid and you receive a clearance<br />

certificate.

DEBT COUNSELLORS ASSOCIATIONS<br />

ANNOUNCEMENT BOARD<br />

We wish our members a good holiday<br />

break and look forward toa productive<br />

2018. We will be holding a series of<br />

regional meetings early in the year<br />

and you can check the January issue<br />

of <strong>Debtfree</strong> or our website for all the<br />

details.<br />

Curious about Crypto Currencies?<br />

Contact us for info on<br />

how they work:<br />

admin@neweracomms.co.za<br />

www.dcasa.co.za<br />

www.newera.org.za<br />

We thank all our members for their<br />

support this year. We wish everyone<br />

happy holidays.<br />

We wish our members a good end of the<br />

year holiday break and remind everyone<br />

to make use of the Facebook page if you<br />

want to share any suggestions or ask<br />

questions.<br />

www.bdcf.co.za<br />

www.allprodc.org

DON’T WORK WITH AN OUT<br />

DATED VERSION OF THE ACT<br />

UPDATED<br />

<strong>2017</strong><br />

We are happy to announce that the Amended National Credit Act booklet<br />

is now available via our shop.<br />

Get the latest version for only R250.00<br />

ORDER NOW<br />

http://debtfreedigi.co.za/product/pocket-sized-national-credit-act-booklet/

DEBT COUNSELLING<br />

COMMUNITY SUPPORT<br />

DEBT COUNSELLING<br />

BACK<br />

COMMUNITY SUPPORT<br />

TO<br />

SCHOOL<br />

DCCS want to thank Nedbank for leading the charge with end<br />

of year hampers for our vulnerable Debt Review consumers. These<br />

consumers have been identified by their Debt Counsellors as needing<br />

a little extra help at the end of the year.<br />

Nedbank have been collecting cans of non perishables, as well as,<br />

basic toiletries and food stuffs. DCCS are helping distribute these to<br />

debt review families who are under pressure.<br />

Contact admin@dccsupport.co.za

Nedbank have also donated thousands of Rands so that DCCS can<br />

reach even more consumers at the end of the year and families with<br />

needs.<br />

These efforts go hand in hand with the DCCS back to school project<br />

for Jan 2018 where participating debt counsellors and PDAs and<br />

credit providers are helping us give ‘back to school’ packs to over<br />

100 debt review families this year.<br />

Sponsor a R150 Back to School Hamper

CLICK THE C<br />

SERVICE D<br />

DEBT COUNSELLORS<br />

SUPPORT<br />

SERVICES<br />

TRAINING<br />

FINANCIAL<br />

FINANCIAL<br />

PLANNING

IRECTORY<br />

ATEGORY<br />

DO YOU WANT TO LIST<br />

YOUR COMPANY?<br />

directory@debtfreedigi.co.za<br />

LEGAL<br />

CREDIT BUREAUS<br />

PAYMENT<br />

DISTRIBUTION<br />

AGENCIES<br />

CREDIT PROVIDER CONTACT<br />

DETAILS & ESCALATION PROCESS

DEBT COUNSELLORS<br />

GAUTENG<br />

KWAZULU-<br />

NATAL<br />

FREE STATE

LIMPOPO NORTH WEST EASTERN CAPE<br />

MPUMALANGA NORTHERN CAPE WESTERN CAPE

PENNY WISE<br />

Cathy Foster<br />

Debt Counsellor – NCRDC1977<br />

Penny Wise Debt Counselling<br />

Tel: (011) 679 1540<br />

Fax: 086 719 3378<br />

Mobile: 083 298 4467<br />

Email: cathy@pennywise.co.za<br />

www.pennywise.co.za<br />

Credit Matters<br />

South Africa’s Leading<br />

Debt Counsellors<br />

14th Floor, The Pinnacle<br />

Cnr Strand & Burg St<br />

Cape Town<br />

Tel: 086 111 6197<br />

Fax: 021 425 6292<br />

info@creditmatters.co.za<br />

GAUTENG<br />

Armani Debt Counselling<br />

Take the First Step<br />

to Financial Freedom<br />

Tania Dekker<br />

Tel: 011 849 3654 / 7659<br />

www.armanigroup.co.za<br />

Dynamix Debt Counselling TLC<br />

Alida Christie NCRDC2324<br />

Office 1, 34 Beefwoodstreet,<br />

Vanderbijlpark, 1911<br />

Tel: 079 520 4369<br />

Tel: 016 100 8020<br />

tlcdebt@mweb.co.za

0861 123 644<br />

Specialist Debt Management Centre<br />

Beverley Ludick, NCRDC948<br />

Pretoria<br />

Tel: 012 377-3557<br />

Email: obligco@gmail.com<br />

Email: dc@obligco.co.za<br />

www.obligco.co.za<br />

Creators In Financial Wellbeing<br />

NCRDC677<br />

You Are Not Alone<br />

We’ll handle your creditors so you<br />

don’t have to!<br />

1 Dingler Street, Rynfield, Benoni<br />

0861 10 11 00<br />

info@debtmend.co.za<br />

www.debtmend.co.za<br />

info@debtrescue.co.za<br />

NCRDC197<br />

Tel: 011 660 9970<br />

Fax: 086 540 5017<br />

KRUGERSDORP<br />

e-mail: nicky@nvdmdc.co.za<br />

www.nvdmdc.co.za<br />

All Debt Solutions<br />

Fast tracking your financial freedom<br />

Tel: 0861 255 3328 / 021-557 9981<br />

Email: info@allds.co.za<br />

www.alldebtsolutions.co.za<br />

https://www.facebook.com/<br />

alldebtsolutions<br />

CCDC<br />

Consumer Care Is our Priority.<br />

Tel: 018 462 4263 / 073 624 6949<br />

Email: info@ccdc.co.za<br />

www.ccdc.co.za

DEBT NO MORE - NCRDC1973<br />

Christelle du Toit<br />

Tel: 016 423 6301<br />

Cell: 083 321 6731<br />

FAX: 086 219 3306<br />

Email: debtnomore@jjckruger.co.za<br />

www.jpawfin.co.za<br />

GAUTENG<br />

MV Business Empowerment<br />

9 River Road<br />

Morning Hill<br />

Bedfordview<br />

(next to Eastgate mall)<br />

Tel: 083 490 3339<br />

velaphi@infitech.co.za<br />

Suite 7 Gladstone Court<br />

103 Smiso Nkwanyana [Goble] Road<br />

Morningside<br />

Durban<br />

Tel: 031 303 1004<br />

Mobile: 076 835 2810<br />

Email: jbechoo@jb-attorneys.co.za

0861 123 644<br />

National Debt Advisors<br />

Fighting For Consumer Justice<br />

Tel: 021 007 1688<br />

www.nationaldebtadvisors.co.za<br />

info@debtrescue.co.za<br />

KWAZULU-<br />

NATAL<br />

Restore your<br />

financial wellness<br />

Debt Review Specialists<br />

23 Coronation Road<br />

Mithanagar<br />

Tongaat<br />

4399<br />

Tel: 071 222 9481<br />

Tel: 032 944 3446<br />

admin@kmadebt.co.za<br />

www.kmadebt.co.za<br />

Our Debt Management<br />

Process is Easy!<br />

DEBT<br />

REVIEW<br />

AWARDS<br />

Telephone<br />

031 303 2448 / 084 250 2356<br />

www.debtfinesse.co.za

DEBT FREE, STRESS FREE<br />

AND LIVE BETTER<br />

087 001 0867<br />

info@bmhdebtsolutions.co.za<br />

www.bmhdebtsolutions.co.za<br />

Registered Debt Counsellor<br />

NCRDC2662<br />

Credit Matters<br />

South Africa’s Leading<br />

Debt Counsellors<br />

14th Floor, The Pinnacle<br />

Cnr Strand & Burg St<br />

Cape Town<br />

Tel: 086 111 6197<br />

Fax: 021 425 6292<br />

info@creditmatters.co.za

National Debt Advisors<br />

Fighting For Consumer Justice<br />

Tel: 021 007 1688<br />

www.nationaldebtadvisors.co.za<br />

Credit Matters<br />

South Africa’s Leading<br />

Debt Counsellors<br />

14th Floor, The Pinnacle<br />

Cnr Strand & Burg St<br />

Cape Town<br />

Tel: 086 111 6197<br />

Fax: 021 425 6292<br />

info@creditmatters.co.za<br />

FREE STATE<br />

0861 123 644<br />

info@debtrescue.co.za

LIMPOPO<br />

National Debt Advisors<br />

Fighting For Consumer Justice<br />

Tel: 021 007 1688<br />

www.nationaldebtadvisors.co.za<br />

Credit Matters<br />

South Africa’s Leading<br />

Debt Counsellors<br />

14th Floor, The Pinnacle<br />

Cnr Strand & Burg St<br />

Cape Town<br />

Tel: 086 111 6197<br />

Fax: 021 425 6292<br />

info@creditmatters.co.za<br />

Depopulating a generation of over<br />

indebted and populating a debt free<br />

generation.<br />

Office no 2, 5 A Schoeman Street,<br />

Polokwane<br />

Tel: 0152912731<br />

Tel: 0877028518<br />

Email: admaau66@gmail.com<br />

www.maaudebts.co.za<br />

SMS Salary Management Services<br />

Annerien de Jager<br />

Registered Debt Counsellor<br />

NCRDC0075<br />

015 307 2772<br />

info@smslimpopo.co.za<br />

0861 123 644<br />

info@debtrescue.co.za

MPUMALANGA<br />

GMC Debt Solutions<br />

52 Kerk Street<br />

Lydenburg<br />

Tel: 087 802 7054<br />

Tel: 087 151 1034<br />

www.gmcdebtsolutions.co.za<br />

National Debt Advisors<br />

Fighting For Consumer Justice<br />

Tel: 021 007 1688<br />

www.nationaldebtadvisors.co.za<br />

Romi Oliphant<br />

Debt Counselling<br />

Service<br />

013 650 0116<br />

rodcs4u@gmail.com<br />

http://rodcs4u.webs.com/<br />

WhatsApp<br />

062 502 5987<br />

Credit Matters<br />

South Africa’s Leading<br />

Debt Counsellors<br />

14th Floor, The Pinnacle<br />

Cnr Strand & Burg St<br />

Cape Town<br />

Tel: 086 111 6197<br />

Fax: 021 425 6292<br />

info@creditmatters.co.za<br />

0861 123 644<br />

info@debtrescue.co.za

National Debt Advisors<br />

Fighting For Consumer Justice<br />

Tel: 021 007 1688<br />

www.nationaldebtadvisors.co.za<br />

Credit Matters<br />

South Africa’s Leading<br />

Debt Counsellors<br />

14th Floor, The Pinnacle<br />

Cnr Strand & Burg St<br />

Cape Town<br />

Tel: 086 111 6197<br />

Fax: 021 425 6292<br />

info@creditmatters.co.za<br />

NORTH WEST<br />

Depopulating a generation of over<br />

indebted and populating a debt free<br />

generation.<br />

Office No. 6, Prime Pharm Building,<br />

36 Dr Nelson Mandela Drive<br />

Tel: 0186320053<br />

Tel: 0877026744<br />

Email: papi@maaudebts.co.za<br />

www.maaudebts.co.za<br />

0861 123 644<br />

info@debtrescue.co.za

National Debt Advisors<br />

Fighting For Consumer Justice<br />

Tel: 021 007 1688<br />

www.nationaldebtadvisors.co.za<br />

Credit Matters<br />

South Africa’s Leading<br />

Debt Counsellors<br />

14th Floor, The Pinnacle<br />

Cnr Strand & Burg St<br />

Cape Town<br />

Tel: 086 111 6197<br />

Fax: 021 425 6292<br />

info@creditmatters.co.za<br />

NORTHERN CAPE<br />

0861 123 644<br />

info@debtrescue.co.za

National Debt Advisors<br />

Fighting For Consumer Justice<br />

Tel: 021 007 1688<br />

www.nationaldebtadvisors.co.za<br />

Credit Matters<br />

South Africa’s Leading<br />

Debt Counsellors<br />

14th Floor, The Pinnacle<br />

Cnr Strand & Burg St<br />

Cape Town<br />

Tel: 086 111 6197<br />

Fax: 021 425 6292<br />

info@creditmatters.co.za<br />

EASTERN CAPE<br />

0861 123 644<br />

info@debtrescue.co.za

WEBSITE | www.debt-therapy.co.za<br />

debt therapy<br />

integrity guaranteed<br />

debt therapy is registered with NCR | NCRDC49<br />

National Debt Advisors<br />

Fighting For Consumer Justice<br />

Tel: 021 007 1688<br />

www.nationaldebtadvisors.co.za<br />

Drastically reduce your monthly<br />

debt repayments<br />

Let US help 0861111863<br />

Regain control of your finances<br />

www.debt-therapy.co.za<br />

WESTERN CAPE<br />

CONSOLIDEBT<br />

Heidie Knorr NCRDC209<br />

Paarl, Worcester, Wellington, Ceres,<br />

Piketberg, Clanwilliam, Vredendal<br />

Tel: 021 863 2754 / 082 380 4401<br />

consolidebt@vodamail.co.za<br />

Encouraging Freedom, Creating Wealth<br />

Etienne Pieterse NCRDC2210<br />

Tel. (021) 204-8001<br />

etienne@ffsdc.co.za<br />

www.financialfreedomsolutions.co.za

ISISEKO DEBT HELP<br />

Get Your Life back on track<br />

TEL: 087 230 0223<br />

FAX: 086 551 1649<br />

EMAIL: makanti@isiseko.co.za<br />

WEB: www.isiseko.co.za<br />

NCRDC1142<br />

No 2 Golden Isle Building<br />

281 Durban Road, Oakdale,<br />

Bellville, 7535<br />

Tel: 086 111 3749<br />

Email: help@zerodebt.co.za<br />

www.zerodebt.co.za<br />

Credit Matters<br />

South Africa’s Leading<br />

Debt Counsellors<br />

14th Floor, The Pinnacle<br />

Cnr Strand & Burg St<br />

Cape Town<br />

Tel: 086 111 6197<br />

Fax: 021 425 6292<br />

info@creditmatters.co.za<br />

All Debt Solutions<br />

Fast tracking your financial freedom<br />

Tel: 0861 255 3328 / 021-557 9981<br />

Email: info@allds.co.za<br />

www.alldebtsolutions.co.za<br />

https://www.facebook.com/<br />

alldebtsolutions<br />

“There is no dignity quite so<br />

Impressive and No Independence<br />

quite so important as Living<br />

within your Means - Calvin Coolidge”<br />

For your Convenience Our Range of<br />

Services are Availble to you Anywhere in<br />

South Africa!<br />

Jackie Coetzee<br />

079 317 8557<br />

022 713 2021<br />

documentswc@fusiondc.co.za

Credit Rescue<br />

Debt Review<br />

Debt Review Removal<br />

Administration Removal<br />

Garnishee Removal<br />

Contact<br />

James Scott<br />

0834525829<br />

Email: helderberg@credit-rescue.co.za<br />

Your Guide to Financial<br />

Wellness and Recovery<br />

0861 229 922<br />

info@debthero.co.za<br />

www.legalhero.co.za<br />

WESTERN CAPE<br />

CONSUMER DEBT SUPPORT<br />

Annienne Nel NCRDC2452<br />

Kairo’s House, 22 Fairfield<br />

Southstreet, Parow, 7550<br />

Office: 021 930 5791<br />

Cell: 082 641 2328<br />

Fax: 086 563 3264<br />

e-mail: info@debtcentre.co.za<br />

www.debtcentre.co.za

0861 123 644<br />

info@debtrescue.co.za<br />

RIGHT STEP TO A<br />

DEBT FREE LIFE.<br />

086 111 2274<br />

081 785 3724<br />

info@logicaldebtsolutions.co.za<br />

www.logicaldebtsolutions.co.za

SUPPORT SERVICES<br />

Tel: 011 451 0041<br />

Tel: 0860 072 768<br />

www.maxpayments.co.za<br />

lana Van Herwaarde,<br />

DC Operation Centre (PTY)<br />

Tel: 0867227405 Email:<br />

info@dcoperations.co.za<br />

www.dcoperations.co.za<br />

DEBT<br />

086 126 6562<br />

debt@one.za.com<br />

www.one.za.com

COMING SOON<br />

TRAINING<br />

COMING SOON<br />

FINANCIAL PLANNING

LEGAL<br />

Liddles & Associates<br />

“It always seems impossible until it<br />

is done” N. Mandela<br />

(T) 021 930 5790<br />

(F) 0866070940<br />

(E) frontdesk@liddles.co.za<br />

www.liddles.co.za<br />

Steyn Coetzee Attorneys /<br />

Prokureurs<br />

Adri de Bruyn<br />

11 Market Street / Markstraat 11,<br />

Paarl, 7646<br />

Tel: 021 872 1968<br />

Fax: 021 872 2678<br />

adri@steyncoetzee.co.za<br />

RM Brown and Associates<br />

16th Floor, The Pinnacle<br />

Cnr Strand & Burg St<br />

Cape Town<br />

Tel: 021 202 1111, f: 021 425 0875<br />

Email: roger@rmbrown.co.za

Your Debt Counselling Attorneys<br />

Johannesburg | Cape Town<br />

Kim Armfield<br />

Attorney & Family Law Mediator<br />

Address: Unit 1B, FinansHuis, 7<br />

Voortrekker Road, Bellville<br />

Tel: 021 949 1758 / 021 945 2526<br />

Office cell: 084 8588 284<br />

kim@legalwc.co.za<br />

Andre Van Zyl<br />

021 494 4862<br />

info@bassonvanzyl.com<br />

www.bassonvanzyl.com<br />

CREDIT<br />

BUREAUS<br />

Xpert Decision Systems (XDS)<br />

South African information bureau.<br />

Cape Town | Johannesburg<br />

+27 11 645 9100<br />

info@xds.co.za<br />

www.xds.co.za

PAYMENT DISTRIBUTION AGENCIES<br />

DC Partner<br />

044 873 4530<br />

Hyphen PDA<br />

011 303 0060<br />

NPDA<br />

0861 628 628

SYSTEM PROVIDERS<br />

Tel: 011 451 0041<br />

Tel: 0860 072 768<br />

www.maxpayments.co.za<br />

Debt Review Software<br />

Tel: 016 004 0031

CAPITEC CONTACT DETAILS<br />

Form 17’s<br />

Proposals<br />

Court documents<br />

General Queries<br />

Refund Requests /<br />

Cancellation of Debit Orders<br />

Complaints<br />

Insurance Certificates<br />

ccsforms17@capitecbank.co.za<br />

ccsproposals@capitecbank.co.za<br />

ccsdebtrevieworders@capitecbank.co.za<br />

ccsdebtreviewqueries@capitecbank.co.za<br />

ccsrefundrequests@capitecbank.co.za<br />

ComplaintManagement@capitecbank.co.za<br />

coming soon<br />

Sharecall Contact Number 086 066 7783 - Select Option 2<br />

ESCALATION PROCESS<br />

COMING SOON

Debt Review DepartmentEmail Address<br />

Turnaround Time<br />

Contact Details Standard Bank Debt Review<br />

Debt Review Call Center: 0861 111 525 or 0861 111 402<br />

Debt Review Documents*:<br />

DRApplications@standardbank.co.za<br />

Debt Review Service requests: debtreviewservices@standardbank.co.za 5 days<br />

Debt Review payment queries: DRPayments@standardbank.co.za 7 days<br />

Debt Review administrative requests**: DebtReviewAdmin@standardbank.co.za 5 days<br />

Debt Review complaints and escalations: debtreviewcomplaints@standardbank.co.za 5 days<br />

Reckless Lending Allegations<br />

recklesslendingallegations@standardbank.co.za<br />

*Debt Review documents: Form 17.1; Form 17.2; Proposals; Court Applications; Court Orders<br />

**Debt Review Admin related requests: debit order cancellations; statement requests ; refunds; paid up<br />

letters; account closure instructions; settlement balances; or outstanding balances<br />

Other Standard Bank areas<br />

Credit Card 086120 1000<br />

Diners Club 0113588400 / 0860346377<br />

Vehicle Asset Finance Recoveries 0861102347<br />

Vehicle Asset Finance Collections 0861102347<br />

Home Loans Pre Legal 0860102270<br />

Home Loans Customer Service 0860123001<br />

Standard Bank Insurance 0860123911<br />

Deceased Estates 0861001868

ABSA TASK SPECIFIC DEBT<br />

ABSA TASK SPECIFIC DEBT REVIEW ENTRY POINTS<br />

REVIEW ENTRY POINTS<br />

Form 17.1<br />

DRCOB@absa.co.za<br />

Debit Order Cancellations<br />

Debitordercancellations@absa.co.za<br />

Proposals<br />

DRProposals@absa.co.za<br />

Exits from Debt Review<br />

17.4@absa.co.za<br />

All Court Documents<br />

Courtapp@absa.co.za<br />

DC Switches<br />

DCTransfere@absa.co.za<br />

Termination Queries<br />

DRTerminations@absa.co.za<br />

Queries<br />

debtreviewqueries@absa.co.za<br />

Escalated Queries<br />

debtreviewmanager@absa.co.za<br />

Call Centre<br />

0861 222 272

First National Bank – a division of FirstRand Bank Limited. An Authorised Financial Services and Credit Provider (NCRCP20). Reg. No. 1929/001225/06.

DC Query Process DC Query Process<br />

www.nedbank.co.za

17.1, 17.2, Proposals, General<br />

correspondence:<br />

debtcounselling@africanbank.co.za<br />

To register for Legal Web Access:<br />

lwac@africanbank.co.za<br />

Reckless Lending investigations:<br />

RLA@africanbank.co.za<br />

ESCALATION PROCESS<br />

DETAILS COMING SOON

Telephone: 031 251 4151<br />

Fax: 031 251 4252<br />

GENERAL CONTACT DETAILS (FIRST POINT OF CALL)*<br />

17.1‘s, 17 .2’s, 17.3’s, Rejections and 17 .W’s, Change or<br />

Transfer of Debt Counsellor<br />

Proposals / Revised Proposals / Consents /<br />

Related Queries<br />

Notice of Service / Court Applications<br />

Updated Balances / Settlements / General Queries<br />

Section 86(10) Letters and All Related Queries<br />

applications@consumerfriend.co.za<br />

proposals@consumerfriend.co.za<br />

courts@consumerfriend.co.za<br />

customeraccounts@consumerfriend.co.za<br />

terminations@consumerfriend.co.za<br />

ESCALATION CONTACT DETAILS*<br />

Complaints / Service Delivery / Management<br />

17.1‘s, 17 .2’s, 17.3’s, Rejections and 17 .W’s,<br />

Change or Transfer of Debt Counsellor<br />

Proposals / Revised Proposals / Consents /<br />

Related Queries<br />

Notice of Service / Court Applications<br />

Updated Balances / Settlements / General Queries<br />

ryan@consumerfriend.co.za<br />

justin@consumerfriend.co.za<br />

charlene@consumerfriend.co.za<br />

charlene@consumerfriend.co.za<br />

roderick@consumerfriend.co.za<br />

diane@consumerfriend.co.za<br />

*Please do not CC multiple email addresses.